1.

October 17, 1907

The Laramie Republican

Laramie, WY

Click image to open full size in new tab

Article Text

HEINZE MAY RESIGN AS PRESIDENT OF BANK of Butte. The state has about $75,000 CONSIDERING POSSIBILITY OF of state funds in the bank. LEAVING MERCANTILE NABulletin on the Door. TIONAL OF NEW YORK The following bulletin was posted on the door of the bank: IN A SHORT TIME. "Because of the unsolid conditions and rumors that cannot be verified, and that may cause unusual demands Crisis in Affairs of United Copper by depositors, and owing to a shortage Company Reached Yesterday, in of currency and our inability to secure additional currency immediately to Failure of Firm Doing Brokerage pay the demands which may be made, Business for Heinze-Some Excitethe management has deemed it adment on Stock Exchange and Some visable, in the interests of all the depositors, to suspend for the time beRather Cutting Statements Made. ing. The bank is solvent." Officials Say No More. Further than this notice, the bank New York, Oct. 17.-F. Augustus officials will make no statement. Heinze, president of the United Cop-

2.

October 18, 1907

The Pacific Commercial Advertiser

Honolulu, HI

Click image to open full size in new tab

Article Text

Failures Are Widespread HOUSTON, Texas, October 18.-A private bank closed its doors here yesterday, its liabilities being two million dollars. NEW YORK, October 17.-The Otto Heinze Company of brokers today suspended business. F. Augustus Heinze has resigned the presidency. The Mercantile National Bank and Haller Sochle Company, bankers of Hamburg, Germany, have failed, and the State Savings Bank, of Butte, Montana, has suspended, all as a result of the unprecedented slump in copper. HAMBURG, October 18.-The firm of Haller Sochle has failed for seven millions.

3.

October 18, 1907

Omaha Daily Bee

Omaha, NE

Click image to open full size in new tab

Article Text

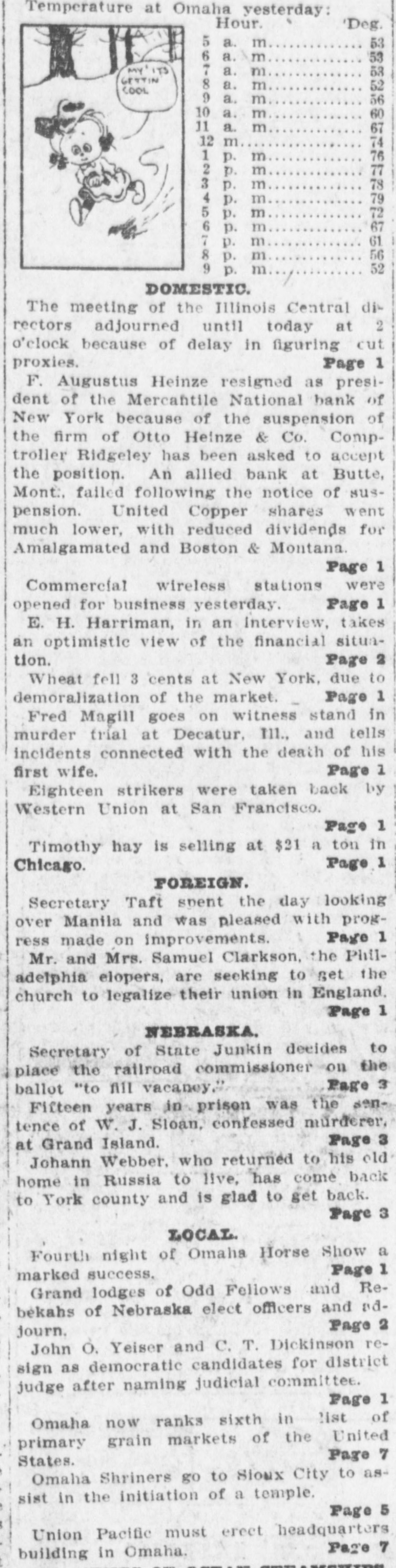

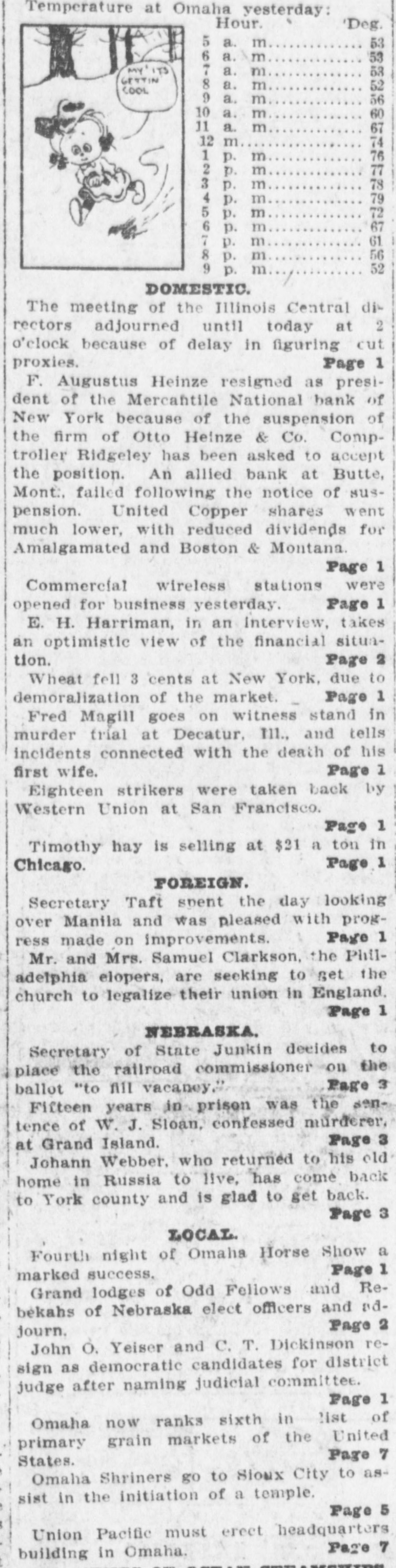

Temperature at Omaha yesterday: Hour. Deg. 5 a. m 53 6 a. m 53 MY ITS 7 a. m 53 It GETTIN 8 a. m 52 COOL 9 a. m 56 10 a. m 60 11 a. m 67 12 m 74 ao 76 1 p. m 77 2 p. m 78 3 p. m 79 4 p. m 72 5 p. m 67 6 p. m 61 7 p. m 56 8 p. m 52 9 p. m DOMESTIC. The meeting of the Illinois Central di2 rectors adjourned until today at o'clock because of delay in figuring cut proxies. Page 1 F. Augustus Heinze resigned as president of the Mercantile National bank of New York because of the suspension of the firm of Otto Heinze & Co. Comptroller Ridgeley has been asked to accept the position. An allied bank at Butte, Mont., failed following the notice of suspension. United Copper shares went much lower. with reduced dividends for Amalgamated and Boston & Montana. Page 1 Commercial wireless stations were opened for business yesterday. Page 1 E. H. Harriman, in an Interview, takes an optimistic view of the financial situation. Page 2 Wheat fell 3 cents at New York, due to demoralization of the market. Page 1 Fred Magill goes on witness stand in murder trial at Decatur. 111., and tells incidents connected with the death of his Page 1 first wife. Eighteen strikers were taken back by Western Union at San Francisco. Page 1 Timothy hay is selling at $21 a ton in Page 1 Chicago. FOREIGN. Secretary Taft spent the day looking over Manila and was pleased with progPage 1 ress made on improvements. Mr. and Mrs. Samuel Clarkson, the Philadelphia elopers, are seeking to get the church to legalize their union in England, Page 1 NEBRASKA. Secretary of State Junkin decides to place the railroad commissioner on the Page 3 ballot "to fill vacaney. Fifteen years in prison was the sentence of W. J. Sloan, confessed murderer, Page 3 at Grand Island. Johann Webber. who returned to his old home in Russia to live, has come back to York county and is glad to get back. Page 3 LOCAL. Fourth night of Omaha Horse Show a Page 1 marked success. Grand lodges of Odd Fellows and Rebekahs of Nebraska elect officers and adPage 2 journ. John O. Yeiser and C. T. Dickinson resign as democratic candidates for district judge after naming judicial committee. Page 1 Omaha now ranks sixth in list of primary grain markets of the United Page 7 States. Omaha Shriners go to Sioux City to assist in the initiation of a temple. Page 5 Union Pacific must erect headquarters Page 7 building in Omaha.

