Click image to open full size in new tab

Article Text

# MONEY MARKE

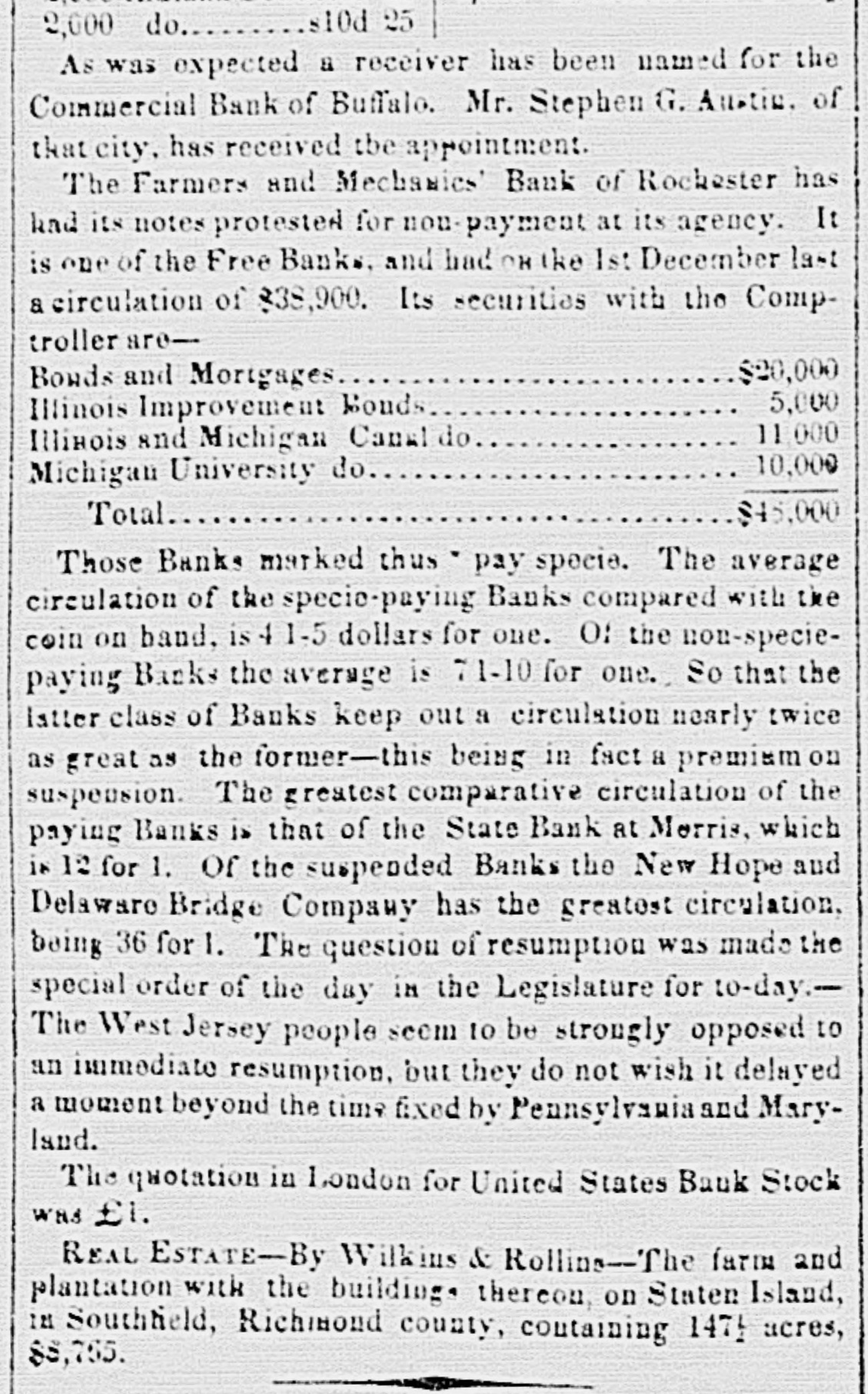

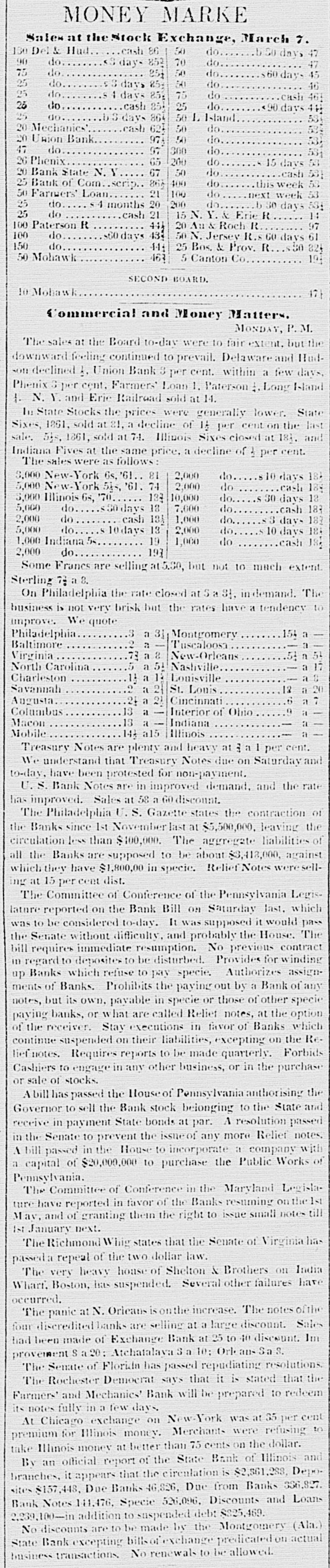

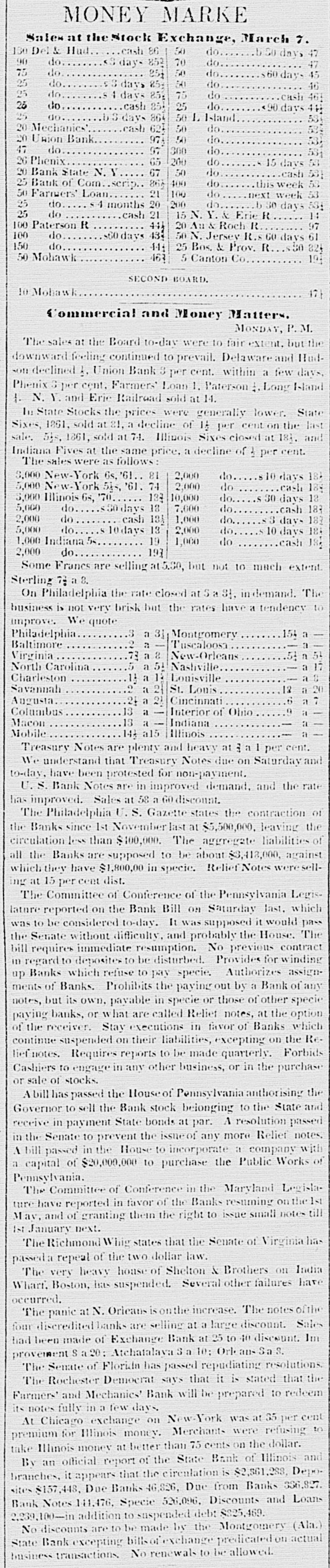

Sales at the Stock Exchange, March 7.

130 Del & Hud.cash 86 50 do..b So0 days 47

90 do...$$ days 852 70 do... 47

75 do 251 50 do.... 60 days 45

25 do. 53 days 85 50 do 46

95 do.. ..s 4 days 851 75 do cash 461

25 do .cash 25 25 do.. ..≤90 days 4

25 do.... ..b 3 days 864 50 L Island. 534

20 Mechanics'.. .cash 624 50 do..

20 Union Bank... 974 50 do.. 47

47 do.. 97 300 do.. 531

26 Phenix. 65 200 do.. 15 days 53

20 Bank State N. Y. 67 50 do ...cash 53

25 Bank of Com..scrip.. 86 400 do this week 53

50 Farmers' Loan.... 21 100 do.. next week 53

25 do s 4 months 20 200 do..b 30 days 531

25 do ...cash 21 15 N. Y. & Erie R 14

100 Paterson R 44 20 Au & Roch R. 97

100 do... 560 days 433 50 N. Jersey R.s 60 days 61

150 do.. 441 25 Bos. & Prov. R...s30 824

50 Mohawk 463 5 Canton Co 19

SECOND BOARD.

10 Mobawk.. 17

# Commercial and Money Matters.

MONDAY, P. M.

