Article Text

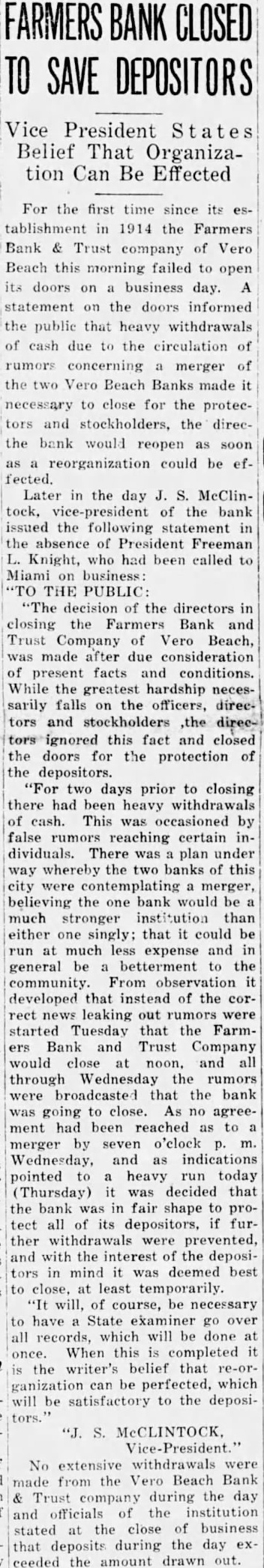

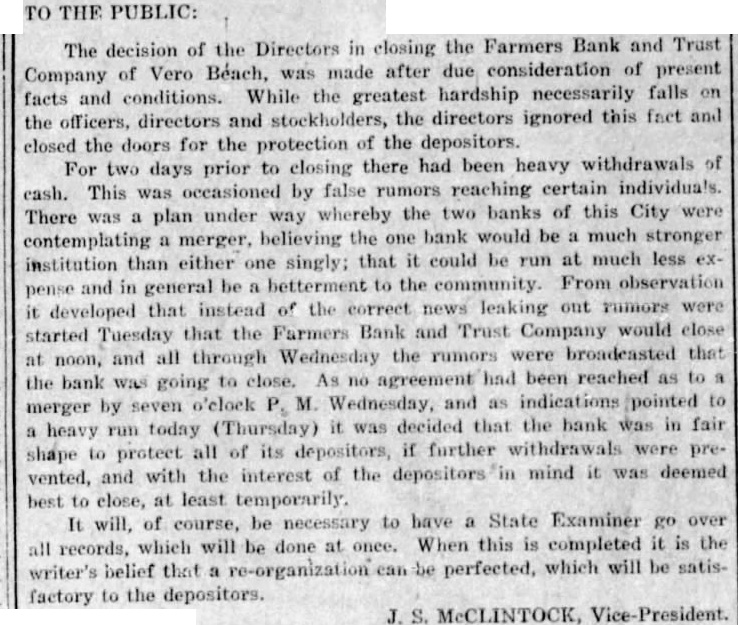

SAVE DEPOSITORS Vice President States Belief That Organization Can Be Effected For the first time since its tablishment in the Farmers Bank Trust of Vero company Beach this morning failed to open doors on business day. A statement on the doors informed public that heavy withdrawals cash due the circulation of rumors concerning merger of the two Vero Beach Banks made necessary to close for the protecand stockholders, the direc- the bank would reopen reorganization could be fected. Later in the day McClintock, vice-president of the bank issued the following statement in the absence of President Freeman Knight, who had been called Miami business: THE PUBLIC: decision of the directors in closing the Farmers Bank and Trust Company of Vero Beach, made after due consideration of present facts and conditions. While the greatest hardship necessarily falls on the officers, directors and stockholders ,the this fact and closed the doors for the protection of the depositors. "For two days prior to closing there had been heavy withdrawals of cash. This was occasioned by false rumors reaching certain dividuals. There plan under way whereby the two banks of this city were contemplating merger, believing the one bank would be much stronger institution than either one singly; that it could be run at much expense and in general be betterment to the community. From observation developed that instead of the correct news leaking out rumors were started Tuesday that the FarmBank and Trust Company would close at noon. and all through Wednesday the rumors broadcasted that the bank going close. As no agreement had been reached as to merger by seven o'clock Wednesday, and as indications pointed heavy run today (Thursday) was decided that the bank was in fair shape to protect all of its depositors, further withdrawals were prevented, and with the interest of the depositors in mind was deemed best to close, at least temporarily. will, of course, be necessary to have State examiner over all records, which be done once. When this is completed the writer's belief that re-organization can be perfected, which will be satisfactory to the deposi- No extensive withdrawals were made from the Vero Beach Bank Trust during the day company officials the institution and stated the close of business that deposits during the day ceeded the amount drawn out.