Article Text

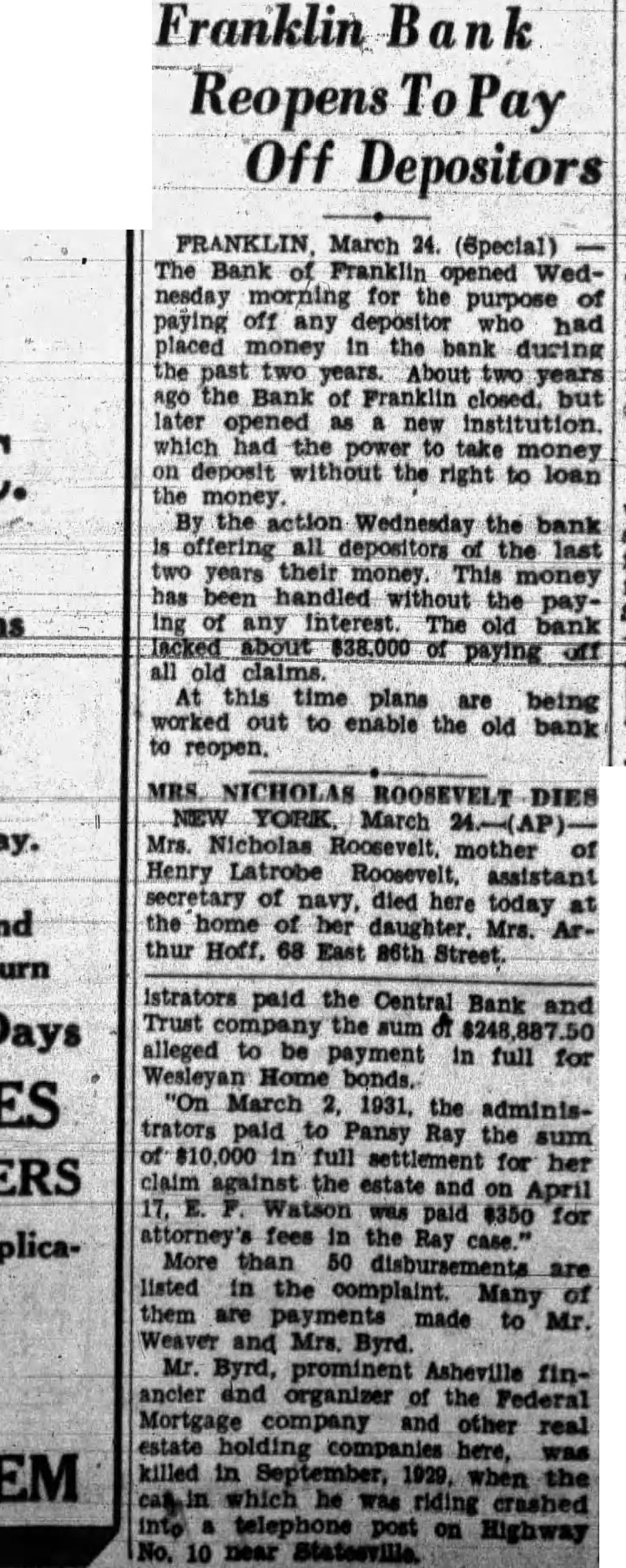

Franklin Bank Reopens To Pay Off Depositors FRANKLIN, March 24. (Special) The Bank of Franklin opened Wednesday morning for the purpose of paying off any who had placed in the bank during the past two years. About two years ago the Bank of Franklin closed. but later opened as new institution. which had the power to take money on deposit without the right to loan the money. By the action Wednesday the bank is offering all depositors the last two years their money. This money has been handled without the paying of any interest. The old bank lacked about $38,000 of paying off all old claims. At this time plans are being worked out to enable the old bank to reopen. MRS. NICHOLAS ROOSEVELT DIES YORK. March Mrs. Nicholas Roosevelt. mother of Henry Latrobe Roosevelt, assistant of navy, died here today at the home her daughter. Mrs. Arthur Hoff. 68 East 86th Street. istrators paid the Central Bank and Trust company the sum of alleged to be payment in full for Wesleyan Home "On March 1931, the administrators paid to Pansy Ray the sum of $10,000 in full for her claim against estate and on April 17, F. Watson was paid 8350 for attorney's fees in the Ray case." More than 50 disbursements. are listed in the complaint. Many them are payments made to Mr. Weaver and Mrs. Byrd. Mr. Byrd, prominent Asheville financier and organizer of the Federal Mortgage company and other real estate here, was killed in 1929, when the can which he was riding crashed post on Highway No. 10 near Statesville.