Article Text

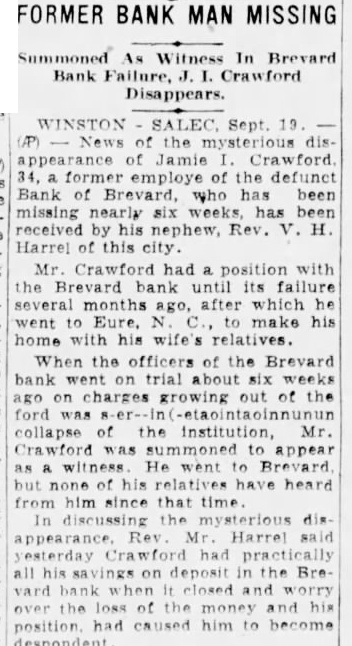

FORMER BANK MAN MISSING Summoned As Witness In Brevard Bank Failure, Crawford Disappears. WINSTON SALEC, Sept. 19. (AP) of the mysterious disappearance of Jamie Crawford former employe of the defunct Bank of Brevard, who has been missing nearly six weeks. has been received by his nephew, Rev. v. H. of this Mr. Crawford had a position with the Brevard bank until its failure several months ago, after which he went to Eure. make his home with his wife's relatives. When the officers of the Brevard bank went on trial about six weeks ago on charges growing out of the ford was collapse of the institution, Mr. Crawford was summoned to appear as witness He to Brevard but relatives have heard from him since that time discussing the mysterious Harrel had his savings on deposit in the Breclosed and worry the the money and his position caused him to become