1.

November 26, 1930

The Webb City Sentinel

Webb City, MO

Click image to open full size in new tab

Article Text

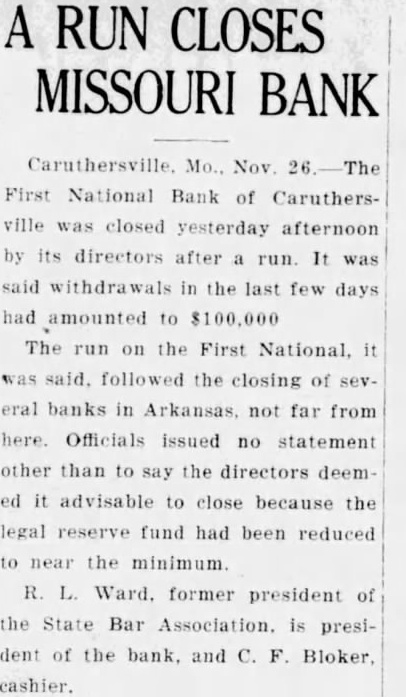

A RUN CLOSES MISSOURI BANK

First National Bank of Caruthersville was closed yesterday afternoon by its directors after a run. It was said withdrawals in the last few days had amounted to $100.000 The run on the First National, it was said, followed the closing of several banks in Arkansas, not far from here. Officials issued no statement other than to say the directors deemed it advisable to close because the legal reserve fund had been reduced to near the minimum.

R. L. Ward. former president of the State Bar Association. is president of the bank, and C. F. Bloker, cashier.

2.

November 26, 1930

The Webb City Sentinel

Webb City, MO

Click image to open full size in new tab

Article Text

A RUN CLOSES MISSOURI BANK

Caruthersville. Mo., Nov. 26.-The First National Bank of Caruthersville was closed yesterday afternoon by its directors after a run. It was said withdrawals in the last few days had amounted to $100.000

The run on the First National. it was said. followed the closing of several banks in Arkansas. not far from here. Officials issued no statement other than to say the directors deemed it advisable to close because the legal reserve fund had been reduced to near the minimum.

R. L. Ward. former president of the State Bar Association. is president of the bank. and C. F. Bloker, cashier.

Trv The Sentinel for Job Work

3.

November 26, 1930

Paragould Soliphone

Paragould, AR

Click image to open full size in new tab

Article Text

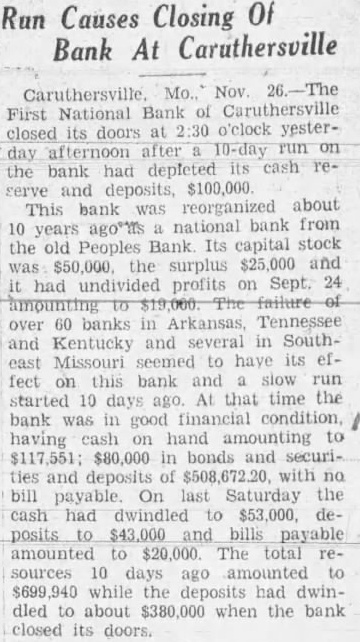

Run Causes Closing Of Bank At Caruthersville

First National Bank of Caruthersville closed its doors at o'clock yesterday afternoon after 10-day run on the bank had depleted its cash reserve and deposits, $100,000. This bank was reorganized about 10 years ago national bank from the old Peoples Bank Its capital stock was $50,000 the surplus $25,000 and had undivided profits on Sept. 24 amounting over 60 banks in Arkansas, Tennessee and Kentucky and several in Southeast Missouri seemed to have its effect on this bank and slow run started 10 days ago. At that time the bank was in good condition having on hand to $117,551; $80,000 in bonds and securities and deposits of with no bill payable. On last Saturday the cash had dwindled to $53,000, deposits $43,000 and bills payable amounted $20,000 The total resources 10 days ago amounted to $699,940 while the deposits had dwindled to about $380,000 when the bank closed its doors.

4.

November 26, 1930

Pensacola News Journal

Pensacola, FL

Click image to open full size in new tab

Article Text

BANK CLOSES CARUTHERSVILLE Mo., Nov. 25. (/P)-The First National Bank of Caruthersville was closed this after- noon by its directors after a run. It was said withdrawals during the last few days had amounted to $100,000.

5.

November 26, 1930

The Kansas City Times

Kansas City, MO

Click image to open full size in new tab

Article Text

PLAN NEW ROAD LAWS.

A Conference Is to Be Held Today in Joplin. dred road boosters and leaders civic from all parts of Southwest are expected here when representatives of the Automobile Club of Missouri will come here for a discussion of program to be placed before the Missouri legislature. Roy Britten of St. Louis, and other members of the board of the club, will attend the The proposed program deals with the organization of a highway patrol and modernization of road and motor car laws.

RUN CLOSES MISSOURI BANK. First National of Caruthersville Fails to Withstand Withdrawals.

First National Bank of Caruthersville was closed this afternoon by its directors after run. It was said withdrawals in the last few days had amounted to The run on the First National, was said, followed the closing of sevbanks in Arkansas, not far from here. Officials issued no statement other than to say the directors deemed it advisable to close because the legal reserve fund had been reduced to near the minimum. R. L. Ward, former president of the State Bar Association, is president of the bank and C. F. Bloker, cashier.

6.

November 26, 1930

Daily American Republic

Poplar Bluff, MO

Click image to open full size in new tab

Article Text

RUN CAUSES CLOSING OF BANK AT CARUTHERSVILLE, MO.

Caruthersville, Mo., Nov. 26.-The First National Bank of Caruthersville was closed Tuesday afternoon by its directors after a run. It was said withdrawals during the last few days had amounted to $100,000.

Gainesville, Ga.-Love and health are the principal qualifications desired in husbands by seniors of Brenau college. By large majorities they have so decided in questions propounded by the faculty. New York. From conspicuous work in developing the skyscraper type which is giving New York its majestice sky line, Cass Gilbert, architect, has been awarded a gold medal by the society of arts and sciences. Although the Woolworth building, which he designed, has lost its supremacy as the largest, it is described by the society as an epochal landmark in the history of architecture. New York.-Back from the lake chad region of Africa, W. C. Seabrook, author, says cannibals there nicer to him than New Yorkers he has met on the street.

