Article Text

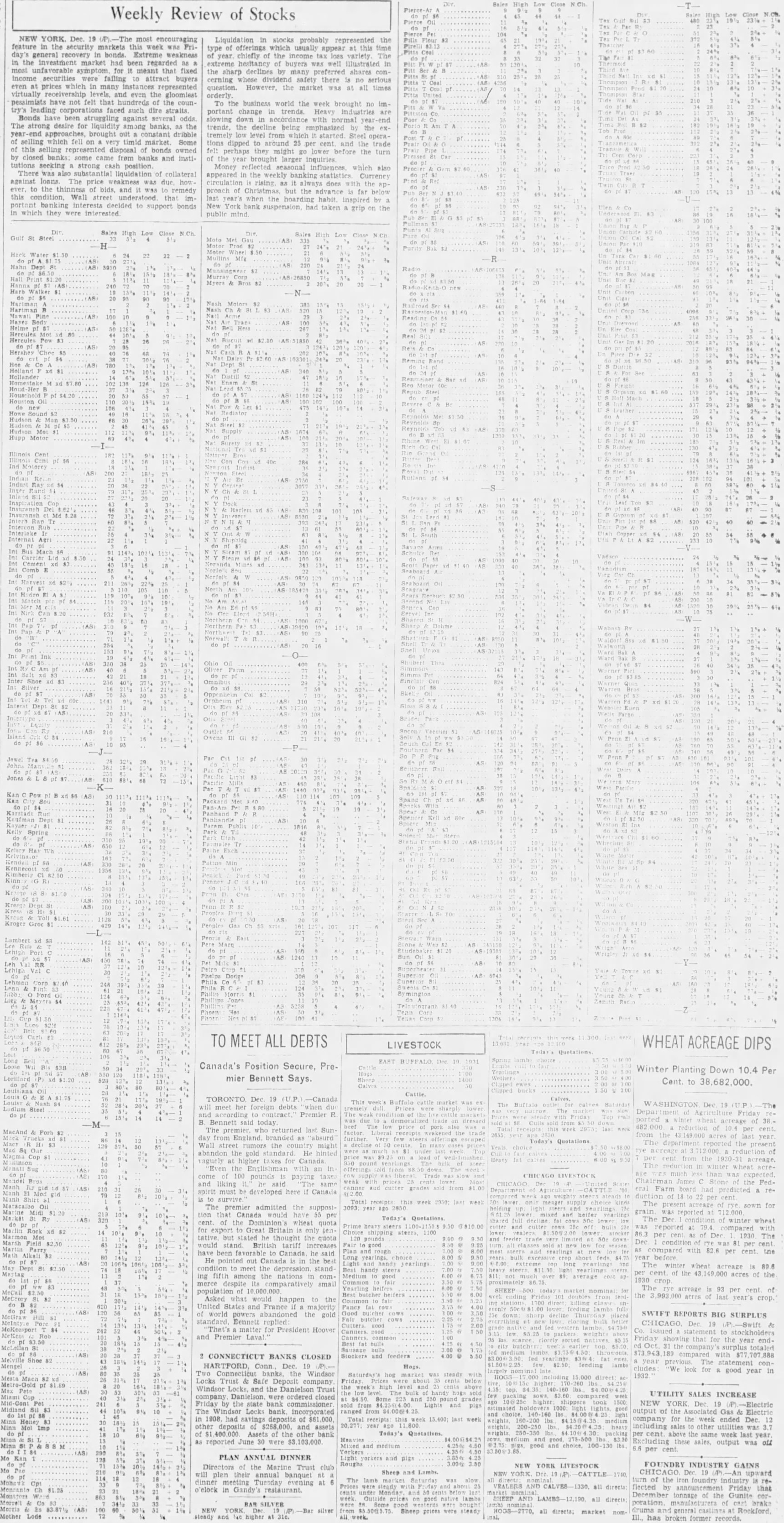

Weekly Review of Stocks NEW YORK Dec. 19 (/P).-The most encouraging feature in the security markets this week was Friday's general recovery in bonds. Extreme weakness in the investment market had been regarded as a most unfavorable symptom, for it meant that fixed income securities were failing to attract buyers even at prices which in many nstances represented virtually receivership levels. and even the gloomiest pessimists have not felt that hundreds of the country's leading corporations faced such dire straits. Bonds have been struggling against several odds The strong desire for liquidity among banks. as the approaches, brought out constant dribble selling which fell on very timid market Some of this selling represented disposal of bonds owned by closed banks: some came from banks and institutions seeking strong cash position. There was also substantial liquidation of collateral against loans The price weakness was due, however to the thinness of bids and it was to remedy this condition. Wall street understood that im portant banking interests decided to support bonds in which they were interested Liquidation in stocks probably represented the type of offerings which usually appear at this time of year. chiefly of the income tax loss variety. The extreme hesitancy of buyers was well illustrated in the sharp declines by many preferred shares concerning whose dividend safety there is no serious question. However, the market was at all times To the business world the week brought no important change in trends. Heavy industries slowing down in accordance with normal trends, the decline being emphasized by the extremely low level from which started Steel operations dipped to around 25 per cent and the trade felt perhaps they might before the go lower turn of the year brought larger inquiries Money reflected seasonal influences. which also appeared in the weekly banking statistics Currency rising. as it always does with the approach of Christmas, but the advance is far below last year's when the hoarding habit. inspired by New York bank suspension, had taken a grip on the public mind Close Moto Mullins Mfg Myers Bros Nash Motors TO MEET ALL DEBTS WHEAT ACREAGE DIPS LIVESTOCK Canada's Position Secure, Pre Winter Planting Down 10.4 Per mier Bennett Says. Cent. to 38,682,000 Calves TORONTO Dec. 19 -Canada Calves week's market Dec 19 -The will meet her foreign debts "when tremely were Depa me and according to Premier weak of to on ported winter B. Bennett said today also 000 last reduction 10.4 MacAnd The who returned last Sun Liberal the from the acres of day from England branded as absurd Today's Quotations department Wall street rumors the might were 000 abandon the gold standard He hinted was rent from vaguely higher taxes for Canada in winter the Englishman with an come of 100 cow : AGO LIVESTOC pounds paying weak with prices James and liking said CHICAGO and cutter grades sold eral board had must be here predicted a developed if Canada week due 18 is Total week The present of sown for