4.

October 19, 1907

Evening Star

Washington, DC

Click image to open full size in new tab

Article Text

MERCANTILE MIX UP House Committee Clearing Perplexed. RIDGELY WILL NOT ACCEPT Question Whether He Will Assume the Presidency. OTHER BANKS IN TROUBLE Debit Balance of the Bank Is Over $1,000,000-May Be Forced to Suspend. NEW YORK, October 19.-A perplexing situation today faced the bankers and financiers who are trying to straighten out the affairs of the Mercantile National Bank and to divorce it completely from any association with F. Augustus Heinze, its former president. With the resignation of Its entire board of directors in the hands of the clearing house, that institution appeared to control the situation and was committed to the task of putting the bank on a firm footing. For this purpose nine .clearing house banks had promised to contribute $200,000 each to tide the Mercantile Bank over any distress which it might encounter as a result of the suspension of Otto Heinze

5.

October 19, 1907

Albuquerque Citizen

Albuquerque, NM

Click image to open full size in new tab

Article Text

SITUATION PURELY A LOCAL AFFAIR No Spread Of Trouble On Market Expected And Matters Are Well In Hand--Stocks Did Not Decline Much Today. New York, Oct. 19.-A perplexing situation is being faced by the bankto and financiers who are trying straighten out the affairs of the Mercantile National bank and divorce it completely from association with F. Augustus Heinze, its former president. With the resignations of its entire board of directors in the hands of the clearing house, that institution appeared to control the situation and was committed to the task of putting the bank on a firm footing. For this purpose nine clearing house banks had promised to contribute $200,000 each to tide the Mercantile bank over any distress it might encounter as a result of the suspension of Otto Heinze and company, and it is F. Augustus Heinze's desire to reestablish that firm. The debit balance of the Mercantile bank to the clearing house this morning was one million one hundred thousand dollars. Heinze Talks. F. Augustus Heinze said today: "I still hold a controlling interest I in the Mercantile National bank. have not parted with a share of my Mercantile stock and I would like to say this about the clearing house committee, It was asked to come into our bank and make a thorough examination. It found it perfectly solvent and said so. Later it added that gratituous. blow about 'surplus impairment.' You know why it did that. Nothing more or less than to induce our depositors to withdraw their accounts. A fine game. It was endeavoring to attract our deposits to its own bank." No Sensational Decline. Stocks declined in the final dealings today, closing weak at the low3 est of the day in most of the active 1 stocks. The closing quotations on United Copper common on the curb was 8 7/3 bid, 9 1/4 asked. While the , prices of metal stocks declined today, the losses were not sensational and the prices of railroad stocks were held better than had been expected. Situation Purely Local. It is an evident fact now that the situation is purely local and that no one will be hurt outside the Heinze interests. Confidence in all other stocks and institutions is being rapidly restored, and the clearing house association has the banking situation will in hand. The solvency of the $ banks of New York is unquestioned today, and while a few of the Heinze institutions throughout the country may be slightly crippled, it is the general belief that his firm will pay out dollar for dollar. ) Heinze has asked that the firm be permitted to do this and be reinstated on change, and while it is hardly likely that the latter request will be $ granted, the clearing house will take steps to see that all claims are paid as far as the brokers' estates have e the funds.

6.

October 19, 1907

Santa Fe New Mexican

Santa Fe., Santa Fe, NM

Click image to open full size in new tab

Article Text

BIG BANK ON VERGE OF FAILURE Affairs of Mercantile National in Bad Tangle DOESN'T WANT PRESIDENCA Comptroller of the Currency Turns Down Invitation to Assume Control. New York, Oct., 19-A most perplex ing situation is being faced by bankers and financiers who are trying to straighten out the affairs of the Mercantile National Bank and divorce it completely from its association with F. Augustus Heinze, its former president. With the resignation of its entire board of directors in the Clearing House that institution appeared to control the situation and was comitted to the task of putting the bank on a firm footing. For this purpose nine Clearing House banks had promised to contribute $200,000 each to tide the Mercantile National Bank over any distress it might encounter as a result of the suspension of Otto Heinze and Company. It is F. Augustus Heinze's desire to re-establish that firm. The debit balance of the Mercantile Bank to the Clearing House this morning was one million one hundred thousand dollars. Stocks declined in the final dealings today, closing weak and at the low. est point of the day in most of the active stocks. The closing quotations on United Copper Common on the curb were 8 7-8 bid, 9 1-4 asked. Heinze Calls it Spite Work. F. Augustus Heinze said today: "I still hold a controlling interest in the Mercantile National bank. have not parted with a share of my Mercantile stock. I would like to say this about the Clearing House committee and that is they were asked to come into our bank and make a thorough examination. They found it perfectly solvent and said so. Later they added that gratuitous blow about the surplus impairment. You know why they did that. It was for nothing more or less than to induce our depositors to withdraw their accounts. A fine game. They were endeavoring to attract deposits to their own banks." While the prices of metal stocks declined today the losses were not sensational and the prices of railroad stocks were held better than had been expected. Ridgley Declines Presidency. Washington, D. C., Oct. 19.-Comptroller of the Currency W. B. Ridgley today declined the presidency of the Mercantile National Bank of New York.

7.

October 19, 1907

The Marion Daily Mirror

Marion, OH

Click image to open full size in new tab

Article Text

Bank's Directors are Forced to Resign New York, Oct. 19.-The clearing house on Friday demanded the resignation of every director of the Mercantile national bank as a condiion of the clearing house coming to he assistance of that bank. The resignations were immediately signed and delivered to the president of the clearing house. It was semi-officially innounced that Comptroller of the Currency Ridgely had accepted the presidency of the Mercantile national sank. The fall in prices in some tocks Friday equalled that in some f the panic periods of the past. The narket was at times demoralized.

8.

October 19, 1907

Waterbury Evening Democrat

Waterbury, CT

Click image to open full size in new tab

Article Text

BANKERS BALKED Financial Siluation Owing to the Heinze Resignation Has Raised a Perplexing Issue BANKS HELPING OUT New York, Oct 19.-A perplexing financial situation to-day faced the bankers and financiers who are trying to straighten out the affairs of the Mercantile National bank and to divorce it completely from any association with F. Augustus Heinze, its former president. With the resignations of its entire board of directors in the hands of the clearing house, that institution appeared to control the situation and was committed to the task of putting the bank on a firm footing. For this purpose nine clearing house banks had promised to contribute $200,000 each, a total of $1,800,000 to tide the Mercautile bank over any distress which it might encounter as a result of the suspension of Otto Heinze & Co and F. Augustus Heinze's desire to re-establish that firm. Public interest in the situation lay in the action to be taken by Comptroiler of the Currency William B. Ridgely, whose acceptance of the presidency of the Mercantile was still in some doubt. It is understood early to-day that Mr Ridgely's decision depended upon whether he would be allowed a free hand in reorganizing the bank and whether he would secure the support of men whom he desired to back him in the task. The stock market opened irregular, gains and losses being mixed. The clearing house committee went into session this morning to consider the affairs of the Mercantile National bank. Opening quotations of United Copper common stock, the Heinze copper property, in the curb market to-day were at $10 a share as compared with a closing price of 10 1/8 last night. Bonds of the Consolidated Steamship Co, controlled by C. W. Morse, who has been associated with Mr Heinez in the Mercantile bank, were sold at the opening at $17, as compared with $18, yesterday's close.

9.

