Article Text

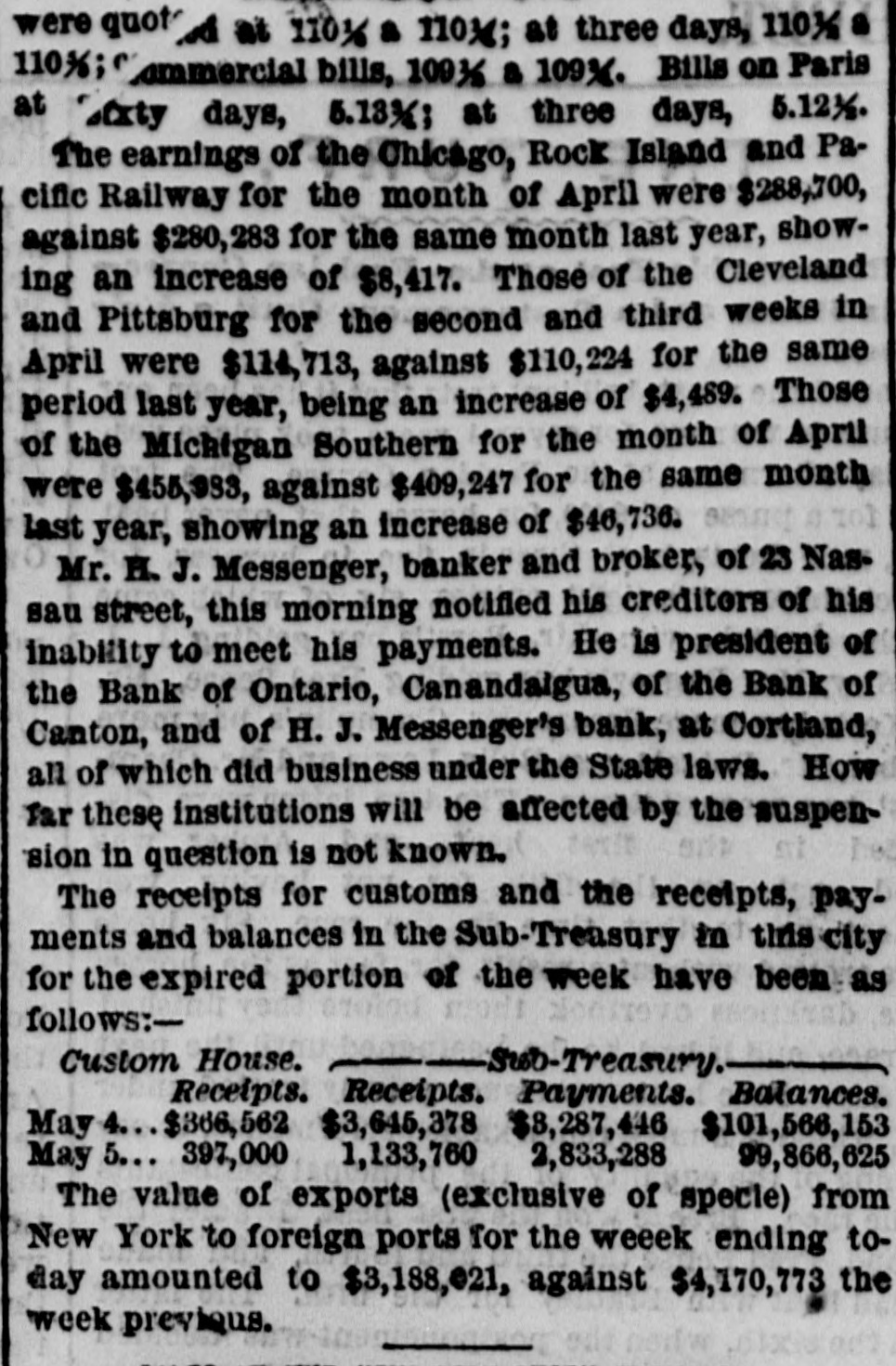

were quot s at 110% nox; at three days, 1101/ a 110%; ammercial bills, 1001/ a 109%. Bills on Paris at 'Styty days, 5.13%; at three days, 5.121/. The earnings of the Chicago, Rock Island and Pacific Railway for the month of April were $288,700, against $280,283 for the same month last year, showing an increase of $8,417. Those of the Cleveland and Pittsburg for the second and third weeks in April were $114,713, against $110,224 for the same period last year, being an increase of $4,489. Those of the Michigan Southern for the month of April were $455,933, against $409,247 for the same month last year, showing an increase of $46,736. Mr. H. J. Messenger, banker and broker, of 23 Nas. sau street, this morning notified his creditors of his inability to meet his payments. He is president of the Bank of Ontario, Canandaigua, of the Bank of Canton, and of H. J. Messenger's bank, at Cortland, all of which did business under the State laws. How far these institutions will be affected by the suspension in question is not known. The receipts for customs and the receipts, payments and balances in the Sub-Treasury in this city for the expired portion of the week have been as follows:Custom House. Sub-Treasury. Receipts. Receipts. Payments. Balances. $366,562 $3,645,378 $8,287,446 May 4. $101,566,153 397,000 2,833,288 1,133,760 May 5. 99,866,625 The value of exports (exclusive of specie) from New York to foreign ports for the weeek ending today amounted to $3,188,021, against $4,170,773 the week previous.