1.

October 25, 1907

The Topeka State Journal

Topeka, KS

Click image to open full size in new tab

Article Text

WHY IT CLOSED. National of Brooklyn Responsible for Two Trust Companies. Washington, Oct. 25.-Comptroller of the Currency Ridgely stated this afternoon that the Jenkins Trust company and the Williamsburg Trust company which suspended payment today, were directly responsible for the closing of the doors of the First National bank of Brooklyn. It appears that the latter bank cleared for the two trust companies and the closing of the bank doors today was for the purpose of protecting their depositors, inasmuch as otherwise it would have been held responsible for the paper of the two trust companies that might come in any time up to tomorrow morning.

2.

October 26, 1907

The Montgomery Advertiser

Montgomery, AL

Click image to open full size in new tab

Article Text

NEW YORK PASSES TRYING DAY (Continued from Page One.) issues occurred in 1873 and 1884. The last occasion on which they were used was in 1893. The clearing house certificate is practically a guarantee byal banks in the clearing house that the certificates shall be redeemed at par, but the clearing house banks are protected against loss by the fact that first class securities, either commercial -paper or stocks and bonds, are required before the certificates are issued. The certificates are used only be tween banks. They do not appear in general circulation, but by relieving the banks of the strain of large debit balances, they enable them to keep their cash reserves comparatively in. tact It is believed by competent bankers that an issue of $50,000,000 will be the outside requirement at present. It is believed also that the mere fact that they are to be issued will so far re store confidence that runs upon banks win cease, so that it will not be necessary to keep certificates outstanding for any considerable time. Already the strong city banks are receiving large deposits from persons who have withdrawn their money from institutions which have fallen under suspicion. This does not preclude the fact that considerable amounts have been put in safe deposit boxes and thereby withdrawn from circulation, but it is believed that renewed confidence will cause the return of this money to the banks within a short time Imports of Gold. Late in the afternoon a favorable light was cast upon the prospects of imports of gold by a sudden fall in foreign exchange. The market has been practically at standstill for several days with large offerings of bills and few takers This afternoon, how ever, the rate dropped to 4.85. which practically makes imports of gold possible at a profit. Leading bankers and foreign exchange houses have been looking for this development but hardly expected that it would come so soon. The tide of gold, once it sets on. the way, will undoubtedly reach a large volume, in view of the considerable amounts due this country for the outgoing crops and for securities. While the present market is one to encourage the general public to buy American securities, there are always shrewd observers in Europe who are disposed to buy at times like the present and some of them have been in the market during the past few days. It will be possible even by the process of Joans to transfer a part of the burden of carrying stocks from New York to London and Paris, but this has been tone thus far to only a limited extent The fact that the banks and the stock exchanges will be open for business but two hours tomorrow and that Sunday with all its opportunities of calming public sentiment will intervene, added to the more hopeful view taken by leading financiers tonight will do much toward clearing the financial skies before next week. At a meeting of the directors of the Lincoln Trust Company tonight, Louis Stern, a director, was authorized to make the following statement: (The directors of the Lincoln Trust Company are justified in stating that the company is in a position to meet every demand that may be made upon it and that the company is In a strong. et position tonight than any day this week. Furthermore, the withdrawal of funds has been less day by day At a meeting late today the direc. tors, of the Knickerbocker Trust Com. pany appointed a committee to take steps to bring about a resumption of business The committee later announced that an agreement providing for the deposit of claims of depositors and of shares of stock of the company was being prepared The committee will meat Monday to pass on this agreement Run Continues Baltimore. Oct. 25. The run on the East Branch of the Home Bank, continued today and shortly before noon, the depositors who were in line waiting for their money were notified that the bank would take advantage of a chare ter provision which permits the institution to demand sixty days notice of a positor's intention to withdraw his or her account A member of the firm of Bernstein, Cohen and Company, owners of the bank, today admitted that the run has been of much larger proportions than had been reported. Runs on Pawtucket Banks. Pawtucket R. I. Oct. -Follow ing the posting of the ninety day notice to depositors by the local branch of the New England Trust Company, of Providence runs were started today on all banks in Pawtucket. With the exception of the New England Trust Company all the banks met the demand without difficulty GOVERNOR APPEALED TO. A Legal Holiday to Relieve Financial Situation Asked For. Albany, N. Y., Oct. 25 -Governor Hughes today received a number of telegrams suggesting that he proclaim a legal holiday during which the financial situation might be relieved. The Governor acknowledged the receipt of all of these messages without indicat ing his intentions. He would not dis. cuss the question tonight, but there is a good reason to believe there is no immediate probability of his taking this step. COMPTROLLER OF CURRENCY GIVES OUT A STATEMENT. Washington, Oct. 25.- The following statement was given out today by the Comptroller's office: The First National Bank of Brook lyn. N. Y., closed its doors this afternoon and National Bank Examiner George T. Cutts has taken charge by order of the Comptroller of the Currency. The First National Bank cleared for the Williamsburg Trust Com pany and the Jenkins Trust Company of Brooklyn, both of which failed to. day The National Bank was closed to protect its depositors against the checks of the Trust Companies, which might be presented through the Clear ing House.

3.

October 26, 1907

The Salt Lake Herald

Salt Lake City, UT

Click image to open full size in new tab

Article Text

Knickerbocker Will Resume. At a meeting late today the directors of the suspended Knickerbocker Trust company appointed a committee to take immediate steps to bring about a resumption of the business of the company. The committee, which is made up of Fred G. Bourne, chairman; President A. Foster Higgins, G. Louis/Boissevain Moses Taylor, William A. Tucker, Charles Perrin and Leopold Wallach, later announced that an agreement providing for the -deposit of claims of depositors and of shares of stock of the company was being prepared. The committee will meet at 10:30 o'clock Monday morning and pass upon this agreement proposition as submitted by counsel. CLOSED FOR PROTECTION. Statement Concerning First National Bank of Brooklyn. Washington, Oct. 25.-Comptroller of the Currency Ridgely stated this afternoon that the Banking & Trust company and the Williamsburg Trust company, which suspended payment today, were directly responsible for the closing of the doors of the First National bank of Brooklyn. It appears that the latter bank cleared for the two trust companies and the closing of the bank doors today was for the purpose of protecting their depositors, inasmuch as otherwise It would have been held responsible for the paper of the two trust companies that might come in any time up to tomorrow morning. The following statement was given out late today from the comptroller's office: "The First National bank of Brooklyn closed its doors this afternoon and National Bank Examiner George T. Cutts has taken charge by order of the comptroller of the currency. The First National bank cleared for the Williamsburg Trust company, and the Jenkins Trust company of Brooklyn, both of which failed today. The National bank was closed to protect its depositors against the checks of the trust companies which might be presented through the clearing house."

4.