It is said that the broadcasting company which engaged Bernard Shaw, dramatist, for his radio talk, expected him to give a play by play description.

"Bargain Sales Banned by Chinese Merchants." Headline. Probably by the peace-loving type who are determined to stop counter-attacks.

In Java, rubber trees are being cut down to make way for rice crops. This is the inevitable result when one tires of rubber,

A college professor advises men to marry their stenographers. Perhaps he believes the men will like their type. There's a rumor that the Prince of Wales will marry Princess Ingrid of Sweden. Well, they say the best matches are made there.

Farm club boys in 23 counties entered 540 calves in the ninth annual fat stock show at Louisville, Ky.

7.

November 27, 1930

The Missouri Cash-Book

Jackson, MO

Click image to open full size in new tab

Article Text

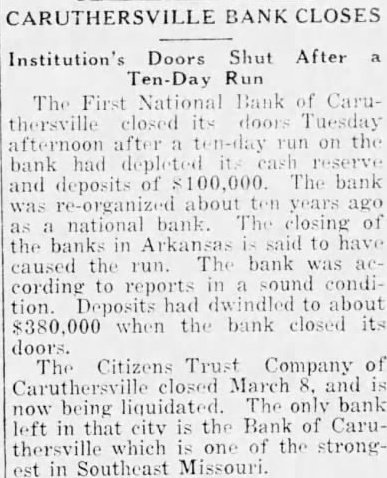

CARUTHERSVILLE BANK CLOSES

Doors Shut After Run

The First National Bank of Caruclosed Tuesday ten-day on the bank and deposits The bank was about ago national bank. of the banks Arkansas to have caused the run. The bank to sound condicording reports tion. Deposits about when the bank closed its doors.

Citizens Trust Company of closed March and being liquidated. bank in that city the Bank of Caruthersville which of the strongest in Southeast Missouri.

8.

November 27, 1930

Iron County Register

Ironton, MO

Click image to open full size in new tab

Article Text

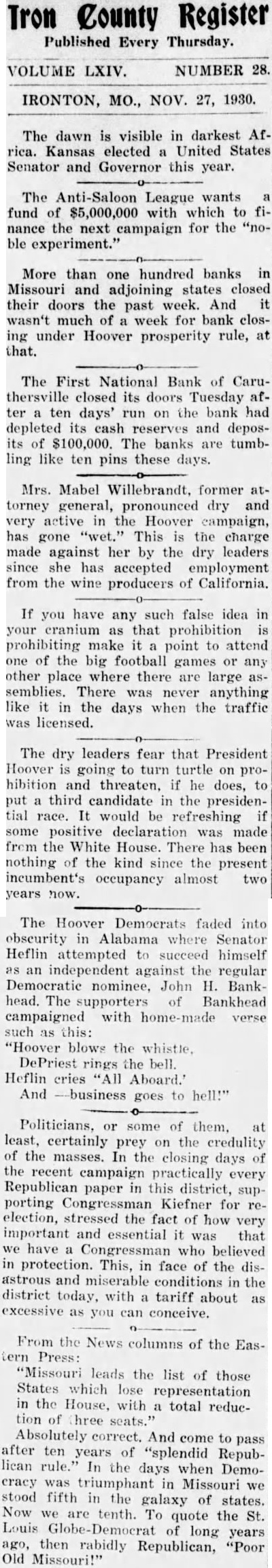

Tron County Register Published Every Thursday.

VOLUME LXIV. NUMBER 28.

IRONTON, MO., NOV. 27, 1930.

The dawn is visible in darkest Africa. Kansas elected a United States Senator and Governor this year.

The Anti-Saloon League wants a fund of $5,000,000 with which to finance the next campaign for the "noble experiment."

More than one hundred banks in Missouri and adjoining states closed their doors the past week. And it wasn't much of a week for bank closing under Hoover prosperity rule, at that.

The First National Bank of Caruthersville closed its doors Tuesday after a ten days' run on the bank had depleted its cash reserves and deposits of $100,000. The banks are tumbling like ten pins these days.

Mrs. Mabel Willebrandt, former attorney general, pronounced dry and very active in the Hoover campaign, has gone "wet." This is the charge made against her by the dry leaders since she has accepted employment from the wine producers of California.

If you have any such false idea in your cranium as that prohibition is prohibiting make it a point to attend one of the big football games or any other place where there are large assemblies. There was never anything like it in the days when the traffic was licensed.

The dry leaders fear that President Hoover is going to turn turtle on prohibition and threaten. if he does, to put a third candidate in the presidential race. It would be refreshing if some positive declaration was made from the White House. There has been nothing of the kind since the present incumbent's occupancy almost two years now.

The Hoover Democrats faded into obscurity in Alabama where Senator Heflin attempted to succeed himself as an independent against the regular Democratic nominee, John H. Bankhead. The supporters of Bankhead campaigned with home-made verse such as this: "Hoover blows the whistle. DePriest rings the bell. Heflin cries "All Aboard.' And business goes to hell!"

Politicians, or some of them. at least, certainly prey on the credulity of the masses. In the closing days of the recent campaign practically every Republican paper in this district, supporting Congressman Kiefner for reelection, stressed the fact of how very important and essential it was that we have a Congressman who believed in protection. This, in face of the disastrous and miserable conditions in the district today, with a tariff about as excessive as you can conceive.

From the News columns of the Eastern Press: "Missouri leads the list of those States which lose representation in the House, with a total reduetion of hree seats." Absolutely correct. And come to pass after ten years of "splendid Republican rule.' In the days when Democracy was triumphant in Missouri we stood fifth in the galaxy of states. Now we are tenth. To quote the St. Louis Globe-Democrat of long years ago, then rabidly Republican, "Poor Old Missouri!"

9.

