Article Text

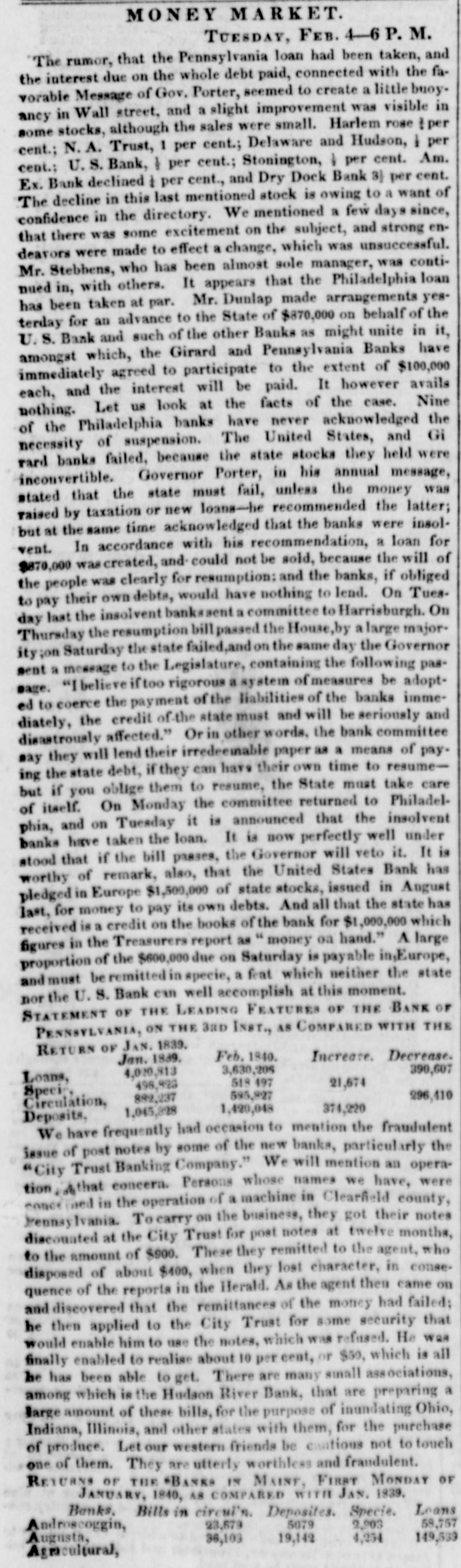

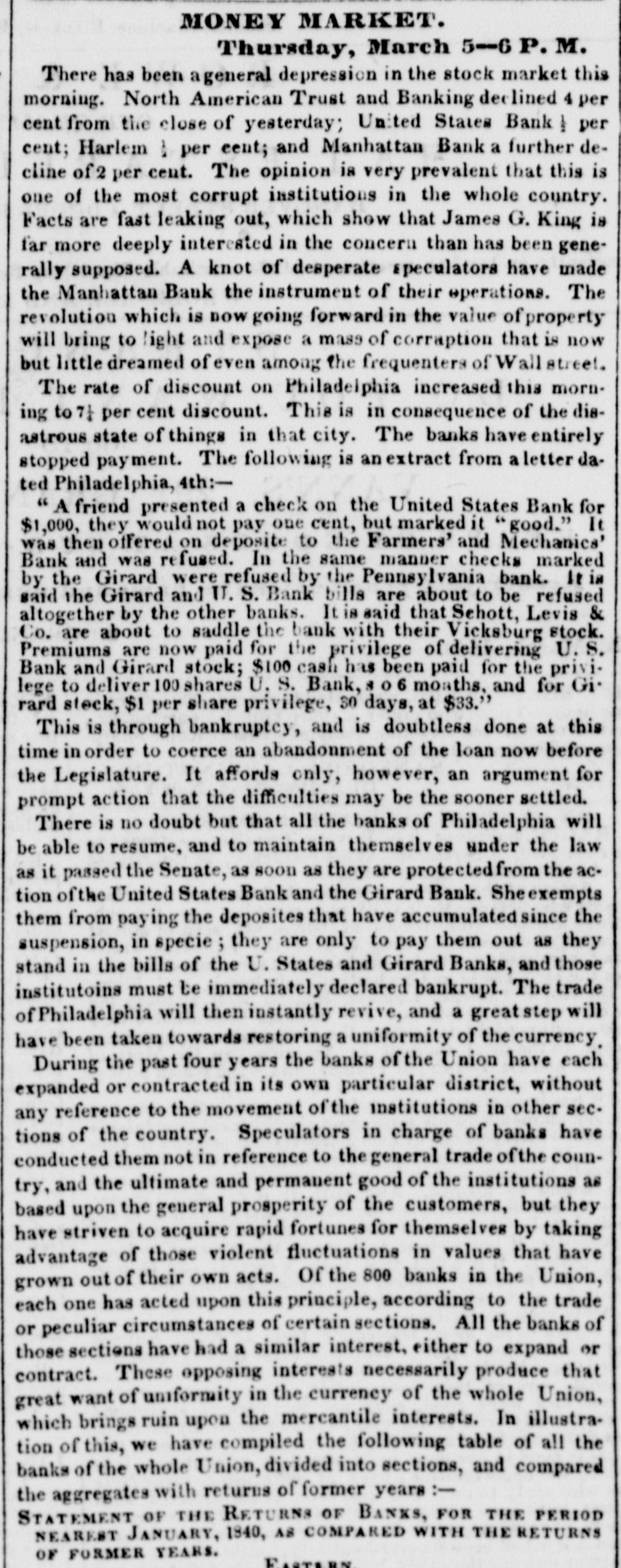

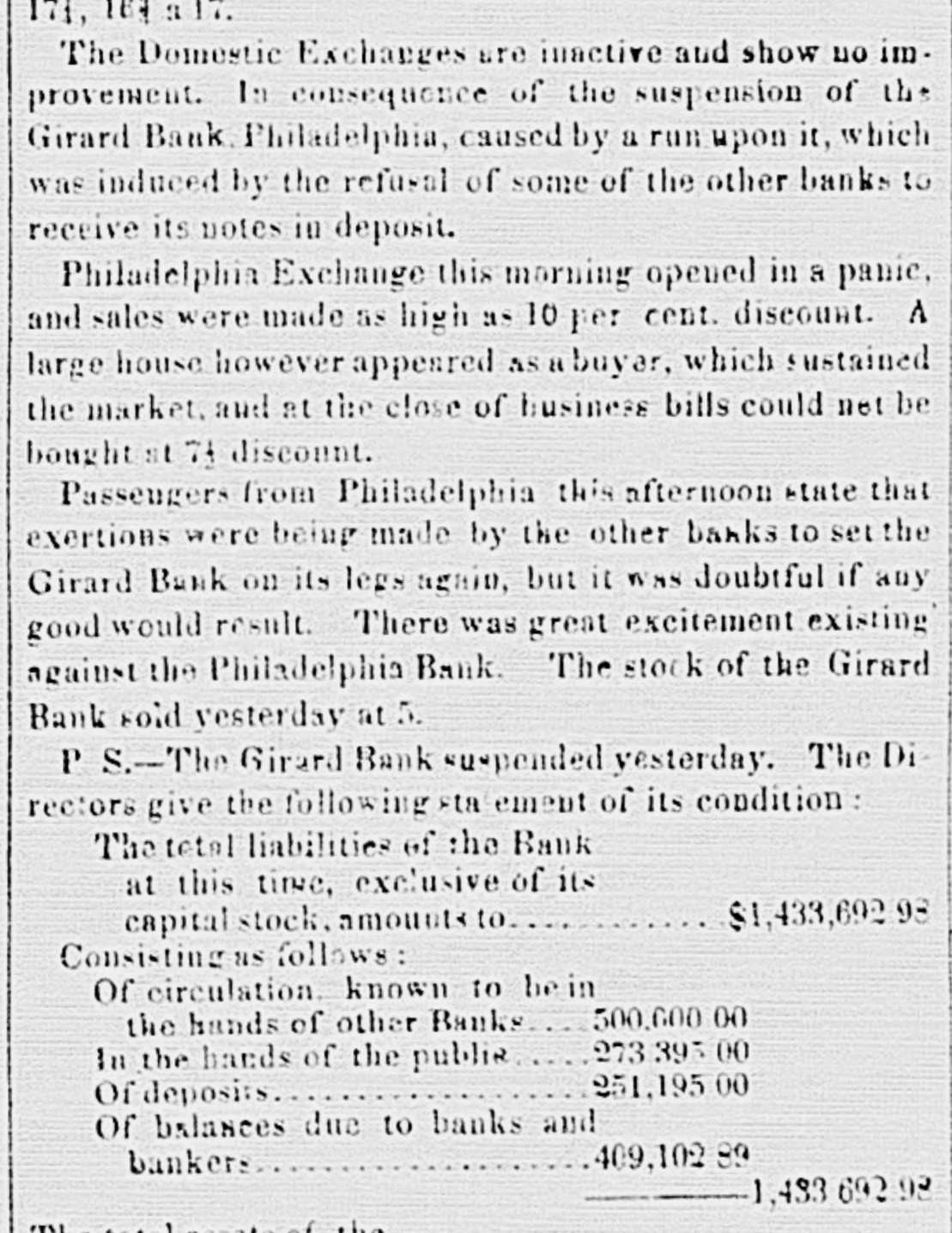

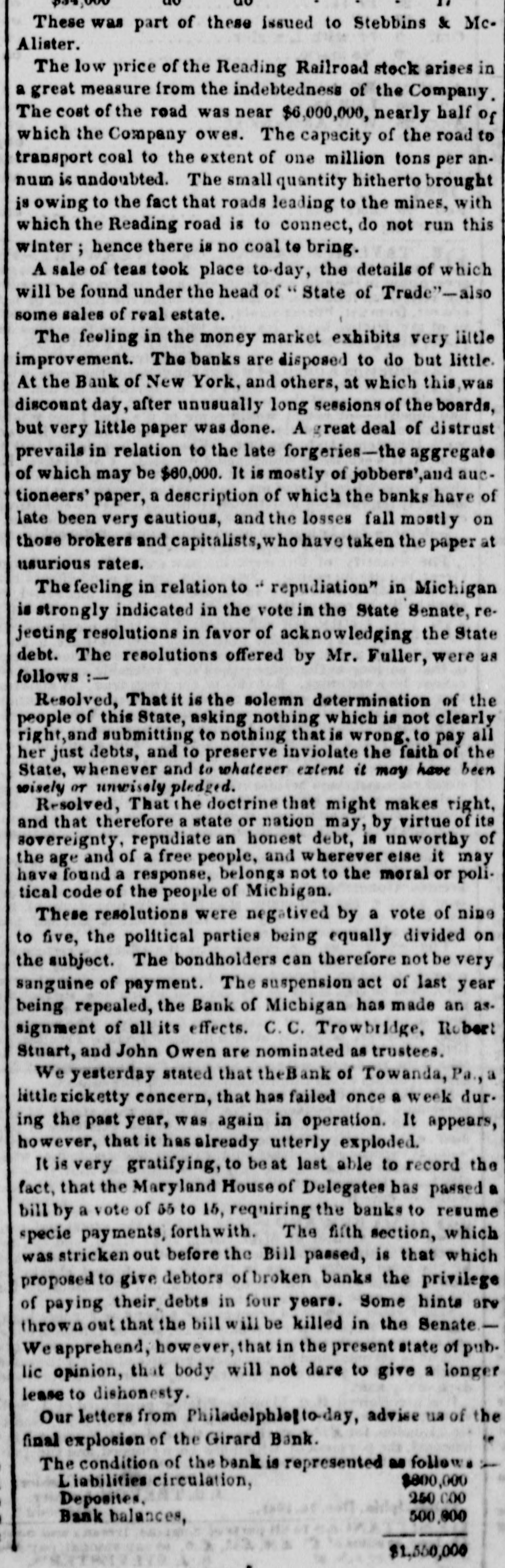

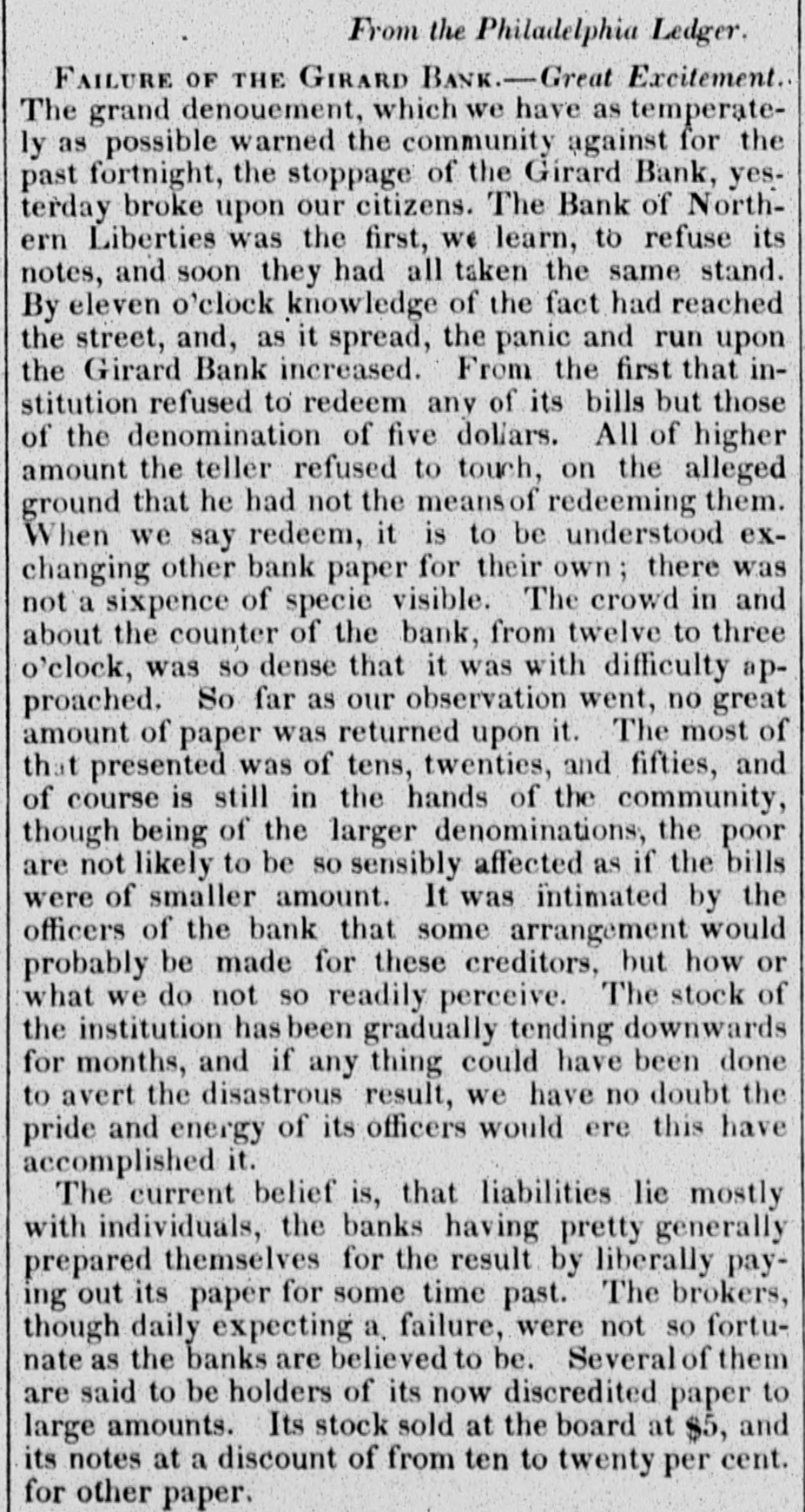

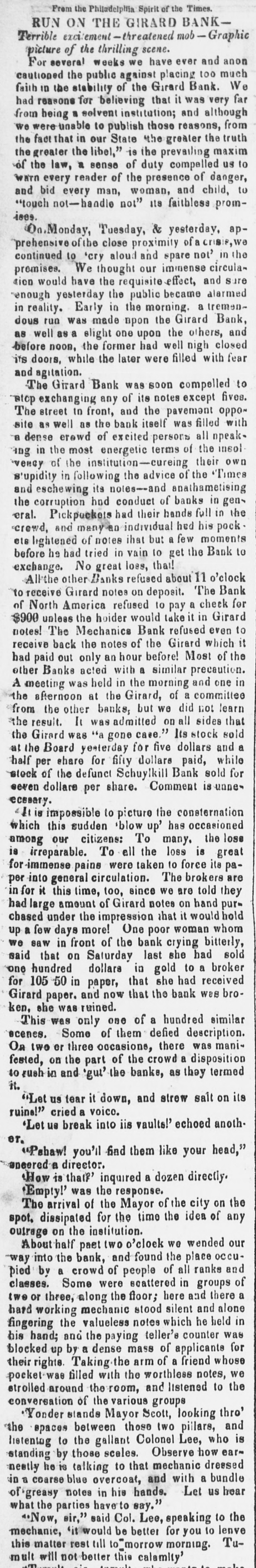

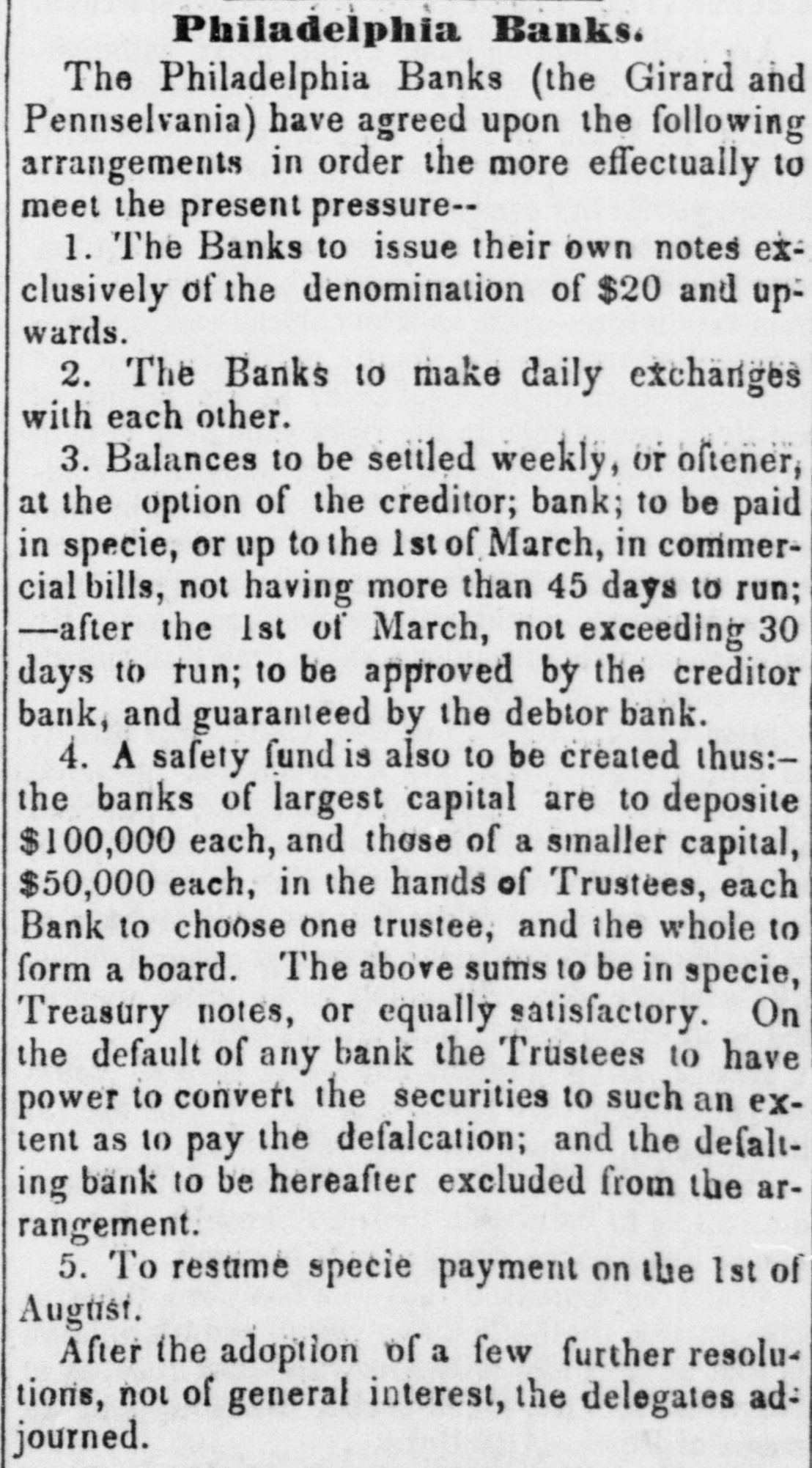

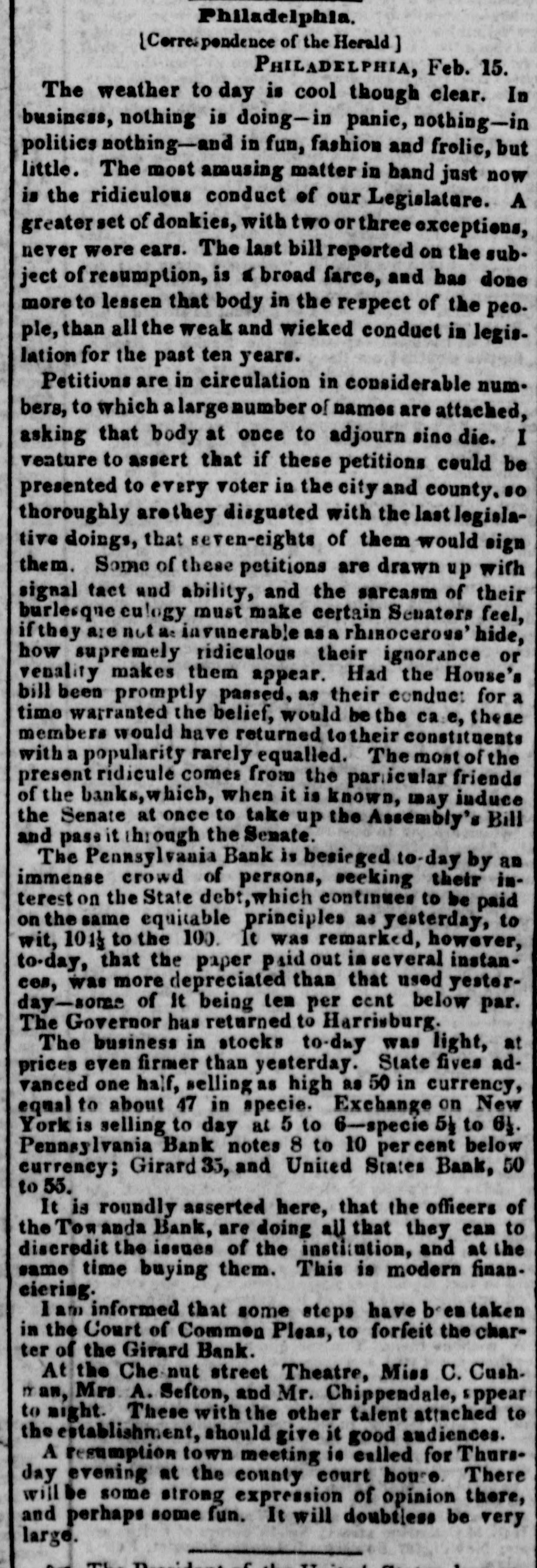

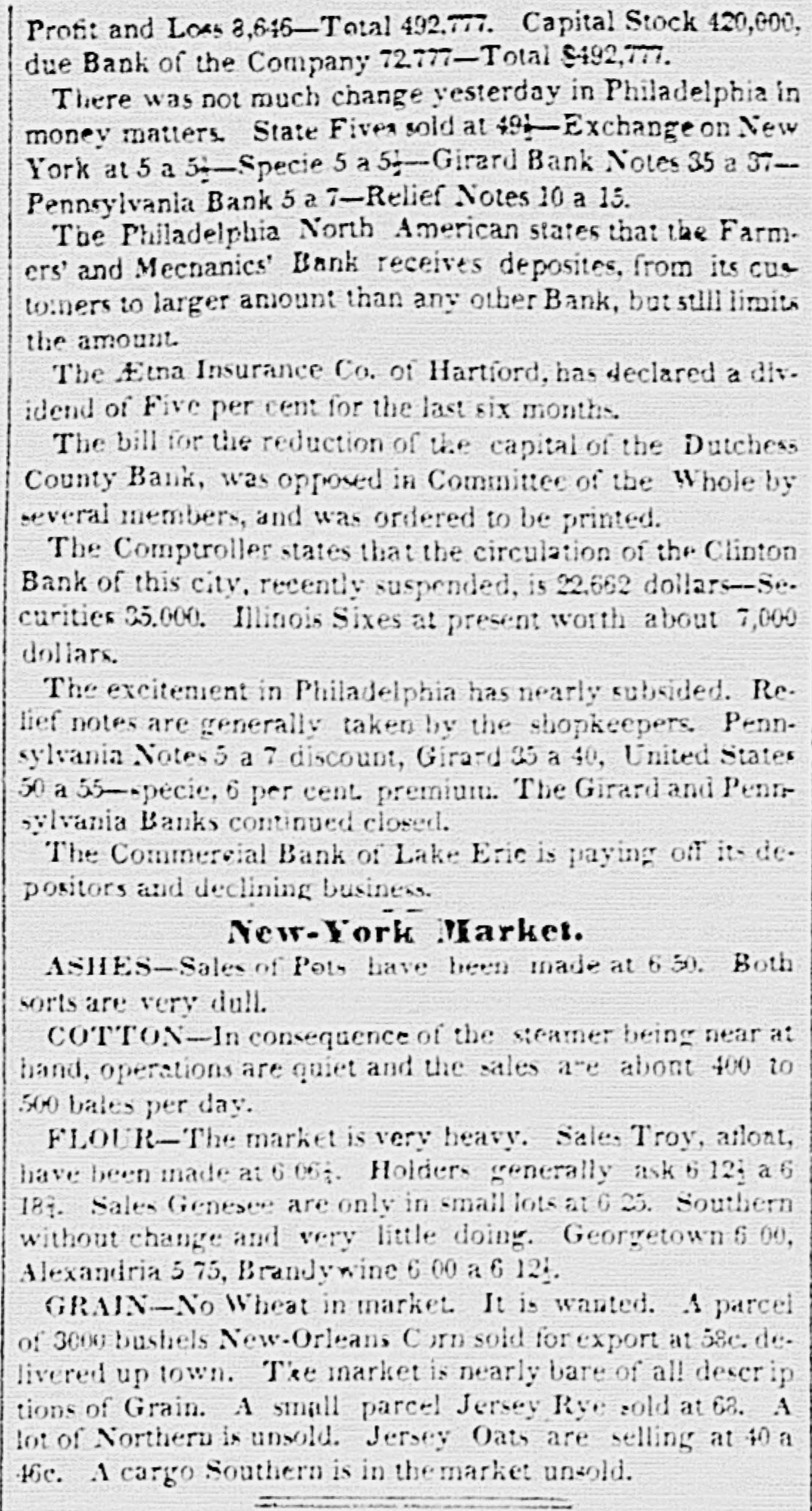

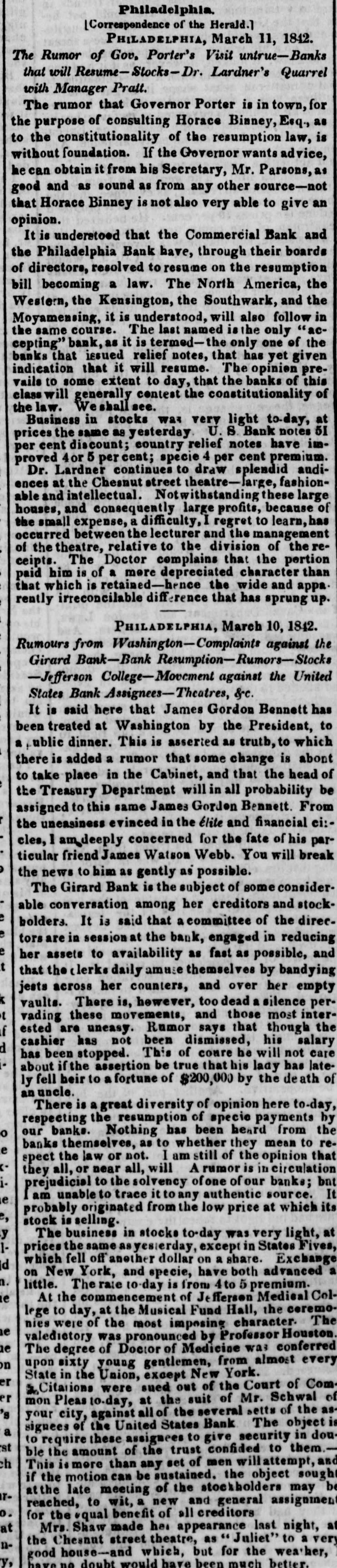

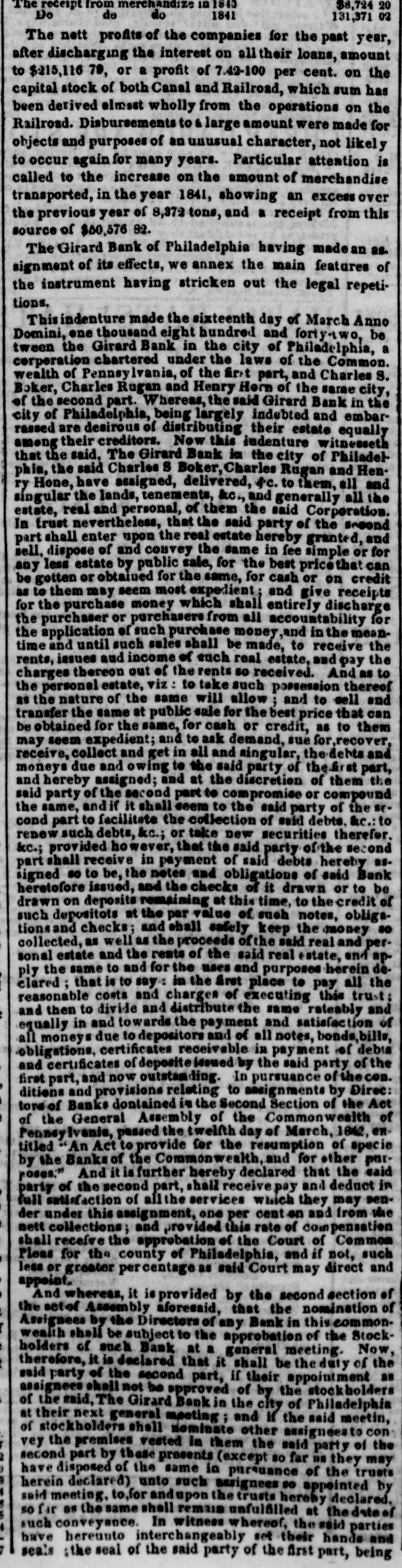

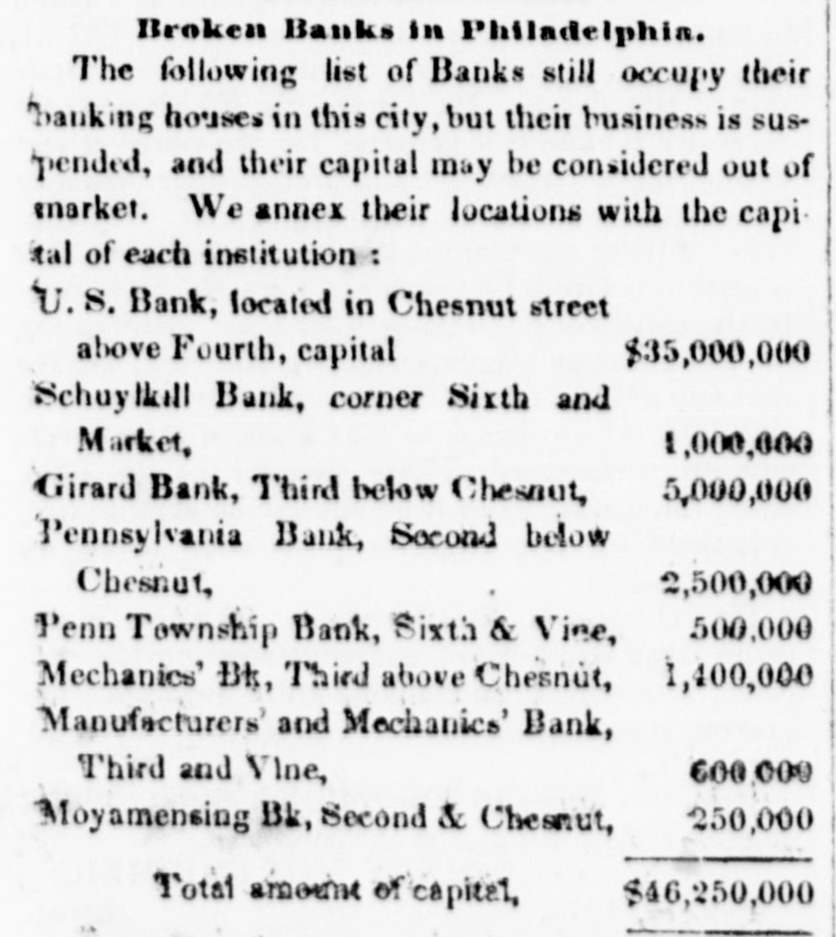

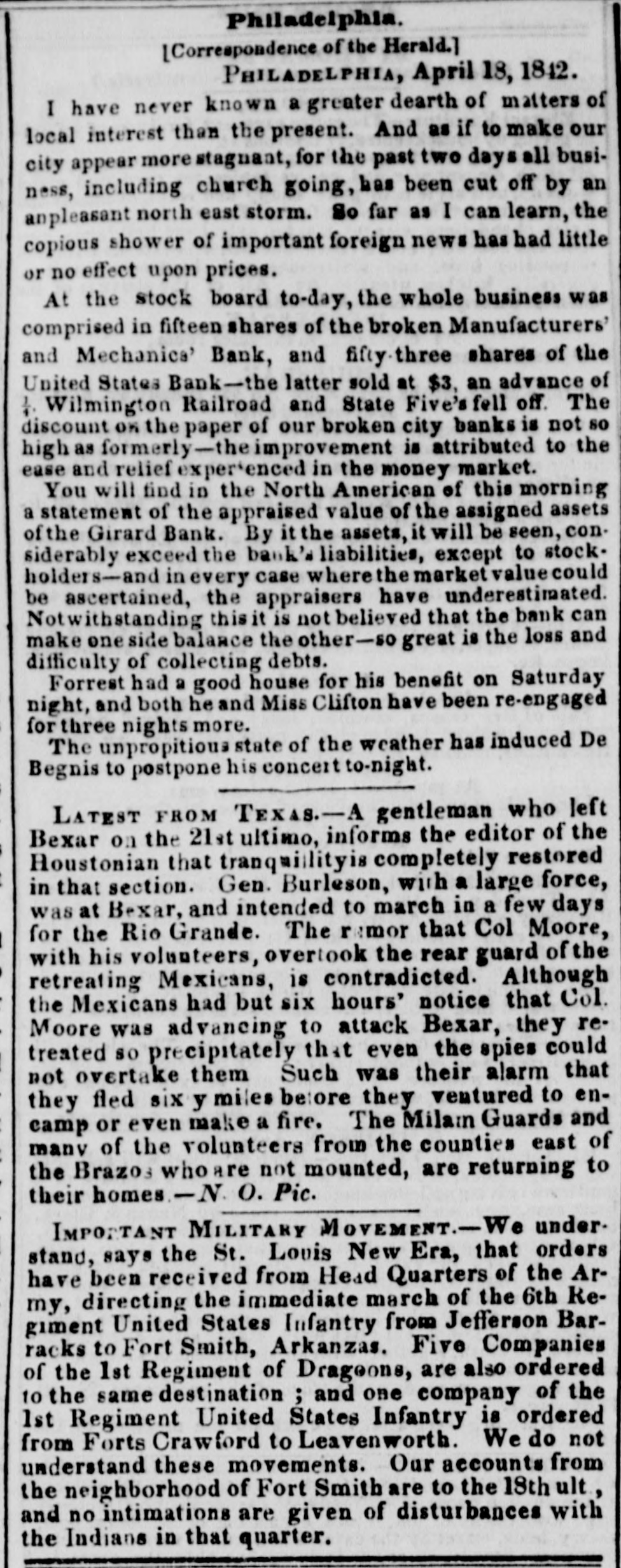

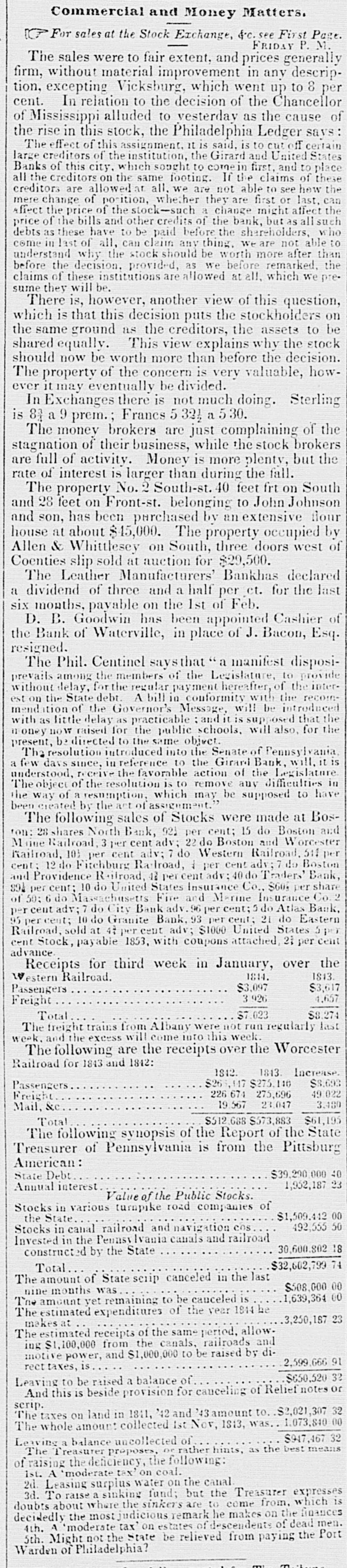

MONEY MARKET. TUESDAY, FEB. 4-6P. M. The rumor, that the Pennsylvania loan had been taken, and the interest