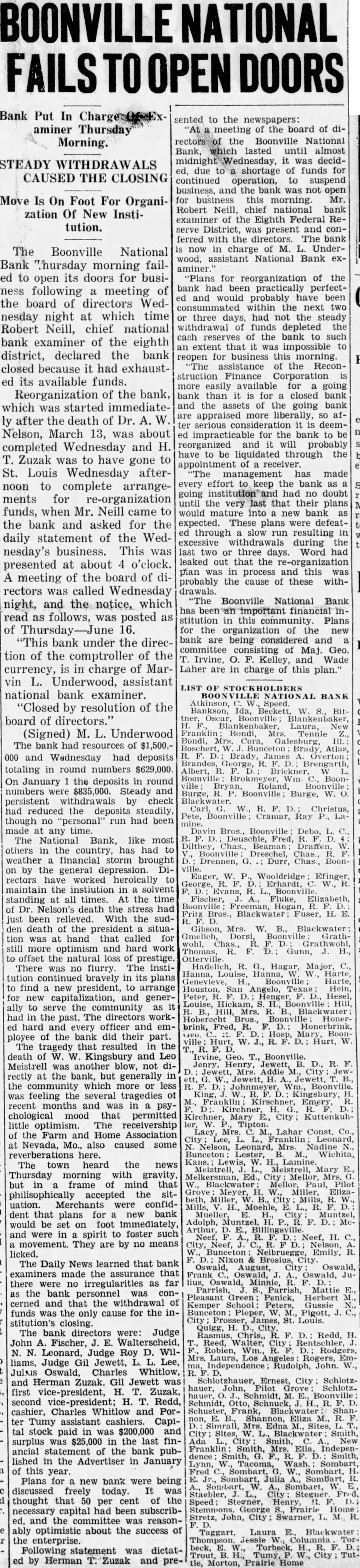

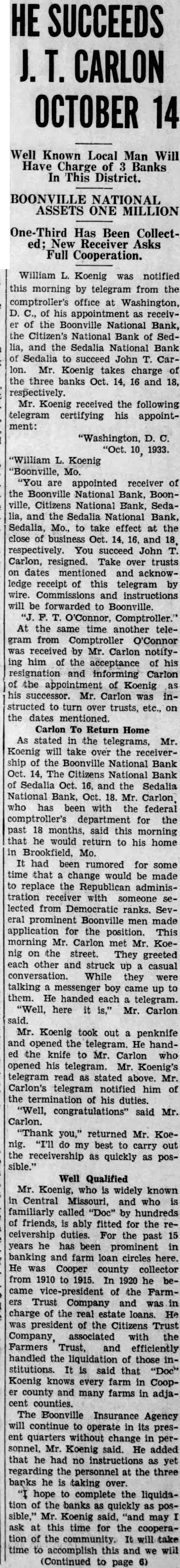

Article Text

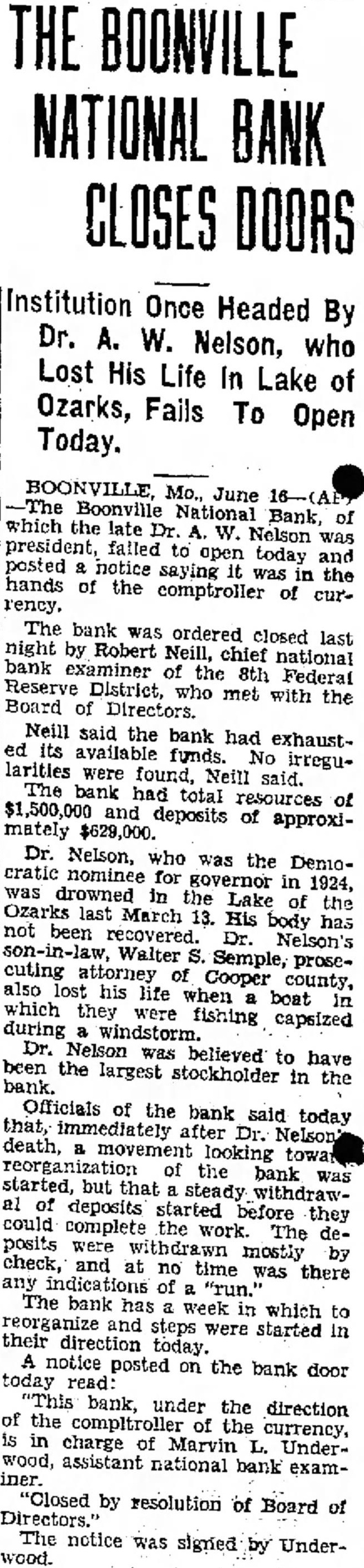

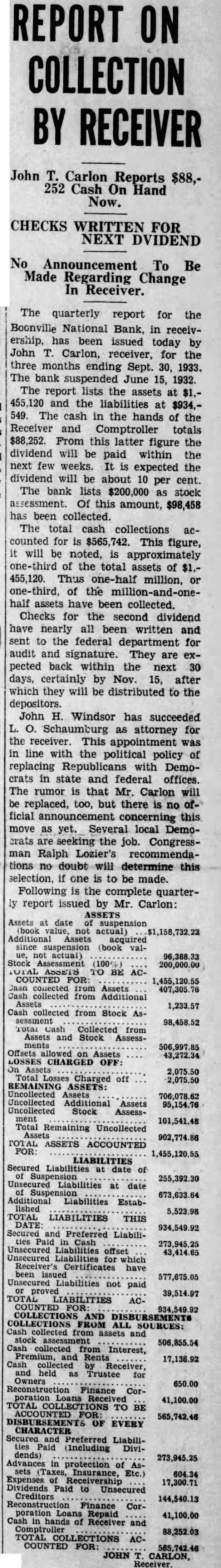

Bank Put In aminer Thursday Morning. STEADY CAUSED THE CLOSING Move Is On Foot For Organization Of New Institution. The Boonville now National Bank Thursday morning failaminer." ed to open its doors for business following meeting of the board of directors Wednesday night at which time three days, Robert Neill, chief national bank examiner of the eighth district, declared the bank closed because it had exhaustits available funds. Reorganization of the bank, which was started immediate- and the assets after death of Dr. Nelson, March 13, was about reorganized completed Wednesday and H. have be Zuzak was to have gone to St. Louis Wednesday aftereffort noon to complete arrangements for re-organization funds, when Mr. Neill came to the bank and asked for the expected. daily statement of the Wednesday's business. This was presented at about o'clock. A meeting of the board of diprobably the rectors was called Wednesday drawals. night, and which read as follows, was posted as of 16. bank under the direccommittee tion of the comptroller of the Irvine, currency, is in charge of Marvin L. Underwood, assistant national bank examiner. "Closed by resolution of the board of directors.' (Signed) Underwood The bank had resources of 000 and Wednesday had deposits totaling in round numbers On January the deposits in round numbers were $835,000. Steady and persistent withdrawals by check had reduced deposits steadily, though no "personal" made any time. The National Bank, like most others in the country, had weather financial storm brought on by the general depression. rectors have worked maintain the instiution all times the death the been relieved. With the just den death the president tion was hand that called still more optimism and hard offset the natural prestige. There flurry The tution bravely in its find president, for and generto serve had in past. The directors ed hard every officer and ployee the bank their part. The that in the tragedy death Kingsbury and Meistrell another blow, rectly at the bank, but in the which or less was feeling the several recent and in chological mood that permitted little The receivership of the Farm Home Association Nevada, caused some The town