Click image to open full size in new tab

Article Text

Virginia City, Montana, will recall a marvelous lemon tree tended with care for eighteen years now by Mrs. G., the genial wife of the Recorder. The blossoms recall moonlight and magnolias, American beauties and the wedding march, honeysuckle and the Suwanee River.

The lemon is a strange tree to botanists—its flowers are of different sexes on the same stock. No pollenizing bee invades the ancient hall of records. Mrs. G. deftly with a feather spreads the pollen to one or two blossoms at a time. Thus limiting the production, she stimulates the fruit of these favored flowers. Here one lemon grows larger than a good sized cantelope.

But no one seeing it has thought it profitable to raise lemons in Montana, until perhaps the big bank mergers were formed last year.

Likenesses between the two projects exist:

The lemon spreads the sweetest odor ever known. Its fruit is the sourest.

# Not Good For Mergers

The climate of Montana does not seem to suit bank mergers. The statement of one blossom which has been favored and pollenized, the Metals Bank of Butte by comparing its statement now with that of June 28th, 1929, shows a falling off in size by $1,107,473.12.

The stock in the merger bank corporation blossomed sweetly last year at a price varying from $52 to $64 a share. The present quotation is $26. Suppose in the next ten months it should fall another twenty-six dollars the share. Montana winters are hard on lemon trees. In the smaller towns the old local officers of banks now merged are being replaced with new men, strangers to our con- ditions. Wheat growers, cattle men, sheep owners, fruit farmers, and even dairymen with their quick turnover, are refused loans or even extensions, which their worth and long dealings with these banks entitle them to. Speculators in stocks of fluctuating value, but which are known to these eastern imported cashiers are accommodated with loans almost to the face value of these stocks.

# Banks and the Merchants

Montana merchants of long standing find their credit with these newcomers restricted—some even feel that Montana moneys through the medium of the merger bank headquarters in the Twin Cities are available to the great chain stores which are entering jour state to drive our local merchants from the field which they have long enjoyed and wherein they have decently served the public, usually with profit to the public as well as to themselves.

With the possible purpose of making a great show of strength in the capital city and to prevent entrance of any independent bank the merger is putting up a bank building to cost three hundred and fifty thousand dollars. At the same time the price of its stock is falling an the market. The great second-class merger (and by the way the merger in which the Metals Bank and the National Bank of Montana and the First National Bank of Great Falls is not thought to be as strong financially as the one in which the First National of Dillon the Bank owned by the Marcus Daly estate in Anaconda and the Great Falls National, entered) is also about to build a large building in Livingston. In Livingston some customers who can pay up to the merger bank are going without any noise to an old independent bank. Customers are the pollenizing bee of a bank.

