Click image to open full size in new tab

Article Text

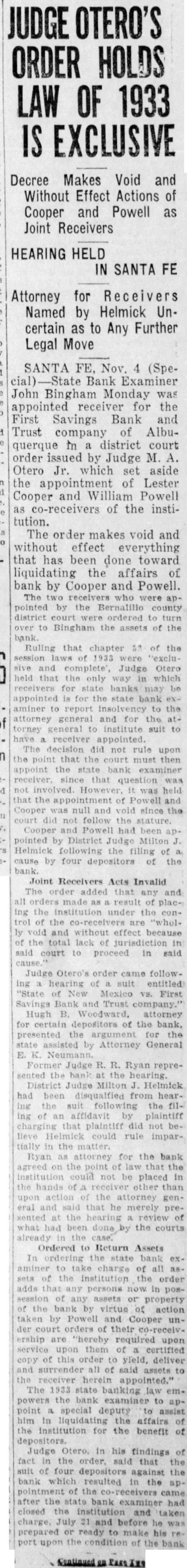

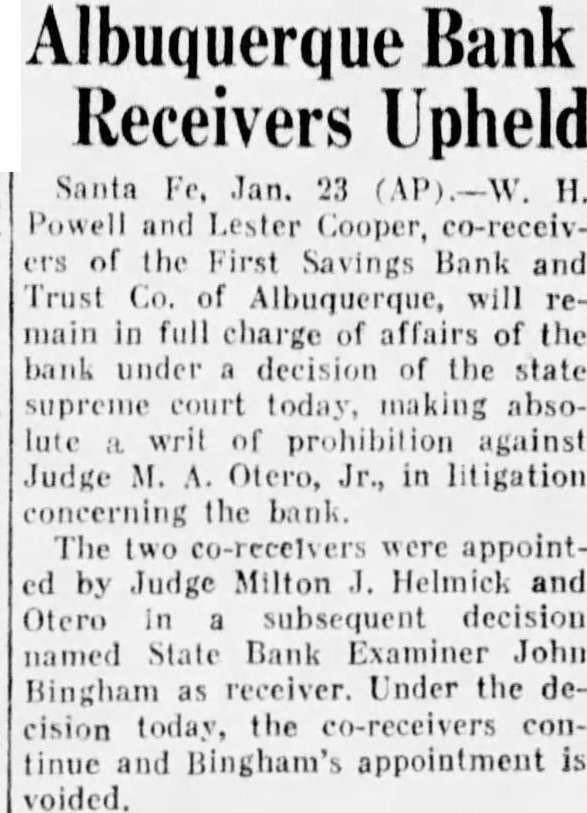

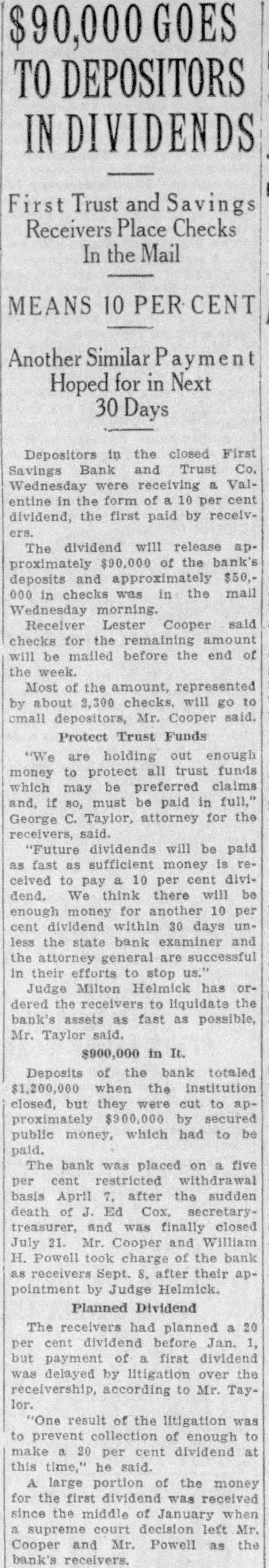

Southwestern Briefs Probably a dozen new liquor bills will be presented at the special session of the New Mexico Legislature if one is called. Civil works administration officials the Arizona dis Jan. 20 totaled announced tributed payroll $317,107.77 the largest of record in the state. Motor vehicle accidents on Arizona highways during 1933 brought death the State announced in a re partment to 155 persons, detailed Health De port to the United States bureau of census. The New Mexico Federation of Tax Associations, meeting at Albutook formal on a program by payers' querque, posed legislative action prepared prothe organization's special legislative committee. Residents of Albuquerque reperted seeing a falling star burst into a bril liance lasting several seconds, recent ly. The falling object. believed to have been a meteor, was seen direct ly south of the city. Assistant Attorney General John Francis Connor of Arizona has com brief which he will present State Supreme state's minimum wage pleted ing to the the a Court, declar law is legal and enforceable. Herman E. Hendrix, state superin tendent of public instruction in Ari zona. has apportioned a total of $66. 674.98 to thirteen counties from fees collected in national forests in the state during the past year. Harry M. Moore, Maricopa county sources Ariz., from all treasurer, reported received amounted by revenues Mariduring 1933 to while $5,368,728.10 copa county disbursements totaled for all purposes during the year $5,551,065.81. Winslow, Ariz., will have only three places where liquor can be bought by the drink unless other applications come in later, according to Chief Rube Neill, who reported that thus far only three have signified their intention to take out the $400 a year license. New Mexico has the smallest aumber of closed banks and the smallest amount of money tied up in defunct institutions of any state in the Union, R. L. Olson, special representative of the United States Home Owners Loan Corporation, announced recently A back to the land movement, op erated by the government and primarily outlined as an auxiliary meas ure in continuing livelihood, has been placed in operation here by P. V. Ful 1er, field representative for the De partment of the Interior in Arizona. Out of $1,562,500 for new Indian hos pitals and sanatoriums, $305,000 will go to two reservations adjacent to Gallup. N. M., it was announced by Commissioner John Collier. Zuni is to receive a $125,000 hospital and Eastern Navajo $180,000 building at Crown Point. Despite the fact it was unable to reach an agreement on a proposal to consolidate counties, the New Mexico Federation of Taxpayers' Associations adopted a fifteen-point legislative program calling for a business tax and delinquent tax collection law similar to that in force in Arizona. Clinton P. Anderson, New Mexico state treasurer, who sent his resigna tion to Gov. A. W. Hockenhull, said he was willing to continue as treas urer, at $1 a year salary if necessary, under the same conditions as in the past if it is in the interests of the of fice that he remain in charge. The city of Williams, Ariz., overwhelmingly approved an $87,000 bond issue to permit construction of a $119, 000 water improvement program. A total of 105 votes was cast in favor of the proposal, with 32 opposed, out of a total registration of 167 property owners, according to official tabulations. W. H. Powell and Lester Cooper, co-receivers of the First Savings Bank & Trust Co. of Albuquerque, will remain in full charge of affairs of the bank under a decision of the State Supreme Court, making absolute a writ of prohibition against Judge M. A. Otero, Jr., in litigation concerning the bank The fight over the suspension of the New Mexico department of the American Legion went into the courts again recently, when the department asked the court of the first judicial district to declare the suspension null and void. The plea also asked that the national headquarters of the Legion be ordered to recognize the New Mex ico department and officers as being in good standing. Scenes of frontier days were re-enacted in Clayton, N. M., for three nights, January 25, 26 and 27, when the American Legion's Old Western for the Old a time. Dance The was staged Western Dance fifteenth where is three day and night attraction plannell