Article Text

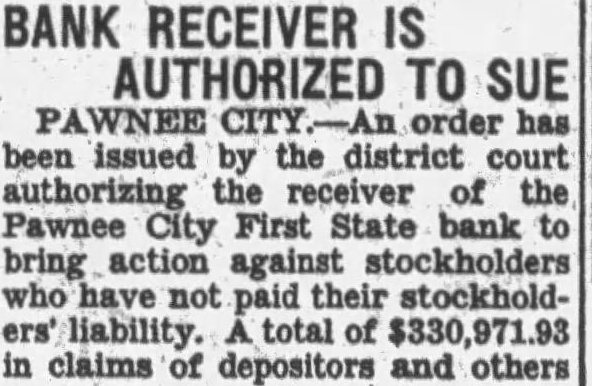

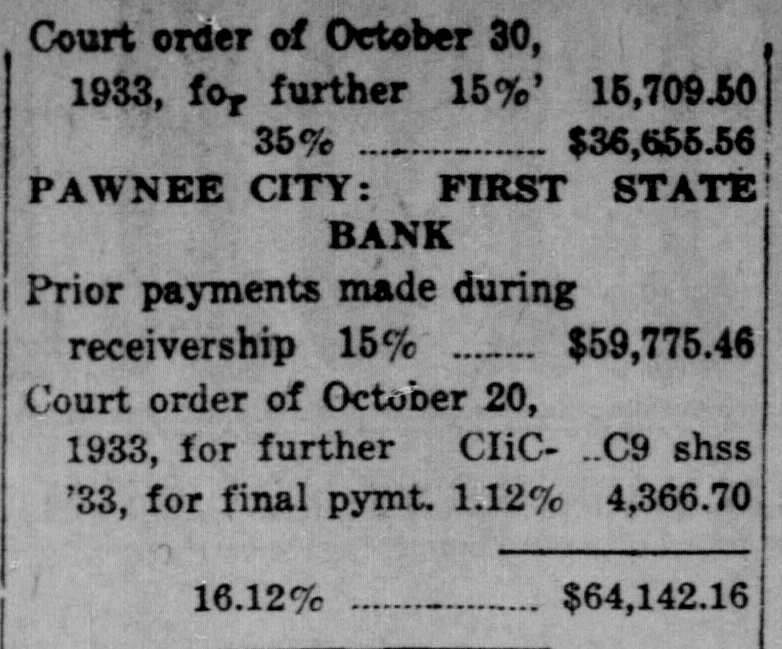

BANK RECEIVER IS AUTHORIZED TO SUE PAWNEE CITY. order has been issued by the district court authorizing receiver of the Pawnee City First State bank to bring action against stockholders who have not paid their stockholders' liability. total of $330,971.93 in claims of depositors and others