October 28, 1907

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

any other institution for the time," he said. "All of the other members of the Clearing House received the same instruction regarding the banks for whom they were clearing That order left us without means of getting cash. We have as good securities as any other bank in the country, but when we were unable to get money upon them we had no alternative but to close our doors. The Clearing House is doing everything that it can to improve the present situation, and as soon as this flurry is over I suppose it will rescind its order regarding clearing. Of course only a certain number of banks can be members of the Clearing House, and the other banks have to clear through them. "The state accountants are still going over our books, and they will not report probably until Tuesday or later. Our bank is entirely sound. The rumor that politicians have had preferences shown them by us is entirely unfounded. As for the International Trust Company, we had never gone into that concern. The action was only proposed, but was not carried out, and now will not be." The Jenkins Trust Company, the First National Bank. the Terminal Bank, the Williamsburg Trust Company and its branches, generally known as the "Jenkins banks," it was generally understood yesterday would reopen on Tuesday. The federal and state examiners, according to the directors, have found the institutions solvent and in a position to continue doing business as soon as the ready cash was obtained. President John G. Jenkins, jr., said yesterday he did not propose to open the Williamsburg Trust Company's offices until he was satisfied he could do SO without closing his doors again. He said that his bank would never have been compelled to close up had it not been for the run which used up all the available cash. A movement is on foot, according to Jullan D. Fairchild, president of the Kings County Trust Company, to bring the banks and the trust companies closer together. "We do not need a clearing house in Brooklyn, as has been suggested," he said yesterday. "We want only one such institution. What we do want is a closer connection between the banks and the trust companies. The trust companies should go into the clearing house, either as regular or as associate members. The trust companies, like the banks, should make weekly reports concerning themselves. That would give people a reliable understanding of the banking situation of the city's institutions. The trust companies have as much. if not more, money on deposit than the banks have, and yet at present they do not take steps to keep the public informed concerning themselves. This crisis may result in bringing them into closer relation with the banks. I do not think that they should be compelled to keep on hand such large reserves as the banks. The banks must have 25 per cent of their deposits, but the trust companies are not required to keep more than about 12 per cent on hand. Their deposits are slower. not so liable to be paid out and their securities are better. The Clearing House and the trust companies should be able to determine upon some equitable arrangement whereby the trust companies could become members or associate members of the former."

5.

October 29, 1907

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

BOROUGH BANK INQUIRY. Examiners Still Busy Finding Cause of Troubles. Bank examiners have 80 far been unable to reach the bottom of the tangled affairs of the Borough Bank. in Brooklyn, which suspended on Friday coincidently with the suspension of the International Trust Company, of Manhattan, and the Brooklyn Bank, a branch of the International Trust Company Paul Grout, of counsel for the institution, .d after R protracted meeting of the directors yesterday afternoon: "The bank examiners are still busy on our books. Until they have made a report we shall make no statement." This declaration was repeated in reply to several questions regarding a number of stories about the financial methods of the suspended institution. Howard C. Pyle, a Brooklyn real estate man, who started aspetition yesterday among the depositors, expressing their confidence in the bank's management and agreeing to leave their money on deposit for six months, said that this action was taken to forestall the possibility of the appointment of a receiver It is felt that A receivership would be distinctly against the best interests of the depositors. Of the 4,250 depositors not more than a score had signed the petition yesterday, but a meeting of the depositors has been called for 11 o'clock to-morrow morning. It will be held in The Assembly, in Pierrepont street, and at that time some action will be taken to conserve the best interests of the depositors, who represent some $2,500,000 of deposits. It was stated on the day the bank suspended that some $2,000,000 had been drawn out within a week. The Oriental Bank, of Manhattan, suddenly ceased to clear for the Borough Bank about five days before the suspension of the latter. There was a story yesterday that about $500,000 of cotlateral which the Borough Bank was supposed to have on deposit with the Oriental had been found not up to the standard and that this had something to do with the suspension. At the Oriental Bank it was said in connection with these stories: "The International Trust Company does not owe anything to the Oriental Bank and the Borough Bank has only a small loan. amply secured by satisfactory collateral. The Oriental stopped the clearing privilege of the Borough Bank because the balances of the Borough were not up to the requirements of the Oriental Bank.'' Regarding two loans, said to be of $140,000 each, said to have been made to two directors of the International Trust Company from the Borough Bank or the Oriental Bank, representatives of the latter institution said they knew nothing of such loans. William Gow, who organized the International Trust Company and owns a controlling interest in the Borough Bank, was quoted yesterday as saying that the International owed money to the Borough. He refused to go into details. Discussing the possibility of the Borough Bank being able to pay its depositors in full, one of the directors said with emphasis: "The directors will have to see that the depositors are paid. I shall insist upon it." He declared that he personally had not borrowed a dollar from the institution. An Alderman who Is running for re-election in one of the South Brooklyn districts has $10,000 tied up in the Borough Bank. This crippled him so seriously that he had to go to a savings bank yesterday to get some of his nest egg. He was allowed to take $150, and will now be able to carry on his campaign. Of the money tied up in the Borough Bank $83,000 is deposited by the city in the form of certified checks given to the city by contractors as bonds for the fulfilment of contracts. The city will be responsible for this money. Confidence was restored in financial circles in Brooklyn yesterday. The uneasiness which was plainly evident on Saturday had been replaced by assurance that the Brooklyn banking institutions were perfectly sound and that it was the part of folly to withdraw money on deposit in them. It was said to be almost certain that the First National Bank of Brooklyn, the Williamsburg Trust Company and the Jenkins Trust Company would reopen within a few days, or as soon as the bank examiners had made their report. In a majority of the institutions the receipts in cash for the day were far ahead of those taken out by depositors. There was only one institution which had a line at the paying teller's window worthy of notice at the opening of banking hours. This was the Home Trust Company. But by noon the officials of the trust company had established connections with Manhattan Institutions, which gave it more resources than it needed. In the morning the depos-

6.

November 8, 1907

The Birmingham Age-Herald

Birmingham, AL

Click image to open full size in new tab

Article Text

Bank Will Reopen. New York, November 7.-The board of directors of the Jenkins Trust company of Brooklyn, which suspended two weeks ago, today issued a formal statement announcing that they are taking measures which will insure the reopening of the institution at an early date.

7.

November 12, 1907

Lewiston Evening Teller

Lewiston, ID

Click image to open full size in new tab

Article Text

RAILROADS RUSH CROP SHIPMENT ALL BIG GRAIN ROADS EAST PREPARING TO GIVE GRAIN SHIPMENTS RIGHT OF WAY so EUROPE CAN BE DRAWN UPON. NEW YORK, Nov. 12.-While the local banking situation continues to clear rapidly, the general shortage of currency is causing trouble in other parts of the country. Money is needed for the movement of crops, and bankers and railroad men are making every effort to get grain to New York and cotton to the Southern ports, that they may draw upon Europe for more gold. A committee of railroad men, representing the big grain roads, returned today from a mission to Washington. They appealed to the interstate commerce commission for permission to give grain shipments the right of way over other freight. The commission refused to authorize the violation of the law, but the railroad men are said to have received the intimation somewhere in Washington that they might hurry the grain along without fear of serious objection from the government. Railroad men declare there is enough grain in Buffalo to save the situation, if it can only be forwarded to New York and loaded on steamers. Europe is anxious to buy, and. once the grain is loaded the bankers can draw against it. It is understood here that Southern railroads will rush cotton shipments to Mobile, Savannah, New Orleans and Galveston on their own responsibility. Cotton exports to date are more than 400,000 bales short of last year. At $50 a bale this is a matter of $20,000,000, which would be a great help in the present stringency. There seemed to be no lack of currency in the Trust Company of America and the Lincoln Trust company. In the Trust Company of America today three tellers were busy during the day, and neårly kept the line wiped out. The number of depositors showed a substantial increase. In Brooklyn the banking situation shows signs of clearing. The Jenkins Trust company, which suspended over two weeks ago, posted this notice: The state bank examiner and a committee of the body having reported the Jenkins Trust company as solvent, the board of directors is tak ing measures which will insure the opening at an early date." There was a long meeting of the Williamsburg Trust company directors. It was said Superintendent

8.

