Article Text

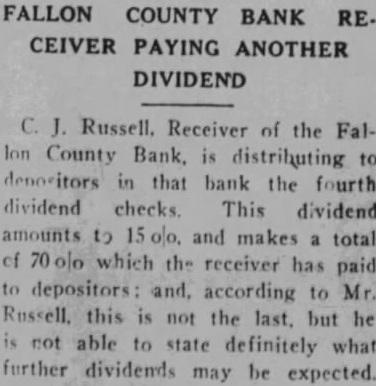

FALLON COUNTY BANK CEIVER PAYING ANOTHER DIVIDEND Russell. Receiver of the Fallon County Bank, is distributing depositors in that bank the fourth dividend This dividend amounts to and makes total of which the receiver has paid to depositors and, according to Mr. Russell. this is not the last, but he not able to state definitely what further dividends be may