Click image to open full size in new tab

Article Text

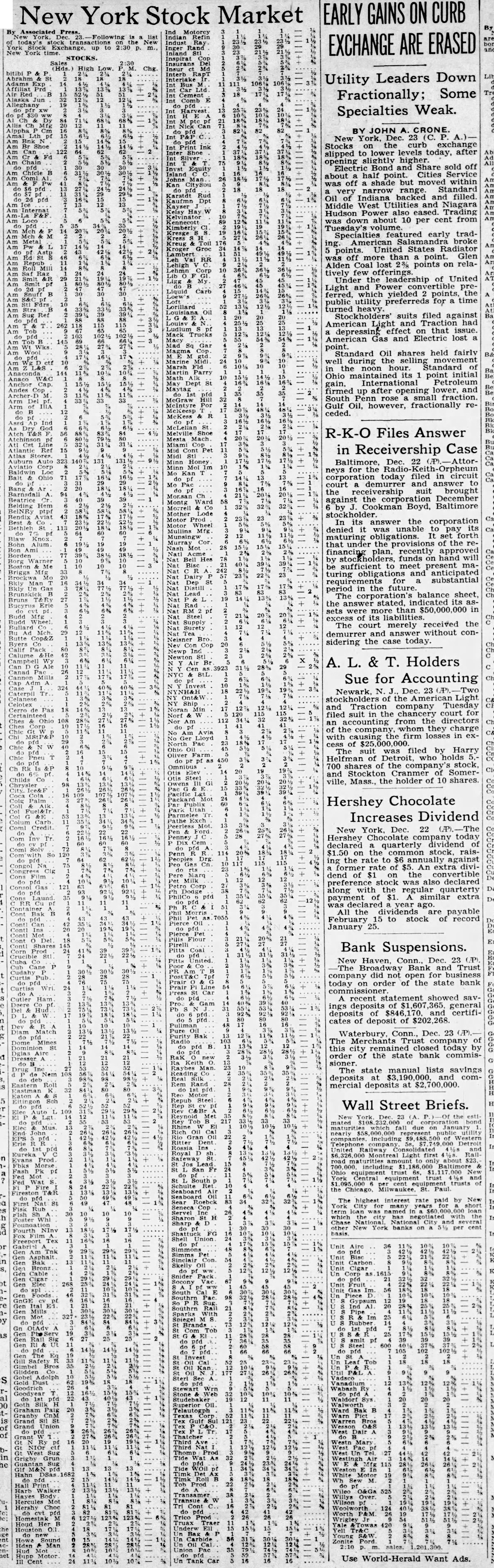

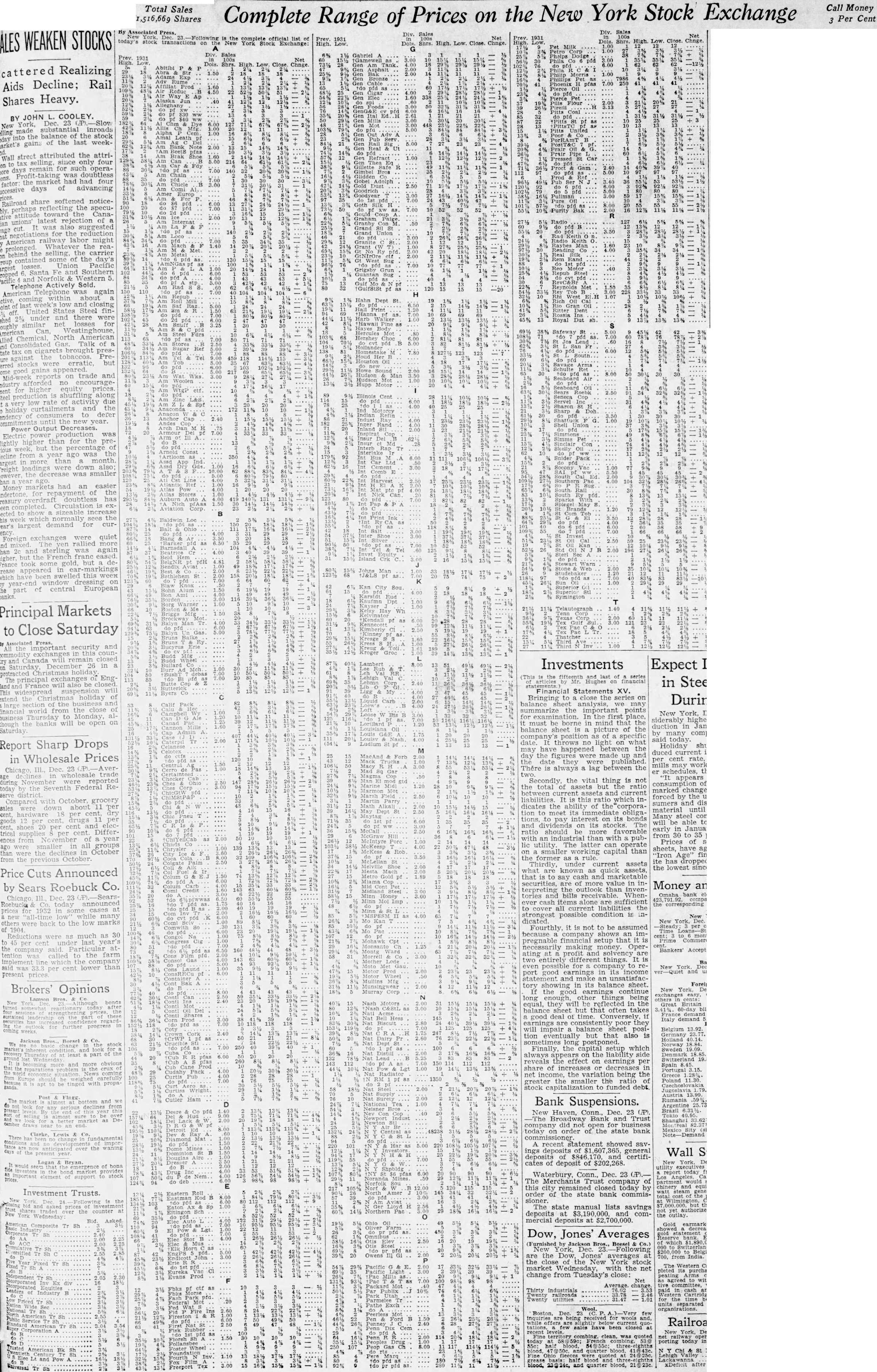

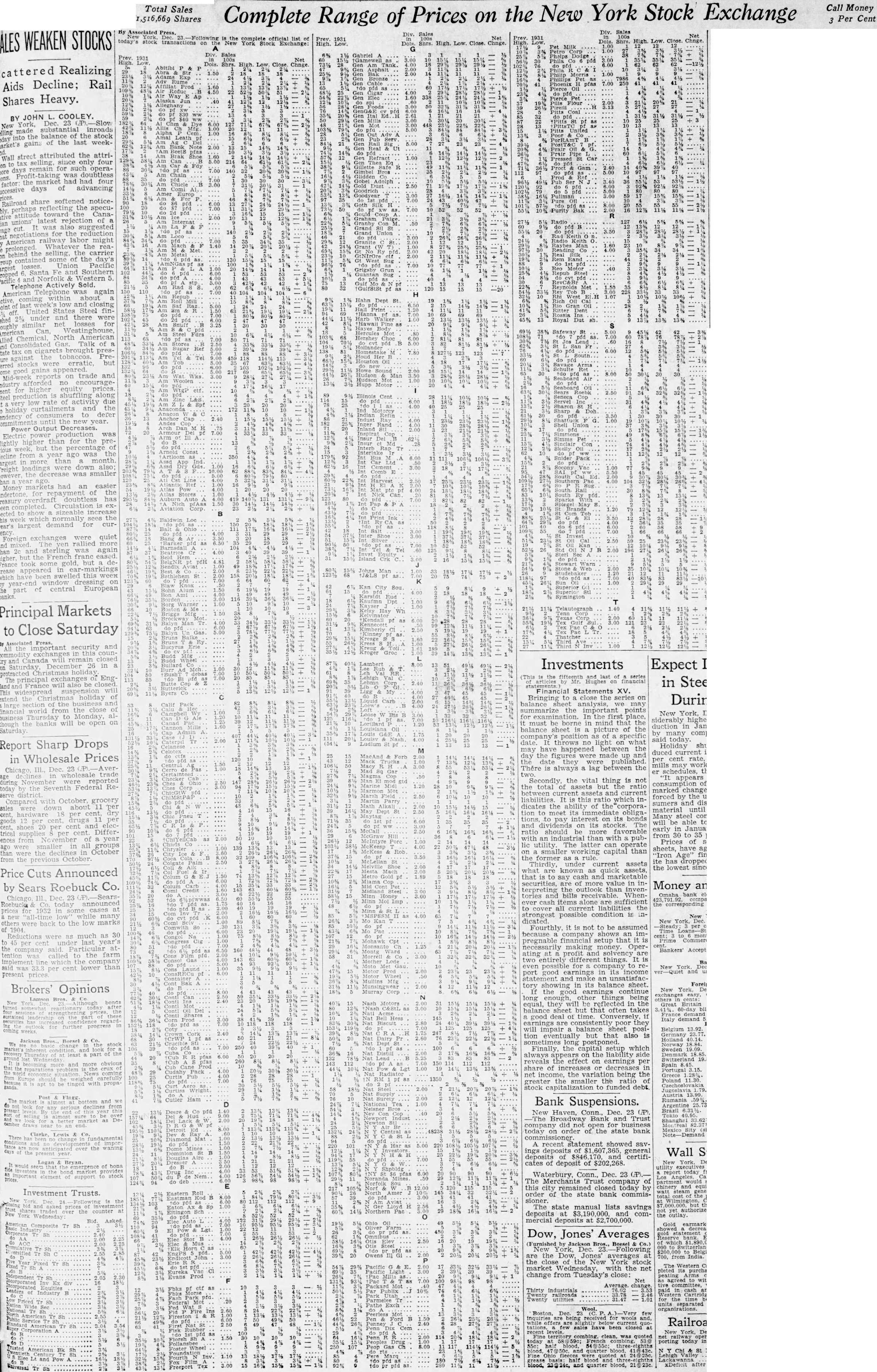

Total Sales 1,516,669 Shares

Call Money Complete Range of Prices on the New York Stock Exchange 3 Per Cent

Brokers' Opinions

Lamson New bonds the for further weeks

Jackson Bros. Boesel We of the least part more obvious the problem be tinged with propa market and almost market as near