The premier admitted the supposi 3093 year and was reported at 712 tion that Canada would have 55 per and The Dec condition of winter wheat cent of the Dominion wheat quota Prime cutter was reported compared for export to Great Britain is only tenshipping cent of Dec 1930 tative but stated he thought the quota 120 pounds down Dec condition rye vas 81 would British tariff increases sold per new and compared with per cent. have been favorable to Canada he said choice feds year before He pointed out Canada in the and handy top long The winter wheat acreage is 89.6 conditon to meet the depression stand Best handy yearlings per cent. of the 149,000 acres of the ing fifth among the nations in com- $11 cost 1930 Common merce despite its omparatively Year helfers for The acreage of population of market nominal: Best butcher Asked what would from the 993 000 acres of last year's crop. happen the United States and France majority of world powers abandoned the gold SWIFT REPORTS BIG SURPLUS down Fair butcher cows Bennett replied ing CHICAGO Dec 19 (P).-Swift & lambs "That's matter for President Hoover Co. issued to stockholders to and Premier Laval Friday common showing that for the year Be bulls ed the company' surplus totaled compared with $77 2 CONNECTICUT BANKS CLOSED Stockers and feeders 4.00 Shoe year previous. statement confew feeding Hogs. cludes "We look for good year in Two Connecticut banks, the Windsor Saturday's hog market steady with HOGS direct Locks Trust & Safe Deposit company Prices were Windsor Locks, and the Danielson Trust week's Pate the level bulk hand UTILITY SALES INCREASE $3.60 compared company Danielson were ordered closed Some and pound Friday by the state bank commissioner sold from Lights and NEW YORK Dec. 19 (A) -Electric pigs 1000 The Windsor Locks incorporated ranged from output of the Associated Gas & Electric and choice light in 1908, had savings deposits of 000, Total receipts this week 15. 400; last week company for the week ended Dec. Honey medium other deposits of $258,000. and assets year heavy including sales to other utilities was Imp of $1,400 000 Assets of the other bank Today's Quotations per cent. above the same week last year Heavies $4 medium and 275-500 lbs $3.50 as reported June 30 were $3,103,000 Excluding these sales, output was off and medium 50 good and choice 130 lbs. 6.6 per cent. 50 PLAN ANNUAL DINNER yorkers and pigs Roughs NEW YORK LIVESTOCK FOUNDRY INDUSTRY GAINS Directors of the Marine Trust club Sheep and Lambs. NEW YORK CHICAGO Dec upward will plan their annual banquet at a The lamb Saturday was all turn of the iron foundry industry redinner meeting Tuesday evening at Prices were steady and about 23 VEALERS AND CALVES 1330. all directs flected by announcement Friday that o'elock in Gandy's restaurant. cents market nominal December tonnage of the Gunite corOutside good native lambs SHEEP AND LAMBS directs all BAR SILVER Some westerns nominal NEW YORK 75. Sheep prices were steady HOGS market drums and general castings Rockford -2770, Mother steady and higher at Ill., has broken former records