October 19, 1907

The Cairo Bulletin

Cairo, IL

Click image to open full size in new tab

Article Text

STREET TRYING TO DOWN HEINZ FOUGHT TOO HARD IN PAST TO HAVE MANY FRIENDS LEFT. HIS BANK UNDER PROBE Montana State Examiner In Butte To Look Into Condition Of Suspended Bank-Believed Salvent. New York, Oct. 18.-Following the relentless pounding of F. Augustus Heinze's mining stock, the suspension of his brother's brokerage firm, the suspension of his Bute, (Mont.) saving bank and his resignation as presi dent of the Mercantile National Bank after sacrificing his holdings, the t Clearing House Committee at a secret 1 meeting began an examination into I the affairs of the Mercantile National Bank. t t The outcome of the examination. as S declared by a member of the com i mittee, is that the bank was found I perfectly solvent. The presidency of the bank has been offered to William S f B. Ridgely, comptroller of the Cur n reney at Washington. It is believed he will accept. b The meeting of the Clearing House. a called secretly that there might be no T apprehension excited in the financial W district, was an unusual occurrence, d the last occasion of the kind having H been in 1903 in the financial emerto gency of that year. The members a went into the Clearing House singly T and met in the committee room be ti hind closed doors. The only member of the committee who failed to appear di was James T. Woodward, president of the Hanover National Bank. SI m The conference lasted one hour, and at upon the highest authority it may be In said the only subject discussed was 0) the affairs of the Mercantile National th Bank. Ways and means were considered to meet any emergency that might arise as the reult of the Heinze connection with the institution. In no direction that he might look could F. Augustus Heinze see any sig nals of sympathy or aid in Wall street. He has been a merciless fifhter all his life. and he is in a land without mercy. He has been caught, as many others have been caught, his loans have been called and his W stock has been hammered; but he has this advantage-his resources are great and he can stand hard chastisement. One nice little jolt given him was a formal notice that he must get out of Do the Mercantile National Bank in the interest of the bank. He has bought into the bank at $300 a share. He was told that a syndicate of the friends of Mr. Ridgeley insisted on the purchase of a substantial interest gra in the institution as a condition preJoi cedent to his acceptance of the presiwh dency, and this syndicate fixed the hu price of the shares at $200. That price ve was accepted.

10.

October 19, 1907

The News-Democrat

Providence, RI

Click image to open full size in new tab

Article Text

MERCILESS SLAUGHTER OF STOCKS New York, Oct. 19.-A merciless slaughter of stock values took place again yesterday. Into the serious situation created by the collapse of the United Copper corner there were hurled, before trading began, rumors affecting the solvency of many of the banks. A storm of tremendous intensity and resistless fury broke as soon as the market opened. In the afternoon when it became known that the Clearing House demanded as a condition of coming to the assistance of the Mercantile National the resignation of every one of the bank's directors, the whirlwind swept all before it. Before the close, when vague reports of suspensions and bank crashes had failed to materialize, a measure of support and covering by the shorts assisted the rally which developed. , A survey of the field when trading for the day was over showed that the final quotations on 30 railroad and industrial stocks averaged 851/4, against an average the day previous at 867/g. The same stocks a month ago averaged 95% and a year ago 1397/s. About 1,000,000 shares changed hands during the day at the lowest prices of the year, for even the highest quotations during the session were well below the averange of prices at the low points of the March and August slumps. From noon until after 2 o'clock, while the wildest excitement held full sway, the market broke wide open and new low records were recorded momentarily. The big operators said that to-day was by no means a "Black Friday," but they expressed deep satisfaction that a short Saturday and Sunday would compel a lull, during which measures could be taken to meet the existing conditions,

11.

October 20, 1907

The Montgomery Advertiser

Montgomery, AL

Click image to open full size in new tab

Article Text

MR. RIDGELY WON'T ACCEPT Decli is Presidency of ew York Bank. THE FINANCIAL SITUATION Mercantile National Bank May Go Into Liquidation. The Distinct Lull Yesterday Was Welcomed In Wall Street And The Previous Excitment Has Materially Subsided. York, Oct. 19-There was a sigh disNew relief throughout the financial of the of when the short session marking trict, exchange ended today, panicky stock of one of the most for the weeks close that Wall Street has known a long time. of declination of the presidency by WillThe National Bank of the Mercantile Ridgely, Federal Comptroller after lam B. did not come and until therethe Currency, day was over, or the C the business no effect on the market situation in the financial may be when to say, the fore had general. market finan- What effect Monday it is impossible of opens it is the general opinion holiday will ciers that settle matters in the serve but that to the there week-end are unexpected street situation, and deunless the delicate will t velopments in in a large measure restored weekly by bank statement of $6,443,100 The addition banks, e confidence unexplained Monday. of the showed bring- above be to an cash holdings $11,180,000 the cash This is the the ing holdings reserves. preparing taken required the banks are may be themselves them next to mean that for any crisis week. that curb forced the on stock exchange stock dealt and in the sufferpractically On every decline during the week. listed ed a net Copper, which is not on the a curb stock United and is net dealt decline in only of the 38 3-8 preferred. for the closing suffered common at a and 7 3-4 exploration 1-2 and for 25 respectively. dropped 45 points. Guggenheim the exchange. Amalgameted closing today Cop- 1-8 at per On reached and showing 43 1-2, a low net point loss of roached years for 44 1-8, the the week. bottom The price for below several the high point was was 77 3-4 points year. American mark of Smelting and also showed a low net loss figure was 611-1 week. The the high price the t on 3-4 point and undeh 77 Railroads 1-2 under and indus- but and the the year for 1906. the made a new the low of weak, 12 points low for 93 case price for suffered during in almost every figfor are F. gave Heinze tonight the trials close substantially today was above the low out Augustus in a he that in said which statement he the which gave interview on to the he did not out, reflect intend His of the House. Clearing committee to he other said, referred rehad made who statements the Bank, National garding not but these members He House Clearing we Committee. of any criticising of member had the no of Intention that

12.

October 22, 1907

Daily Kennebec Journal

Augusta, ME

Click image to open full size in new tab

Article Text

IMPROVING. New York Bank Situation Looks Much Better. Action of Clearing House Serves to Prevent Alarm. Many Banks Affected, Though, Still Need Assistance. New York, Oct. 21.-The recent tension of the banking community was todayconsiderably relieved and the day passed with no adverse developments of a serious character but with much reassuring. At the same time there was evidence that some of the banks most affected by recent events were still in need of assistance. but the promptness with which the Clearing House accorded it did much to allay further alarm. The general improvement was reflected in the buoyancy of the stock market and the steady advance in prices from previous low levels. On the other hand, the conservative element deferred a too optimistic view until the relief given by the Clearing House had continued for several days and had permanently re-established the stability of some of the weaker institutions, notably the Mercantile National Bank and the New Ainsterdam National Bank. The Clearing House was called upon today to meet debit balances of the Mercantile and the New Amsterdam Banks to the extent of upwards of $2,000,000. of which the Mercantile owed about $1,900,000 and the New Amsterdam $200,000. The debit balance of the National Bank of North America amounted to $850,000. While there was said to have been some discussion between the Clearing House committee and the officers of the latter bank a3 to the necessity of giving it any support, it was not found necessary to do SO and William M. Havemeyer, the president of the institution, declared that the Bank of North America had not and would not ask one dollar's aid from the Clearing House. "The situation," Mr. Havemeyer said, "is really far better than we expected. So far only about $150,000 has been withdrawn. When the bank opened this morning we had a million dollars on hand to pay all comers, but only a small portion was used." The fact that the Clearing House committee regards the situation as still serious was shown by the remark of a member of the committee that the Mercantile Bank's debit balance was "unexpectedly large and disconcerting." The committee remained in session the greater part of the day discussing a general plan of policy with regard to assisting such banks as might need help. After the committee had adjourned for the day. James T. Woodward. president of the Hanover National Bank and chairman of the committee. said the conditions were improving and that the committee felt equal to meeting any emergency that might arise tomorrow. William Sharer, manager of the Clearing House, said the situation was under control that some of the more awkard features had been eliminated. and that

13.

