Article Text

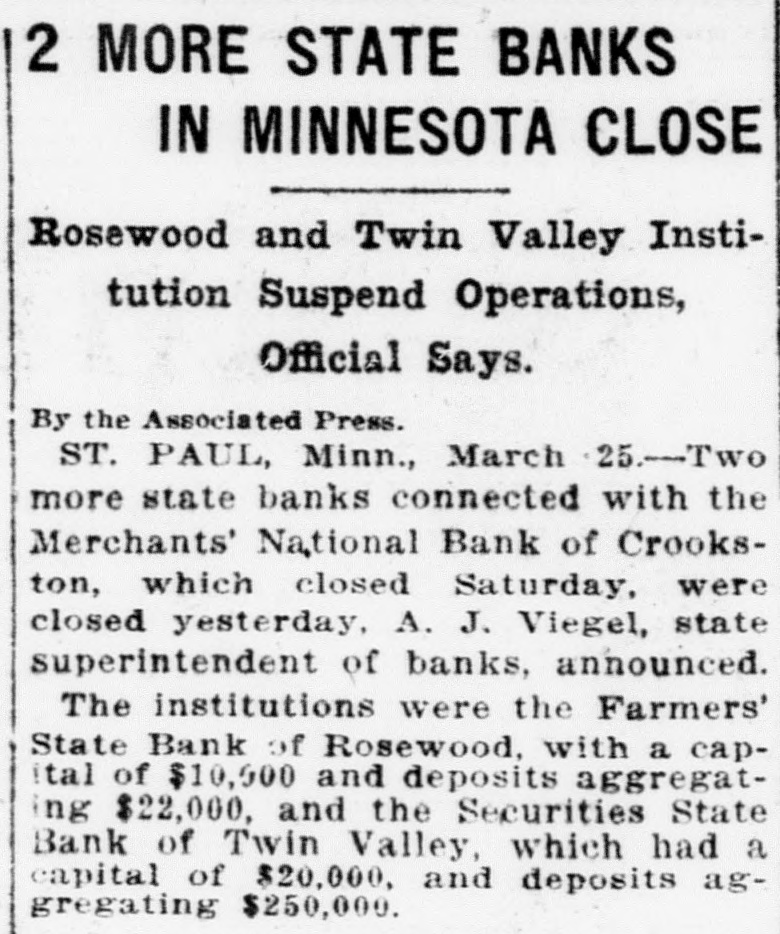

2 MORE STATE BANKS IN MINNESOTA CLOSE Rosewood and Twin Valley Institution Suspend Operations, Official Says. By the Associated Press. ST. PAUL, Minn., March 25.-Two more state banks connected with the Merchants' National Bank of Crookston, which closed Saturday, were closed yesterday, A. J. Viegel, state superintendent of banks, announced. The institutions were the Farmers' State Bank of Rosewood, with a capital of $10,500 and deposits aggregatng $22,000, and the Securities State Bank of Twin Valley, which had a capital of $20,000. and deposits aggregating $250,000.