November 27, 1930

The Steele Enterprise

Steele, MO

Click image to open full size in new tab

Article Text

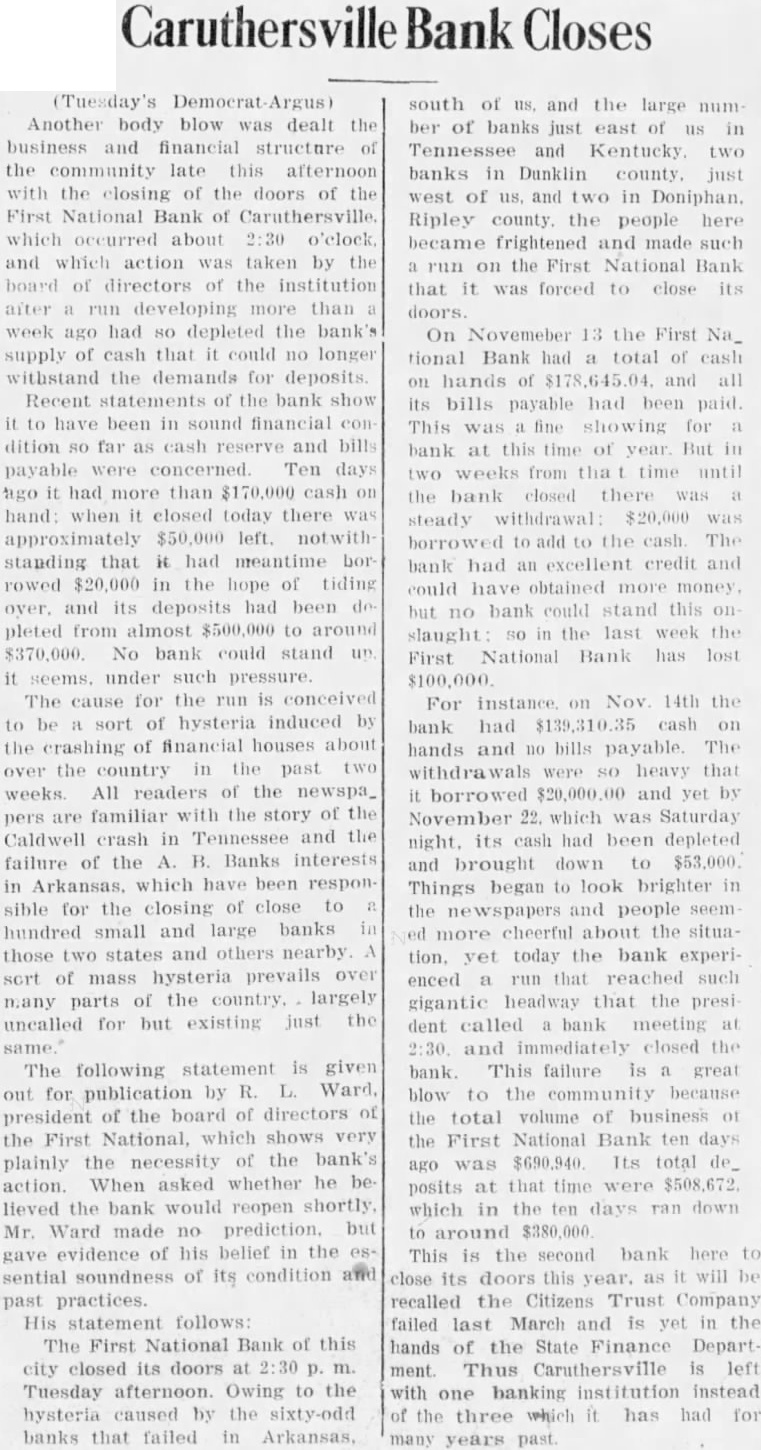

(Tuesday's Another body blow dealt the business and financial structure the community late this afternoon with the closing of the doors of the First National Bank of Caruthersville which occurred about and which action taken by the board directors the institution run developing more than week ago had depleted the bank's supply of cash that could no longer withstand the demands for deposits. Recent statements of the bank show to have been in sound financial dition far cash reserve and bills concerned. Ten days it had more than cash hand: when elosed today there approximately standing that had meantime rowed $20,000 in the hope of tiding and its deposits had been pleted from almost to around No bank could stand seems. under such pressure The cause for the run is conceived sort of hysteria induced crashing financial houses about country past weeks. All readers of the newspa_ familiar with the story of the Caldwell crash in and the failure of the Banks interests Arkansas, which have been responsible for the closing of close to hundred small and large banks those states and others nearby scrt of mass hysteria prevails over many parts the country. largely uncalled for but existing just the The following statement is given for by Ward. out publication president of the directors the First National, which shows very plainly the necessity of the bank's action. When asked whether he believed the bank would reopen shortly. Mr. Ward made no prediction. but evidence of his belief in the sential soundness of its condition past practices. statement follows: The First National Bank of this city closed its doors m. Tuesday afternoon. Owing to the hysteria caused by the sixty-odd banks that failed in south and the large number of banks just east of Tennessee and Kentucky. two banks in Dunklin county. just west of us, and two in Doniphan. Ripley county. the people here became frightened and made such on the First National Bank that was forced to close its doors. On Novemeber 13 the First tional Bank had total cash hands and all its bills payable had been paid. This showing for bank at time of year But in weeks from tha time until the bank closed there steady withdrawal: $20,000 borrowed The bank had an excellent credit and could more but bank could stand slaught the last week First National Bank has lost For instance Nov 14th the bank had cash hands and bills payable. The heavy that borrowed and yet November which was Saturday night. its cash had been depleted and brought down Things began to look brighter the newspapers and people more about the situation. today the bank experienced run that such gigantic headway that the presi dent called bank meeting and immediately closed bank. This failure great blow to community because the total volume business the First National Bank ten days ago was $690,940 Its total posits at that time which in the ten days ran down around $380,000 This the second bank here close its doors this year. as will recalled the Citizens Trust Company failed last March and is yet the hands of the State Finance Depart ment. Thus Caruthersville left with one banking institution instead the three which has had years past.

10.