Clarke Lewis There over the waning the

Logan Bryan. would of bona market element support stock

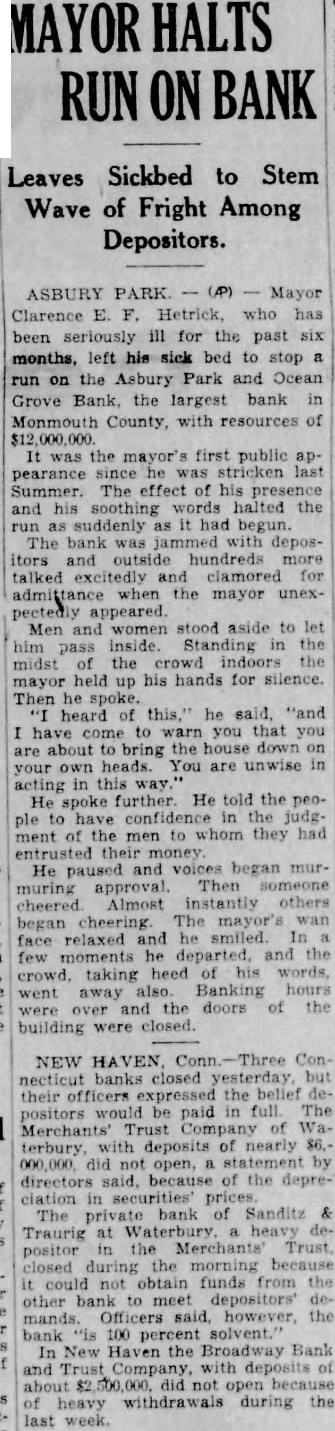

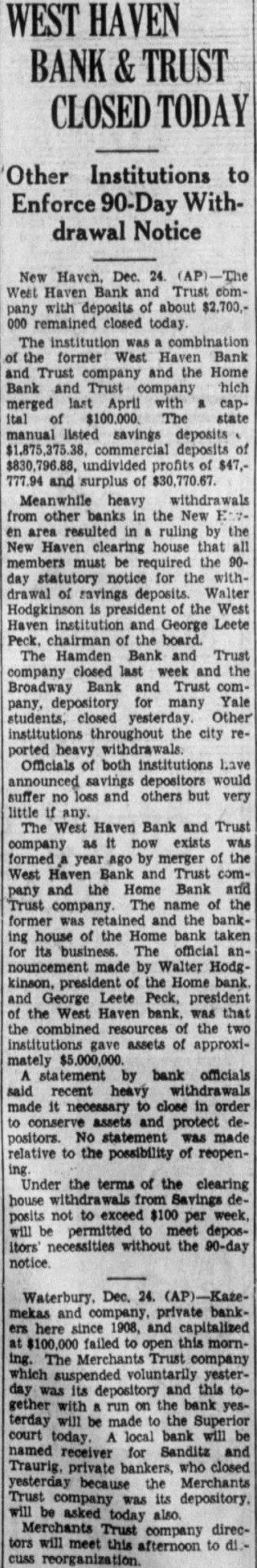

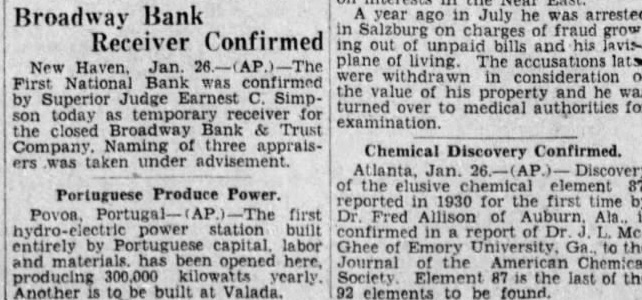

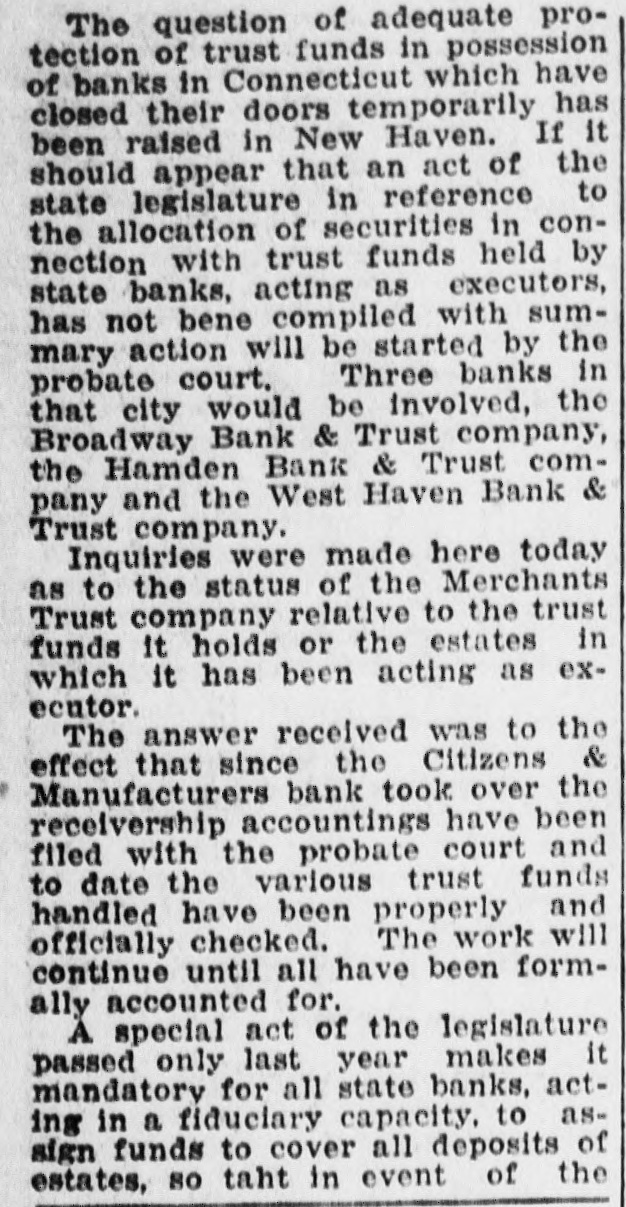

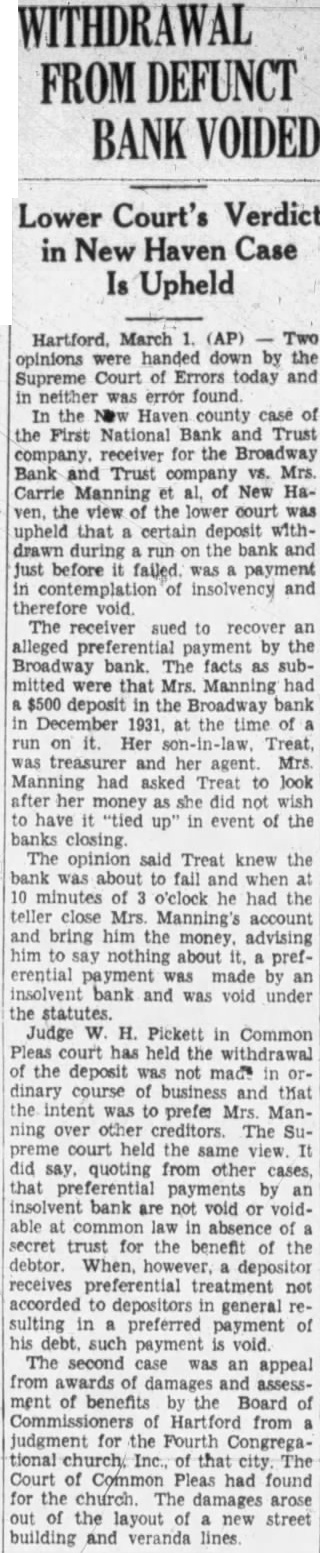

Associated complete today's stock New Close. Gabriel High Chnge Principal Markets to Close Saturday Associated Press. the important security and exchanges in this closed counand Canada try on Saturday, December 26 in Investments ristmas holiday protracted The principal exchanges of Eng- (This the fifteenth series Hughes on land and France will also be closed This widespread suspension will Financial Statements XV. extend the Christmas holiday of Bringing to close the series on section of the and balance analysis, we may financial world from the close of the important points business Thursday to Monday, for In the first place, though the banks will be open on must be borne in mind that the Saturday. balance sheet is picture of the company's position as of specific said date. It throws no light on what Report Sharp Drops may have happened between the the figures were made up and in Wholesale Prices they published. There is always a lag between the Chicago, III. Dec. 23 Aver- trade in Secondly, the vital thing is not during Novem were today the Seventh Federal Re- the total of assets but the ratio between current assets and current serve district liabilities. It is this ratio which inCompared with October, grocery sales were down about 