November 16, 1907

Rock Island Argus

Rock Island, IL

Click image to open full size in new tab

Article Text

Little Improvement in This Respect Shown at New York as Yet. BOND ISSUE SOON Cortelyou Planning to Put Out $50,000,000 for Building of the Panama Canal. New York, Nov. 16.- - The weekly bank statement follows: The banks hold $53,667,000 less than requirements of 25 per cent reserve rule. Loans increased $4,694,000. Deposits increased $2,426,000. Reserve decreased $1,136,000. Deficit increased $1,742,000. Ex. U. S. deposits increased $1,925, 000. Finds Evidence of Crime. New York, Nov. 16.-Attorney General Jackson gave out a statement this to the effect in his of both criminal afternoon evidence and opinion civil liability had been unearthed of the investigation Brooklyn Borough Bank in the of and the Jenkins Trust company of Brooklyn. Receivers for Six Failed Banks. Kingston, N. Y., Nov. 16.-Temporary receivers were appointed today for six New York banks which recently payment. They are: New York and suspended Hamilton. Brooklyn The banks, Borough Bank of of Brooklyn, and Jenkins of New International Brooklyn. York, Application was made in behalf of the attorney general of I the state. Factories Affected. Pa., Nov. 16.-The plant of the mansburg Easton, American Free. Novwill close first of next after elty company the year. tonight The until company owns 32 plants in the and it is stated all afStates, fected will United be by the suspension. The wages of employes of the Andover furnace of Phillipsburg and the m Empire Iron works of Oxford. N. J., have been reduced 10 per cent. Silk Mills Close. t. is York, Pa., Nov. 16.-Three silk mills f of this city, owned by the American k Silk company. closed at noon today. 800 and 1.000 out of work. The because Between thrown employes closing were was of lack of orders. The o paid the were nouncing not management hands anits inability to secure currency. May Issue Canal Bonds. S Washington, D. C., Nov. 16.-Panama bonds to the amount 1. will be issued Sec. 000,000 canal probably of by $50.1retary of the Treasury Cortelyou. When the secretary was in New York dThursday he consulted with a number as to the d and, finding that the d of this bankers action. advisability bonds of g would be subscribed for at least par he has practically decided to make at the issue. e a It developed that the president and i. his cabinet have given considerable y thought to this matter. When Leslie was secretary of ury $30,000,000 worth of M. Shaw he sold the treas- canal On account of the 1 the treasury during his bonds. plus in large admin- surnistration he declined to sell additional congress had bonds, although authork. total issue of in expenses of canal work Vcash balance. of the available The from need 14 bonds by national paid to izeda government increase the $135.000.000, banks but their issue of er itself he has impressed strongly bank upon notes Sec. it. retary Cortelyou for several weeks past. he VBonds Available Are High. The bonds now available are at a high figure as to such make quoted them almost prohibitive. United States 2s. re for example, rising from 102 to 108. s' During the last session of congress he was passed removing 24 as to taxation strictions bill which certain made re- a 0. the Panama canal bonds available as a basis for bank note is as the Some doubt expressed issues. to ay wisdom of the secretary's th an issue of bonds at et making It this policy time. in is claimed the effect would be to by withdraw $50,000,000 from the market. which eventually would go back in the form of bank notes. It is secretary's he ever, to be to the make purpose, understood howgo the subscription popular 60 in order to attract money which has ment in form of been the invest. withdrawn from banks and is being hoarded in safe deposit boxes or other recep'ntacles where it is unavailable for cirbe culation.

9.

November 17, 1907

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

RECEIVERS FOR 6 BANKS . ATTORNEY GENERAL'S ACT ! Sees Crime in Two Brooklyn Institutions-All Closed Before. Justice Betts of the Supreme Court, sitting all Kingston. on the application of Attorney General Jackson. appointed receivers yesterday for the Hamilton Bank and the International Trust Company, of Manhattan. and the Jenkins Trust Company, the Williamsburg Trust Company. the Brooklvn Bank and the Borough Bank. of Brooklyn, all of which were closed by the State Banking Department in the recent financial flurry. Evidences of criminality were found in the Borough Bank. the Attorney General said. consisting of forged paper, overloans and overdrafts, all of which would be laid before the grand jury. In the Jenkins Trust Company, Mr. Jackson said, there were evidences of illegal overloans. one to John G. Jenkins, jr., the president. being for $557,000. William R. Montgomery, president of the Hamilton Bank. denounced at his home last night the action of the Attorney General in asking for a receiver for the Hamilton Bank He said that Mr. Jackson knew that a plan had been partly arranged for strong banking interests to take over the institution. advancing at once $1,500,000 In the case of the Williamsburg Trust Company the application for a receiver was no Sure prise to the officers, as a committee of directors, headed by Charles Jerome Edwards, had made application on Friday to the local office of the Attorney General for such a proceeding. A.C. Scharmann, a director of the Jenking Trust Company, said that he knew nothing et the contemplated appointment of a receiver in the company when he left the offices of the company at noon He said also that he was unaware of the existence of any irregularities in the affairs of the institution. as charged by the Attorney General. William Gow. who was one of the organizer> of the International Trust Company and is a director of the Borough Bank, said of the latter institution that he was sure none of the things charged against the institution were true. The directors of the Borough Bank of Brooklyn issued the following statement last night: The result of the Borough Bank directors' investigation was given to the State Banking Department yesterday morning. This investigation developed the fact of irregularities so eleverly conceived and manipulated that the books of the institution failed to disclose them. As a result of this the directors were enabled to recover the whole of the discrepancies and through this directors' investigation the entire facts are now in possession of both the State Banking Department and Attorney General Jackson. The directors of the Borough Bank decline to make any statement further than to say that a thorough examination of the institution's affairs has been made by expert bank accountants of highest standing, with the result that the bank was found to be perfectly solvent and its capital unimpaired. The bank examiner in his report says: "Since the beginning of this examination the directors have secured from Mr. Gow, of Ward & Gow. and others an assignment of all their equities in real estate and other properties worth at least $700,000. and, if this additional collateral is allowed, all loans by this bank to Mr. Gow, either directly or indirectly. are amply secured, and instead of a surplus of $11,935 ; *303 my asset and liability sheet will show a surplus of $137,080 74." MR. JACKSON'S +STATEMENT. The application of the Attorney General for the appointment of the receivers was based on affidavits made by Clark Williams, the State Superintendent of Banks. The following statement in explanation of Mr. Jackson's step was issued at the office of the Attorney General here: Attorney General Jackson appeared before Justice Betts in Special Term of the Supreme Court at Kingston this morning and made application for the appointment of receivers for the Williamsburg Trust Company, the Hamilton Bank, the Borough Bank of Brooklyn, the

10.

November 17, 1907

Daily Press

Newport News, VA

Click image to open full size in new tab

Article Text

TWO of the Suspended Institutions Found to be In Bad Shape. OVERLOANEO TO THE PRESIDENT Attorney General Jackson of New York State, Unearths Some Acts Which are Criminal and Which He Will Place Before the Grand Jury. (By Associated Press) NEW YORK, Nov. 16-In securing today the appointment of "receivers for three banks and three trust companies in New York and Brooklyn, which recently suspended payment, State Attorney General Jackson declar. ed that in the Borough Bank of Brook lyn and in the Jenkins Trust Company evidence has been found of illegal overloans and of both civil and criminal liability. In the case of the Borough Bank, Mr. Jackson stated that there is evidence also of overdrafts, forged papers and other criminal transactions, all of which will be presented to the grand jury. In the Jenkins Trust Company the attorney general declares the records show overloans to the president. John G. Jenkins, Jr., aggregating $557,000. The applications for receivers were made to Justice Betts of the Supreme Court at Kingston, N. Y., and were based upon affidavits of Clark WIIliams, superintendent of banking. Mr. Jackson said today that he will still continue to co-operate in all efforts to rehabilitate the banks now in the hands of temporary receivers. The investigation thus far has been confined to the Borough Bank of Brooklyn and the Jenkins Trust Company. Attorneys for the Brooklyn bank is. sued 3 statement this afternoon in which they declared that the Brook. lyn bank and the International Trust Company have assets of $800.000 in excess of the amount owed depositors: that they expect soon to com plete arrangements with depositors to accept certificates of deposit in part payment of their claims, and that they hope to avert a permanent receivership.

