Article Text

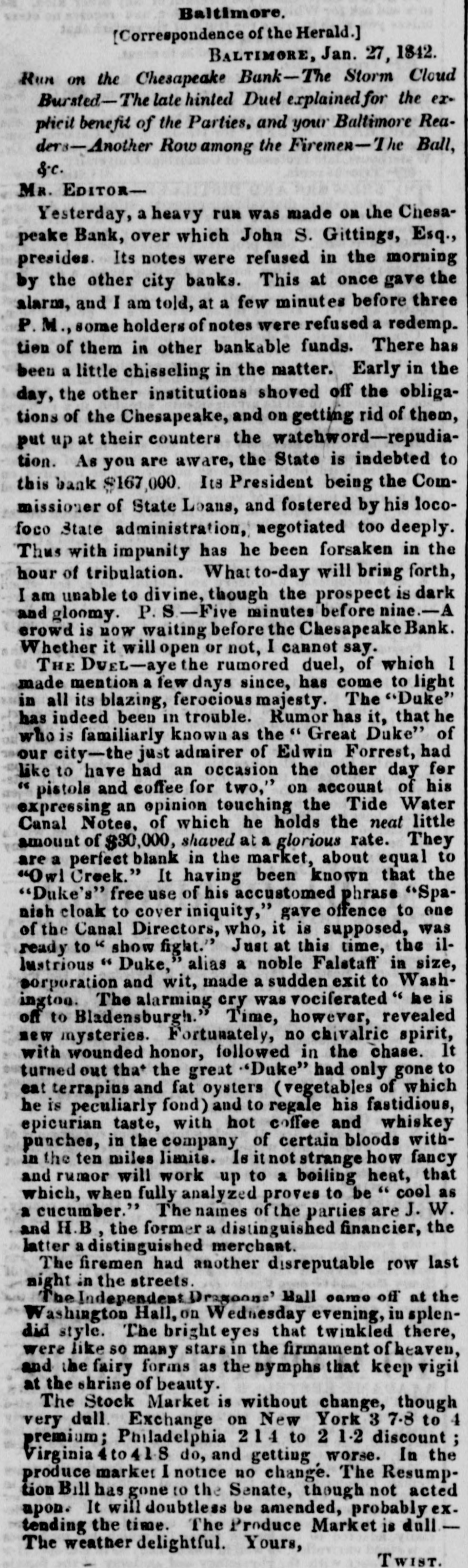

Baltimore. [Correspondence of the Herald.] BALTIMORE, Jan. 27, 1842. Run on the Chesapeake Bank-The Storm Cloud Bursted-The late hinted Duel explained for the explicit benefit of the Parties, and your Baltimore Readers Another - Row among the Firemen-The Ball, &.c. MR. EDITORYesterday, a heavy run was made ON the Chesapeake Bank, over which John S. Gittings, Esq., presides. Its notes were refused in the morning by the other city banks. This at once gave the alarm, and I am told, at a few minutes before three P.M., some holders of notes were refused a redemp. tien of them in other bankable funds. There has been a little chisseling in the matter. Early in the day, the other institutions shoved off the obligations of the Chesapeake, and on getting rid of them, put up at their counters the watchword-repudiation. As you are aware, the State is indebted to this bank $167,000. Its President being the Commissioner of State Loans, and fostered by his locofoco State administration, negotiated too deeply. Thus with impunity has he been forsaken in the hour of tribulation. What to-day will bring forth, I am unable to divine, though the prospect is dark and gloomy. P. S -Five minutes before nine.-A erowd is now waiting before the Chesapeake Bank. Whether it will open or not, I cannot say. THE DVEL-aye the rumored duel, of which I made mention a few days since, has come to light in all its blazing, ferocious majesty. The "Duke" has indeed been in trouble. Rumor has it, that he who is familiarly known as the " Great Duke" of our city-the just admirer of Edwin Forrest, had like to have had an occasion the other day fer pistols and coffee for two," on account of his expressing an opinion touching the Tide Water Canal Notes, of which he holds the neat little amount of $30,000, shaved at a glorious rate. They are a perfect blank in the market, about equal to "Owl Creek. It having been known that the "Duke's" free use of his accustomed phrase "Spanish cloak to cover iniquity," gave offence to one of the Canal Directors, who, it is supposed, was ready to " show fight." Just at this time, the ilJustrious Duke, alias a noble Falstaff in size, corporation and wit, made a sudden exit to Washingtoo. The alarming cry was vociferated he is off to Bladensburgh.' Time, however, revealed new mysteries. Fortunately, no chivalric spirit, with wounded honor, followed in the chase. It turned out tha+ the great 'Duke" had only gone to eat terrapins and fat oysters (vegetables of which he is peculiarly fond) and to regale his fastidious, epicurian taste, with hot coffee and whiskey punches, in the company of certain bloods within the ten miles limits. Is it not strange how fancy and rumor will work up to a boiling heat, that which, when fully analyzed proves to be " cool as a cucumber. The names of the parties are J. W. and H.B, the former a distinguished financier, the latter a distinguished merchant. The firemen had another disreputable row last night in the streets. The Independent Dragoons' Hall came off at the Washington Hall, on Wednesday evening, in splendid style. The bright eyes that twinkled there, were like so many stars in the firmament of heaven, and the fairy forms as the nymphs that keep vigil at the shrine of beauty. The Stock Market is without change, though very dull. Exchange on New York 3 7.8 to 4 premium; Philadelphia 214 to 2 1-2 discount Virginia to 418 do, and getting worse. In the produce market I notice no change. The Resumption Bill has gone to the Senate, though not acted upon. It will doubtless be amended, probably tending the time. The Produce Market is dull The weather delightful. Yours, TWIST.