Click image to open full size in new tab

Article Text

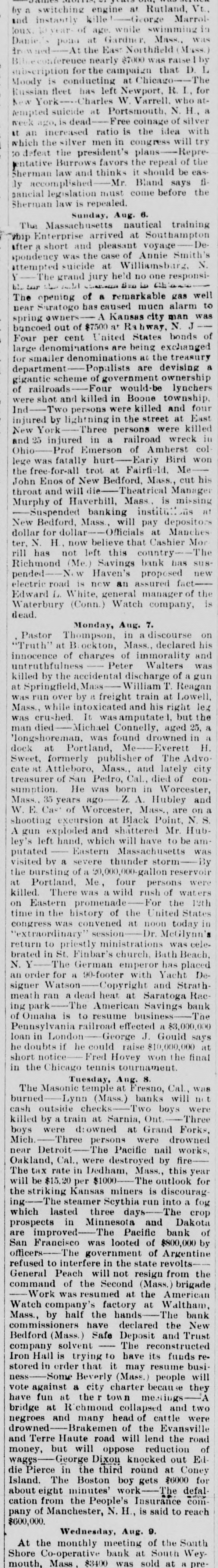

Russian fleet has left Newport, R. L, for New York--Charles W. Varrell. who attempted suicide at Portsmouth, N. H., a week ago, is dead-Free coinage of silver at an increased ratio is the idea with which the silver men in congress will try to defeat the president's plans-Repreentative Burrows favors the repeal of the Sherman law and thinks it should be easly accomplished-Mr. Bland says financial legislation must come before the Sherman law is repealed. Sunday, Aug. 6. The Massachusetts nautical training Thip Enterprise arrived at Southampton after a short and pleasant voyage spondency was the case of Annie Smith's attempted suicide at Williamsbarg, N. Y-The grand jury held no one responsibill for AND - fire E The opening of a remarkable gas well near Saratogo has caused much alarm to spring owners- A Kansas city man was buncoed out of $7500 at hway, N. J Four per cent United States bonds of large denominations are being exchanged for smaller denominations at the treasury department-Populists are devising a gigantic scheme of government ownership of railroads-Four would-be lynchers were shot and killed in Boone township, Ind-Two persons were killed and four injured by lightning in the street at East New York-Three persons were killed and 25 injured in a railroad wreck in Ohio-Prof Emerson of Amherst col lege was fatally hurt-Eariy Bird won the free-for-all trot at Fairfield. MeJohn Enos of New Bedford, Mass., cut his throat and will -Theatrical Manager Murphy of Haverbill, Mass. is missing -Suspended banking institution at New Bedford, Mass., will pay depositors dollar for dollar-Officials at Manches ter. N. H., now believe that Cashier Mor rill has not left this country-The Richmond (Me.) Savings bank has suspended-Now Haven's proposed new electric road is new an assured fact— Edward L. White, general manager of the Waterbury (Conn.) Watch company, is dead. Monday, Aug. 7. Pastor Thompson, in a discourse on "Truth" at Brockton, Mass., declared his innocence of charges of immorality and untruthfulness Peter Walters was killed by the accidental discharge of a gun at Springfield, William T. Reagan was run over by a freight train at Lowell, Mass., while intoxicated and his right leg was crushed. It was amputated, but the man died-Michael Connelly, aged 25, a 'longshoreman, was found drowned in a dock at Portland, Me-Everett H. Sweet, formerly publisher of The Advo. cate at Attleboro, Mass., and lately city treasurer of San Pedro, Cal., died of consumption. He was born in Worcester, Mass. 35 years ago-Z. A. Hubley and W. E. Cas' of Worcester, Mass., are on a shooting excursion at Black Point, N. S. A gun exploded and shattered Mr. Hubley's left hand, which will have to be amputated Eastern Massachusetts was visited by a severe thunder storm-By the bursting of a 20,000,000-gallon reservoir at Portland, Me, four persons were killed. There was a wild rush of waters on Eastern promenade-For the 12th time in the history of the United States congress was convened at noon today in "extraordinary" session-Dr. McGlynn's return to priestly ministrations was celebrated in St. Finbar's church, Bath Beach, N. Y-The German emperor has placed an order for a 90-footer with Yacht Designer Watson-Copyright and Strathmeath ran a dead heat at Saratoga Racing park-The American Savings bank of Omaha is to resume business-The Pennsylvania railroad effected a $3,000,000 loan in London-George J. Gould says he doubts if he could raise $10,000,000 at short notice- Fred Hovey won the final in the Chicago tennis tournament. Tuesday, Aug. 8. The Masonic temple at Fresno, Cal., was burned-Lynn (Mass.) banks will not cash outside checks-Two boys were killed by a train at Sarnia, Ont.-Three boys were d:owned at Grand Forks, Mich.-Three persons were drowned near Detroit-The Pacific nail works, Oakland, Cal., were destroyed by fireThe tax rate in Dedham, Mass., this year will be $15.20 per $1000-The outlook for the striking Kansas miners is discouraging-The steamer Scythia run into a fog which lasted three days-The crop prospects in Minnesota and Dakota are improved—The Pacific bank of San Francisco was looted of $800,000 by officers--The government of Argentine refused to interfere in the state revolts— General Peach will not resign from the command of the Second (Mass.) brigade -Work was resumed at the American Watch company's factory at Waltham, Mass., by half the hands-The bank commissioners have declared the New Bedford (Mass.) Safe Deposit and Trust company solvent - The reconstructed Iron Hall is trying to have its funds restored in order that it may resume business-Some Beverly (Mass.) people will vote against a city charter because they have fun at the r town mestings-A bridge at Richmond collapsed and two negroes and many head of cattle were drowned-Brakemen of the Evansville and Terre Haute road will lend the road money, but will oppose reduction of