Click image to open full size in new tab

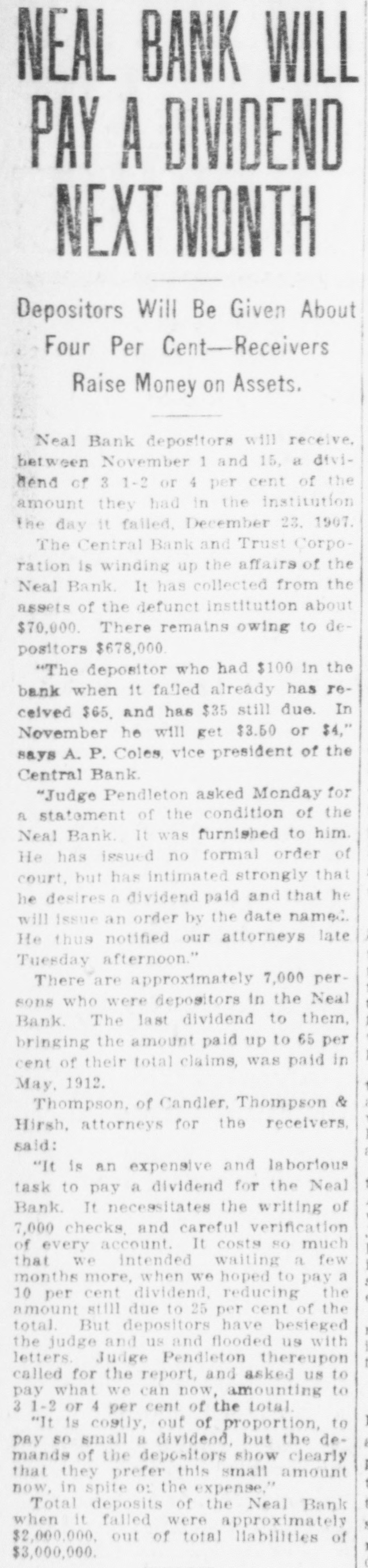

Article Text

REAL ESTATE AND CONSTRUCTION NEWS Schaal, lot 42 by 118 feet, east side Waldo street, 168 feet north of Killian street. February 18. ve Inches of Peters Street $1,400-William Rawling to Equitable Mortgage and Trust Company, 133 CoopProperty Sold for $50 Per er street, 35 by 115 feet. February 15. $1,300-William Rawling to Equitable Mortgage and Trust Company, 129 Coopnch-Sewage Troubles Iner street, 35 by 115 feet. February 15. Receiver's Deed. erest Real Estate Dealers. $5-Central Bank and Trust Corporation as receiver of Neal bank to J. H. Porter et al., lot 59 by 150 feet, northOther Activities of the Day. west corner Forrest and Piedmont avenues. February 19. Bonds For Title. $2,500 Penal Sum-Thomas Realty Compiece of Peters street property sold pany to Charles Henry Murray, 240 ay by the front inch, probably the Humphries street, 30x101 feet. February time this has ever happened in the 15, 1913. tory of Atlanta real estate. Five $4,300 Penal Sum-Mrs. Susie T. Griffin hes on Peters street, between Jeanto Mrs. M. J. Bell and C. A. Bell, Jr., 7 te and Walker streets, sold for $250, Bryan street, 43x130 feet. Transferred to $50 an inch. The seller was H. C. C. A. Bell, Jr., February 17, 1913. June 21, 1909. ith, a jeweler at 241 Peters street, $1,000 Penal Sum-Pearson-Jones Lumeast of the Farmers and Traders ber Company to Miss Ella Brown, lot ak, and the buyer was W. H. Bowen, 50x151 feet, east side Acorn avenue, 600 merchant east of Smith. The fivefeet north of Mayson avenue. September 12, 1911. h strip, it is said, was wanted for a or for easement purposes. $5,225 Penal Sum-Mrs. Venia L. RegenMr. Smith should pay a real estate stein and Mrs. Beulah L. Bowles to Charles Franklin, 20 and 24 Mayes street, ent's commission it would be $12.50 100x100 feet. February 18, 1913. the regular rate, and if Mr. Bowen $2,250 Penal Sum-George H. Seal to sists on examining Mr. Smith's title Lynn W. Hudson, Jr., lot 45x120 feet, will cost him an additional $10 or so north side Boulevard circle, 340 feet east lawyer's fees. The name of the real of Boulevard. January, 1913. tate firm handling the transaction $6,500 Penal Sum-Grace E. O'Brien to Mrs. M. K. Daly and John N. Malone, 256 as not divulged. The sale of five inches reminded realLuckie 1913. street, 23x81 feet. February 15, men today of the sale recently of Irteen feet on Marietta street and of Mortgages. one-foot frontage which the $500-Montefiore Selig to Georgia Inlouse that Jack Built" has on Peachvestments (Inc.), lot 55x143 feet, west at the intersection of Forsyth. side Marion avenue, 194 feet south of Central Peachtree inches would cost Ormewood avenue. February 18, 1913. $1,500-Mrs. Georgia Isom to T. L. 33.33 each, but not many are on the Francis, 51 Glenn street, 100x130 feet. arket. February 15, 1913. Dealers in property are watching Liens. sely the discussion of sewage in $308-Godfrey Mosaic-Tile Company vs. achtree creek and the influence of R. V. Connerat, 532 West Peachtree rtilizer factories on north Fulton street, 57x154 feet. February 18, 1913. $439-Beck & Gregg Hardware Company operty. This is an old discussion, it is of enough importance to en1913. vs. same, same property. February 18, considerable attention any time is mentioned. The odors arising in Quitclaim Deeds. mmer time from Peachtree creek and $5-Hugh Richardson to Eugene and presence of the fertilizer plants Fair Dodd, 45 West Baker street, 58x168 ve injured adjacent property, accordfeet. February 18, 1913. to the owners, and real estate men $6,250-John H. Inman to same, same property. February 14, 1913. the locality are watching for a $2,700-Mrs. Blanche H. Mecaslin to ance to abate the alleged nuisance. Mrs. Annie S. Morris, lot 50x190 feet, west only a question of time, say those side Washington street. 100 feet south of terested, before Peachtree creek shall Georgia avenue. February 17, 1913. purged and the fertilizer factories have to move to manufacturing Sheriff's Deed. ctions. Hundreds of acres of splendid $100-H. J. Cranshaw (by sheriff) to nd could be opened up. Mrs. M. A. Sage, lot 70x200 feet, southeast corner Hampton and Ethel streets. February 10, 1913. Building Permtis. W Lindsey Ponlar street one