Article Text

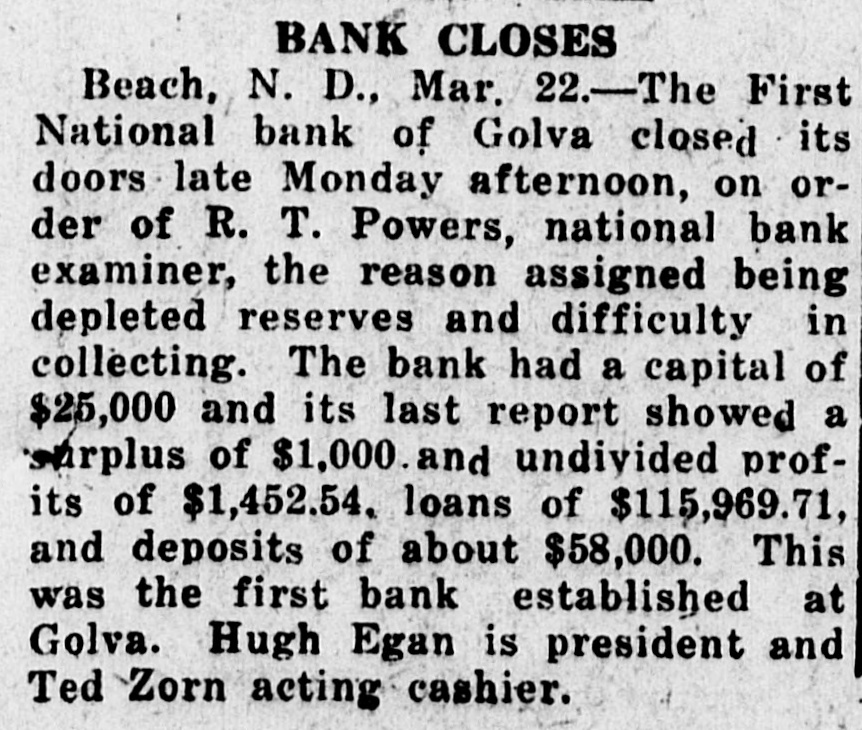

BANK CLOSES Beach, N. D., Mar. 22.-The First National bank of Golva closed its doors late Monday afternoon, on order of R. T. Powers, national bank examiner, the reason assigned being depleted reserves and difficulty in collecting. The bank had a capital of $25,000 and its last report showed a surplus of $1,000 and undivided profits of $1,452.54. loans of $115,969.71, and deposits of about $58,000. This was the first bank established at Golva. Hugh Egan is president and Ted Zorn acting cashier.