11.

November 17, 1907

Omaha Daily Bee

Omaha, NE

Click image to open full size in new tab

Article Text

RECEIVERS FOR SIX BANKS Application Made on Behalf of Attorney General Jackson of New York. KINGSTON. N. Y., Nov. 16. - -Temporary receivers were appointed today for six New York City banks and trust companies which recently suspended payment The banks are the Hamilton of One Hun dred and Twenty-fifth street, New York the Brooklyn bank, and the Borough bank of Brooklyn, and the trust companies, the Williamsburg and Jenkins of Brooklyn. and the International of New York. Ap plication for the receivers was made by William F. Mackey for Attorney General Jackson. Orders to show cause why permanent receivers should not be appointed were granted and were made returnable at Albany November 30. NEW YORK, Nov. 16.-Attorney General Jackson stated this afternoon that, in his opinion, evidence of both criminal and civil liability has been unearthed in the investigation of the Borough Bank of Brook lyn and the Jenkins Trust company of Brooklyn, and that in the Borough Bank of Brooklyn there has been found evidence of illegal overloans, overdrafts, forged paper and other criminal transactions, all of which will be presented to the grand jury. In the Jenkins Trust company, the attorney general says, there, has been found evidence of illegal overloans. It is claimed by the trustees, the attorney general adds, that they knew nothing about these illegal loans made to the president of the company. The attorney general's announcement contains the statement that the investigation thus far has been confined to the Borough Bank of Brooklyn and the Jenkins Trust company.

12.

November 22, 1907

Troy Weekly News

Troy, ID

Click image to open full size in new tab

Article Text

Fraud Charged. New York, Nov. 18.-Charging that the president of the Jenkins Trust company of Brooklyn borrowed illegally $557,000 from that institution and that evidence of civil and crimnal liability had been found in the Borough bank of Brooklyn as well, Attorney General Jackson has startled financial circles by the obtaining of temporary receivers for six suspended banks and trust companies.

13.

November 24, 1907

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

WALL STREET CHEERS UP. Money Stringency Relaxes, Stocks Advance and Gold Flows In. A more cheerful feeling than has been evident for many days prevailed yesterday in Wall Street, based upon the opinion that definite relaxation in the money stringency was at hand. The premium on currency remained at about Friday's closing rates, 1 per cent being paid by the money brokers for cash sold to them and 2 per cent asked by them from purchasers; but only a moderate business was done, and the money dealers characterized the market for currency as weak. In the Danks it was said that the demand from institutions in the interior, which has been held chiefly responsible for a continuance of the money famine at this centre, was slackening, and that as a consequence the prospect was that the local banks would be able this week to accommodate their customers with currency to a much larger extent than before. Currency transfers through the Sub-Treasury aggregated $390,000, of which $310,000 was sent to San Francisco, $50,000 to Denver and $30,000 to Philadelphia. The stock market was strong during the two hours of business. prices advancing from the outset and closing at the best figures of the day. Among the net gains were 3% points in Union Paelfic, 21/4. in St. Paul, 2% in Pennsylvania, 2% in Reading, 21/4 in Northern Pacific, 3% in American Smelting and Refiring, and 2 points each in Southern Pacific and in Amalgamated Copper. The weekly bank statement, which was issued at the close of the market. made an encouraging showing Loans decreased $4,012,000. the first shrinkage in this item since the beginning of the panic period. and deposits decreased $9,485,000. A decrease in cash holdings of $2,807,900 was shown, comparing with the preliminary estimates of a less of more than $6,000,000. Owing to the large decrease in deposits, the decrease in required reserve was only $436,650 less than that in the actual reserve, this amount bringing the total deficit in reserve to $54,103,600. The percentage of reserve to liabilities is now 19.99. against 20.07 a week ago. Some of the banks which have subscribed for the government 3 per cent certificates of indebtedness, for the purpose of using them as a basis for taking out additional circulation, made payments of cash at the local Sub-Treasury yesterday, on account of their subscriptions. Of these subscriptions the banks are to be allowed to retain 75 per cent as special government deposits, secured by collateral other than government bonds, the remaining 25 per cent to be paid over to the Treasury. No additional gold engagements were announced. The Sub-Treasury and the Assay Office had a busy day, receiving more than $12,000,000 gold which had been brought in by the Mauretania, the Baltic and La Savoie. the gold going to the Sub-Treasury and the bars to the Assay Office. Committees representing the depositors of the Jenkins Trust Company and its various branches effected a permanent organization at the Brooklyn Club last night. Almet R. Latson, president of the Union League Club, was selected as counsel, and Magistrate E. G. Higginbotham and ex-Judge Owen Finnerty as members of an executive committee. They will co-operate with Hugo Hirsh, counsel of the directors, in fighting making the receivership permanent. Reports of progress will be made at a meeting of depositors to be held at the Bedford branch of the Young Men's Christian Association on Tuesday night.

14.

November 29, 1907

The Mankato Free Press

Mankato, MN

Click image to open full size in new tab

Article Text

INDICTED FOR FORGERY. Three Brooklyn Financiers Arrested and Released Under Bond. New York, Nov. 27.-John G. Jenkins, Jr., until recently president of the Jenkins Trust company of Brooklyn; Frank Jenkins, deposed head of the Williamsburg Trust company, and Fred Jenkins, formerly a director of the latter institution, have been jointly indicated for forgery in the third degree. The indicted men are brothers and the charge against them grew out of loans made the brokerage firm of F. and J. G. Jenkins, Jr., & Co. by the Jenkins Trust company. The transactions were disclosed during the examination of the trust company's books made by the state banking department after the institution had suspended. These revelations, with others, brought about the receivership and later were laid before the Kings county grand jury, which has concerned itself with banking irregularities in Brooklyn. The three men indicted were arraigned and after entering pleas of not guilty were released, each under a bond of $10,000. The Jenkinses are jointly indicted on four counts alleging that they caused false entries to be made in the books of the Jenkins Trust company whereby loans made by the trust company to the president, in excess of what he could have legally secured as an officer of the institution, were made to appear as loans to employes of the firm of F. and J. G. Jenkins, Jr., & Co. The specific charge against Former President Jenkins is that a certain part of the $557,000 secured as a loan from the trust company on Oct. 1, and standing in the names of several clerks of F. and J. G. Jenkins, Jr., & Co., was in reality a loan to him, and that the whole amount had been loaned to him and his firm and not to the clerks to whom it was nominally paid.

15.

November 29, 1907

Iowa State Bystander

Des Moines, IA

Click image to open full size in new tab

Article Text

# JENKINS BROTHERS INDICTED.

Former Officials of Trust Companies

Accused of Forgery.

New York.--John G. Jenkins, Jr., until recently president of the Jenkins Trust company of Brooklyn; Frank Jenkins, deposed head of the Williamsburg Trust company, and Fred Jenkins, formerly a director of the latter institution, were jointly indicted Tuesday for forgery in the third degree.