The sales at the Board to-day were to fair extent, but the

downward feeling continued to prevail. Delaware and Hud-

son declined, Union Bank 3 per cent. within a few days,

Phenix 3 per cent, Farmers' Loan 1. Paterson, Long Island

4. N. Y. and Eric Railroad sold at 14.

Tu State Stocks the prices were generally lower. State

Sixes, 1861, sold at 21, a decline of 1 per cent on the last

sale. 51s, 1861, sold at 74. Illinois Sixes closed at 184, and

Indiana Fives at the same price, a decline of per cent.

The sales were as follows:

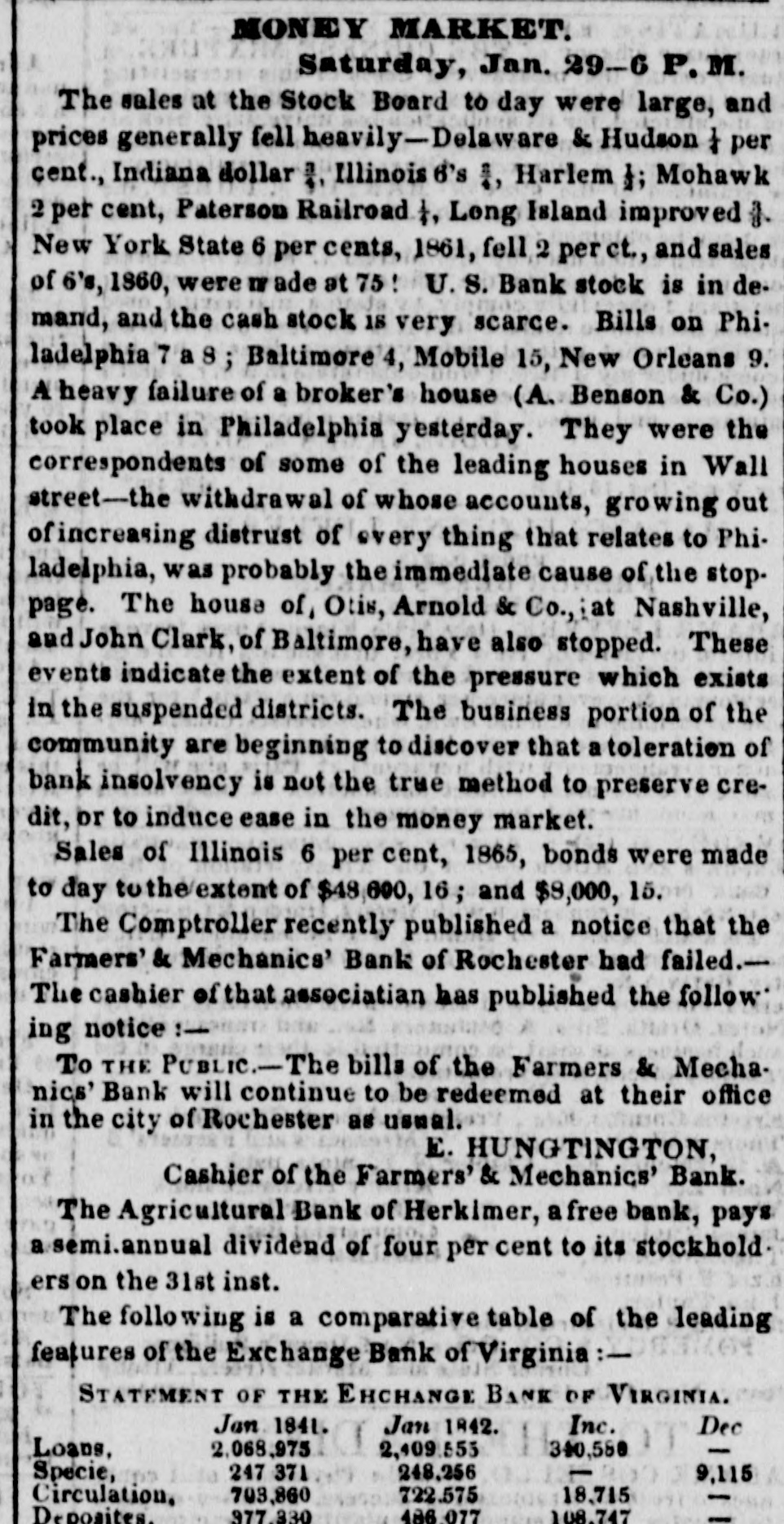

3,000 New-York 6s, '61..81 2,000 dos 10 days 184

5,000 New-York 5s, 61. 74 2,000 do ...cash 184

5,000 Illinois 6s, '70. 183 10,000 dos 30 days 18

2,000 dos 30 days 18 7,000 do... .cash 183

2,000 do cash 13 1,000 do.s 3 days 182

5,000 dos 10 days 13 5,000 dos 10 days 184

2,000 dos 10 days 184 1,000 Indiana 5s.. 19

1,000 do ....cash 18 2,000 do. 193

Some Francs are selling at 5.30, but not to much extent.