# The Mysterious Bankers

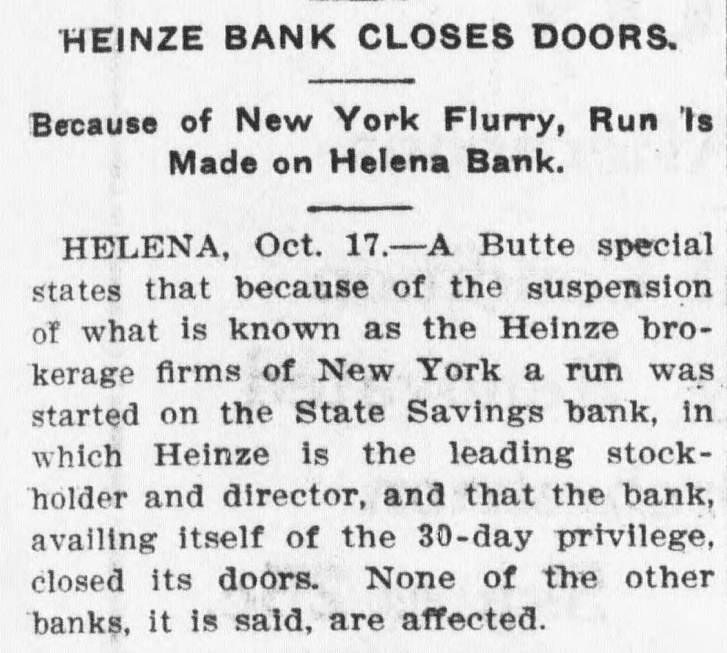

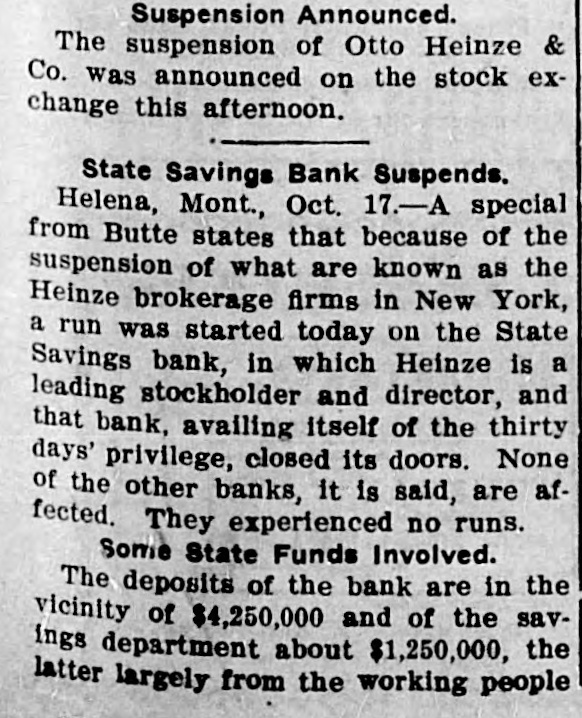

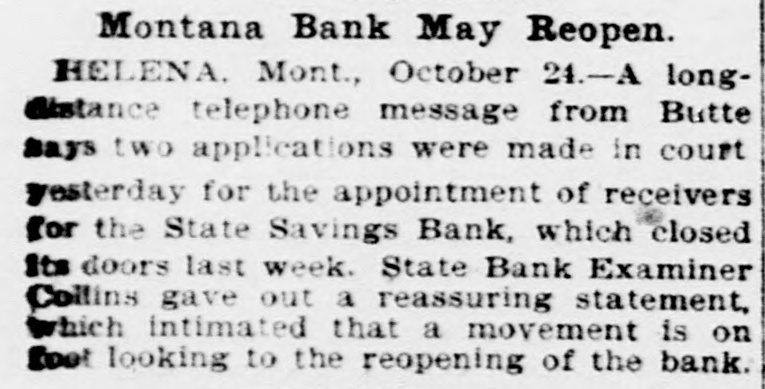

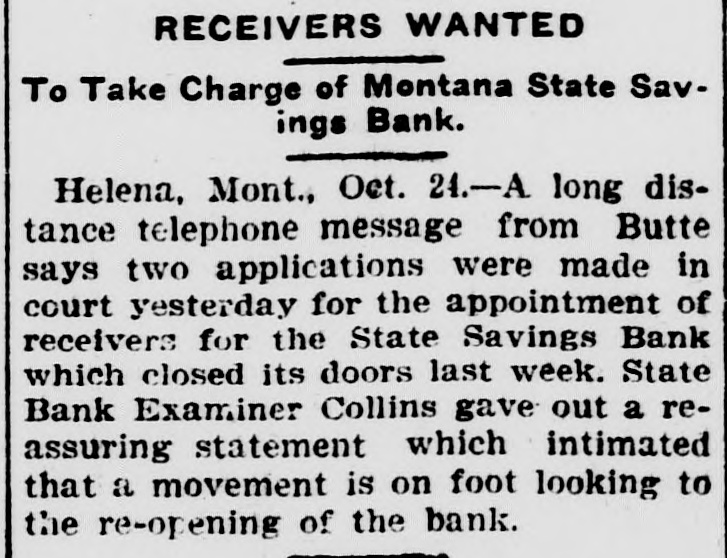

The ways of bankers are a mystery to the less fortunate members of the community. We thought when the State Savings Bank in 1907 was building its banner bank building that the Rock of Gibraltar was a shifting sand compared to i's strength. The building was finished just in time for the bank examiner to take charge of the business going on inside.

Old citizens remember the great cut stone building built, but never occupied by the old Hauser First National Bank in Helena. The receiver and his half dozen clerks had quarters there large enough for the Chemical National of New York.

Our dear old fellow townsmen the Yegen Brothers cancelled the lease on a profitable store room half of their bank building: tore the partition down, remodeled their quarters at an expense, not to them but to their depositors and receiver afterwards, of $33,000.00 just before they closed their doors. We, uninitiated understand bankers not at all. Two weeks before the Yegens went down when there was a silly run on the Metals Bank which it was amply able to stand and could have stood paying dollar for dollar until their last depositor was paid, Chris Yegen was going through the crowd outside the Metals Bank and saying, pointing to the Bank, "They rood boys. If they need a million dollars Yegen Brothers will let them have it." And there was not enough money in all three of the Yegen banks to pay in cash 50 cents on the dollar of their own.