Click image to open full size in new tab

Article Text

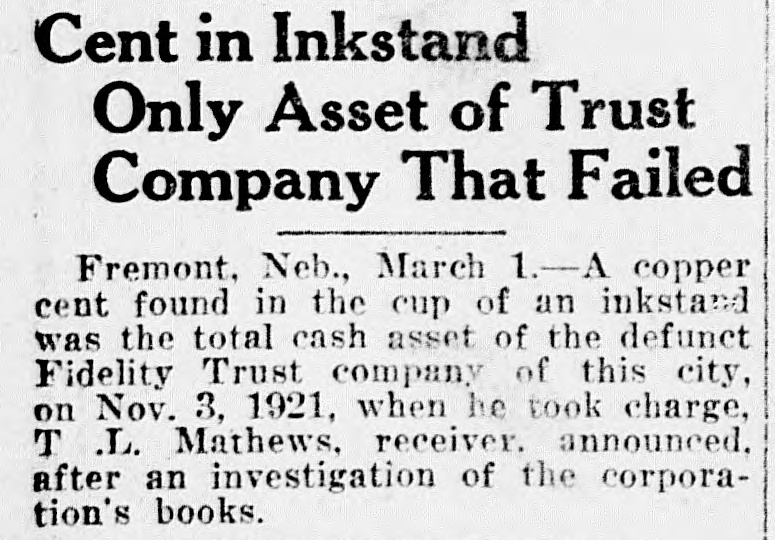

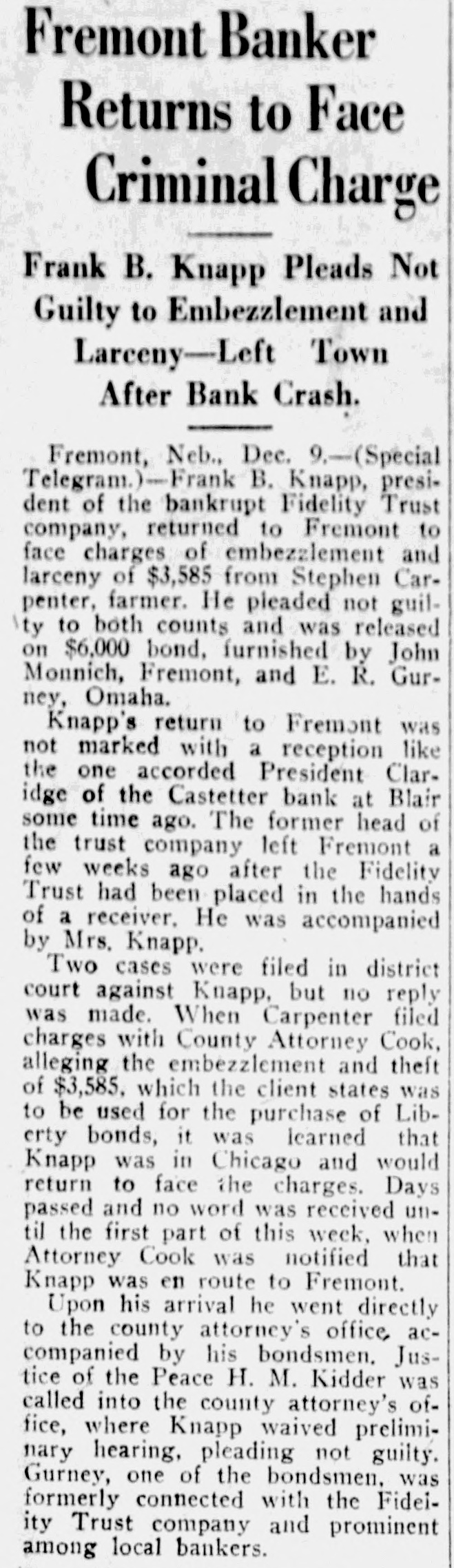

Fremont Banker Returns to Face Criminal Charge Frank B. Knapp Pleads Not Guilty to Embezzlement and Lareeny-Left Town After Bank Crash. Fremont, Neb., Dec. 9.-(Special Telegram.)-Frank B. Knapp, president of the bankrupt Fidelity Trust company, returned to Fremont to face charges of embezzlement and larceny of $3,585 from Stephen Carpenter, farmer. He pleaded not guil\ty to both counts and was released on $6,000 bond, furnished by John Monnich, Fremont, and E. R. Gurney, Omaha. Knapp's return to Fremont was not marked with a reception like the one accorded President Claridge of the Castetter bank at Blair some time ago. The former head of the trust company left Fremont a few weeks ago after the Fidelity Trust had been placed in the hands of a receiver. He was accompanied by Mrs. Knapp. Two cases were filed in district court against Knapp, but no reply was made. When Carpenter filed charges with County Attorney Cook, alleging the embezzlement and theft of $3,585. which the client states was to be used for the purchase of Libcity bonds, it was learned that Knapp was in Chicago and would return to face the charges. Days passed and no word was received until the first part of this week, when Attorney Cook was notified that Knapp was en route to Fremont. Upon his arrival he went directly to the county attorney's office, accompanied by his bondsmen, Justice of the Peace H. M. Kidder was called into the county attorney's office, where Knapp waived preliminary hearing, pleading not guilty. Gurney, one of the bondsmen, was formerly connected with the Fideiity Trust company and prominent among local bankers.