Click image to open full size in new tab

Article Text

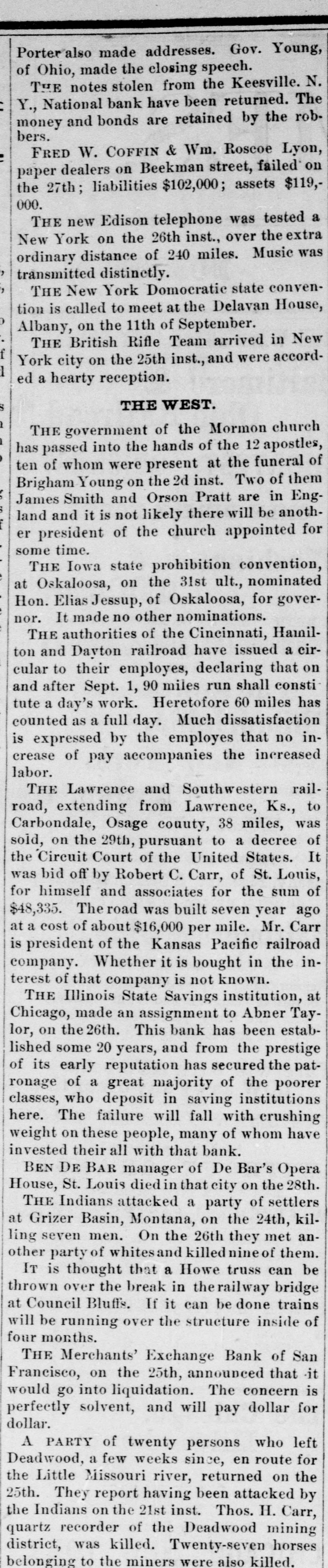

Porter also made addresses. Gov. Young, of Ohio, made the closing speech. THE notes stolen from the Keesville. E Y., National bank have been returned. The money and bonds are retained by the robbers. FRED W. COFFIN & Wm. Roscoe Lyon, E paper dealers on Beekman street, failed on the 27th; liabilities $102,000; assets $119,000. THE new Edison telephone was tested a New York on the 26th inst., over the extra ordinary distance of 240 miles. Music was , transmitted distinctly. , THE New York Domocratic state convention is called to meet at the Delavan House, P Albany, on the 11th of September. THE British Rifle Team arrived in New f York city on the 25th inst., and were accord1 ed a hearty reception. THE WEST. $ THE government of the Mormon church has passed into the hands of the 12 apostles, ten of whom were present at the funeral of Brigham Young on the 2d inst. Two of them : James Smith and Orson Pratt are in Eng$ land and it is not likely there will be another president of the church appointed for some time. THE Iowa state prohibition convention, at Oskaloosa, on the 31st ult., nominated Hon. Elias Jessup, of Oskaloosa, for gover: nor. It made no other nominations. THE authorities of the Cineinnati, Hamilton and Dayton railroad have issued a circular to their employes, declaring that on and after Sept. 1, 90 miles run shall consti tute a day's work. Heretofore 60 miles has counted as a full day. Much dissatisfaction is expressed by the employes that no increase of pay accompanies the increased labor. THE Lawrence and Southwestern railroad, extending from Lawrence, Ks., to Carbondale, Osage county, 38 miles, was sold, on the 29th, pursuant to a decree of the Circuit Court of the United States. It was bid off by Robert C. Carr, of St. Louis, for himself and associates for the sum of $48,335. The road was built seven year ago at a cost of about $16,000 per mile. Mr. Carr is president of the Kansas Pacific railroad company. Whether it is bought in the interest of that company is not known. THE Illinois State Savings institution, at Chicago, made an assignment to Abner Taylor, on the 26th. This bank has been established some 20 years, and from the prestige of its early reputation has secured the patronage of a great majority of the poorer classes, who deposit in saving institutions here. The failure will fall with crushing weight on these people, many of whom have invested their all with that bank. BEN DE BAR manager of De Bar's Opera House, St. Louis died in that city on the 28th. THE Indians attacked a party of settlers at Grizer Basin, Montana, on the 24th, killing seven men. On the 26th they met another party of whitesand killed nine of them. IT is thought that a Howe truss can be thrown over the break in the railway bridge at Council Bluffs. If it can be done trains will be running over the structure inside of four months. THE Merchants' Exchange Bank of San Francisco, on the 25th, announced that it would go into liquidation. The concern is perfectly solvent, and will pay dollar for dollar. A PARTY of twenty persons who left Deadwood, a few weeks since, en route for the Little Missouri river, returned on the 25th. They report having been attacked by the Indians on the 21st inst. Thos. H. Carr, quartz recorder of the Deadwood mining district, was killed. Twenty-seven horses belonging to the miners were also killed.