Click image to open full size in new tab

Article Text

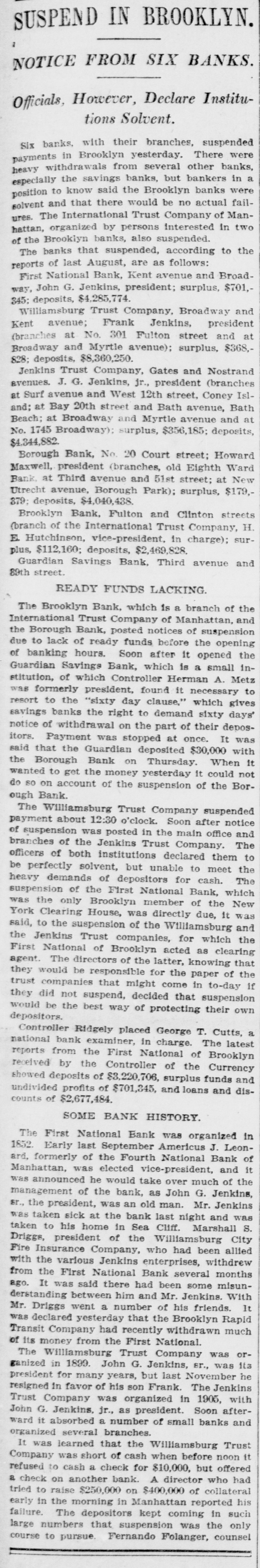

SUSPEND IN BROOKLYN. NOTICE FROM SIX BANKS. Officials, However, Declare Institutions Solvent. Six banks, with their branches, suspended payments in Brooklyn yesterday. There were withdrawals from several other banks, the savings a to know said were position especially heavy the banks, would Brooklyn be but bankers banks actual fail- in solvent and that there no ures. The International Trust Company of Manhattan, organized by persons interested in two of the Brooklyn banks, also suspended. The banks that suspended, according to the reports of last August, are as follows: First National Bank, Kent avenue and Broadway, John G. Jenkins, president; surplus, $701,345: deposits, $4,285,774. Williamsburg Trust Company. Broadway and Kent avenue; Frank Jenkins, president (branches at No. 301 Fulton street and at Broadway and Myrtle avenue): surplus, $368,828; deposits, $8,360,250. Jenkins Trust Company, Gates and Nostrand avenues. J. G. Jenkins, jr., president (branches at Surf avenue and West 12th street, Coney Island: at Bay 20th street and Bath avenue, Bath Beach; at Broadway and Myrtle avenue and at No. 1745 Broadway): surplus, $356,185; deposits, $4,344,882. Borough Bank, No. 20 Court street; Howard Maxwell, president (branches, old Eighth Ward Bank at Third avenue and 51st street; at New Utrecht avenue, Borough Park): surplus, $179,379: deposits, $4,040,438. Brooklyn Bank, Fulton and Clinton streets (branch of the International Trust Company, H. El Hutchinson, vice-president, in charge); surplus, $112,160; deposits, $2,469,828. Guardian Savings Bank, Third avenue and 89th street. READY FUNDS LACKING. The Brooklyn Bank, which is a branch of the International Trust Company of Manhattan, and the Borough Bank, posted notices of suspension due to lack of ready funds before the opening of banking hours. Soon after it opened the Guardian Savings Bank, which is a small institution, of which Controller Herman A. Metz was formerly president, found it necessary to resort to the "sixty day clause," which gives savings banks the right to demand sixty days' notice of withdrawal on the part of their depositors. Payment was stopped at once. It was said that the Guardian deposited $30,000 with the Borough Bank on Thursday. When it wanted to get the money yesterday it could not do so on account of the suspension of the Borough Bank. The Williamsburg Trust Company suspended payment about 12:30 o'clock. Soon after notice of suspension was posted in the main office and branches of the Jenkins Trust Company. The officers of both institutions declared them to be perfectly solvent, but unable to meet the heavy demands of depositors for cash. The suspension of the First National Bank, which was the only Brooklyn member of the New York Clearing House, was directly due, it was said, to the suspension of the Williamsburg and the Jenkins Trust companies, for which the First National of Brooklyn acted as clearing agent. The directors of the latter, knowing that they would be responsible for the paper of the trust companies that might come in to-day if they did not suspend, decided that suspension would be the best way of protecting their own depositors. Controller Ridgely placed George T. Cutts, a national bank examiner, in charge. The latest reports from the First National of Brooklyn received by the Controller of the Currency showed deposits of $3,220,706, surplus funds and undivided profits of $701,345. and loans and discounts of $2,677,484. SOME BANK HISTORY. The First National Bank was organized in 1852. Early last September Americus J. Leonard, formerly of the Fourth National Bank of Manhattan, was elected vice-president, and it was announced he would take over much of the management of the bank, as John G. Jenkins, sr., the president, was an old man. Mr. Jenkins was taken sick at the bank last night and was taken to his home in Sea Cliff. Marshall S. Driggs, president of the Williamsburg City Fire Insurance Company, who had been allied with the various Jenkins enterprises, withdrew from the First National Bank several months ago. It was said there had been some misunderstanding between him and Mr. Jenkins. With Mr. Driggs went a number of his friends. It was declared yesterday that the Brooklyn Rapid Transit Company had recently withdrawn much of its money from the First National. The Williamsburg Trust Company was organized in 1899. John G. Jenkins, sr., was its president for many years, but last November he resigned in favor of his son Frank. The Jenkins Trust Company was organized in 1905, with John G. Jenkins, jr., as president. Soon afterward it absorbed a number of small banks and organized several branches. It was learned that the Williamsburg Trust Company was short of cash when before noon it refused to cash a check for $10,000, but offered a check on another bank. A director who had tried to raise $250,000 on $400,000 of collateral early in the morning in Manhattan reported his failure. The depositors kept coming in such large numbers that suspension was the only course to pursue. Fernando Folanger, counsel