Click image to open full size in new tab

Article Text

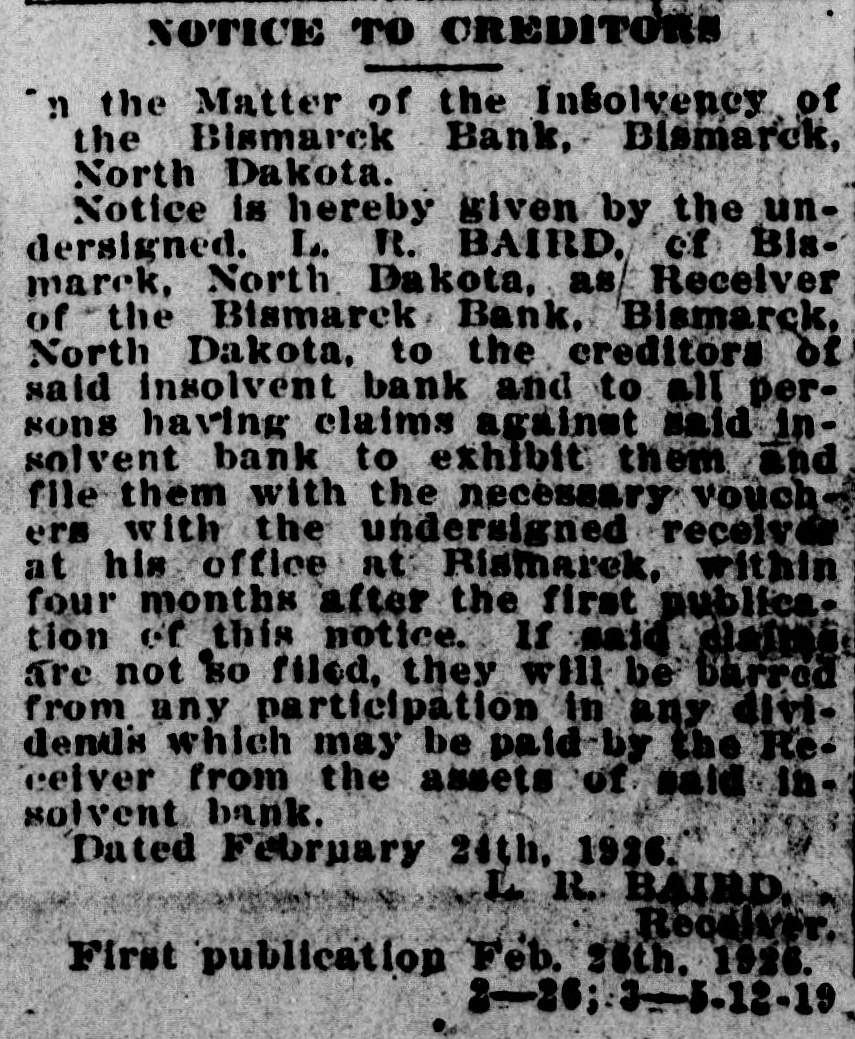

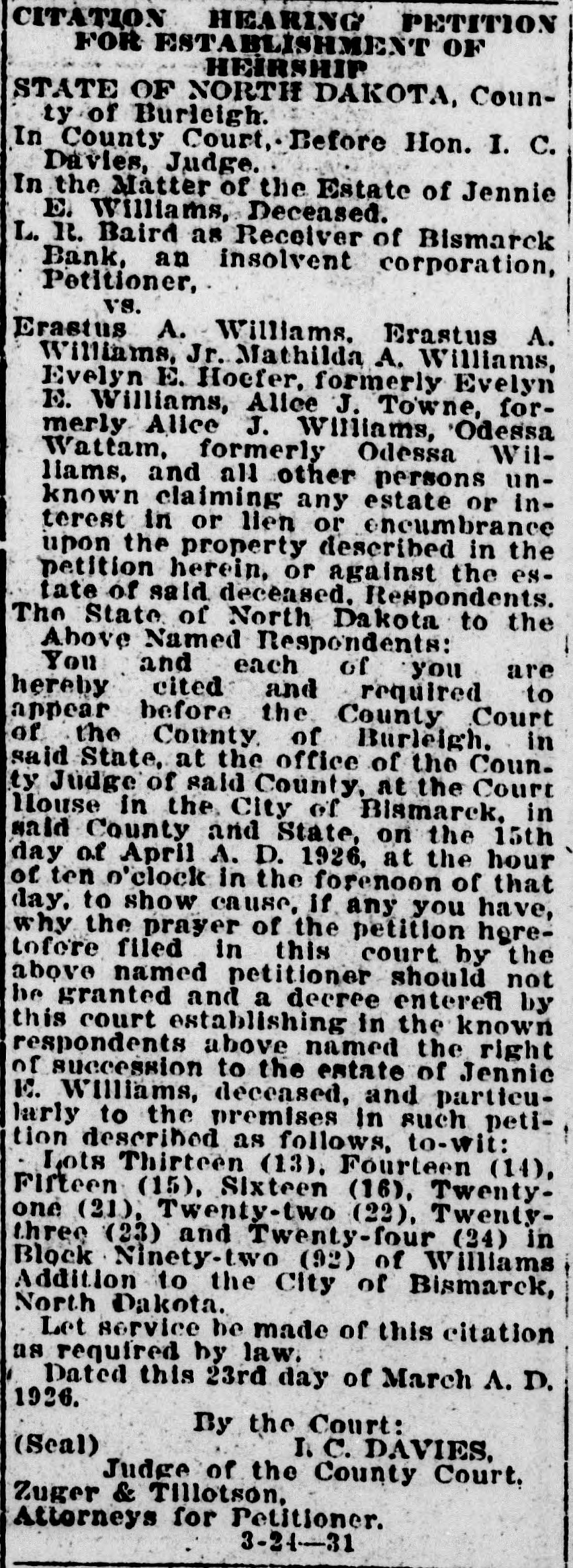

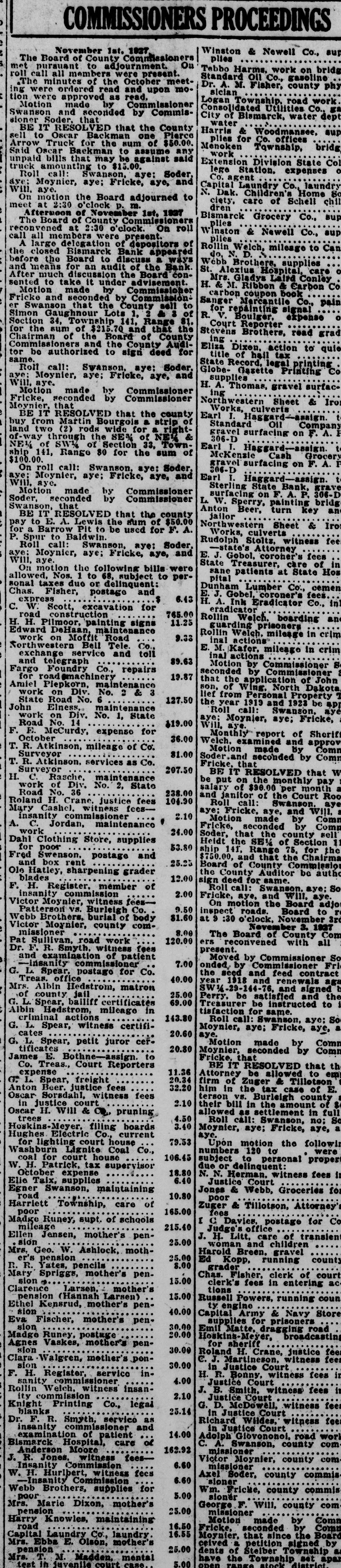

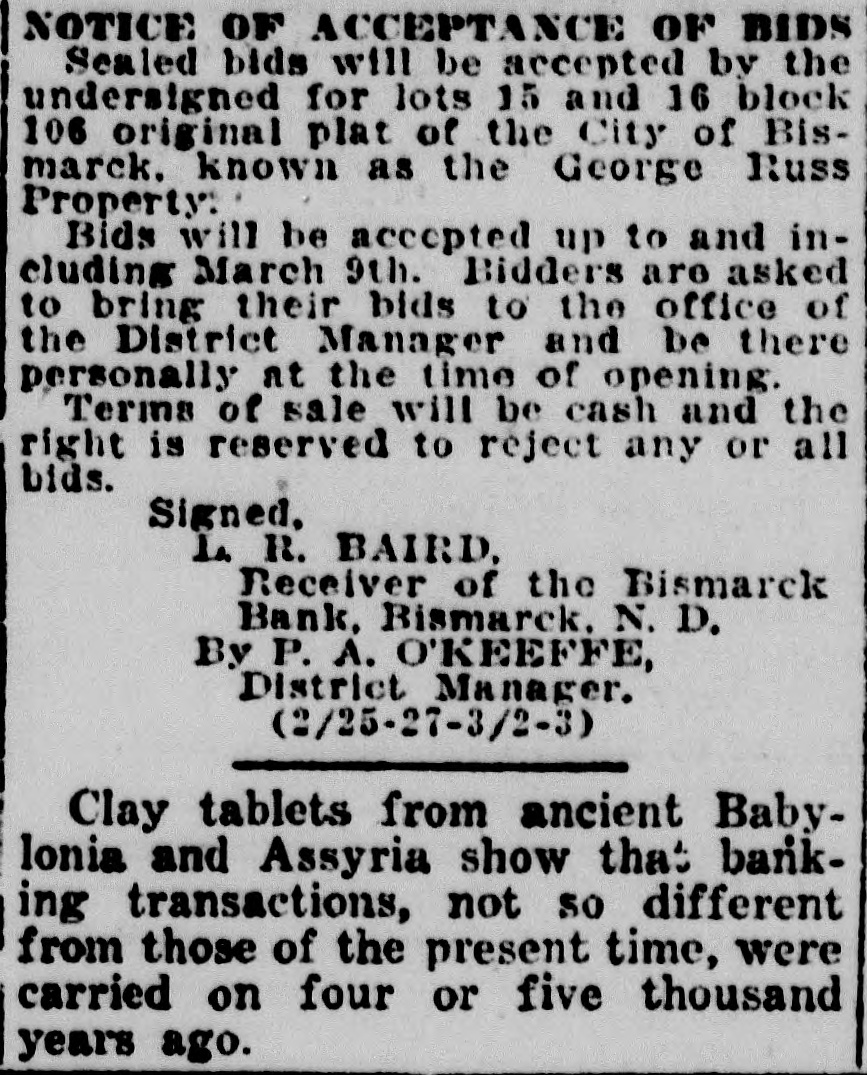

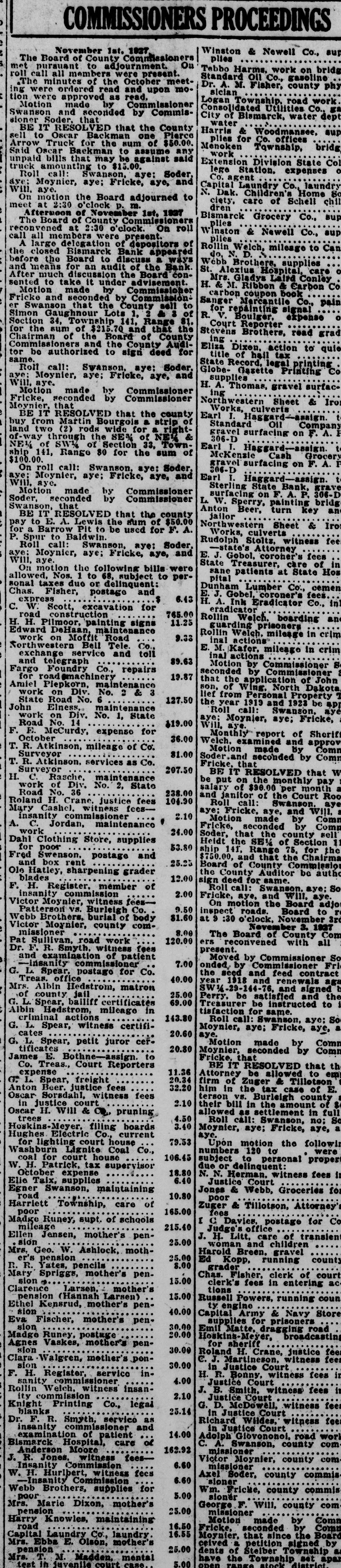

to Oscar Backman one Pierc Truck for the sum of $50.00 Oscar Backman to assume an bills that may be against sai amounting to $15.00. Roll call: Swanson, aye: Sode: Moynier, aye; Fricke, aye, an aye. motion the Board adjourned t at 2:30 o'clock p. m. Afternoon of November 1st, 1937 The Board of County Commissioner convened at 2:30 o'clock. On rol all members were present. A large delegation of depositors o closed Bismarck Bank appeare fore the Board to discuss a way means for an audit of the Bank much discussion the Board con to take it under advisement. Motion made by Commissione and seconded by Commission Swanson that the County sell t Gaughnour Lots 1, 2 & 3 0 ction 34, Township 141, Range 81 the sum of $215.70 and that th hairman of the Board of Count ommissioners and the County Audi be authorized