heard the news Thursday morning with gravity, in frame of mind that philisophically accepted situation. Merchants were confiddent plans new bank would be set on foot immediately, and were spirit foster such movement. They are by no means licked. The Daily News learned that bank examiners made assurance that there were no irregularities far as the bank personnel cerned and that withdrawal funds was the only cause for the stitution's closing. The bank directors were: Judge John Fischer, Walterscheid, Leonard, Judge D. liams, Judge Gil Jewett, Lee, Oswald, Charles Whitlow, and Herman Zuzak. Gil Jewett was first vice-president, Zuzak, second Redd, cashier, Charles Whitlow and PorTumy cashiers. Capital stock paid and surplus in the last ancial statement of the bank published the Advertiser in January this Plans for new bank were being discussed freely today thought that per cent of the necessary capital had been subscribed, and the reasonably optimistic about the success of the enterprise. was by Herman sented to the newspapers: meeting the board of the Boonville National Bank, which lasted until almost decided, due shortage of funds for continued operation, to suspend business, and the bank was for business morning. Robert Neill, chief national bank examiner of the Eighth Federal ReDistrict, present and conferred with The bank charge Underwood, assistant National Bank ex"Plans for reorganization of the bank had been practically perfectwould probably have been consummated within the next two had not the steady withdrawal funds depleted cash reserves bank such extent that was impossible reopen business this morning. assistance Reconstruction Finance Corporation more easily available going bank than for closed bank the going bank more liberally, serious consideration deemfor the bank probably liquidated through the appointment of receiver. management made keep the bank going had no doubt until the very last that their plans would mature new bank These plans were defeatthrough slow resulting withdrawals during the last two or three Word leaked out that the re-organization pian process and cause of these withBoonville National Bank has important financial stitution in this community. Plans for organization of the new bank being considered and consisting of Maj. Geo. Kelley, and Wade Laher are in charge of this plan.' Hurt, Lahar Oswald, Pigott, Ernest, Laura