Article Text

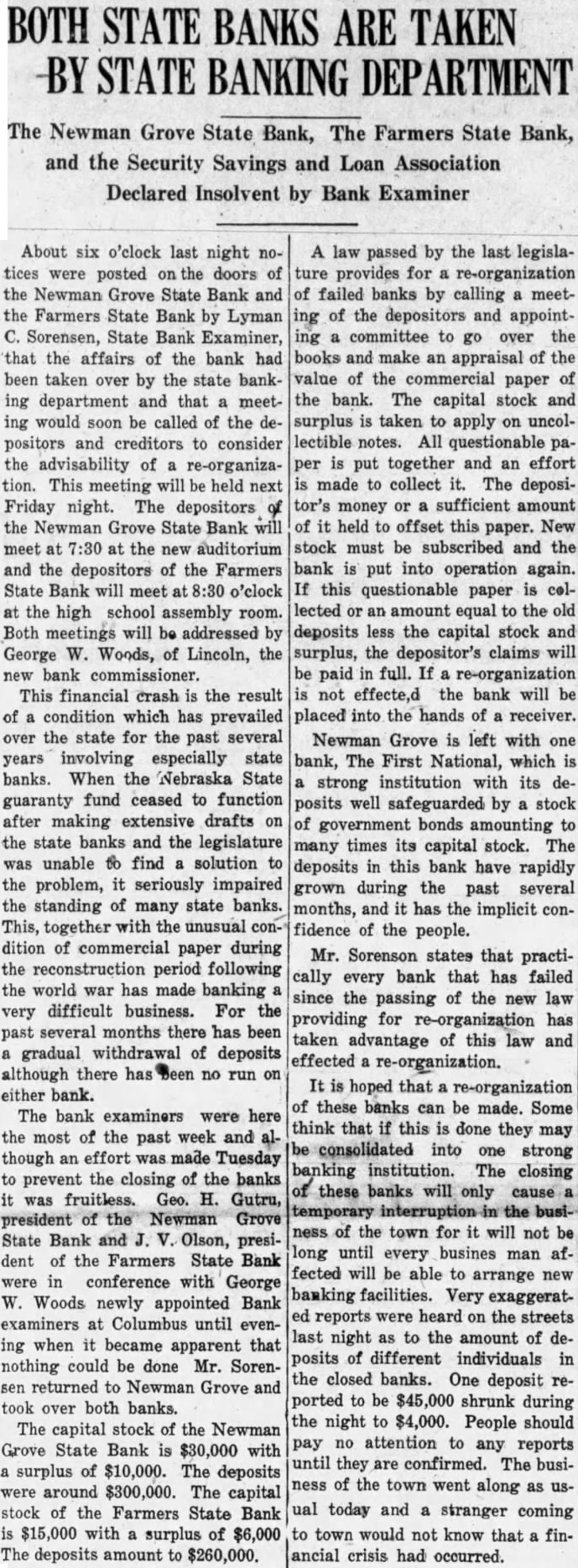

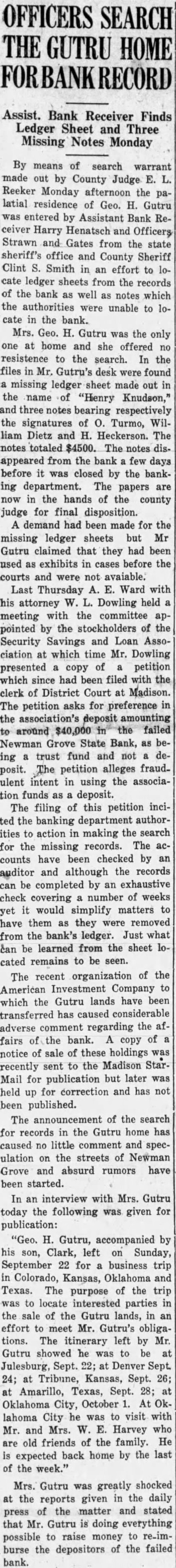

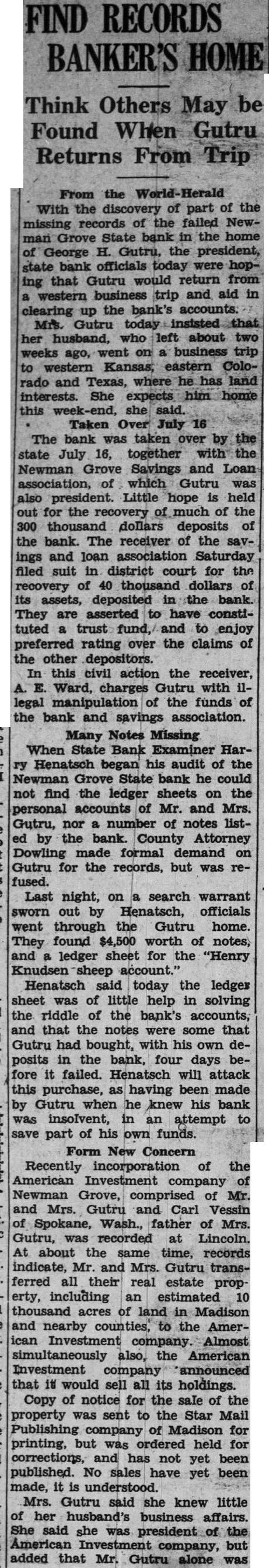

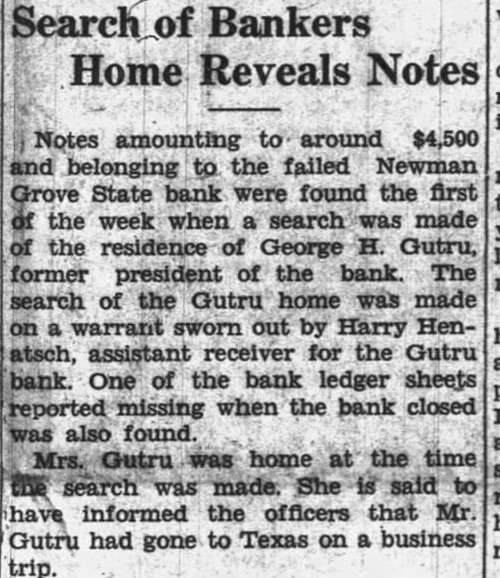

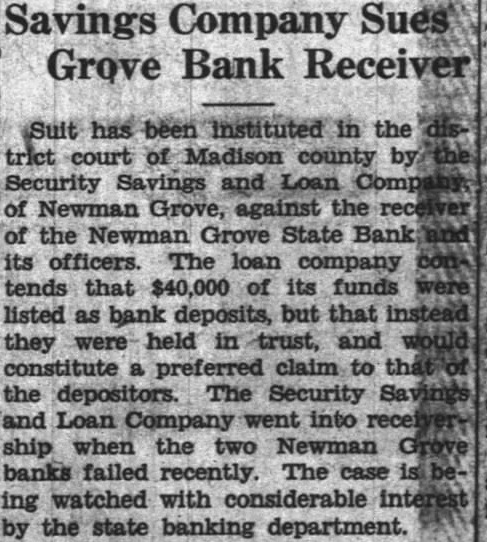

BOTH STATE BANKS ARE TAKEN BANKING DEPARTMENT The Newman Grove State Bank, The Farmers State Bank, and the Security Savings and Loan Association Declared Insolvent by Bank Examiner About six o'clock last night notices were posted the doors of the Newman Grove State Bank and the Farmers State Bank by Lyman C. Sorensen, State Bank Examiner, that the affairs of the bank had been taken over by the state banking department and that a meeting would soon be called of the positors and creditors to consider the advisability of re-organization. This meeting will be held next Friday night. The depositors the Newman Grove State Bank will meet at 7:30 at the new auditorium and the depositors of the Farmers State Bank will meet 8:30 o'clock at the high school assembly room. Both meetings will be addressed by George W. Woods, of Lincoln, the new bank commissioner. This financial crash is the result of condition which has prevailed over the state for the past several years involving especially state banks. When the Nebraska State guaranty fund ceased to function after making extensive drafts on the state banks and the legislature was unable to find solution to the problem, it seriously impaired the standing of many state banks. This, together with the unusual dition of commercial paper during the reconstruction period following the world war has made banking very difficult business. For the past several months there has been gradual withdrawal of deposits although there no run on either bank. The bank examiners were here the most of the past week and though an effort was made Tuesday to prevent the closing of the banks was fruitless. Geo. H. Gutru, president of the State Bank and Olson, president of the Farmers State Bank were in conference with George W. Woods newly appointed Bank examiners at Columbus until evening when it became apparent that nothing could be done Mr. Sorensen returned to Newman Grove and took over both banks. The capital stock