The indicted men are brothers and the charge against them grew out of loans made the broker firm of F. & J. G. Jenkins, Jr., & Co., by the Jenkins Trust company. The transactions were disclosed during the examination of the trust company's books after the institution had suspended.

The three men were arraigned and after entering pleas of not guilty, were released, each under a bond of $10,000.

16.

November 30, 1907

Waterbury Evening Democrat

Waterbury, CT

Click image to open full size in new tab

Article Text

Wants Receiver Named. Albany, N. Y., Nov 30. - -Receivership proceedings concerning three banks and three trust companies of New York city were the center of interest in Justice Betts's special term in supreme court here to-day. The hearing came up on orders issued at Kingston, November 16, on the application of Attorney General Jackson, appointing temporary receivers and fixing to-day as the time for showing cause why the receivership should not be made permanent. The temporary receivers were named on the affidavits of Clark Williams, state superintendent of banks. Justice Betts named these receivers: Williamsburg Trust Co of Brooklyn, Frank L. Bapst, president of the Buffalo Dredging Co, bond $300,000; Brooklyn Bank of New York, Bruyn Hasbrouck of New Paltz, bond $150,000; Hamilton bank of New York, Frank White of Albany, bond $200,000; Jenkins Trust Co of Brooklyn, John Mulhall of New York, bond $200,000; Borough bank of Brooklyn, Henry A. Powell of Brooklyn and Isaac N. Cox of Ellinville, bond $100,000 each; International Trust Co of the Borough of Manhattan, George Brown of New York, bond $100,000. It was on October 25 and 26 last that State Superintendent Williams reported to Attorney General Jackson that he had taken possession of the Williamsburg Trust Co, the Hamilton bank, the Borough bank, the Jenkins Trust Co and the International Trust Co and the Brooklyn bank. A few days later the state superintendent notified the attorneygeneral that the banks and trust companies were unable to continue business and should be placed in the hands of receivers. The attorney-general co-operated with the state superintendent of banks with the result that receivers were named for all the institutions.

17.

December 4, 1907

The Evening World

New York, NY

Click image to open full size in new tab

Article Text

NEW INDICTMENTS ARE DRAWN FOR BANK WRECKERS Brooklyn Grand Jury Ready to Present More Bills in Scandal. POLITICIANS UNEASY. Men Who Expected Subpoenas Are Wondering Why They Didn't Get Them. The December Grand Jury investigathan into the wrecking of the Brooklyn banks has progressed so far that indictments have, been prepared and will be submitted "to the Court as soon as the evidence is all in. The Williamsburg Trust Company officials were on the Grand Jury rack to-day. Marshall Driggs, a director who was apposed to the control of the conqern by the Jenkins family, was called beSere the Grand Jury twice. The other witnesses were Directors Charles Jerome Edwards, J. H. Weber, J. N. Mobeidt, T. F. Jackson, R. T. Weber and Paying Teller W. A. Fields. District-Attorney Clarke has succeeded in burying his investigations under mound of secrecy that is causing a lot of uneasiness in Brooklyn financial and political circles. Certain directors of suspended banks who have not been called as witnesses before the Grand Jury are wondering why. They recall that none of those thus far indicted was called before the Grand Jury except Arthur Campbell, cashier of the Borsugh Bank, who turned State's evidenoe. Ald for Two Trust Companies. The controversy between the receive ers appointed at the instance of Attor ney-General Jackson for the bankrupt Brooklyn banks and the stockholders and depositors who are not willing to have the institutions go into permanent receiverships wages bitterly. It was announced to-day that two syndicates have been formed to aid the Williams. burg Trust Company and the Jenkins Trust Company to resume business, the former company to be advanced $1,000,000 and the latter $500,000. Stephen C. Baldwin, attorney for the three Jenkins brothers, against whom indictments have already been found, fearing his clients may be indicted on other counts, has addressed letters to Police Commissioner Bingham and Deputy O'Keeffe warning the Police De partnent not to put John G. Jenkins, Jr., through the workings of the Berfillon system if he is arrested. The report current to-day was that Indictments were expected against at least two of the Jenkins family for alleged fraudulent loans from the Williamsburg Trust Company. made through clerks. Frank Jenkins, deposed head of the Williamsburg Trust Company: John G. Jenkins, Jr., former President of the Jenkins Trust Company, and Fred Jen. kins, a director in the latter CO ern, have already been indicted for similar loans made from the Jenkins Trust Company. After their first indictments Frank and Fred Jenkins were photographed for the Rogues' Gallery and measured by the Bertillon system. John G., Jr., escaped this humiliation through a writ after surfendering in court. Mr. Baldwin has promised to surrender any member of the Jenkins family to court as soon as additional indictments are found. Sympathy for Jenkins, Sr. Two sons-in-law of John G. Jenkins,

18.

December 10, 1907

Omaha Daily Bee

Omaha, NE

Click image to open full size in new tab

Article Text

GRAND JURY WILL MAKE REPORT Isspended Jenkins and Williamsburg Trust Companies Under Fire. NEW YORK, Dec. 9.-The Brooklyn grand jury which last week investigated he affairs of the suspended Jenkins and Williamsburg Trust companies will make a report today and it is expected that sevral Indictments will be handed down. Then the jury will take up the affairs of he Brooklyn bank and the International trust company.

19.

December 11, 1907

Evening Journal

Wilmington, DE

Click image to open full size in new tab

Article Text

BROOKLYN BANK MEN INDICTED Four Members of the Jenkins Family Held in Heavy Bail By THE JOURNAL'S Special Wire, BROOKLYN, Dec. 11-Seven indictments against four of the Jenkins family in connection with the Brooklyn banking scandals were handed down by the King's County Grand Jury this morning. Following are those indicted: John J. Jenkins, Sr., president of the First National Bank, conspiracy and perjury; John G. Jenkins, Jr., former president of the Jenkins Trust Company, conspiracy and perjury; Frank Jenkins, former president of the Williamsburg Trust Company, conspiracy and perjury; Fred. Jenkins, director of Williamsburg Trust Company and manager Jenkins brokerage house conspiracy. The defendants pleaded not guilty, and were held in heavy bail. Trial will be probably set late this month. The conspiracy indictments alleged that the four Jenkinses, jointly indicted, conspired unlawfully to secure loans from the Williamsburg and Jenkins Trust Companies by the use of dummies and falsify the records to conceal such acts and to deceive the banking department. These unlawful loans from the Williamsburg Trust Company amounted to $421,000 and from the Jenkins Trust Company, $526,000. The perjury indictments charge the mailing of false reports to the State superintendent of banks. Bail for John Jenkins, Sr., was fixed at $10,000, on each charge, and the other Jenkinses at $2500 each on each indictment, they already being under heavy bail on other indictments. On handing the indictments to the court the Grand Jury made a presentment denouncing the manner in which the directors of the suspended Brooklyn banks had discharged their duties, stating that "the careless methods by the directors had given opportunity for crime, fraud and gross mosmanagement."

20.

January 5, 1908

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

DELAY IN JENKINS RECEIVERSHIP. Kingston, N. Y., Jan. 4. - -The hearing of the application to make permanent the appointment of John Marshall as receiver for the Jenkins Trust Company, of Brooklyn, which had been adjourned until to-day, was further adjourned until next Satorday at Albany by consent of counsel to-day. Clark Williams, State Superintendent of Banks, who has been investigating the trust company's effairs, expects to have his report ready by that time.

21.