November 27, 1930

Caruthersville Journal

Caruthersville, MO

Click image to open full size in new tab

Article Text

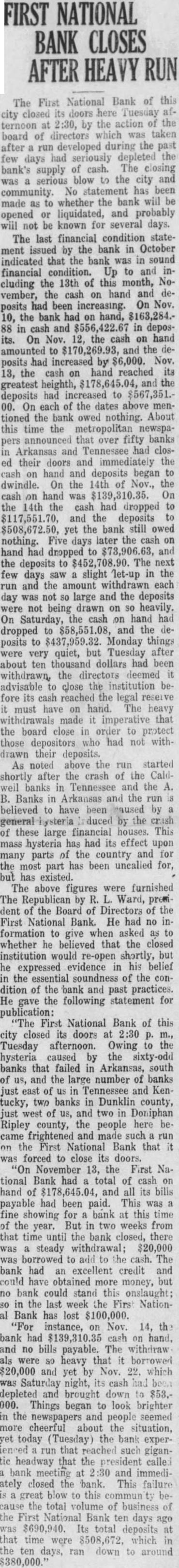

FIRST NATIONAL BANK CLOSES

The First National Bank of closed doors here Tuesday 2:30, by the action ternoon directors which taken board of during the developed few had seriously depleted days of cash. The closing bank's supply serious blow the city No statement has been community. whether the bank will made as to opened liquidated, and probably not be known for several days. The last financial condition statement issued by the bank in October indicated that the bank was in sound financial condition. Up to and 13th of this month, Nocluding the the cash on hand and vember, had been increasing. On posits 10, the bank had on hand, in cash and in deposOn Nov. 12, the cash on hand to and the had increased by $6,000. Nov. posits the cash on hand reached its heighth, $178,645.04, and the greatest deposits had increased to On each of the dates above mentioned the bank owed nothing. About this time the metropolitan that over fifty banks Arkansas and Tennessee had clostheir doors and immediately the on hand and deposits began dwindle. On the of Nov., cash hand was On on the the cash had dropped and the deposits $508,672.50, the bank still owed yet nothing. Five days later the cash hand dropped to the to The next deposits few days slight let-up in the saw and the amount withdrawn each not large and the deposits not being drawn on heavily. Saturday, the cash on hand had and the dedropped posits to Monday things quiet, but Tuesday after were very about ten thousand dollars had been withdrawn, the directors deemed advisable to close the institution fore its cash reached the legal must have on hand. The heavy withdrawals made imperative that the board close in order protect those depositors who had not drawn their deposits. As noted above the run started shortly after the crash of the Caldwell banks Tennessee and the Banks in Arkansas and the run believed have been the crush these large financial This mass hysteria has had its effect upon many parts of the country and for the most part has been uncalled for, has existed. The above figures were furnished The by Ward, dent the Board of Directors of the First National Bank. He had no information to give when asked whether he believed that the closed institution would re-open shortly, but expressed evidence in his belief the essential soundness of the con dition of the bank and past practices. He the following statement for First National Bank of this city closed its doors at Tuesday afternoon. Owing hysteria caused the banks that failed Arkansas, south of and the large number of banks just east of Tennessee and Kentucky, two banks Dunklin county, west of us, and two in Doniphan Ripley county, the people here became frightened and the First National Bank that forced to close its doors. "On November the National Bank had total of and bills payable had been paid. This fine showing for bank at this time the year. But in two weeks from that time until the bank closed, there steady withdrawal: borrowed add cash. The bank had excellent credit and could obtained more money, but no bank could stand this onslaught; the last week the NationBank has lost "For instance, on Nov. 14, bank had cash on hand, and no bills payable. The withdraw were heavy that borrowed and yet Nov. which Saturday night, cash depleted brought down $53.000. Things began to look brighter the newspapers and people seemed more cheerful about the situation, today (Tuesday) the bank experrun that reached such gigantic headway that the president bank meeting and immediately closed the bank. This failure great blow this commun cause the total volume of business of the First National Bank ten days $690,940. Its total deposits that time were which the ten days, ran down around $380,000.

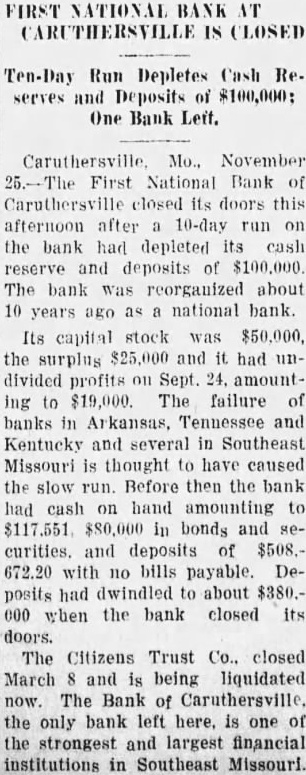

11.

November 27, 1930

The Daily Statesman

Dexter, MO

Click image to open full size in new tab

Article Text

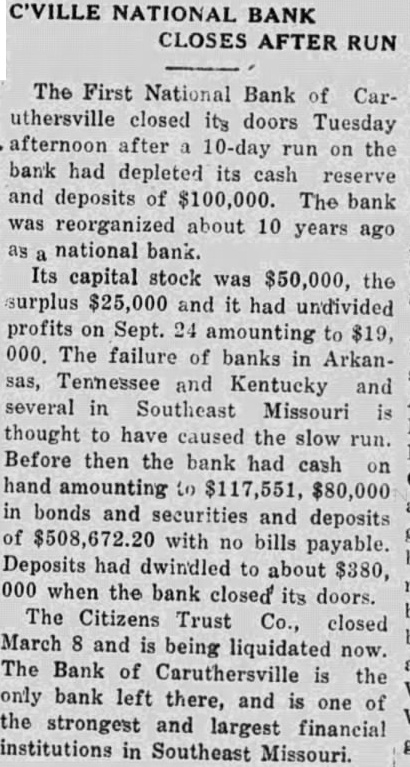

C'VILLE NATIONAL BANK CLOSES AFTER RUN

The First National Bank of Caruthersville closed its doors Tuesday afternoon after a 10-day run on the bank had depleted its cash reserve and deposits of $100,000. The bank was reorganized about 10 years ago as a national bank. Its capital stock was $50,000, the surplus $25,000 and it had undivided profits on Sept. 24 amounting to $19, 000. The failure of banks in Arkansas, Tennessee and Kentucky and several in Southeast Missouri is thought to have caused the slow run. Before then the bank had cash on hand amounting to $117,551, $80,000 in bonds and securities and deposits of $508,672.20 with no bills payable. Deposits had dwindled to about $380, 000 when the bank closed its doors. The Citizens Trust Co., closed March 8 and is being liquidated now. The Bank of Caruthersville is the only bank left there, and is one of the strongest and largest financial institutions in Southeast Missouri.

