Article Text

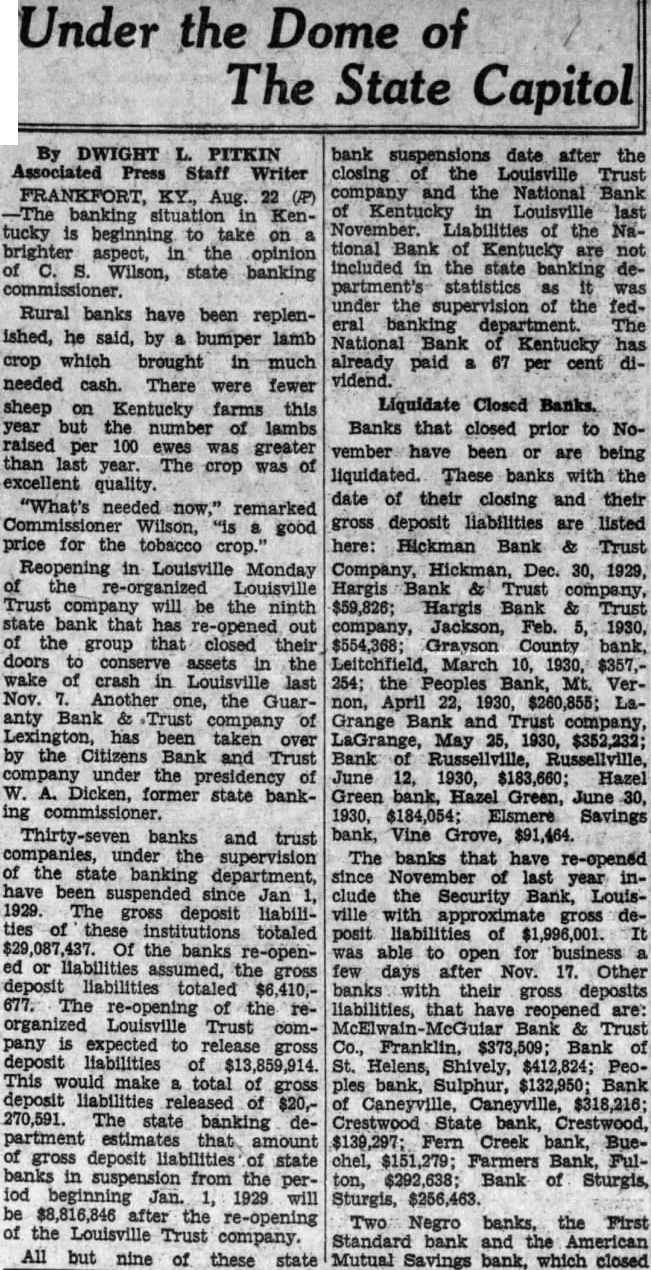

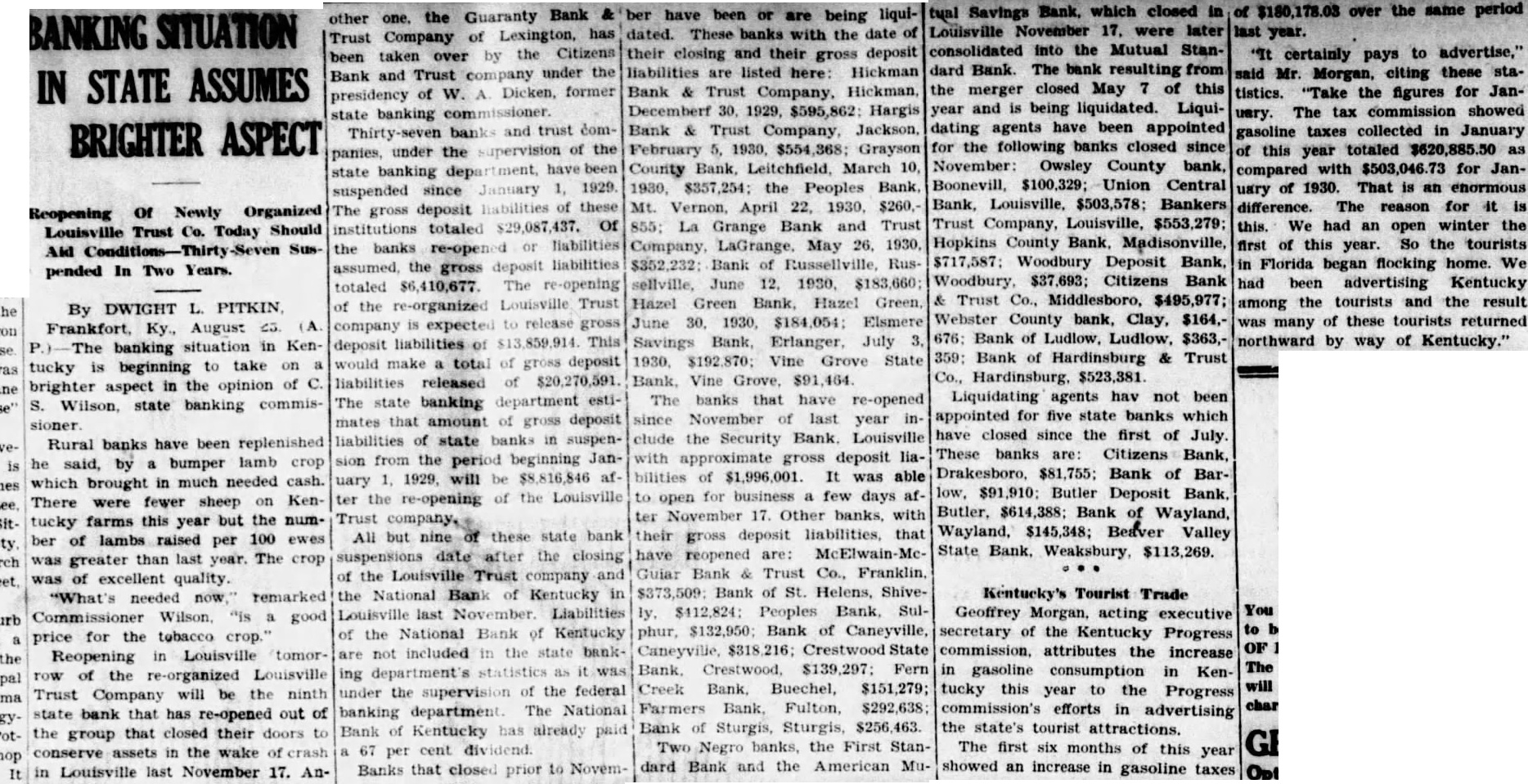

of the re-organized Louisville Trust company is expected to release gross deposit liabilities of $13,859,914. This would make a total of gross deposit liabilities released of $20,270,591. The state banking department estimates that amount of gross deposit liabilities of state banks in suspension from the period beginning January 1, 1929, will be $8,816,846 after the re-opening of the Louisville Trust company, All but nine of these state bank suspensions date after the closing of the Louisville Trust company and the National Bank of Kentucky in Louisville last November. Liabilities of the National Bank of Kentucky are not included in the state banking department's statistics as it was under the supervision of the federal banking department. The National Bank of Kentucky has already paid a 67 per cent dividend Banks that closed prior to Novem- other one. the Guaranty Bank ber have been or are being liquidated. These banks with the date of Trust Company of Lexington, has been taken over by the Citizens their closing and their gross deposit Bank and Trust company under the liabilities are listed here: Hickman presidency of W. A. Dicken, former Bank & Trust Company, Hickman, state banking commissioner. Decemberf 30, 1929, $595,862: Hargis Thirty-seven banks and trust com- Bank & Trust Company, Jackson, panies, under the supervision of the February 5, 1930, $554,368; Grayson state banking department, have been County Bank, Leitchfield, March 10, suspended since January 1, 1929 1930, $357,254; the Peoples Bank, The gross deposit liabilities of these Mt. Vernon, April 22, 1930, $260,institutions totaled $29,087,437. Of 855; La Grange Bank and Trust the banks re-opened or liabilities Company, LaGrange, May 26, 1930. assumed, the gross deposit liabilities $352,232; Bank of Russellville, Rustotaled $6,410,677. The re-opening sellville, June 12. 1930. $183,660; Hazel Green Bank, Hazel Green, June 30. 