due on the whole debt paid, connected with the favorable Message of Gov. Porter, seemed to create a little buoyancy in Wall street, and a slight improvement was visible in some stocks, although the sales were small. Harlem rose per cent.; N.A. Trust, 1 per cent.; Delaware and Hudson, 1 per U.S. I per cent.; Stonington, 1 per cent. Am. t per cent., and Dry per in this last mentioned a The Ex. cent.; Bank decline declined Bank, mentioned stock Dock is owing Bank few to 3) days want since, cent. of confidence in the directory. We a that there was some excitement on the subject, and strong endeavors were made to effect a change, which was unsuccessful. Mr. Stebbens, who has been almost sole manager, was continued in, with others. It appears that the Philadelphia loan has been taken at par. Mr. Dunlap made arrangements yesterday for an advance to the State of $870,000 on behalf of the U.S. Bank and such of the other Banks as might unite in it, the Girard and Pennsylvania Banks agreed to participate to extent and the interest will be paid. immediately each, amongst which, the of It the however of $100,000 avails Nine have nothing. Let us look at the facts case. of the Philadelphia banks have never acknowledged the necessity of suspension. The United States, and Gi rard banks failed, because the state stocks they held were inconvertible. Governor Porter, in his annual message, stated that the state must fail, unless the money was raised by taxation or new loans-the recommended the latter; the same time acknowledged that the banks were insolIn accordance with his a was created, and could not be was clearly for resumption: the people $870,000 vent. but at recommendation, and sold, the because banks, lend. the On if loan obliged will Tues. for of o pay their n debts, would have nothing to day last the insolvent banksant a committee to Harrisburgh. On Thursday the resumption bill passed the House,by a large majority;on Saturday the state failed, and on the same day the Governor to the Legislature, containing the following pasrigorous a system measures the payment of the sent eage. ed to a coerce "Ibelieve iftoo message liabilities and of will of the be banks seriously be imme- adopt- and diately, the credit of the state must affected." Or in other will lend their irredeemable paper as a means state debt, if they can have own say disastrously ing the they their words. the State the time bank must to committee take resume- of pay- care but if you oblige them to resume, of itself. On Monday the committee returned to Philadelphia, and on Tuesday it is announced that the insolvent banks have taken the loan. It is now perfectly well under if the bill passes, the Governor of remark, also, that the United in Europe $1,500,000 of state pledged stood worthy that stocks, all will issued States that veto the in Bank state it. August It has has is last, for money to pay its own debts. And received is a credit on the books of the bank for $1,000,000 which figures in the Treasurers report as money oa hand." A large proportion of the $600,000 due on Saturday is payable in,Europe, and must be remitted specie, a feat which neither the state nor the U. S. Bank can well accomplish at this moment. STATEMENT OF THE LEADING FEATURES OF THE BANK OF PENNSYLVANIA, ON THE 3RD INST., AS COMPARED WITH THE RETURN OF JAN. 1839. Feb. 1840. Increase Decrease. Jan. 1839. 3,630,205 390,607 4,020,913 Loans, 518 497 21,674 498,823 Specify 595,827 296,410 Circulation, 882,237 374,220 1,420,048 1,045,828 Deposits, We have frequently had occasion to mention the fraudulent issue of post notes by some of the new banks, particularly the "City Trust Banking Company." We will mention an operation, that concera. Persons whose names we have, were cance Fined in the operation of a machine in Clearfield county, ) l' c a carry on the business, they got their notes at the City Trust for post of $900. These they of about $400, when they disposed to discounted the amount remitted lost notes character. at to twelve the agent, in months, conse- who quence of the reports in the Herald. As the agent then came on and discovered that the remittances of the money had failed: he then applied to the City Trust for some security that would enable him to use the notes, which was refused. He was finally enabled to realise about 10 per cent, or $50. which is all he has been able to get. There are many small associations, among which is the Hudaon River Bank, that are preparing a large amount of these bills, for the purpose of inundating Ohio, Indiana, Illinois, and other states with them, for the purchase of produce. Letour western friends be cantious not to touch one of them. They are utterly worthless and fraudulent. RETURNS OF THE *BANKS IN MAINT, FIRST MONDAY OF JANUARY. 1840, AS COMPARED WITH JAN. 1939. Banks, Bills in circui's Deposites. Specie. Loans 5079 58,757 2,003 23,679 Androscoggin, 149,539 Augusta, 4,254 19,142 36,103 Agricultural,