12.

November 28, 1930

The Daily Dunklin Democrat

Kennett, MO

Click image to open full size in new tab

Article Text

FIRST NATIONAL BANK AT CLOSED

Run Depletes Cash Reserves Deposits of $100,000: One Bank Left.

Mo., November First National Bank of Caruthersville closed its doors this afternoon after 10-day run on the bank had depleted its cash reserve and deposits of $100,000 The bank was reorganized about 10 years national bank. Its capital stock was $50,000. the surplus and had divided profits Sept. amounting to $19,000. The failure of banks in Arkansas, and Kentucky and several in Southeast Missouri thought to have caused the slow run. Before then the bank had cash hand amounting to $80,000 bonds and curities. deposits of $508.672.20 with bills payable Deposits had about $380.000 when the bank closed its doors. The Citizens Trust Co., closed March and being liquidated now. The Bank of Caruthersville the only bank here, is of the strongest and largest financial institutions in Southeast Missouri.

13.

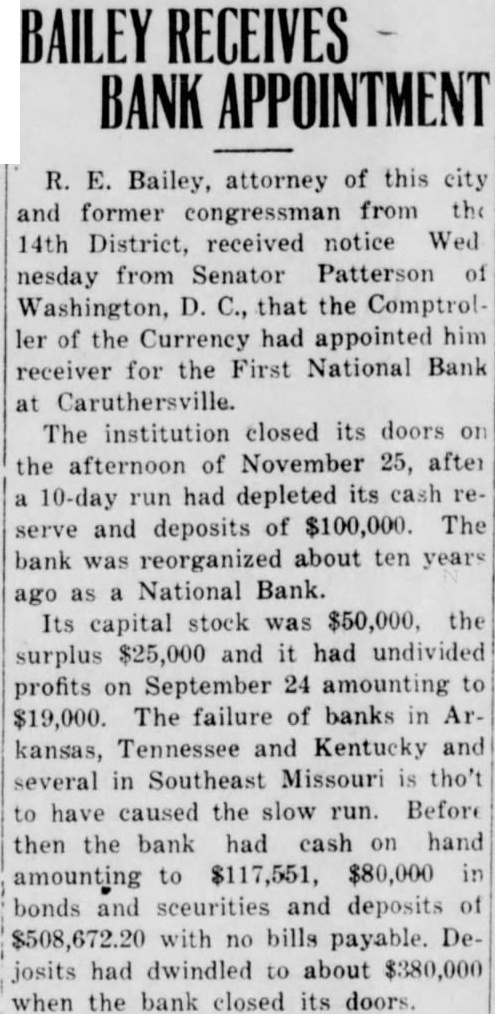

December 19, 1930

The Daily Standard

Sikeston, MO

Click image to open full size in new tab

Article Text

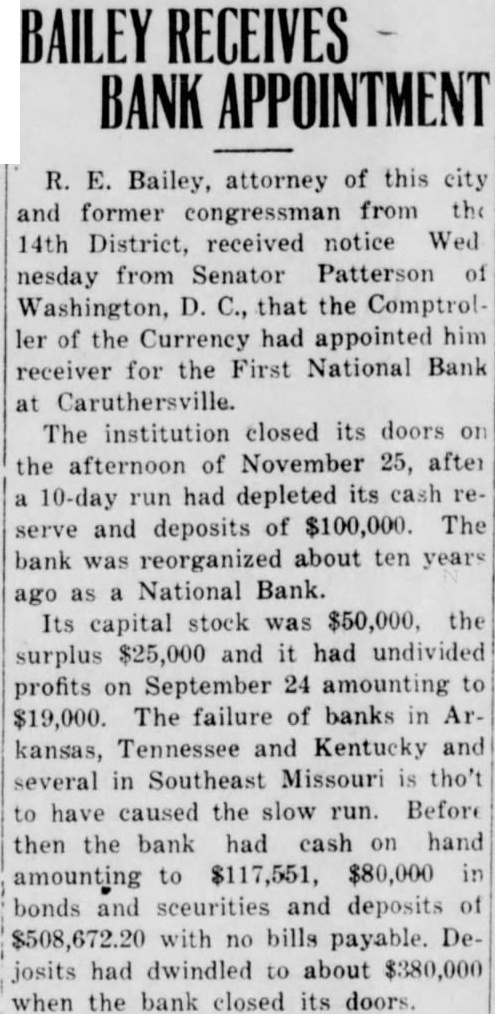

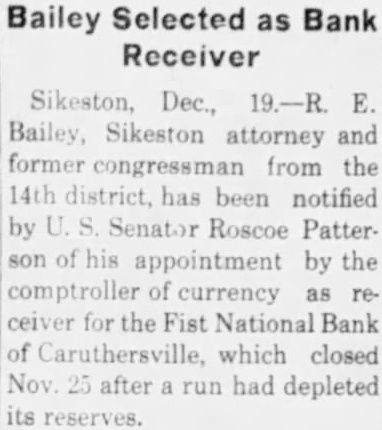

BAILEY RECEIVES BANK APPOINTMENT

R. E. Bailey, attorney of this city and former congressman from the 14th District, received notice Wed nesday from Senator Patterson of Washington, D. C., that the Comptroller of the Currency had appointed him receiver for the First National Bank at Caruthersville. The institution closed its doors on the afternoon of November 25, after a 10-day run had depleted its cash reserve and deposits of $100,000. The bank was reorganized about ten years ago as a National Bank. Its capital stock was $50,000, the surplus $25,000 and it had undivided profits on September 24 amounting to $19,000. The failure of banks in Arkansas, Tennessee and Kentucky and several in Southeast Missouri is tho't to have caused the slow run. Before then the bank had cash on hand amounting to $117,551, $80,000 in bonds and sceurities and deposits of $508,672.20 with no bills payable. Dejosits had dwindled to about $380,000 when the bank closed its doors.