11 dicates the ability of the corporation to meet its obligacent, hardware 18 per cent, drugs 11 tions, to pay interest on its bonds goods 12 per and dividends on its stocks. The cent, shoes 20 per cent and trical per Differ- ratio should be more favorable with an industrial than with pubences from of a year lic utility. The latter can operate ago were smaller in all groups than were the declines in October on smaller working capital than the former as rule. from the previous October under current assets what are known as quick assets, Price Cuts Announced that is to say cash and marketable securities, are of more value in inby Sears Roebuck Co. terpreting the outlook than inventories and bills receivable. WhenChicago, III. Dec. 23 Searsever cash items alone are sufficient Roebucks & today announced to cover all current liabilities the prices for 1932 in some cases at while many strongest possible condition is in- New "all-time dicated New others were back to the low marks per Fourthly it is not to be assumed of 1904 Time because company shows an imReductions were as much as 30 pregnable financial setup that it is 45 last year's necessarily making money. Operthe ating at a profit and solvency are tention called to the farm two entirely different things. It is which the company Bar even possible for a company to re- New York said was 33.3 per cent lower than port good earnings in its income and present and make an unsatisfactory showing in its balance sheet. If the earnings continue long other things being others Nash equal, they will be reflected in the Great Britain balance sheet but that often takes bills a good deal of time. Conversely, if earnings are consistently poor they will impair balance sheet posi- Belgium tion eventually but that also is Germany Holland sometimes long postponed. Norway Finally, the capital setup which Sweden always appears on the liability side Denmark 19.51. reveals the effect on earnings per share of increases or decreases in net income, the variation being the Greece Poland 11.30. greater the smaller the ratio stock capitalization to funded debt. Jugoslavia Rumania Bank Suspensions. Argentine New Haven, Conn., Dec. 23 (AP). The Broadway Bank and Trust company did not open for business today on order of the state bank A recent statement showed savings deposits of $1,607,365, general deposits of $846, and certificates of deposit of $202,268. New report today Waterbury, Conn. Dec. 23 (P) The Merchants Trust company of and this city remained closed today by steam Investment Trusts. order of the state bank commissioner. at the prices The state manual lists savings the counter deposits at $3,190,000. and comWednesday mercial deposits at $2,700,000. Gold earmarked Tr Sh Dow, Jones' Averages (Furnished Jackson Bros., Boesel & Co.) York, Dec. are the Dow, Jones' averages from India. the of the New York stock The Western market with the net its change from Tuesday's close peating Net with Average. tive industrials cash and Industry utilities the units Wool. Boston been at New York Dec. was quoted porting today quarter and quarter blood, after