Article Text

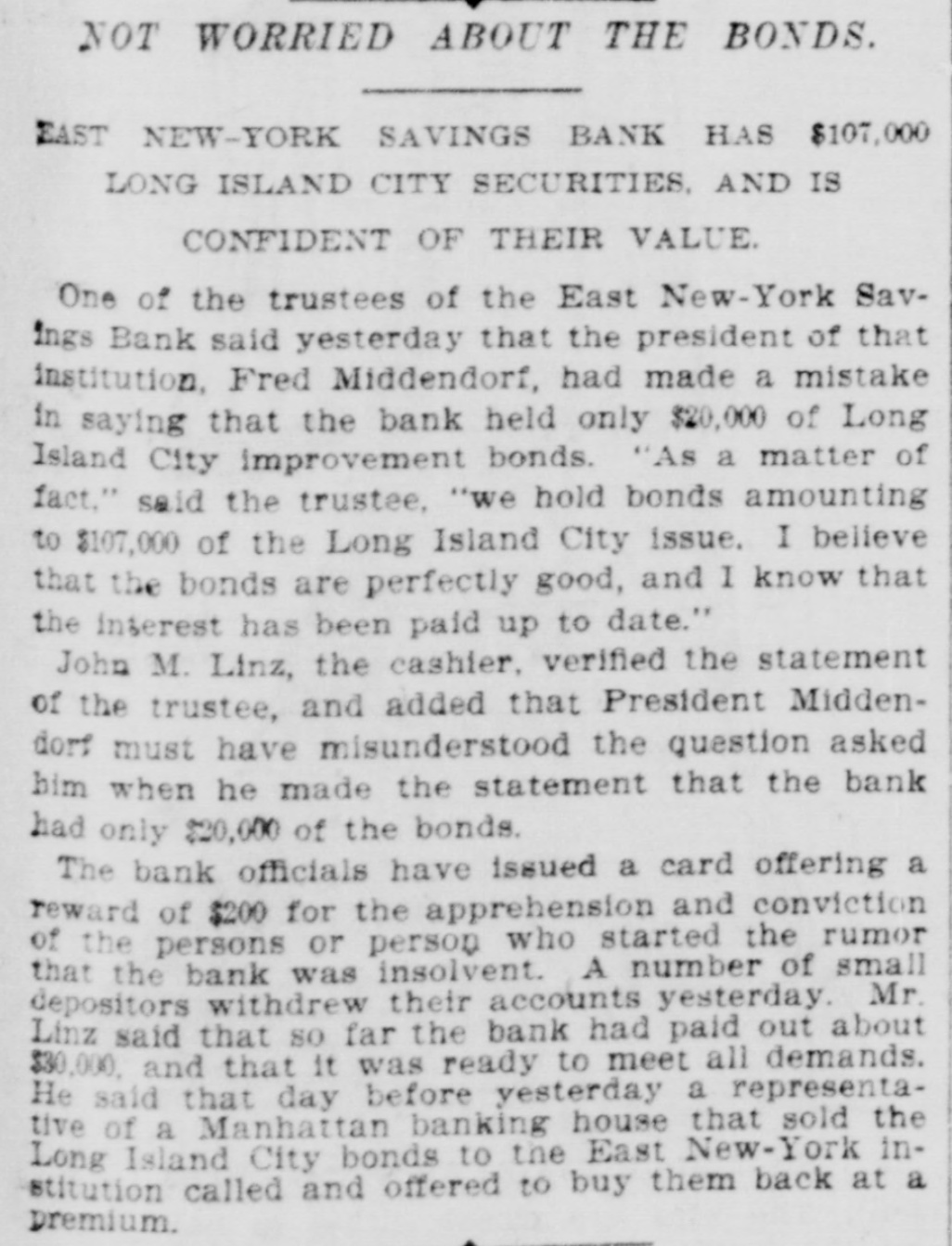

NOT WORRIED ABOUT THE BONDS. EAST NEW-YORK SAVINGS BANK HAS $107,000 LONG ISLAND CITY SECURITIES, AND IS CONFIDENT OF THEIR VALUE. One of the trustees of the East New-York SavIngs Bank said yesterday that the president of that institution, Fred Middendorf, had made a mistake in saying that the bank held only $20,000 of Long Island City improvement bonds. "As a matter of fact," said the trustee, "we hold bonds amounting to $107,000 of the Long Island City issue. I believe that the bonds are perfectly good, and I know that the interest has been paid up to date." John M. Linz, the cashier, verified the statement of the trustee, and added that President Middendorf must have misunderstood the question asked him when he made the statement that the bank had only $20,000 of the bonds. The bank officials have issued a card offering a reward of $200 for the apprehension and conviction of the persons or person who started the rumor that the bank was insolvent. A number of small depositors withdrew their accounts yesterday. Mr. Linz said that SO far the bank had paid out about $30,000, and that it was ready to meet all demands. He said that day before yesterday a representative of a Manhattan banking house that sold the Long Island City bonds to the East New-York institution called and offered to buy them back at a premium.