January 12, 1908

New-York Tribune

New York, NY

Click image to open full size in new tab

Article Text

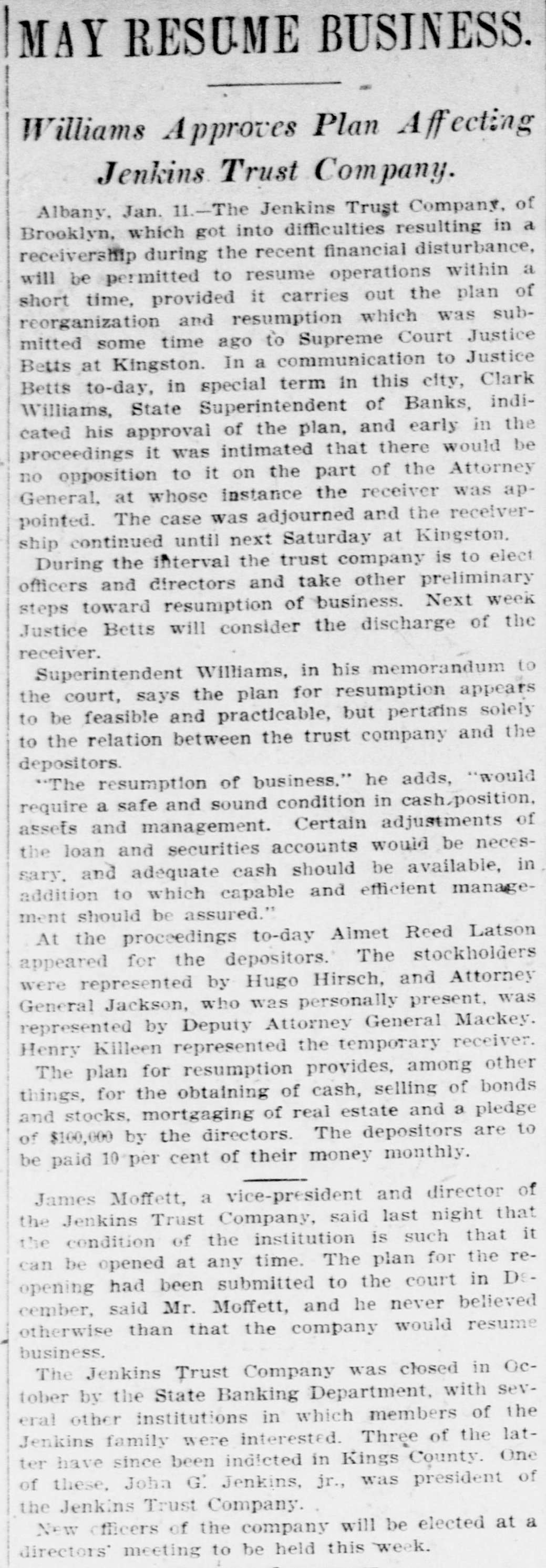

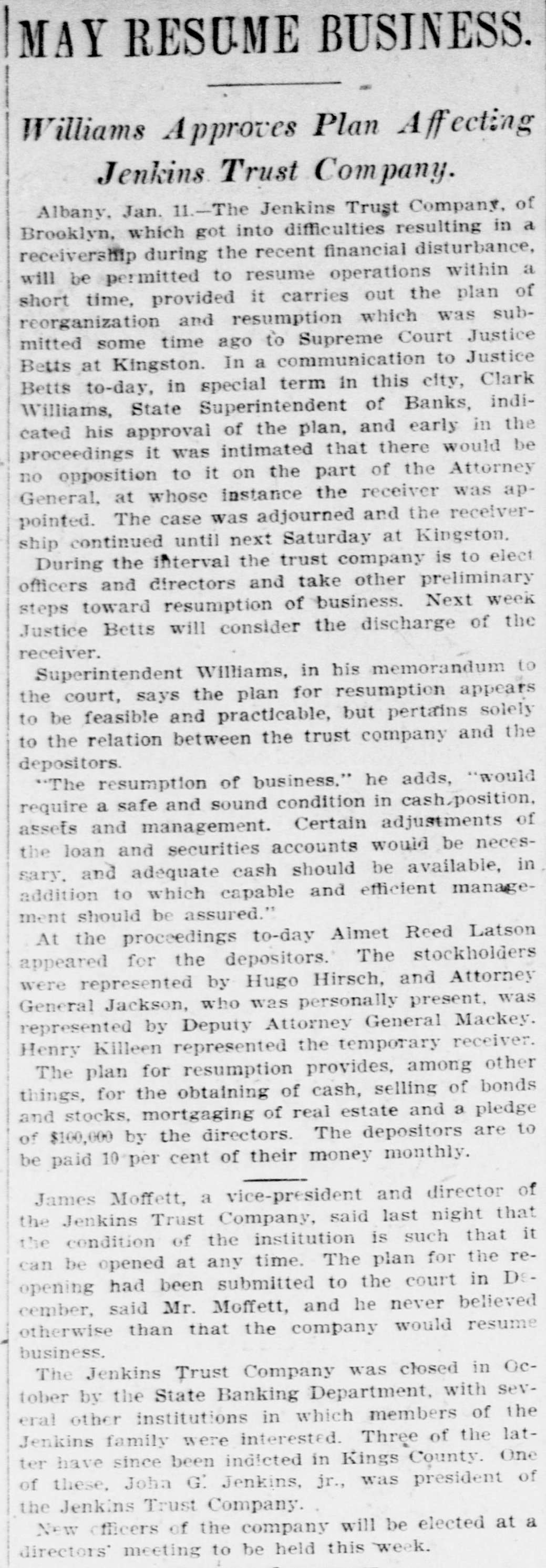

MAY RESUME BUSINESS. Williams Approves Plan Affecting Jenkins Trust Company. Albany, Jan. 11.-The Jenkins Trust Company, of Brooklyn, which got into difficulties resulting in a receivership during the recent financial disturbance, will be permitted to resume operations within a short time, provided it carries out the plan of reorganization and resumption which was submitted some time ago to Supreme Court Justice Betts at Kingston. In a communication to Justice Betts to-day, in special term in this city, Clark Williams, State Superintendent of Banks, indicated his approval of the plan, and early in the proceedings it was intimated that there would be no opposition to it on the part of the Attorney General, at whose instance the receiver was appointed. The case was adjourned and the receivership continued until next Saturday at Kingston. During the interval the trust company is to elect officers and directors and take other preliminary steps toward resumption of business. Next week Justice Betts will consider the discharge of the receiver. Superintendent Williams, in his memorandum to the court, says the plan for resumption appears to be feasible and practicable, but pertains solely to the relation between the trust company and the depositors. "The resumption of business." he adds, "would require a safe and sound condition in cash/position, assets and management. Certain adjustments of the loan and securities accounts would be necessary, and adéquate cash should be available, in addition to which capable and efficient management should be assured." At the proceedings to-day Almet Reed Latson appeared for the depositors. The stockholders were represented by Hugo Hirsch, and Attorney General Jackson, who was personally present. was represented by Deputy Attorney General Mackey. Henry Killeen represented the temporary receiver. The plan for resumption provides, among other things, for the obtaining of cash, selling of bonds and stocks, mortgaging of real estate and a pledge of $100,000 by the directors. The depositors are to be paid 10 per cent of their money monthly. James Moffett, a vice-president and director of the Jenkins Trust Company, said last night that the condition of the institution is such that it can be opened at any time. The plan for the reopening had been submitted to the court in D cember, said Mr. Moffett, and he never believed otherwise than that the company would resume business. The Jenkins Trust Company was closed in October by the State Banking Department, with several other institutions in which members of the Jenkins family were interested. Three of the latter have since been indicted in Kings County. One of these, Joha G. Jenkins, jr., was president of the Jenkins Trust Company. New officers of the company will be elected at a directors meeting to be held this week.

