Article Text

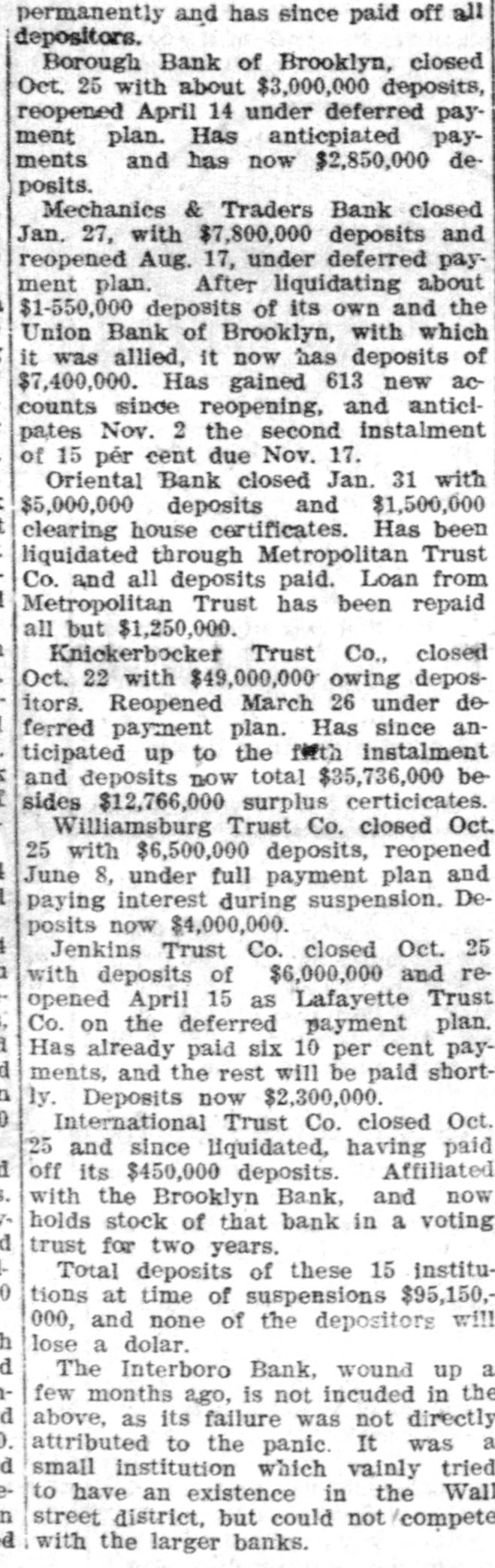

NOW UNLI Worst of the New York Bank Run Has Subsided. , WITHDRAWALS DECREASE Some Belated But Timid Ones Still Stand in Line. SAVINGS BANK *PRECAUTIONS Criticism of the Managers Is Tempered With Commendation-Restoring Confidence. Special Dispatch to The Star. NEW YORK October 26 With the marked abatement yesterday in the runs on the trust companies, which have been paying out money to timid depositors since Wednesday morning. the officers of the concerns looked today for a continued diminution that would bring the request for withdrawals down to the normal Of course there were the usual though smaller. crowds awaiting the opening of the doors this morning and the same crowds assurance was given that all demands would be paid. At the offices of the Trust Company of America. where only $2,000,000 wa paid out yesterday, as compared with $12,000,000 on Wed esday and $9,000.000 on Thursday, the officers were confident that the flurry, so far as the run was concerned, was about over. The reformation of the line at the company's offices at 37 Wall street began less than two hours after the close of business yesterday. The first man took his stand in front 0° the door at 4:45 and at 6 o'clock he had nineteen to keep him company. Two young women, numb rs 22 and 24 in the line, went on picket duty at 10 o'clock last night. At the Colonial branch of the trust company. as on Thursday night, the number of all-night vigilants was much smaller than at the company's headquarters. Five stuck it out from last evening and two of these spent the night in the corridor within the revolving doors. Both were said to be bankers' representatives. At 6:20 o'clock this morning there were only fifteen in line. At the Lincoln Trust Company's 5th avenue entrance there were several of those who failed to get admitted when the doors swung shut yesterday afternoon who remained in their places all through the afternoon. being joined late in the evening by a few more, while this mornIng at sunrise the line was considerably lengthened "Deposit Brokers." At the Dollar Savings Bank, 147th street and 3d avenue, where a run started several days ago. a line of some length formed early this morning Several men who called themselves "brokers" went down the line offering to take over the accounts of any anxious ones at 90 cents on the dollar, spot cash. but they found few takers At the Harlem Savings Bank, where the officers announced yesterday that they would take advantage of a thirty days notice, "as a protection to the depositors, there were only a few persons collected Following the suspension of some small Brooklyn banks because of the lack of ready cash in the present financial situation. there were depositors at the doors of some of the trust companies and banks there this morning prepared to withdraw their accounts One line formed outside the Union branch of the Mechanics' and Traders' Pank in the Temple Bar building. This bank has ten branches distributed throughout the borough. The line began to form outside the bank at 8:30 o'clock. when between thirty and thirty-five persons took their places before the doors. Another line formed outside the Nassau Trust Company's building at Fulton street and Red Hook lane As early as 7:45 o'clock there were a few persons in front of the doors. The depositors also gathered outside the Brooklyn Savings Bank, at Pierepont and Clinton streets the second largest bank in Brooklyn, There was a rush of depositors to that bank yesterday afternoon. and this morning at o'clock ther were between fifteen and twenty persons outside its door. The executive committee of the clearing house association this morning issued a call for meeting of the full association to be held at 12 o'clock to decide whether or not to issue clearing house certificates James T. Woodward. chairman of the clearing house committee, said that the situation today depended largely upon developments among the Brooklvn banks. Soon after arriving at the subtreasury this morning Secretary Cortelyou had a conference with George W. Perkins of J. P. Morgan & Co. Mr. Perkins subsequently said "The atmosphere is fast clearing up. as any one can see. Mr. Perkins was asked if he thought this would be the last day of the financial difficulty He replied: "I think it is. James Stillman this morning after the conference at the clearing house. said: "The situation has been saved by the of the heroie Treasury action Secretary of the who has been so ab.y assisted by the whole-hearted co-operation of Mr. Morgan.