Click image to open full size in new tab

Article Text

Historic Postoffice Department Rejects Free Building, Pays Rent

Handled 9 Million Eggs in 20 Years

Royal, Neb., July while the books in their mercantile office at Royal, Neb., Rundquist discovered two which his father, the late Matt Rundquist, kept had handled from 1913 The compilation reveals that he handled 26 cases, 780 thousand dozor 9,360,000 eggs.

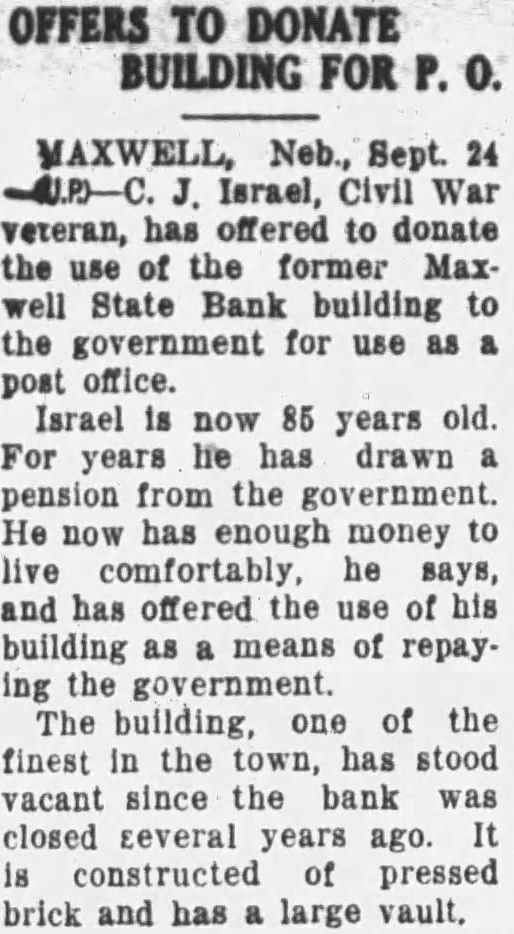

Above shown building given to the government postoffice at Maxwell, Neb., the brick structure; and at right above the building now used for postoffice on which rent being paid while the former stands idle. Below are Israel, 87, donor of the building, at right, and Schopp, acting postmaster. the the director of Maxwell, July objected on the ground strange situation exists in this that the cost the town 450 population. building would exceed the rental The government was given forpaid. was the bank building for postoffice, that frame but does not it. paying rent building by the instead on building across the post office owned by Miss Ellen street. Schopp, and located directly across On January 5. 1932, Israel, the street from your building, civil war pensioner who now 87 might be for $180 year, years old, donated brick building, and since appeared that the for the postoffice, without strings Schopp building was preferred by attached. the and would be Formerly the building had housed isfactory to the patrons, the dethe Maxwell State which partment removal of failed several years ago, and Israel the office thereto June bought the structure for $1,725 from the bank receiver.

Grateful Uncle Sam.

Israel explained that he had been pensioner for some years, and wished to repay the government part for what had been done for him, as he had plenty to live on otherwise. He said he had made request for any pen-

After the gift was announced, Mr. Israel letters from the country, lauding his gift. Charles Kuhns was postmaster the time. Congress approved legislation authorizing acceptance of the building. Then on June M. Schopp named acting postmaster, and three days later the office was moved to frame building across the street from that offered by Mr. Israel, for which rent of $180 year is to be paid. Mr. Israel thereupon got out petition, which protested that move, and was sent to Washington with 65 names attached.

Upkeep Cost Cited.

The new postmaster explains that costs of maintenance, upkeep and of the donated building would be greater than rent item. He asserted that $18 month had been paid for the time bank building before congress its Now much hurt. He said he is being persecuted. He had printed leaflet which said that thistles are the reward of giver letter to Mr. Israel from Purdum, acting fourth assistant postmaster general, replying his petition said part: "While true the congress approved authorizing acceptance of your building