October 22, 1907

The Daily Banner

Cambridge, MD

Click image to open full size in new tab

Article Text

BANKS RELIEVED The New York Clearing House Helps Two. SITUATION STILL SERIOUS Over $2,000,000 Was Required to Meet Debit Balances of the Mercantile and New Amsterdam Banks-Stock Market Was Steady. New York, Oct. 22.-The recent tension of the banking community was considerably relieved and no adverse developments of a serious character materialized. At the same time there was evidence that some of the banks most affected by recent events were still in need of assistance, but the promptness with which the clearing house accorded it did much to allay further alarm. The general improvement was reflected in the buoyancy of the stock market and the steady advance in prices from previous low levels. On the other hand, this conservative element deferred a too optamistic view until the relief by the clearing house had continued for several days and had permanently re-established the stability of some of the weaker institutions, notably the Mercantile National bank and the New Amsterdam National bank. The clearing house was called upon to meet debit balances of the Mercantile and New Amsterdam banks to the extent of upwards of $2,000,000, of which the Mercantile owed about $1,900,000, and the New Amsterdam $200,000. The debit balance of the national bank of North America amounted to $850,000. While there was said to have been some discussion between the clearing house committee and the officers of the latter bank as to the necessity of giving it any support, it was not found necessary to do so, and William F. Havemeyer, the new president of the institution, declared that the Bank of North America had not and and would not ask one dollar's aid from the clearing house. "The situation," Mr. Havemeyer said, "is really far better than we expected. So far only about $150,000 has been withdrawn. When the bank opened we had $1,000,000 on hand to pay all comers, but only a small portion was used.". The fact that the clearing house committee regards the situation as still serious was shown by the remark of a member of the committee that the Mercantile bank's debit balance was "unexpectedly large and discon certing." The National Bank of Commerce gave 24 hours' notice to the clearing house, of which it is a member, that it would no longer c.ear for the Knickerbocker company. The directors of the National would not comment upon their action. The National has for some time acted as clearing agent for the Knickerbocker. One development which did not tend to ease the prevailing conditions was the application for a receiver for the firm of Otto Heinze & Co., the brokers, who were suspended from the New York Stock Exchange last week, after a disagreement between that firm and Gross & Kleeberg, over the acceptance of a block of stock of the United Copper Co., Argument on the motion for the appointment of a receiver was deferred until Wednes day.

14.

October 24, 1907

The National Tribune

Washington, DC

Click image to open full size in new tab

Article Text

NEED FOR RADICAL REFORMS. Every day's developments in the financial world brings new and stronger support to the President's attitude in insisting that business generally in this country shall be brought back to a safe and sane basis. There was imminent need of radical housecleaning in the business world when such rottenness as that which has been developed in the investigation of the traction affairs in New York remained so long undiscovered. The vigorous probing by the Public Service Commission shows that under guise of making improvements and safe investments a lot of "financiers" have made away with over $1,000,000 of other people's money in the Metropolitan Securities Company. Lawyer Ivins, who is managing the investigation, thinks that he has only made a beginning, and is now on the track of a $250,000 check for which there is no reliable accounting. Still more to the point and bearing directly upon this urgent need of business reforms are the sensational revelations regarding the operations of F. Augustus Heinze and his brothers. Heinze has been the great copper king in the West, and his operations there have been of really royal magnificence, since they involved the mustering of real armies of men, and the fighting of pitched battles for the possession of mines. The method of the Heinzes in banking has been similar to that of Mr. Harriman in railroading. After getting control of one bank they used its money and securities to get control of the stock of another bank, which they put thru the same operation, and SO on thru an endless chain. It passeth the understanding that this operation should go on as long as it has, but at last the New York Clearing House Committee called a halt and set examiners to work. Fortunately it was found that the assets of the banks which had been put thru this operation had not been seriously impaired, tho one of them, the Mercantile National Bank, a very large institution, was found to be in a highly critical situation. The other two large banks were the National Bank of North America and the New Amsterdam National Bank. The magnitude of these institutions is shown by the National Bank of North America having loans to the amount of $15,000,000 and $13,320,000 of deposits, while the New Amsterdam Bank had $4,474,000 loans and $4,945,000 deposits. The cash reserve of all these institutions had been impaired below the legal limit. All the Heinzes and their accomplices, the Thomas brothers and C. W. Morse have been compelled to withdraw from the directorate of every bank and corporation in which they were. The Mercantile National Bank is only kept from suspending by the other bankers carrying it along, which they have now done to the amount of $1,137,000. The 'expectation is to reorganize it with men at the head in whom the people can have confidence. All this salutary housecleaning is an exceedingly bitter pill for such reckless financiers, and will be a wholesome lesson to others who have emulated their "Napoleonic" ideas of finance.

15.

January 8, 1908

The Morning Astorian

Astoria, OR

Click image to open full size in new tab

Article Text

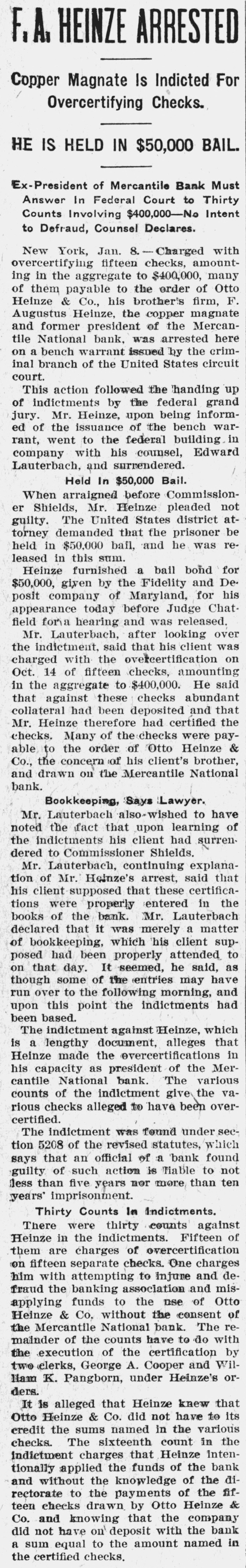

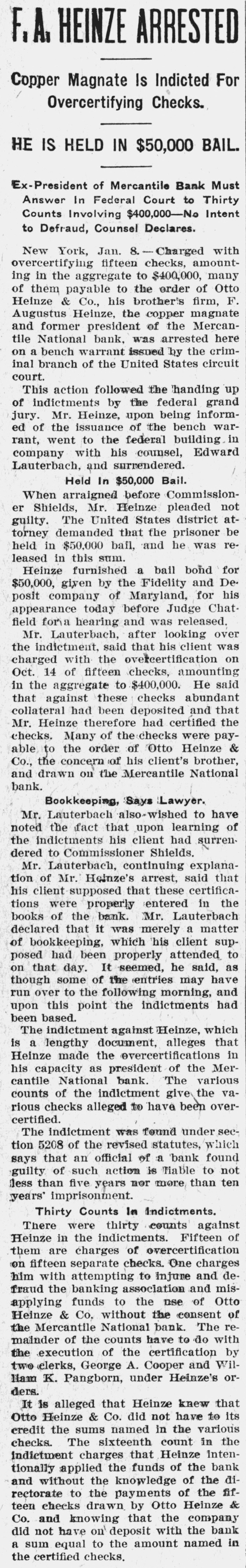

# Federal Grand Jury Takes Action

# After Investigating Defunct Bank.

FURNISHES $50,000 BONDS

Aftermath of Collapse of Heinze Pool in United Copper and the Suspension of Mercantile National Bank Results in Indictment of Copper Magnate.

NEW YORK, Jan. 7.-Indicted by the federal grand jury for the over-certification of checks, representing in the aggregate over $400,000, drawn by the firm of Otto Heinze & Co., on the Mercantile National Bank, F. A. Heinze, copper magnate and former president of the Mercantile National Bank, surrendered himself to United States Commissioner Shields today and later was released on $50,000 bail. Heinze will be formally arraigned to plead to the indictment tomorrow. Edward Lauterback, counsel for Heinze stated tonight that his client did not wilfully overcertify the checks, as he had drawn a check to the credit of Otto Heinze & Co., for the amount of $500,000 which the bookkeeper of the bank probably failed to enter on the books until the day after the certification of the checks in question. The indictment by the federal grand jury, which has been investigating the Mercantile, and other banks identified with the Heinze and Charles W. Morse interest, is the after cause of the collapse of the Heinze pool in United Copper, which brought about the suspension of Gross & Kleeburg, stock brokers, and resulted in the resignation of F. A. Heinze from the presidency and retirement of the directorate of Mercantile National Bank, after the examination of that institution had been made by the Clearing-House. He declared at the time he had been betrayed by his friends in the United Copper pool. Heinze had been informed quietly that indictments, charging him with over-certification of 15 checks, all drawn October 14, just before the smash in United Copper, had been found by the grand jury on December 2, and that his appearance would be required today.

