Article Text

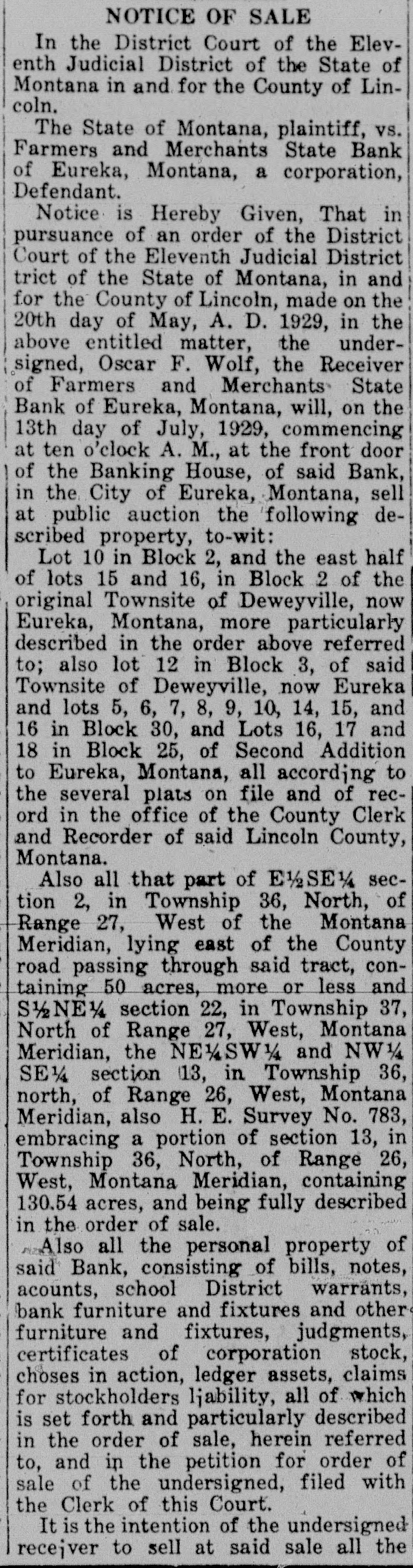

ORDER TO SHOW CAUSE WHY ORDER OF SALE OF REAL ESTATE, PERSONAL PROPERTY AND OTHER ASSETS SHOULD NOT BE MADE In the District Court of the Eleventh Judicial District of the State of Montana, in and for the County of Lincoln. The State of Montana, Plaintiff, vs. Farmers and Merchants State Bank of Eureka, Montana, a Corporation, Defendant. Oscar F. Wolf, Receiver of Farmers and Merchants State Bank of Eureka, Montana, a corporation, having filed herein his petition, praying for an order of sale of all remaining real estate, personal property and other assets, at either private sale or public auction, and to close the receivership, for the reasons therein set forth. It is Therefore Ordered by the Judge of this Court, that all persons interested in the receivership of said defendant bank appear before the said District Court on the 20th day of May, 1929, at three-thirty p. m. of said day, at the Court Room of this Court, at the Court House, in Libby, County of Lincoln, to" show cause why an order should not be granted to sell all the real estate, personal property and other assets of said defendant, in order that said receivership may be closed. And that a copy of this order be published at least once a week for two successive weeks in the Western News, a newspaper printed and published in said Lincoln County, and posted in at least three public places, for a period of not less than two weeks. Dated April 29, 1929. C.W. POMEROY, m2-9-2t District Judge.