of the Newman Grove State Bank is $30,000 with surplus of $10,000. The deposits were around $300,000. The capital stock of the Farmers State Bank is $15,000 with surplus of $6,000 The deposits amount to A law passed by the last legislature provides for re-organization of failed banks by calling meetof the depositors and appointing committee to go over the books and make an appraisal of the value of the commercial paper of the bank. The capital stock and surplus is taken to apply on uncollectible notes. All questionable is put together and an effort per made to collect it. The depositor's money or sufficient amount of it held to offset this paper. New stock must be subscribed and the bank is put into operation again. If this questionable paper is collected or an amount equal to the old deposits less the capital stock and surplus, the depositor's claims will be paid in full. If a re-organization not effecte,d the bank will be placed into the hands of receiver. Newman Grove is left with one bank, The First National, which is strong institution with its deposits well safeguarded by stock of government bonds amounting to many times its capital stock. The deposits in this bank have rapidly grown during the past several months, and it has the implicit confidence of the people. Mr. Sorenson states that practically every bank that has failed since the passing of the new law providing for re-organization has taken advantage of this law and effected re-organization. It is hoped that re-organization of these banks can be made. Some think that if this is done they may be consolidated into one strong banking institution. The closing these banks will only the ness of the town for it will not be long until every busines man affected will be able to arrange new banking facilities. Very exaggeratreports were heard on the streets last night as to the amount of deposits of different individuals the closed banks. One deposit ported to be $45,000 shrunk during the night to $4,000. People should pay no attention to any reports until they are confirmed. The business of the town went along as ual today and stranger coming to town would not know that financial crisis had occurred.