1930, $184,054: Elsmere Savings Bank, Erlanger, July 3, 1930. $192,870: Vine Grove State Bank, Vine Grove, $91,464. The banks that have re-opened since November of last year include the Security Bank. Louisville with approximate gross deposit liabilities of $1,996,001. It was able to open for business a few days after November 17. Other banks, with their gross deposit liabilities, that have reopened are: McElwain-McGuiar Bank & Trust Co., Franklin. $373,509: Bank of St. Helens, Shively, $412,824: Peoples Bank, Sulphur, $132,950; Bank of Caneyville, Caneyville, $318,216; Crestwood State Bank. Crestwood, $139,297: Fern Creek Bank, Buechel, $151,279; Farmers Bank, Fulton, $292,638; Bank of Sturgis, Sturgis, $256,463. Two Negro banks, the First Standard Bank and the American Mu- tual Savings Bank. which closed in Louisville November 17. were later consolidated into the Mutual Standard Bank. The bank resulting from the merger closed May 7 of this year and is being liquidated. Liquidating agents have been appointed for the following banks closed since November: Owsley County bank, Boonevill, $100,329; Union Central Bank, Louisville, $503,578; Bankers Trust Company, Louisville, $553,279; Hopkins County Bank, Madisonville, $717,587; Woodbury Deposit Bank, Woodbury, $37,693; Citizens Bank & Trust Co., Middlesboro, $495,977; Webster County bank, Clay, $164,676: Bank of Ludlow, Ludlow, $363,359: Bank of Hardinsburg & Trust Co., Hardinsburg, $523,381 Liquidating agents hav not been appointed for five state banks which have closed since the first of July. These banks are: Citizens Bank, Drakesboro, $81,755; Bank of Barlow, $91,910: Butler Deposit Bank. Butler, $614,388; Bank of Wayland, Wayland, $145,348; Beaver Valley State Bank. Weaksbury, $113,269.

Kentucky's Tourist Trade Geoffrey Morgan, acting executive secretary of the Kentucky Progress commission, attributes the increase in gasoline consumption in Kentucky this year to the Progress commission's efforts in advertising the state's tourist attractions. The first six months of this year showed an increase in gasoline taxes of $180,178.03 over the same period last year. "It certainly pays to advertise," said Mr. Morgan, citing these statistics. "Take the figures for Janusry. The tax commission showed gasoline taxes collected in January of this year totaled $620,885.50 as compared with $503,046.73 for January of 1930. That is an enormous difference. The reason for it is this. We had an open winter the first of this year. So the tourists in Florida began flocking home. We had been advertising Kentucky among the tourists and the result was many of these tourists returned northward by way of Kentucky."