Without awaiting service of a bench warrant, Heinze in company with his counsel appeared before Shields this afternoon. The proceedings were short. Heinze pleaded not guilty and bail was immediately furnished by a surety company.

16.

January 9, 1908

The Free Lance

Fredericksburg, VA

Click image to open full size in new tab

Article Text

HEiNZE ARRESTED Banker Charged With Illegally Certifying Checks. HELD UNDER $50,000 BAIL Indictment Is the Aftermath of Collapse of Heinze Pool In Copper and the Failure of the Mercantile Na. tional Bank. New York, Jan. 8.-Indicated by the federal grand jury for the over-certification of fifteen checks, representing. in the aggregate, over $400,000. and drawn by the firm of Otto Heinze & Company on the Mercantile National bank, F. Augustus Heinze, the copper magnate and former president of the Mercantile National bank. surrendered himself to United States Commissioner Shields, and later was released on $50,000 bail. Edward Lauterbach. counsel for Heinze, stated that his client did not wilfully over-certify the checks. as he had drawn a check to the credit of Otto Heinze & Company to the amount of $400,000 which the bookkeeper of the bank possibly failed to enter on the books until a day after the ceritfication of the checks in question. The indictment of Heinze by the federal grand jury. which has been investigating the Mercantile and other banks identified with the Heinze and Charles W. Morse Interests, is the aftermath of the collapse of the Heinze pool in United Copper and which brought about the suspension of Gross & Kleeberg. stock brokers. and subsequently resulted in the resignation of F. Augustus Heinze from the presidency and the retirement of the directors of the Mercantile National bank after an examination of the institution had been made by the clearing house committee. The indictment specifically charges that Heinze, while president of the Mercantile National bank. over-certified fifteen checks. That is. that he guaranteed by the bank signature that the sums indicated in the checks were held by the Institution to the credit of the drawer. To over-certify bank paper is, under the federal statute, an offense punishable by imprisonment of not less than five years and not more than ten years. One count is devoted to each of the checks involved. It is alleged that Heinze knew that Otto Heinze & Company did not have to Its credit the sunis named in the various checks. The sixteen count in the indictment charges that Heinze intentionally applied the funds of the bank. and without the knowledge of the directorate, to the payments of the fifteen checks drawn by Otto Heinze & Company. and knowing that the company did not have on deposit with the bank a sum equal to the amount nam ed in the the certified checks. For such an offense the federal statutes provide a penalty of not less than five years imprisonment or a fine of not more than $5000 or both.

17.

January 9, 1908

Connecticut Western News

North Canaan, Salisbury, Canaan, CT

Click image to open full size in new tab

Article Text

F.A. HEINZE ARRESTED Copper Magnate Is Indicted For Overcertifying Checks. HE IS HELD IN $50,000 BAIL. Ex-President of Mercantile Bank Must Answer In Federal Court to Thirty Counts Involving $400,000-No Intent to Defraud, Counsel Declares. New York, Jan. 8. Charged with overcertifying fifteen checks, amountto ing in the aggregate $400,000, order of many Otto of them payable to the his Heinze, the copper Heinze Augustus & Co., brother's magnate Mercan- firm, F. president of the was and tile National former bank, arrested the crim- here on a bench warrant issued by inal branch of the United States circuit court. action followed the handing up of by the This indictments federal inform- grand jury. Mr. Heinze, upon being the issuance of the warwent to the federal rant, ed of bench building Edward company with his counsel, Lauterbach, and surrendered. Held In $50,000 Bail. before Mr. Heinze When Shields, arraigned Commission- pleaded not The United States atdemanded that the torney er guilty. he prisoner district was re- be held in $50,000 bail, and leased in this sum. Heinze furnished a bail bond for by the of posit $50,000, company given Maryland, Fidelity Judge and for Chat- De- his today before field and was appearance for a hearing looking released. Mr. Lauterbach, after over the said that was with the on charged indictment, overcertification his client of fifteen checks, amounting in to $400,000. Oct. the 14 aggregate abundant He said that against these checks had been deposited therefore had Mr. collateral Heinze certified and that the Many of the checks were paythe order of & concern of his able checks. Co., the to Otto client's Heinze brother, and drawn on the Mercantile National bank. Bookkeeping, Says Lawyer. Mr. Lauterbach also-wished to have noted the fact that upon learning of the indictments his client had surrendered to Commissioner Shields. explanaHeinze's tion Mr. of Lauterbach, Mr. continuing arrest, said certifica- that his that these tions client were supposed properly entered Lauterbach in the books of the bank. Mr. declared that it was merely a matter of bookkeeping, which his client suphad been properly attended to It seemed, as some of the entries may though on posed that day. he said, have to the following and this point the run upon over indictments morning, had been based. The indictment against Heinze, which is a lengthy document, alleges that the as president his Heinze capacity made overcertifications of the various Mer- in cantile National bank. The of the indictment vacounts give been the overrious checks alleged to have certified. The indictment was found under secof the revised statutes, which that an official of a tion says 5208 Tiable 'bank to found not guilty of such action is less than five years nor more than ten years' imprisonment. Thirty Counts In Indictments. were thirty against There counts Fifteen in the indictments. of of on checks. to them Heinze fifteen are separate charges overcertification One charges defraud him with the banking attempting association injure and of and Otto misfunds to the use without the of applying Heinze Mercantile & Co. bank. consent The the National remainder of the counts have to do with the execution of the certification by two elerks, George A. Cooper and William K. Pangborn, under Heinze's orders. that Heinze knew that & Co. did not Otto It is Heinze alleged have to its sums named in the various sixteenth credit checks. the The Heinze count in inten- the indictment charges that the the and tionally without applied knowledge funds of of the the bank fif- dito the payments of the drawn by Otto & teen rectorate checks the Heinze company Co. and knowing that on deposit to the amount did a sum not equal have with named the bank in the certified checks.

18.

January 11, 1908

Spirit of the Age

Woodstock, VT

Click image to open full size in new tab

Article Text

THURSDAY, January 9, 1908. Fred W. Elliott of Auburndale, Mass., held by Boston police on charge of being accessory after the fact of murder of Mrs. Theodore S. Whitmore of New York. Six of the necessary Thaw jurors sworn in and three more provisional members in the box; Littleton shows purpose to lay broad foundation for defence of insanity. Miss Mary McCarty murdered in vestibule of her home in Roxbury, Mass.; Michael H. Norton, a tenant, arrested. Unable to meet his notes, F. Augustus Heinze loses control of the Mercantile National bank of New York, his stock passing back to Edwin Gould; when arraigned Heinze pleads not guilty of over-certification of checks. Fowler currency bill adopted by subcommittee of house committee on banking. North German Lloyd steamship company sends passenger manager to Boston to look over the field. Bishop George Worthington dies in France. Ex-President Cleveland's letter furnishes keynote of anti-Bryan dinner of National Democratic club in New York. Ex-Insurance Commissioner Frederick L. Cutting dead at Wellesley, Mass. George Baker Glover files a petition in South Dakota asking that his mother, Mary Baker G. Eddy, be examined as to her sanity. Trial of Thomas David of Lowell, Mass., charged with wife murder, opened in Fredericton, N. B. Receivers appointed in St. Paul for the Chicago Great Western road. Striking teamsters in Brockton, Mass., reject two offers submitted by the employers. Fish and game association of Massachusetts to ask legislature for close season for one year on upland game birds.

19.