to sign deed fo Roll call: Swanson, aye: Sode Moynier, aye; Fricke, aye, an aye. Motion made by Commissione seconded by Commissione oynier, that BE IT RESOLVED that the count from Martin Bourgois a strip o nd two (2) rods wide for a right -way through the SE% of NEW 4 E½ of SW4 of Section 33, Town 141, Range 80 for the sum o 00.00. On roll call: Swanson, aye: Sode: Moynier, aye; Fricke, aye, an aye. Motion made by Commissione der, seconded by Commissione vanson, that BE IT RESOLVED that the count: to E. A. Lewis the sum of $50.0 a Barrow Pit to be used for F. A Spur to Baldwin. Roll call: Swanson, aye: Sode: Moynier, aye; Fricke, aye, an aye. On motion the following bills wer lowed, Nos. 1 to 68, subject to per taxes due or delinquent: Fisher, postage and express $ 6.4 W. Scott, excavation for road construction 765.0 11.2 H. Pilmoor, painting signs dward DeHaan, maintenance work on Moffit Road 9.3 orthwestern Bell Tele. Co., exchange service and toll and telegraph 89.6 Foundry Co., repairs 19.8 for road@machinery miel Piepkorn, maintenance work on Div. No. 2 & 3 State Road No. 6 127.5 Elness, maintenance work on Div. No. 1, State No. Road 14 $19.0 E. McCurdy, expense for October 36.0 R. Atkinson, mileage of Co. 81.0 R. Atkinson, services as Co. Surveyor 207.5 C. Rasche, maintenance work of Div. No. 2, State Road No. 36 238.0 H. Crane, justice fees 104.9 ary Cashel. witness fees— insanity commissioner 2.1 , C. Jordan, maintenance work 24.0 Clothing Store, supplies for poor 53.8 Swenson. postage and and box rent 25.2 Hatley, sharpening grader blades 12.0 H. Register. member of insanity commission 2.0 ictor Moynier, witness fees9.5 Patterson vs. Burleigh Co. 81.6 ebb Brothers. burial of body ictor Moynier, county commissioner 8.0 Sullivan, road work 120.0 F. R. Smyth, witness fees and examination of patient -Insanity commissioner 7.0 L. Spear, postage for Co. Treas. office 40.0 Albin Hedstrom, matron of county jail 25.0 L. Spear, bailiff certificates 69.0 Hedstrom, mileage in criminal actions 143.8 L. Spear, witness certificates 20.6 L. Spear, petit juror certificates 20.8 E. Bothne-assign. to Co. Treas., Court Reporters 11.30 expense 20.3 L. Spear, freight 32.20 iton Beer. justice fees Soradahl, witness fees in justice court 2.1 H. Will & CO., pruning trees 4.5 3.4 bskins-Meyer. filing boards ughes Electric Co., current 79.5 for lighting court house ashburn Lignite Coal Co., coal for court house 106.48 H. Patrick, tax supervisor October expense 18.8 6.4 Taix, supplies gner Swanson, maintaining 10.8 arriett Township, care of poor 165.00 adge Runey, supt. of schools mileage 215.4 Jensen, mother's pen25.00 Geo. W. Ashlock, moth25.00 pension 8.00 R. Yates, pencils Spriggs, mother's pen. 15.00 arence Larsen, mother's 15.00 pension (Hannah Larsen) Kensrud, mother's pension 40.00 Fischer, mother's pen30.00 20.00 Runey, postage Vaskes, mother's pen30.00 Walgren, mother's ponsion 30.00 H. Register, service insanity commissioner 4.00 ollin Welch, witness insancommission 2.10 night Printing Co., legal blanks 25.1 F. R. Smyth, service as insanity commissioner and 14.00 examination of patient smarck Hospital, care of Anderson Moore 162.92 R. Jones. witness fees6.6 Insanity Commission