Article Text

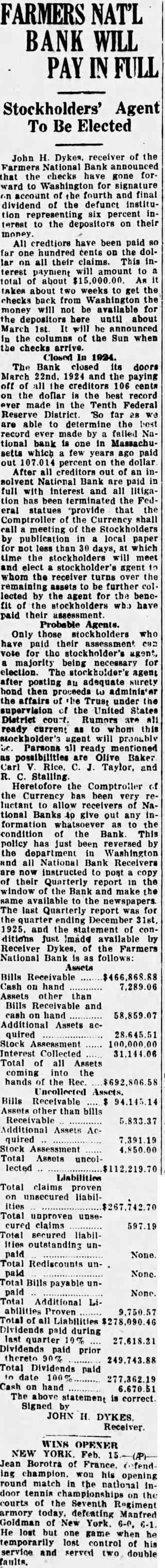

PAVEMENT PICK-UPS Sues Santa Fe. Mrs. Dora White of Iola has filed suit for $10,000 in Montgomery county district court against the Santa Fe railroad, alleging that the defendant is to blame for the death of her son. F. S. Atkins and This wife at crossing at the south edge of Wayside, in Montgomery. Oct. 16. The couple were enroute to Iola to be at the bedside of a sick relative when the accident happened. Insure with, Pay Taxes to OLIVE BAKER, Notary Exchange Bank Bldg., Ph 275 n13tf Alligator Is Frozen An alligator. dead and frozen stiff, was found in Onion creek vesterday morning by Bud Kauf man car the L. W. Kaufman farm three miles southwest of Coffeyville The rentile was taken to the Kaufman home and efforts made to revive it, but this was un- Are You Running On TIME? You'll always be on schedule If you let Newfield adjust your watch. 2130 Main. Phone 127. To Compete With Bus. John Schoenborn. Katy ticket agent. has received copy of res olution passed at the of the American Association Railroad Ticket Agents at St. Petersburg. Fa., urging that members USA their influence in assisting railroads to compete against mctor bus transportation Plummer Is Held John Plummer. colored. arrested Saturday night for being drunk and resisting an officer, is still be Ing held by the police department in connection with the attempt to enter the J. C. Penney store Saturday night. Take tamales home. 0. D. Dudley, Buckhorn Cafe, 209 S. Cen*ral. Phone 273. Revival Effort. The revival meeting being held in the First Church of The Brethren, 26th and Washington streets are progressing The weather conditions and season interests have militated against the best attendance. but each night a good. ly number are present to enjoy the devotional services and the Rev. W. T. Luckett announces the following subject for this week. "The Unanswered Question." "Flirting With The Devil." "What Will You Do With Jesus?' "Christian Freedom.' Another Chance To Make Good." "The Home." General Insurance F. E. Gehring. 1809 Broadway. Phone 409. To Hold Open House. Announcement has been made that the Faer club will hold open house New Year's Eve at the Y. W. A. All men and women are cardially invited A program is promised every hour, in charge of Miss Ruth Walton Refreshments will be served THE MAIN STREET CAFETERIA Serves Maxwell House Coffee, the best the market affords. No charge for second cup. 07tf. To Help In Revival. Rev and Mrs. C. D. Wheat of Joplin arrived in the city last night to assist with revival servIce being conducted at 2027 Main street by Rev. Heiskel Rev Wheat will have charge of the music each evening Make It A Habit. To go to the Commercial Barber shop, 106 N. Central, P. M. Johnson, proprietor. Phone 212. Fire Boys Make Ran. A trash fire on North Thirtieth street necessitated a run by the fire department yesterday afternoon No damage was done although the flames were threatening some buildings If your electric washer or sweeper needs repair Call 446. J1 Dividend Checks Here. The ten percent dividend checks for the depositors of the defunct Farmers National Bank have arrived and are being distributed it was announced last night by John H. Dykes, The checks were scheduled to arrive before Christmas but for some reason they were delayed. Each depositor must submit his certificate at the bank office on Broadway. Mr Dykes said New Mattresses Cheap Old mattresses renovated and recovered and home same day invited Feather beds made into sanitary mattresses Acme Mattress Factory, 202 N. Central, Phone 77. The Main Street Cafeteria will Laundry open January 4th at noon Adam Gross and F. H Frost proprietors F. H Frost. manager 431 Dry Wash Successful Try Havnes new DRY WASH. Satisfaction at low cost. 6c 1b. Call 144 and ask about It. 07 Miss Wells Returns Miss Ethel Wells has resumed her duties in the city water department after spending Christmas and the end with relalives and friends in Bartlesville.