Click image to open full size in new tab

Article Text

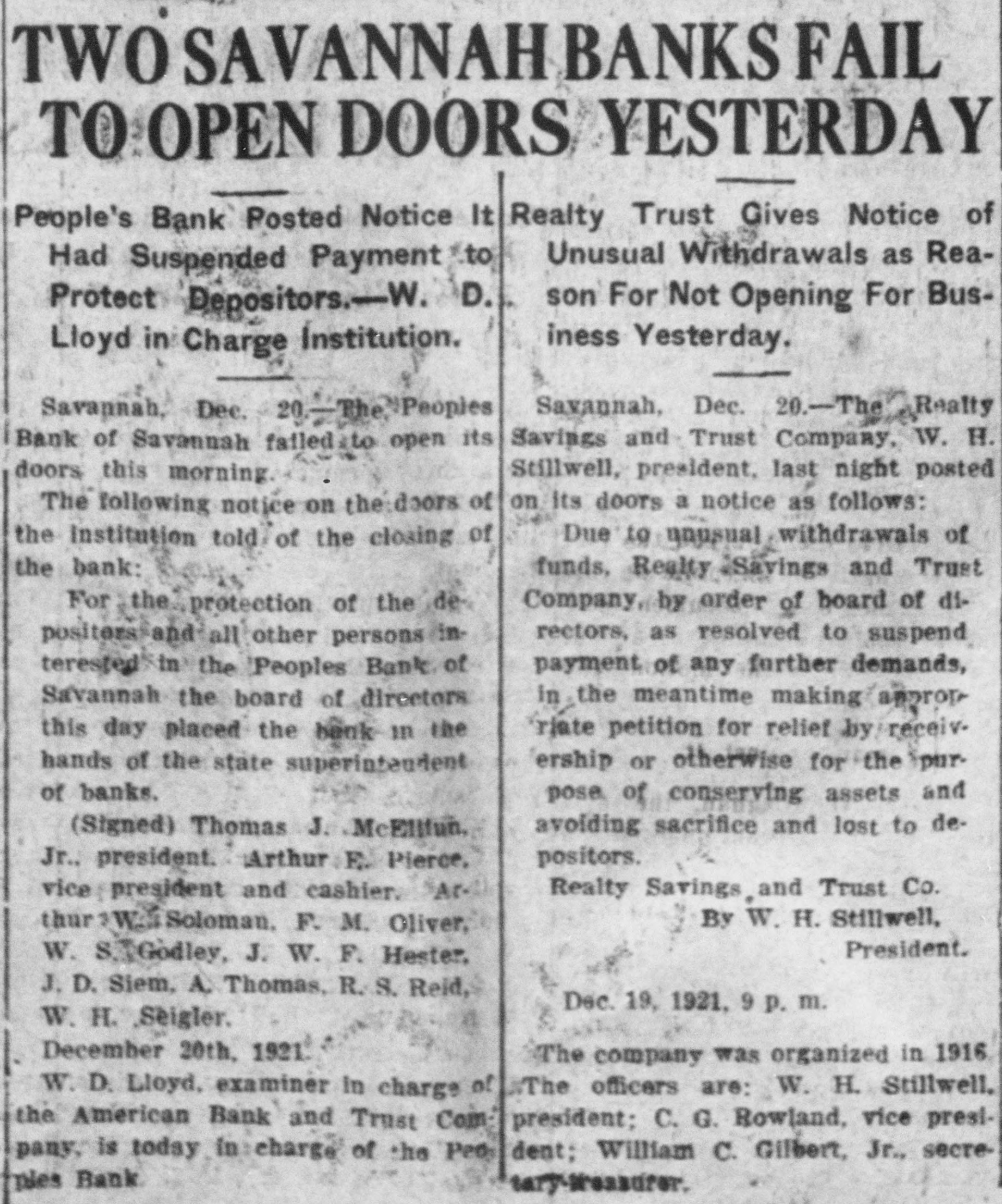

enuea by troops who arrested thirty persons and seized huge uantities of ammunition J. C. Ropp was appointed assistant commissioner of the national budget by Charles G. Dawes. Thomas Findley, president of the Massey Harris Co., of Toronto, died at his home in Toronto. Fifth avenue, New York, is in the midst of the greatest Christmas shopping carnival it has ever known. The death of Cardinal Francis Mary Roverie De Cabrieres bishop of Montpelier, France, was announced. American Malt & Grain Co. liuidating trustees. sold the Buffalo plant for $500.000 to a Minneapolis milling concern. Idle freight cars on Dec. 8 totaled $528,158. compared with 455,376 on Dec 1. an increase of 72.782 cars, according to the American Railway association. A messenger of the Chotean Trust Co., of St. Louis was held up by three bandits. who escaped with a satchel containing $8,180. George Rogers, an escaped convict is being held by the Chicago police in connection with the million dollar mail robbery in Toledo Under a ruling by the Interstate Commerce Commission many big rail men must give up their directorships on competing roads. It was announced at the White House that President Harding will make publie next Friday a list of Christmas pardons, Sir James McKechnie, of Vickers, Ltd., of Barrow, England, arrived on the Cunard liner Scythia to study shipbuilding conditions in the United States. Custom officers seized the tramp ship Javary, which arrived at New York from Baltimore. It is alleged she had aword 250 drums of alcohol Representative Volk of New York, introduced a bill in the house to provide a soldiers' bonus, funds to be obtained by n a sales tax. Notices were posted by Philadelphia & Readisg Railway Co announcing wage cuts of maintenance of way employes t ranging from 5 to 15 cents an hour. 1 An official order to close the Sedalia shops of the Missouri Pacific railroad was received from St. Louis. Approximately 1,400 men are affected. s Closing of small railroad stations for purposes of economy will be opposed by o the Massachusetts state department of t public utilities. d The expected arrival of big shipes ments of Christmas trees from Maine rt promise to assure a plentiful supply of holiday greens for greater Boston. at if Rev. Dr. James Ballantyne. formerly th moderator of the Canadian Presbyterian