October 23, 1908

The Star and Newark Advertiser

Newark, NJ

Click image to open full size in new tab

Article Text

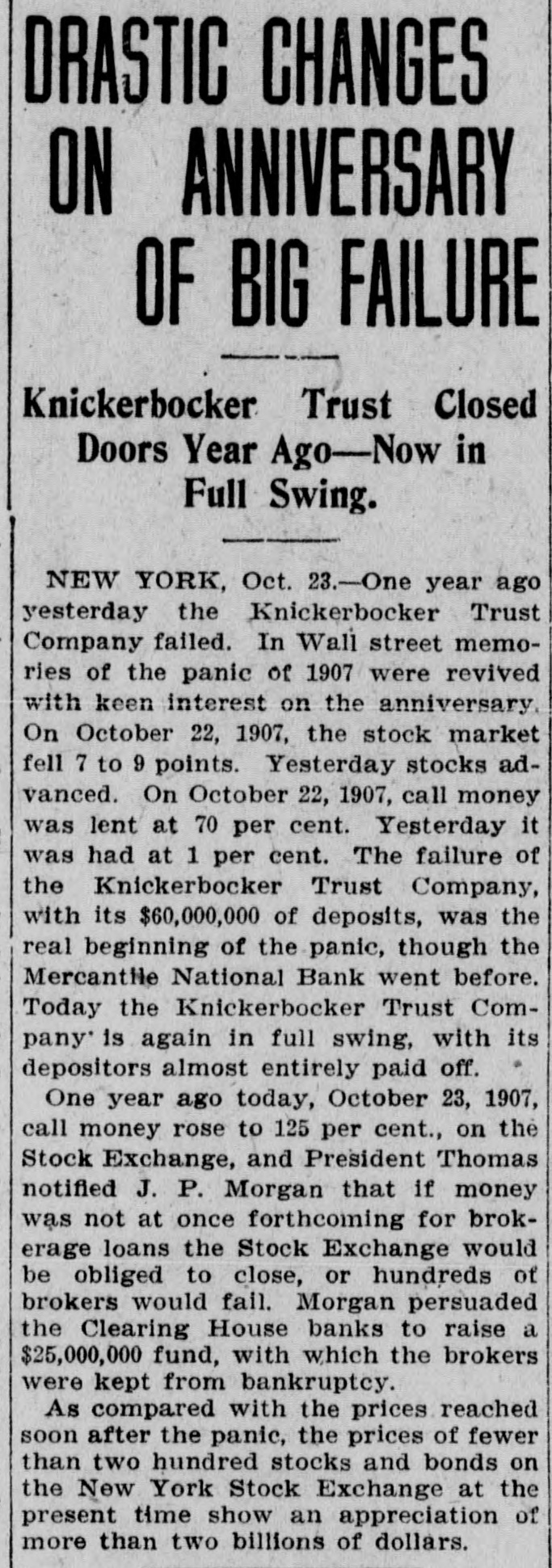

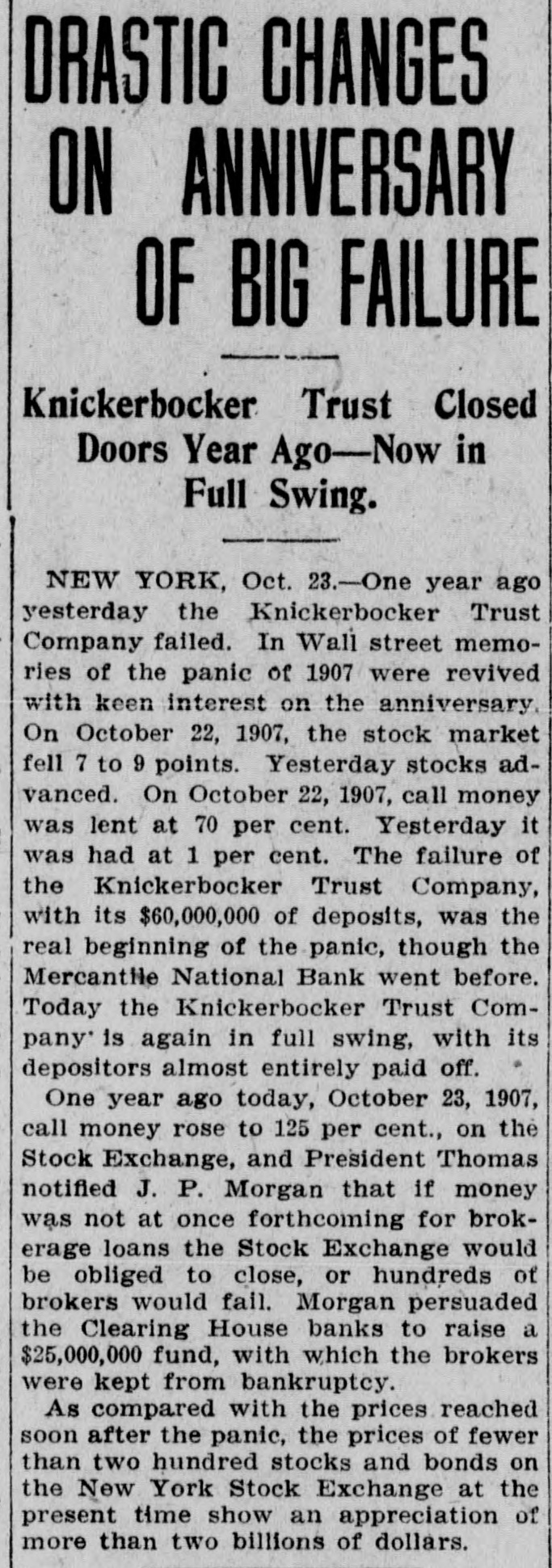

DRASTIC CHANGES ON ANNIVERSARY OF BIG FAILURE Knickerbocker Trust Closed Doors Year Ago-Now in Full Swing. NEW YORK, Oct. 23.-One year ago yesterday the Knickerbocker Trust Company failed. In Wall street memories of the panic of 1907 were revived with keen interest on the anniversary On October 22, 1907, the stock market fell 7 to 9 points. Yesterday stocks advanced. On October 22, 1907, call money was lent at 70 per cent. Yesterday it was had at 1 per cent. The failure of the Knickerbocker Trust Company, with its $60,000,000 of deposits, was the real beginning of the panic, though the Mercantile National Bank went before. Today the Knickerbocker Trust Company' is again in full swing, with its depositors almost entirely paid off. One year ago today, October 23, 1907, call money rose to 125 per cent., on the Stock Exchange, and President Thomas notified J. P. Morgan that if money was not at once forthcoming for brokerage loans the Stock Exchange would be obliged to close, or hundreds of brokers would fail. Morgan persuaded the Clearing House banks to raise a $25,000,000 fund, with which the brokers were kept from bankruptcy. As compared with the prices reached soon after the panic, the prices of fewer than two hundred stocks and bonds on the New York Stock Exchange at the present time show an appreciation of more than two billions of dollars.

20.

