Click image to open full size in new tab

Article Text

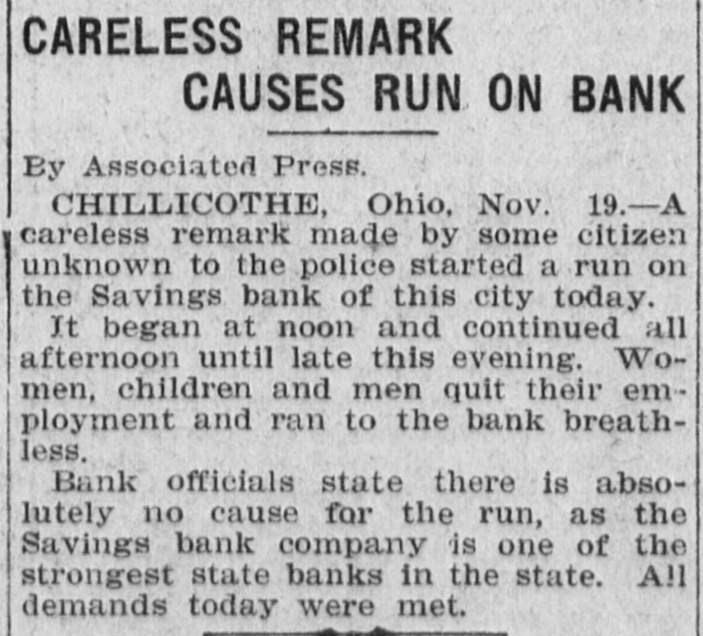

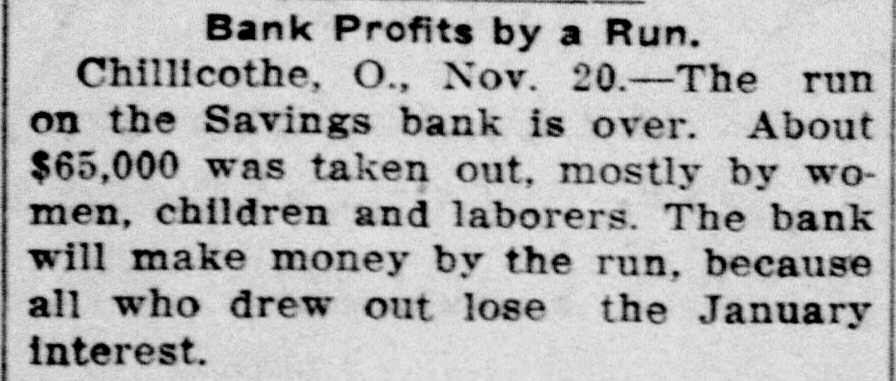

WEEK'S NEWS I CONDENSED FORM RECORD OF MOST INTERESTING EVENTS TOLD IN BRIEFEST MANNER POSSIBLE. HOME AND FOREIGN ITEMS Information Gathered from All Quarters of the Civilized World and Prepared for the Perusal of the Busy Man. The scandal involving an English countess and an Anglo-American millionaire is said to have been hushed by the use of money. The earl and his wife, well supplied with funds, left London together, and no legal steps will be taken by the husband. Commander Peary reached Sydney and said he may make another polar trip, for which he has designed a ship in the style of a monitor. Resolutions offered by W. J. Bryan declaring against private monopolies and favoring arbitrataion between nations of international disputes were by the conafter the on adopted gress committee Transmississippi them out. resolutions failed to report Wages of 60.000 employes of the United States Steel corporation, Fall River mills, New York Central and other companies were advanced from five to ten per cent. Mayor Schmitz, of San Francisco, arrived in New York from Europe and denied all charges against him, declarmg that they were the work of political enemies. Enrico Caruso, the Italian singer, was found guilty in New York of inmulting women and sentenced to pay a fine of $10. Gov.-elect Hughes in an address at a Republican meeting in New York served notice on the party machine that his administration is to be independent and have for its aim only the public good. Mrs. James H. Delaney, of Chicago, killed her husband, president of the American Shipping company, and then committed suicide. Street car strikers at Hamilton, Ont., became violent and troops were summoney from Toronto to restore order. Joseph F. Smith, president of the Mormon church, pleaded guilty to a charge of unlawful cohabitation and was fined $300. Premier Laurier announced in the house at Ottawa, Ont., that Charles Hyman had announced his resignation as a commissioner of public work on account of poor health. Ouster suits were brought in the Kansas supreme court against the mayors of Wichita and Leavenworth, because of the non-enforcement of the prohibition law. Thomas Forsyth Hunt, professor of astronomy at Cornell, has accepted the position of dean of the Pennsylvania a college of agriculture. Prof. Hunt is graduate of the University of Illinois. As the result of friction over publishers' privileges in the United States and Canada, the dominion has notified the Washington government that the postal agreement between the two countries will be abrogated May 7. next. Edward L. Cronkrite, former mayor of Freeport, Ill., and for six terms a member of the Illinois leglislature, being Democratic caucus nominee for speaker at the time of the historic fight between Logan and Morrison for the United States senatorship, died suddenly. A new counterfeit five-dollar silver certificate announced from Washing ton, D. C., as circulating in Chicago was discovered by a clerk in the subtreasury. Ernest D. Keeler, of New York, demonstrator and professional driver of racing automobiles, was killed and Henry Lutton, of Colwyn, Pa., was dangerously hurt in a collision while trying out racing cars. Prairie fires in western Texas and eastern New Mexico have swept over a million acres of grazing and homestead land. Alarming earthquake shocks in German New Guinea, the Bismarck archipelago, followed by tidal waves, causing much loss of life among the natives, are reported by the steamer Miowera from the South Sea. Capt. Andrew Crockett, of the Chesapeake Bay oyster schooner dredge James A. Whiting, indicted under the new federal "shanghaiing" law, was found guilty and sentenced to pay a fine of $500 by December 1 or serve six months in jail. In a fight over a pool game James McLean, a Cincinnati contractor, was shot and instantly killed by George Scherd. Secretary Taft ordered that discharges of colored troops be suspended pending further ,advices from President Roosevelt. The anarchist, Saverio Lagana, who stabbed and killed Prof. Giovanni Rossi, of the University of Naples, was arrested. Careless remarks of a citizen caused a foolish run on the savings bank of Chillicothe, O. The German Insurance company, which reinsured in the Royal of Liverpool, was placed in the hands of a receiver, the Chicago Trust & Title company being named. A Swiss governess threw an immigrant's baby into the sea from the deck of an ocean liner. Charles Thomas, serving a life imprisonment term for the murder of Mabel Scofield seven years ago, was denied a new trial by the Iowa supreme court. Episcopal court of review affirmed the verdict Dr. from Crapsey heresy ministerial suspending Kansas functions. Secretary Root, in City speech, said the United States was