Sterling 7 a 8.

On Philadelphia the rate closed at 5 a 31, in demand. The

business is not very brisk but the rates have a tendency to

improve. We quote

Philadelphia.. 3 a 3 Montgomery 154 a

Baltimore 2 Tuscaloosa a

Virginia .73 a 2 New-Orleans 54 n 54

North Carolina .5 a 51 Nashville.. a 17

Charleston 14 a 12 Louisville as

Savannal 2 a 2 St. Louis. 12 a 20

Augusta.. 24 a 2 Cincinnati 6a7

Columbus 13 a Interior of Ohio.9 a

Macon 13 a Indiana a

Mobile ..14 a15 Illinois a

Treasury Notes are plenty and heavy at al per cent.

We understand that Treasury Notes due on Saturday and

to-day, have been protested for non-payment.

U. S. Bank Notes are in improved demand, and the rate

has improved. Sales at 58 a 60 discount.

The Philadelphia U. S. Gazette states the contraction of

the Banks since 1st November last at $5,500,000, leaving the

circulation less than $100,000. The aggregate liabilities of

all the Banks are supposed to be about $3,418,000, against

which they have $1,800,00 in specie. Relief Notes were sell-

ing at 15 per cent dist.

The Committee of Conference of the Pennsylvania Legis-

lature reported on the Bank Bill on Saturday last, which

was to be considered to-day. It was supposed it would pass

the Senate without difficulty, and probably the House. The

bill requires immediate resumption. No previous contract

in regard to deposites to be disturbed. Provides for winding

up Banks which refuse to pay specie. Authorizes assign-

ments of Banks. Prohibits the paying out by a Bank of any

notes, but its own, payable in specie or those of other specie

paying banks, or what are called Relief notes, at the option

of the receiver. Stay executions in favor of Banks which

continue suspended on their liabilities, excepting on the Re-

lief notes. Requires reports to be made quarterly. Forbids

Cashiers to engage in any other business, or in the purchase

or sale of stocks.

A bill has passed the House of Pennsylvania anthorising the

Governor to sell the Bank stock belonging to the State and

receive in payment State bonds at par. A resolution passed

in the Senate to prevent the issue of any more Relief notes.

A bill passed in the House to incorporate a company with

a capital of $20,000,000 to purchase the Public Works of

Pennsylvania.

The Committee of Conference in the Maryland Legisla-

ture have reported in favor of the Banks resuming on the 1st

May, and of granting them the right to issue small notes till

Ist January next.

The Richmond Wing states that the Senate of Virginia has

passed a repeal of the two dollar law.

The very heavy house of Shelton & Brothers on India

Whart, Boston, has suspended. Several other failures have

occurred.

The panic at N. Orieaus is on the increase. The notes of the

four discredited banks are selling at a large discount. Sales

had been made of Exchange Bank at 25 to 40 discount. Im-

provement S a 20: Atchatalaya 3 a 10; Orleans Sa S.

The Senate of Florida has passed repudiating resolutions.

The Rochester Democrat says that it is stated that the

Farmers' and Mechanics' Bank will be prepared to redeem

its notes fully in a few days,

At Chicago exchange on New-York was at 35 per cent

premium for Illinois money. Merchants were refusing to

take Ilinois money at better than 75 cents on the dollar.

By an official report of the State Bank of Illinois and

branches, it appears that the circulation is $2,361,288, Depo-

sites $157,448, Due Banks 46,826, Due from Banks 336,827.

Bank Notes 141,476, Specie 526,096, Discounts and Loans

2,239,100-in addition to suspended debt $825,469.

No discounts are to be made by the Montgomery (Ala.)

State Bank excepting bills of exchange predicated on actual

business transactions. No renewals to be allowed.