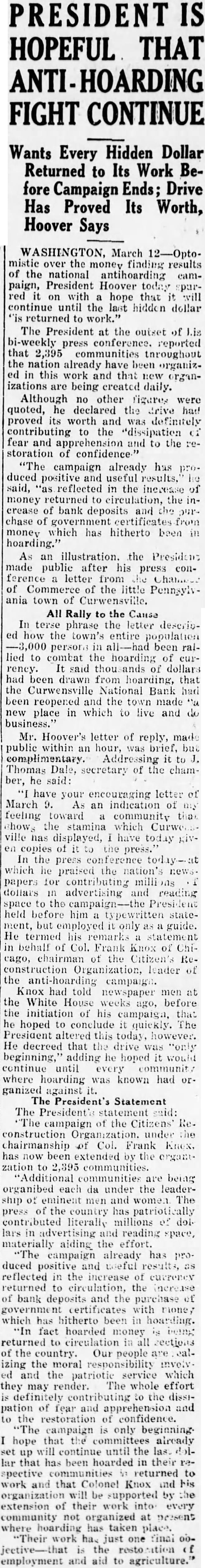

Article Text

HOPEFUL THAT Wants Every Hidden Dollar Returned to Its Work Before Campaign Drive Has Proved Its Worth, Hoover Says March mistic the money finding results the national antihoarding campaign, President Hoover today on with hope that will continue until the last hidden dollar returned The President at the outset of bi-weekly press conference. reported that 2,395 communities throughout the nation already have been organizin this work and that izations are being created daily. Although no other figares were quoted, he declared the proved its worth and was definitely contributing to the "dissipation fear and apprehension the storation campaign already has duced said, reflected the increase money returned circulation, the crease of bank deposits and chase from money which has hitherto been hoarding." As an illustration. the President made public after his press conference letter from Commerce of the little Pennsylvtown of All Rally the Cause In terse phrase the letter describhow the entire population persons been rallied to combat the hoarding currency. said dollars had been drawn from hoarding, that the Curwensville National Bank been reopered and the made new place in which to live and business." Mr. Hoover's letter of reply, made public within an hour, was brief, but complimentary. Addressing Thomas secretary the chamhe said: have your encouraging March an indication of feeling toward community the stamina which displayed, copies press. In the press which praised the nation's papers for dollars advertising and reading the President held before him typewritten statement, but He termed statement behalf of Col. Frank Knox Chicago, the Citizen's ReOrganization, lender the campaign. had told newspaper men the White House weeks before the initiation his campaign, that he hoped to conclude quickly. The President altered today, however. He decreed that the beginning,' adding hoped continue until where hoarding known had ganized against President's Statement The President's campaign the Reconstruction under chairmanship Col. Frank has been extended by the organzation to 2.395 communities. communities are being organibed under the leadereminent and women The the country literally millions lars and reading space, materially aiding the effort. campaign already duced and useful reflected the increase the bank deposits and the purchase certificates with which has hitherto been hoarding. fact hoarded money being returned circulation country Our people izing the moral responsibility and the patriotic service which they may render. The whole effort the dissipation and and the restoration confidence. campaign only beginning hope that the committees already continue until the up lar that has been hoarded their spective communities returned and that Colonel Knox and organization will supported the extension of their work every community organized present hoarding taken place. work just final employment and aid to agriculture."