22.

March 12, 1908

The Evening World

New York, NY

Click image to open full size in new tab

Article Text

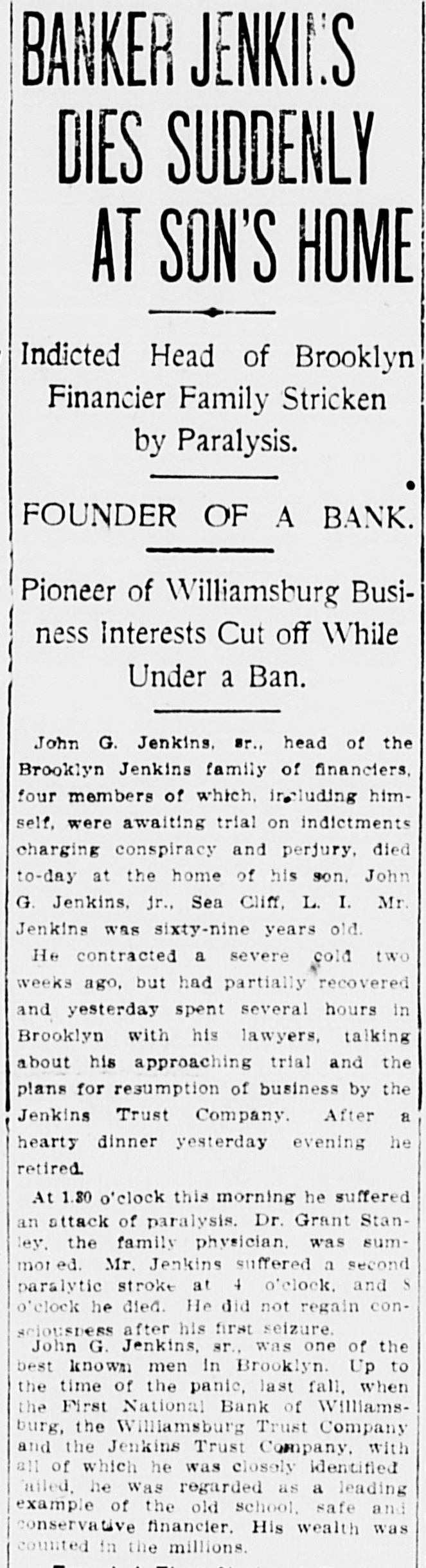

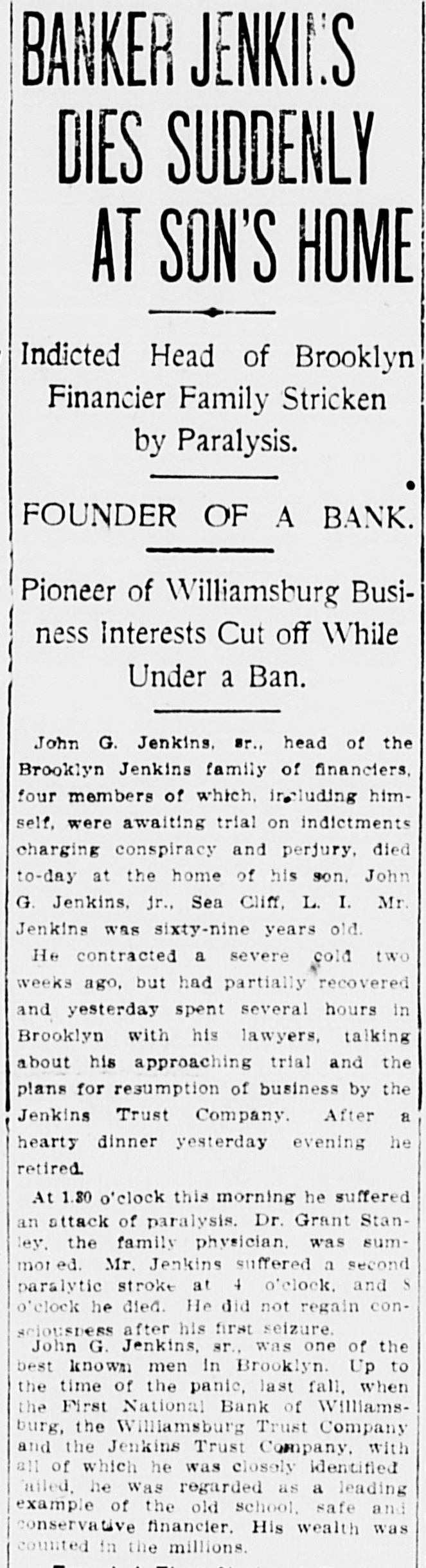

BANKER JENKINS DIES SUDDENLY AT SON'S HOME Indicted Head of Brooklyn Financier Family Stricken by Paralysis. FOUNDER OF A BANK. Pioneer of Williamsburg Business Interests Cut off While Under a Ban. John G. Jenkins, sr., head of the Brooklyn Jenkins family of financiers, four members of which, including himself, were awaiting trial on indictments charging conspiracy and perjury, died to-day at the home of his son, John G. Jenkins, jr., Sea Cliff, L. I. Mr. Jenkins was sixty-nine years old. He contracted a severe cold two weeks ago, but had partially recovered and yesterday spent several hours in Brooklyn with his lawyers, talking about his approaching trial and the plans for resumption of business by the Jenkins Trust Company. After a hearty dinner yesterday evening he retired. At 1.30 o'clock this morning he suffered an attack of paralysis. Dr. Grant Stanley. the family physician. was summored. Mr. Jenkins suffered a second paralytic stroke at 4 o'clock. and S o'clock he died. He did not regain consciousness after his first seizure. John G. Jenkins, sr., was one of the best known men in Brooklyn. Up to the time of the panic, last fall, when the First National Bank of Williamsburg, the Williamsburg Trust Company and the Jenkins Trust Company, with all of which he was closely identified ailed. he was regarded as a leading example of the old school, safe and conservative financier. His wealth was counted in the millions.

23.