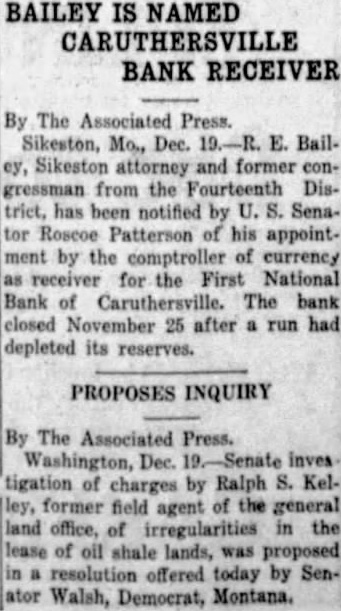

14.

December 19, 1930

Daily American Republic

Poplar Bluff, MO

Click image to open full size in new tab

Article Text

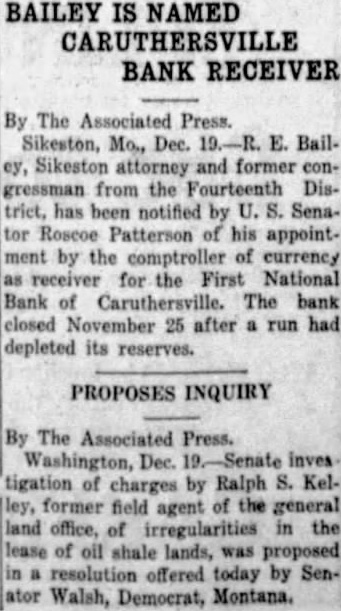

BAILEY IS NAMED CARUTHERSVILLE BANK RECEIVER

By The Associated Press. Sikeston, Mo., Dec. E. Bailey, Sikeston attorney and former congressman from the Fourteenth District, has been notified by U. Senator Roscoe Patterson of his appointment by the comptroller of currency receiver for the First National Bank of Caruthersville. The bank closed November 25 after run had depleted its reserves.

PROPOSES INQUIRY

By The Associated Press. Washington, Dec. inves tigation of charges by Ralph S. Kel[ley, former field agent of the general land office, of irregularities in the of oil shale lands, was proposed offered today by SenWalsh, Democrat, Montana.

15.

December 25, 1930

Cape County Post

Jackson, MO

Click image to open full size in new tab

Article Text

Bailey Is Named Caruthersville Bank Receiver.

Sikeston attorney and former congressman from the Fourteenth Dist. rict. has been notified by 1'. S. Senator Roscoe Patterson of his appoint. ment by the comptroller of currency as receiver for the First National Bank , Caruthersville The bank closed November 25 after a run had depleted its reserves

16.

December 25, 1930

Caruthersville Journal

Caruthersville, MO

Click image to open full size in new tab

Article Text

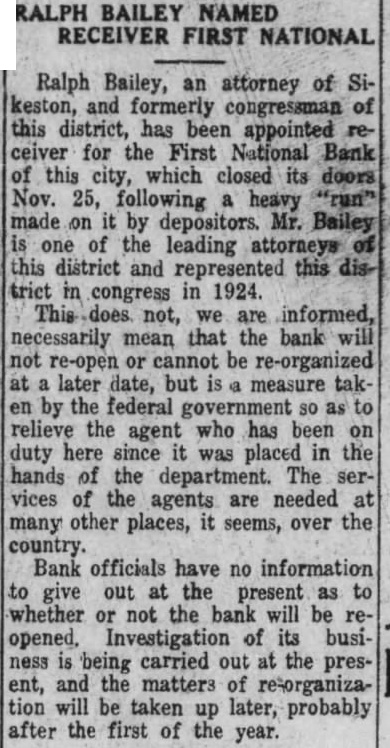

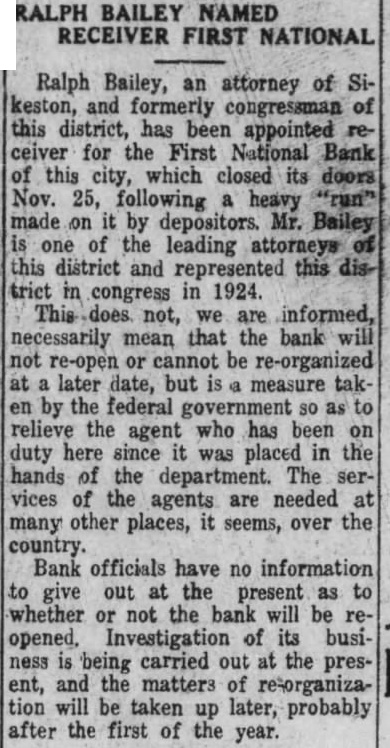

RALPH BAILEY NAMED RECEIVER FIRST NATIONAL

Ralph Bailey, an attorney of keston, and formerly congressman of this district, has been appointed ceiver for the First National Bank this city, which closed its doors Nov. 25, following heavy made on by depositors. Mr. Bailey one of the leading attorneys this district and this trict in congress in 1924. not, we are informed, necessarily mean that the bank not re-open or cannot re-organized later date, but measure tak the federal government relieve the agent who has been duty here since was placed in the hands of the department. The services of the agents are needed many other places, seems, over the country. Bank officials have no information to give out at the present whether or not the bank will be Investigation of its business being carried out at the ent, and the matters of re-organization will be taken later, probably up after the first of the year.

17.

December 26, 1930

Portageville Southeast Missourian

Portageville, MO

Click image to open full size in new tab

Article Text

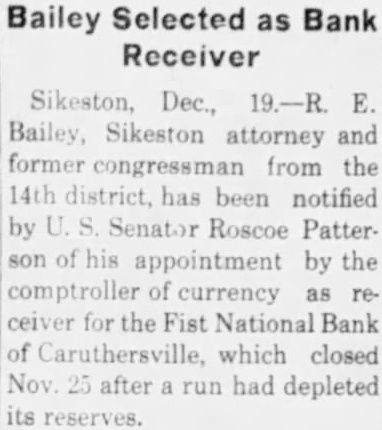

Bailey Selected as Bank Receiver

Sikeston, Dec., 19.-R. E. Bailey, Sikeston attorney and former congressman from the 14th district, has been notified by U. S. Senator Roscoe Patterson of his appointment by the comptroller of currency as receiver for the Fist National Bank of Caruthersville, which closed Nov. 25 after a run had depleted its reserves.