ageneral assembly, died suddenly at his at home in Toronto, He was 64 years old. nt t An express train from Paris collided bt last night with the Trieste-Rome express ion the bridge crossing the Plave at San al Dona. Relief trains have been sent to a the wreck, but details are lacking ce er A woman, 50 years of age. who had n, just made a trip by water and rail from ly Boston to Jacksonville, Florida, and bback, has been found to be suffering from typhus. on of Excitement prevailed at the corner its of Chauncey and Essex streets, Boston nwhen a charge of dynamite. used to nblast away pieces of concrete in buildit ing operations, went the wrong way and on threw rocks and stones in all directions he TDr. Walter Simons, the former foreign ry minster, in an open lette to Von Hindenburg. accuses the field marshal of doty ing him a bitter injustice in asserting ke that Simons had renewed in ondon his so Versailles admission of Germany's war slguilt. ect of American exporters were told to "hold a their heads up" as their feet were "on se solid ground" by Dr. Julius Klein. diof rector of the bureau of foreign and dohe mestic commerce, of the commerce dete partment in an address before the Philadelphia Export club. he od Major General Clarence R. Edwards n. commanding the First Army Corps area ier will act as a post-Christmas Santa as Claus on December 27 when he will con ed fer decorations awarded by this and oth its er governments on 13 persons from vato rious parts of New England. an loPeoples' Bank and Realty Sovings & aty were Trust Co., of Savannah, C1. ail. placed in the haids of the State Bank Exthe aminer. due to heavy withdrawals of de posits. During the last few months five ap. banks suspended in Savannah, to ion Gluseppe Parisi, arrested in Spring the field soon after Carlo Siniscalchi, local to Italian teacher had been shot in his au the tomobile, was arraigned in district cour eeon a charge of murder and was help without bail for preliminary hearing De cember 27. S'N Fire damage that may exceed $30. 000 was done to a store in a Main stree erbusiness block in Springfield and ser ood oc ously threatened the Hotel Hawking, to7 cupying the same building. whose an, guests made their escape with little dif of ficulty. ciainA scheme to defraud in stock an ful bond transactions by misuse of the Unit ened States mails said to involve million miof dollars alleged in Indictments mad