July 2, 1908

Lewiston Evening Teller

Lewiston, ID

Click image to open full size in new tab

Article Text

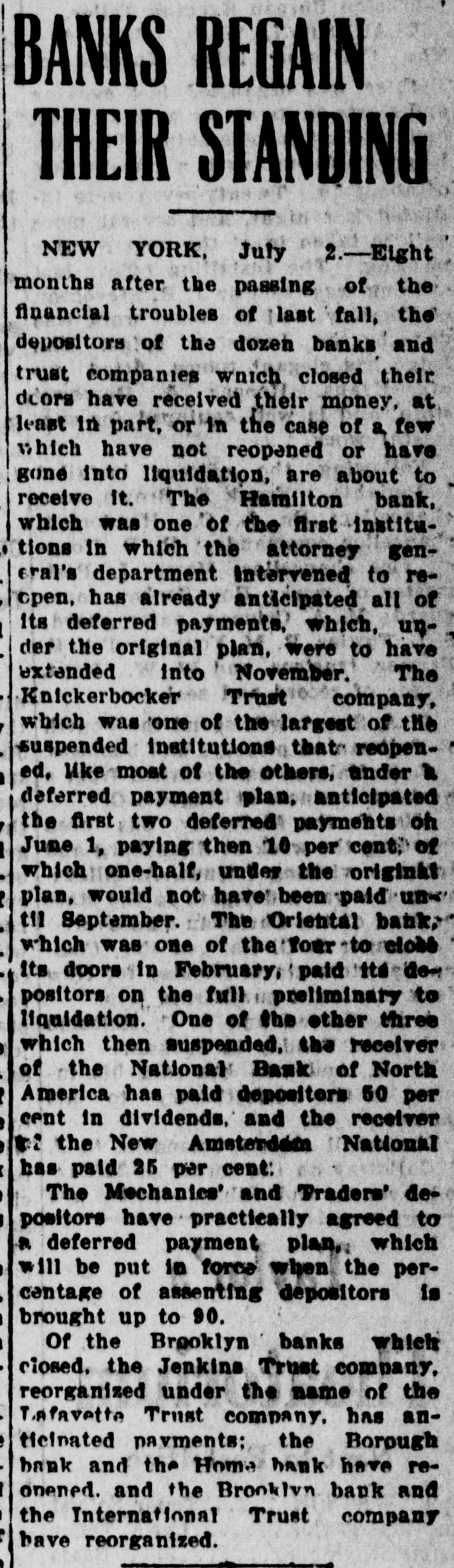

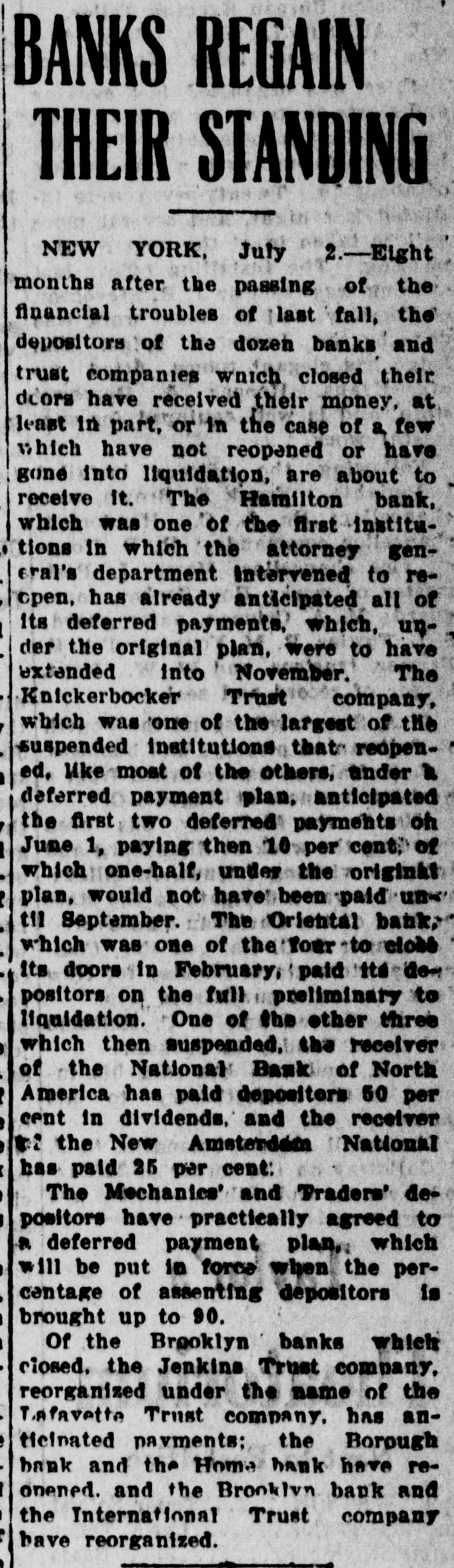

BANKS REGAIN THEIR STANDING NEW YORK, July 2.-Eight months after the passing of the financial troubles of last fall, the depositors of the dozen banks and trust companies which closed their doors have received their money, at least in part, or in the case of a few which have not reopened or have gone into liquidation, are about to receive it. The Hamilton bank, which was one of the first institutions in which the attorney general's department Intervened to reopen, has already anticipated all of its deferred payments, which, under the original plan, were to have extended into November. The Knickerbocker Trust company, which was one of the largest of the suspended institutions that reopened, like most of the others, under in deferred payment plan, anticipated the first two deferred payments oh June 1, paying then 10 per cent, of which one-half, under the original plan, would not have been paid until September. The Oriental bank, which was one of the four to close its doors in February, paid its de-: positors on the full preliminary to liquidation. One of the other three which then suspended, the receiver of the National Bank of North America has paid depositors 50 per cent in dividends, and the receiver to: the New Amsterdam National has paid 25 per cent: The Mechanics' and Traders' depositors have practically agreed to R. deferred payment plan, which will be put in force when the percentage of assenting depositors is brought up to 90. Of the Brooklyn banks which closed. the Jenkins Trust company, reorganized under the name of the T.afavette Trust company. has anticinated payments: the Borough bank and the Home bank have reonened. and the Brooklyn bank and the International Trust company have reorganized.

24.

November 24, 1908

Bisbee Daily Review

Bisbee, AZ

Click image to open full size in new tab

Article Text

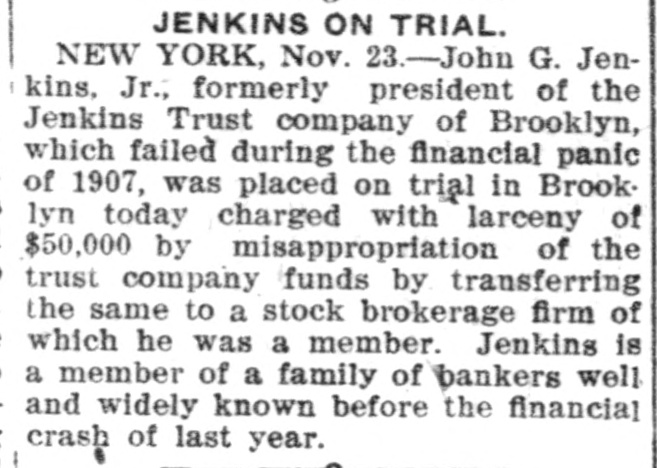

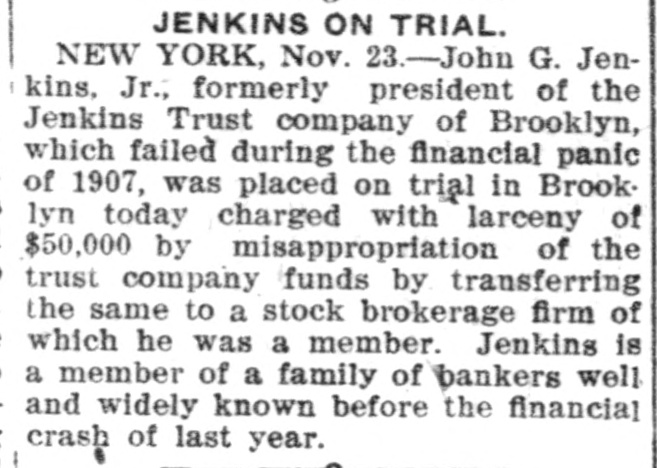

JENKINS ON TRIAL. NEW YORK, Nov. 23.-John G. Jenkins, Jr., formerly president of the Jenkins Trust company of Brooklyn, which failed during the financial panic of 1907, was placed on trial in Brooklyn today charged with larceny of $50,000 by misappropriation of the trust company funds by transferring the same to a stock brokerage firm of which he was a member. Jenkins is a member of a family of bankers well and widely known before the financial crash of last year.