June 5, 1909

Bismarck Daily Tribune

Bismarck, ND

Click image to open full size in new tab

Article Text

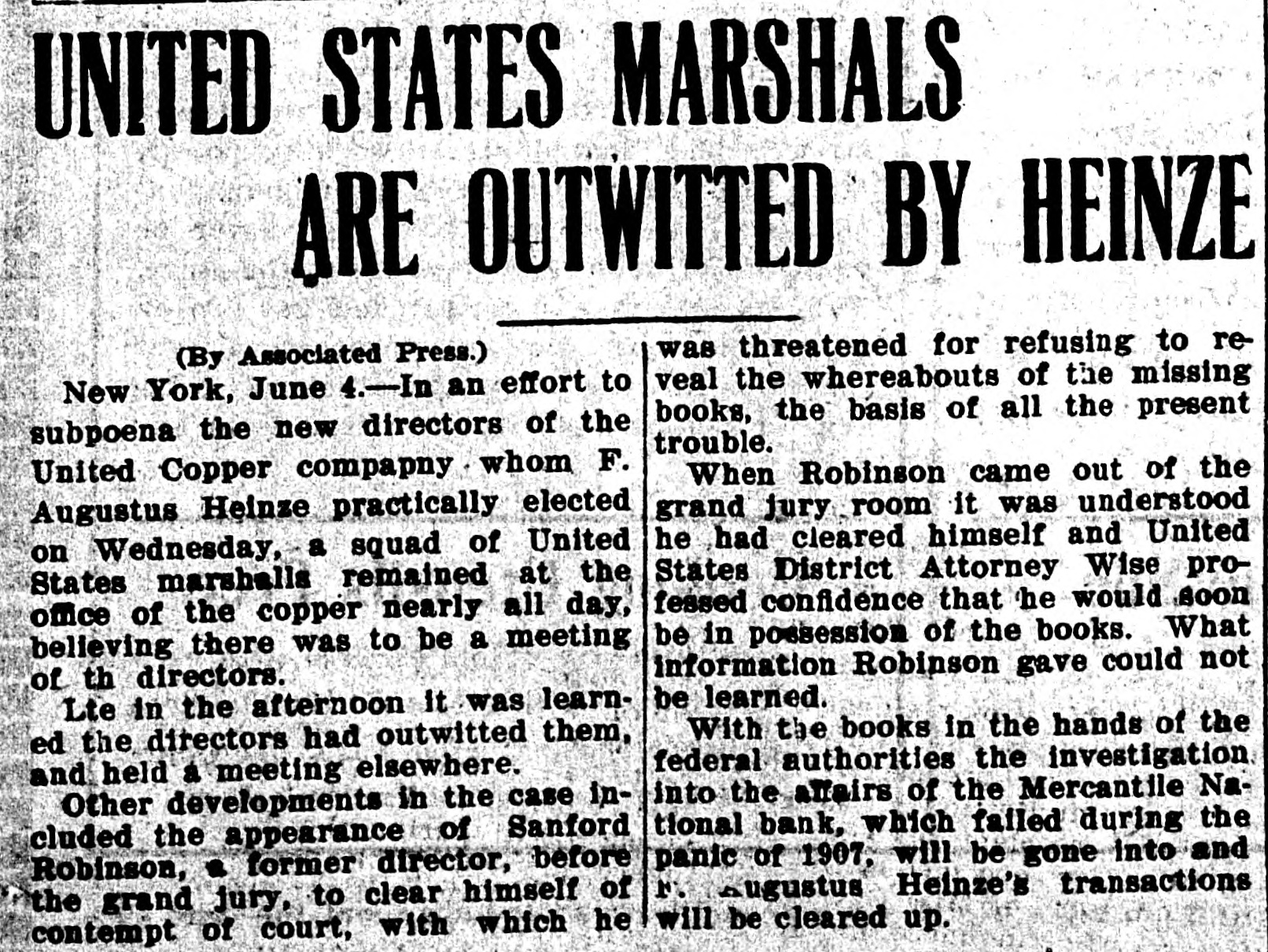

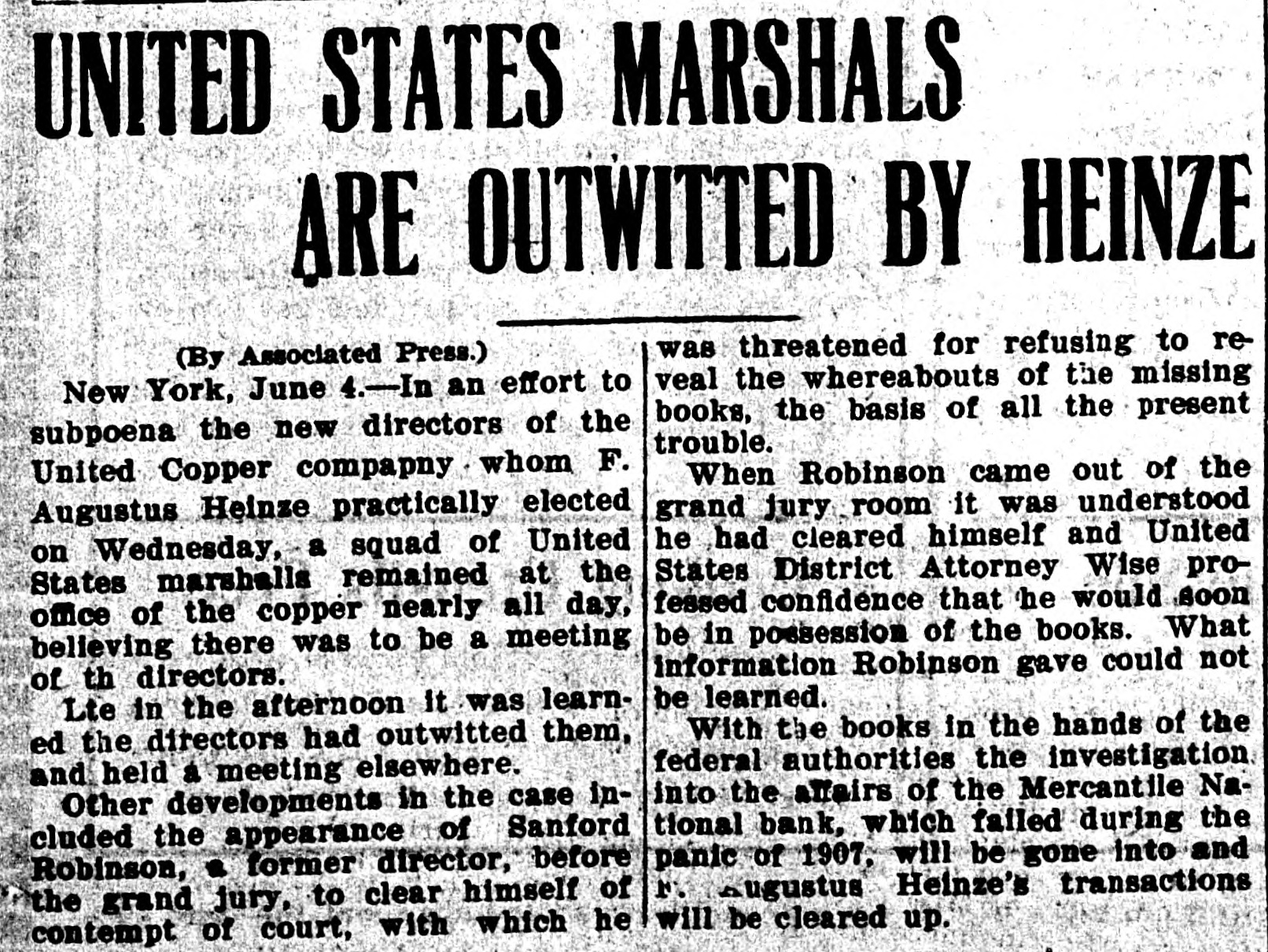

UNITED STATES MARSHALS ARE OUTWITTED BY HEINZE was threatened for refusing to re(By Associated Press.) veal the whereabouts of the missing New York, June 4.-In an effort to books, the basis of all the present subpoena the new directors of the trouble. United Copper compapny . whom F. When Robinson came out of the grand jury room it was understood Augustus Heinze practically elected he had cleared himself and United on Wednesday, a squad of United States District Attorney Wise proStates marshalls remained at the fessed confidence that he would soon office of the copper nearly all day, be in poesession of the books. What believing there was to be a meeting information Robinson gave could not of th directors. be learned. Lte in the afternoon it was learnWith the books in the hands of the ed the directors had outwitted them, federal authorities the investigation and held a meeting elsewhere. into the affairs of the Mercantile NaOther developments in the case included the appearance of Sanford tional bank, which failed during the Robinson, a former director, before panic of 1907, will be gone into and the grand jury, to clear himself of N. augustus Heinze's transactions contempt of court, with which he will be cleared up.

21.

June 5, 1909

Los Angeles Herald

Los Angeles, CA

Click image to open full size in new tab

Article Text

# UNITED COPPER COMPANY

# DECEIVES U. S. MARSHALS

Officers Remain at Office All Day to

Summon Directors, but Meeting

Is Held Elsewhere

NEW YORK, June 4.-In an effort to subpoena directors of the New Unit- ed Copper company, which Augustus Heinze practically elected Wednesday, a squad of United States marshals were kept at the office of the company nearly all day, it being understood there was to be a meeting. Late in the afternoon it was learned the directors had met elsewhere.

Other developments included the appearance of Stanford Robincon, a former director, before the grand jury in order to clear himself of contempt of court with which he was threatened for refusing to reveal the whereabouts of the missing books, the basis of all the present trouble. When Robinson came from the grand jury it was understood he had purged himself and District Attorney Wise expressed confidence he soon would have the books.

With the books in the hands of the federal authorities the inquiry into the affairs of the Mercantile National bank, which failed in the panic of 1907, will begin and the transactions of F. Augustus Heinze will be investigated.

22.

