Article Text

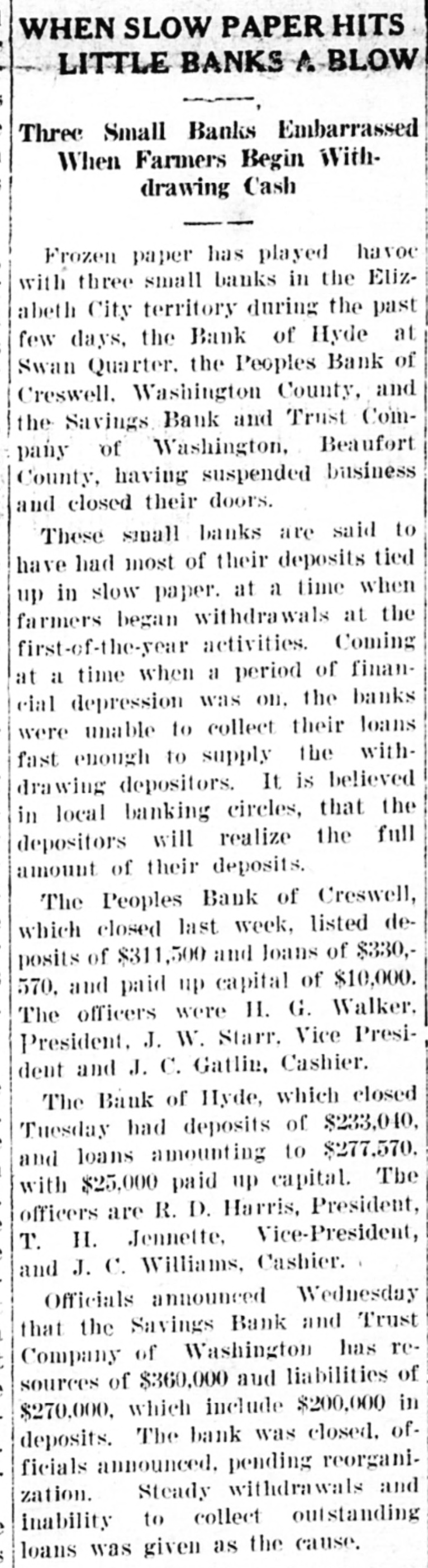

WHEN SLOW PAPER HITS LITTLE BANKS A BLOW Three Small Banks Embarrassed When Farmers Begin Withdrawing Cash Frozen paper has played havoc with three small banks in the Elizabeth City territory during the past few days, the Bank of Hyde at Swan Quarter. the Peoples Bank of Creswell. Washington County, and the Savings Bauk and Trust Company of Washington, Beaufort County, having suspended business and closed their doors. These small banks are said to have had most of their deposits tied up in slow paper. at a time when farmers began withdrawals at the first-of-the-year activities. Coming at a time when a period of financial depression was on. the banks were unable to collect their loans fast enough to supply the withdrawing depositors. It is believed in local banking circles, that the depositors will realize the full amount of their deposits. The Peoples Bank of Creswell, which closed last week, listed deposits of $311,500 and loans of $330,570. and paid up capital of $10,000. The officers were H. G. Walker. President, J. W. Starr. Vice President and J. C. Gatlin, Cashier. The Bank of Hyde, which closed Tuesday had deposits of $233,040, and loans amounting to $277,570. with $25,000 paid up capital. The officers are R. D. Harris, President, T. H. Jennette, Vice-President, and J. C. Williams, Cashier. Officials announced Wednesday that the Savings Bank and Trust Company of Washington has resources of $360,000 aud liabilities of $270,000. which include $200,000 in deposits. The bank was closed. officials announced. pending reorganization. Steady withdrawals and inability to collect outstanding loans was given as the cause.