18.

July 9, 1931

Caruthersville Journal

Caruthersville, MO

Click image to open full size in new tab

Article Text

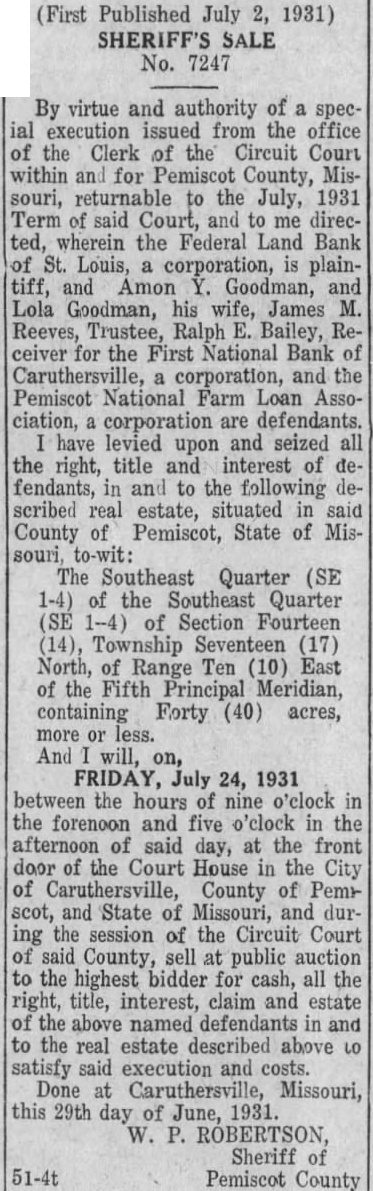

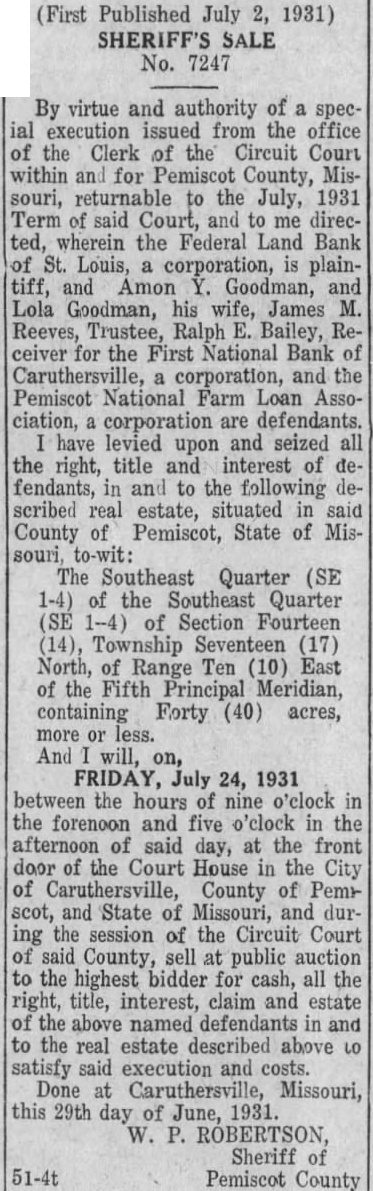

(First Published July 1931) SHERIFF'S SALE No. 7247

By virtue and authority of execution issued from the office the Clerk of the Circuit Court within for Pemiscot County, Missouri, returnable the July, 1931 Term of said Court, me direcwherein the Federal Land Bank Louis, plaintiff, and Amon Lola Goodman, his wife, James Reeves, Trustee, Ralph Bailey, ceiver for the First National Bank of corporation, and the Pemiscot National Farm Loan ciation, corporation are defendants. have levied upon and seized the right, title and interest of fendants, to the scribed real estate, situated County Pemiscot, State to-wit: The Southeast Quarter (SE of the Southeast Quarter Section Fourteen (14), Township Seventeen (17) North, Ten (10) of the Fifth Principal Meridian, Forty (40) acres, more less. And FRIDAY, July 24, 1931 between the hours of nine o'clock the forenoon and five in the afternoon said day, at the front door of the Court House in the City County of Pemr and State of Missouri, and the session of the Circuit Court said County, sell public auction the highest bidder for cash, all the title, interest, claim and estate the above named and real estate described above satisfy said execution costs. Done Caruthersville, Missouri, this 29th day June, W. ROBERTSON, Sheriff Pemiscot County

19.