June 5, 1909

The Salt Lake Herald

Salt Lake City, UT

Click image to open full size in new tab

Article Text

CASE OF HEINZE ON THE BOARDS So Far the Copper Magnate Has Held His Own in the Federal Court. New York, June 4.-In an effort to subpoena new directors of the United Copper company, whom F. Augustus Heinze practically elected on Wednesday, a squad of United States marshals remained at the office of the company nearly all day, understanding that there was to be a meeting. Late in the afternoon it was learned that the directors had met elsewhere. Other developments included the appearance of Sanford Robinson, a former director, before the grand jury in order to clear himself of contempt of court, with which he was threatened for refusing to reveal the whereabouts of the missing books, the basis of all the present trouble. When Robinson came from the grand jury room it was understood that he had purged himself, and District Attorney Wise expressed confidence that he soon would have the books. With the books in the hands of the federal authorities, the inquiry into the affairs of the Mercantile National bank, which failed in the panic of 1907, will begin, and the transactions of F. Augustus Heinze will be investigated.

23.

June 6, 1909

Omaha Daily Bee

Omaha, NE

Click image to open full size in new tab

Article Text

COPPER BOOKS ARE COMING Director Robinson Agrees to Produce Necessary Records. OPEN SHOP IN SHEET MILLS Judge Gary of Steel Combine Explains Notices Recently Posted in Sheet and Tin Plants. NEW YORK, N. Y., June 5.-In an effort to subpoena new directors of the United Copper company, whom F Augustus Heinze practically elected on Wednesday, a squad of United States marshals remained at the offices of the company nearly all day understanding that there was to be a meeting. Late in the evening it was learned the directors had held a meeting elsewhere, just where is not known. Other developments in the case included the appearance of Sanford Robinson, a former director. before the grand jury with the idea of clearing himself of contempt of court with which he was threatened for refusing to reveal whereabouts of the missing books, the basis of all the present trouble When Robinson came from the grand jury room It was understood that he had purged himself and United States District "Attorney Wise professed confidence that he would soon be in possession of the books. What information Robinson volunteered concerning the whereabouts of the books could not be learned, but Mr. Wise indicated that he would have them in the near future. With the books in the hands of the federal authorities investigation into affairs of the Mercantile National bank, which failed in the panic of 1907, will be gone into and F. Augustus Heinze's transactions will be cleared up. His apparent effort to checkmate such a move has caused the present mix up. Open Shop in Steel Mills. In explanation of the new wage scale posted a few days ago at mills of the American Sheet and Tin Plate company, Elbert H. Hary, chairman of the United States Steel corporation, made the following statement today: "Most of the mills of the American Sheet and Tin Plate company here have for some years been operated as 'open shops,' the others were run as union mills and with these the wage scale has been signed on July 1 of each year. The management of the American Sheet and Tin Plate company has dicovered it has been discriminated against and in other ways unfairly treated by the Amalgamated association; the management also discovered beyond question that a decided majority of the men prefer to have all the mills operated as 'open shops.' Under these conditions It has become clear It is for the best interests for the operators to conform to the wishes of the majority. As a result the company posted notices accordingly and also posted the wage scale effective on and after July 1, which in all essential respects is unchanged. There is no dispute regarding wages. It is clear that the employes have appreciated the attitude of the company in its maintenance of the high Level of wages in the period of great business depression." Rockefeller Likes Golf. Saying that the financial situation is not half as interesting as golf, John D. Rockefeller returned here today from Hot Springs, Va., where he took Mrs. Rockefeller five months ago for her health. "We have had a splendid time," said Mr. Rockefeller, "and Mrs. Rockefeller is much better." Mr. Rockefeller was asked If he cared to say anything regarding the financial situation. "What do I know about the financial situation?" he replied. "Why, finance can't be compared with golf. I hope some day to be able to play good golf. I have played a good deal of it in my life." He spoke feelingly of the recent death of H. H. Rogers. "It is sad, very sad," he said. More Delay ir Gould Trial. Probability of a further delay in brining to trial the suit of Mrs. Katherine Clemmons Gould for a separation from her husband, Howard Gould, was indicated today when Supreme Court Justice Gildersleeve appointed Junius T. Auerbach of Boston a commissioner to examine Dr. Martin D. Moran of that city as a witness in behalf of Mrs. Gould. It was stated that Monday and Tuesday of next week might be required for the examination of Dr. Moran and that the trial of the suit would probably not be started before next Wednesday. Mayor McClellan has sent a letter to the father of George B. Duffy, the Brooklyn boy whose troubles with the police have been at the bottom of the charges brought by Supreme Court Justice Gaynor against Police Commissioner Bingham, asking that the youth be brought before the mayor next Monday.. The father is requested also to bring character witnesses. Fight With Counterfeiters. Four Italians suspected of counterfeiting were arrested in a saloon today by agents of the secret service after a fight in which bottles and glasses were thrown. The police say they found seventeen bad $2 bills on one prisoner. In his room was a rubber stamp which would print a fair imitation of a $2 bill. Bee Want Ads. are bustness boosters

24.

October 8, 1911

The Washington Herald

Washington, DC

Click image to open full size in new tab

Article Text

ber marks two important American an-

niversaries. On October 12, 1492, Colum-

bus discovered America, and on October

1, 1907, began the most serious money

panic in the experience of the country,

marked by the most stupendous issue of

unauthorized or wildcat currency in the

history of modern nations. Of the two

events the latter is unquestionably of

greater concern to the average business

man, for, while Columbus is not likely

to discover America again, nothing has

been done as yet to prevent a recurrence

of the conditions that made 1907 a black-

letter year in the memory of most Amer-

ican citizens.

Events moved so rapidly and in such

confusion during the closing months of

1907 that many of the developments of

the panic and the devices used in the at-

tempt to stay its course are unknown

history to the average citizen. Probably

not one person in 10,00 is aware that the

people of the United States were carry-

ing on much of their business during the

latter part of 1907 with substitutes for

money such as had not been seen in any

other country in a century or that the

premium on coin reached a higher point

than it ever did in Europe in modern

times except on one occasion in France

during the Commune. Few except resi-

dents of the Pacific Coast are aware

that as an incident of the panic the

people of California had a continuous

holiday of more than seven weeks. These

holidays were declared from October 21

to December 21, in order to enable the

banks to decline payment and to pre-

vent the forcing of collections that would

have driven many business houses into

bankruptcy. In Nevada and Oregon sim-

ilar holidays were declared for shorter

periods.

# Pay Checks in Pittsburg.

In Pittsburg $4700.000 of pay checks

were issued by various concerns, and

throughout the country $500,000,000 of panic

money was issued-much of it real wild-

cat currency made useful only by com-

mon consent of the people. In nearly

every large city of the country bank pay-

ments were partly suspended, as they

were in a vast number of smaller pieces,

one village in Georgia of only 400 popu-

lation resorting to the issue of certifi-

cates in lieu of cash.

Up to the middle of October, 1907, the

business situation of the country was re-

garded as highly satisfactory. While there

had been predictions from financial ex-

perts of a serious recession in the expan-

sion which had been proceeding at a tre-

mendous rate for three years, there was

nothing in view to suggest to the ordi-

nary man any greater likelihood of an

immediate and serious interruption of

prosperity than there had been for a year

or more before. In fact, the bank state-

ment at the beginning of September, 1907,

was slightly more favorable than it had

been a year previously.

In the old-fashioned school readers there

used to be a story of a loose stone that

set an avalanche in motion. It was so

with the panic. The stone that set it

going was a seemingly unimportant hap-

pening in New York, an event that or-

dinarily would have caused scarcely a

perceptible local flurry.

A well-known copper speculator had

been trying to engineer a corner in the

stock of a copper company. With his as-

sociates he controlled the Mercantile Na-

tional Bank, a relatively small institution.

Four other banks, of which the largest

was the Bank of North America, were

held in speculative control by men asso-

ciated in one way or another with the

interests dominating the Mercantile Na-

tional. As a result of the collapse of

the copper corner, the withdrawal of

deposits and the fact that their funds

were tied up in unmarketable securities,

these banks were unable to meet their

balances at the clearing house. The total

deposits of the five institutions were

only $56,000,00. In response to their re-

quests for assistance a committee of the

clearing house examined their affairs, en-

forced changes in their management, and

raised a fund of $10,000,000 to tide them

over their difficulties. At various times

many banks have undergone similar reor-

ganizations without any unfavorable after

effects. These events took place in the