January 16, 1932

Daily American Republic

Poplar Bluff, MO

Click image to open full size in new tab

Article Text

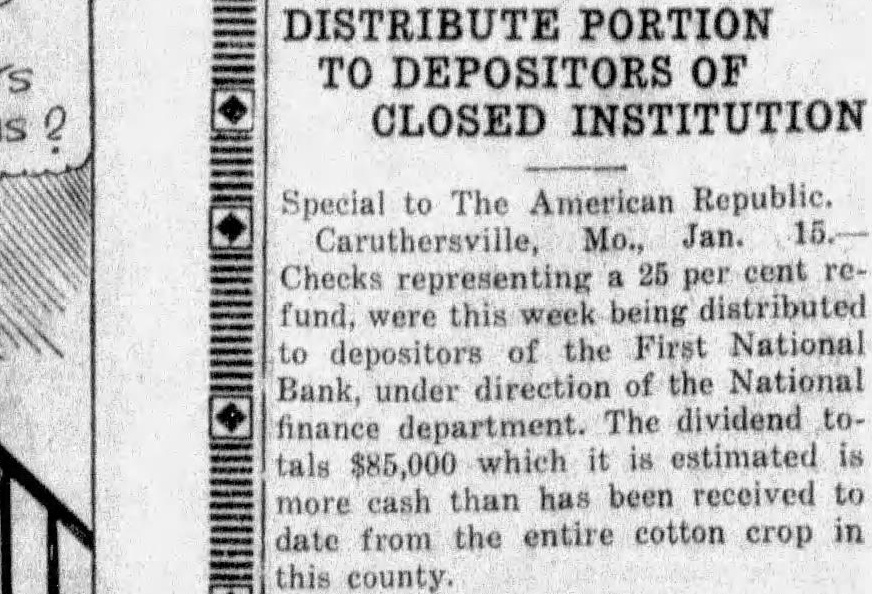

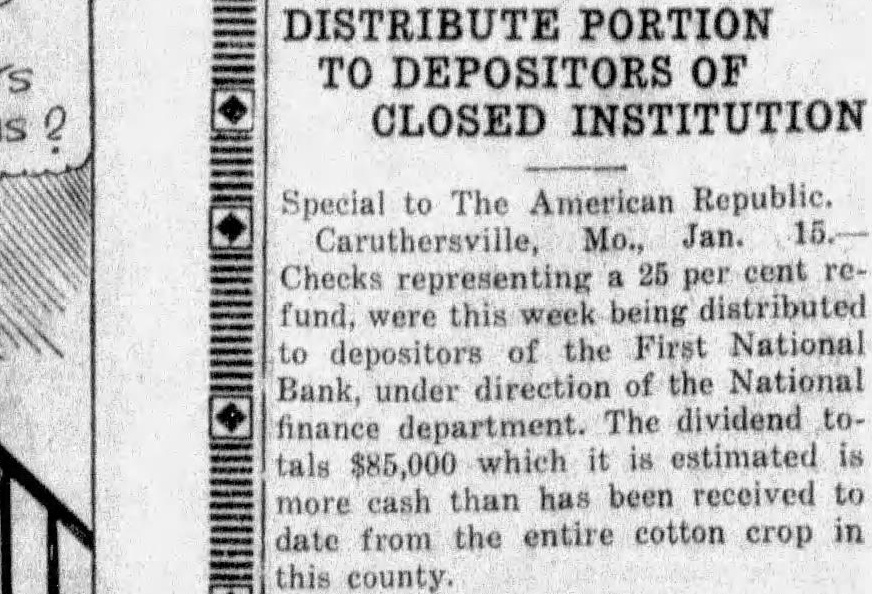

DISTRIBUTE PORTION TO DEPOSITORS OF CLOSED INSTITUTION

Special to The American Republic. Caruthersville, Mo., Jan. 15.Checks representing a 25 per cent refund, were this week being distributed to depositors of the First National Bank, under direction of the National finance department. The dividend totals $85,000 which it is estimated is more cash than has been received to date from the entire cotton crop in this county.

20.

November 4, 1932

The Democrat-Argus

Caruthersville, MO

Click image to open full size in new tab

Article Text

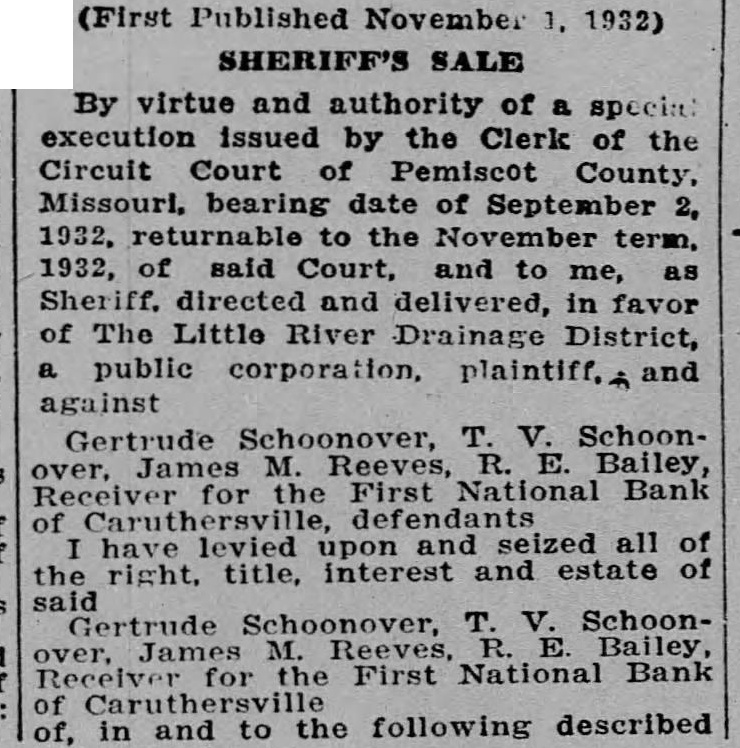

(First Published November 1, 1932) SHERIFF'S SALE

By virtue and authority of a special execution issued by the Clerk of the Circuit Court of Pemiscot County, Missouri, bearing date of September 2, 1932, returnable to the November term, 1932, of said Court, and to me, as Sheriff. directed and delivered, in favor of The Little River Drainage District, a public corporation, plaintiff, and against Gertrude Schoonover, T. V. Schoonover, James M. Reeves, R. E. Bailey, Receiver for the First National Bank of Caruthersville, defendants I have levied upon and seized all of the right, title, interest and estate of said Gertrude Schoonover, T. V. Schoonover, James M. Reeves, R. E. Bailey, Receiver for the First National Bank of Caruthersville of, in and to the following described

21.

March 21, 1933

The Democrat-Argus

Caruthersville, MO

Click image to open full size in new tab

Article Text

Jas. A. Bradley, who has succeded to the receivership of the First National Bank here, following Atty. E. Bailey of Sikeston in this work and combining the local work with that connected with the First National in Blytheville, asks to advise the public the of April the that after 1st bank here will be open only on the first three days of each day, Tuesday and Wednesday work of making settlecarry on the ments with individuals. He states he will have only one assistant, young lady of Blytheville, and in line with policies of retrenchment in such matters, will not keep the doors of the lobank all the time, as has cal open been done thus far. The services has been with the Guy E. Michie, who bank here since its closing (and long being distime prior thereto,) with and Mr. Bradley and his pensed lady assistant will handle young affairs in future.