Article Text

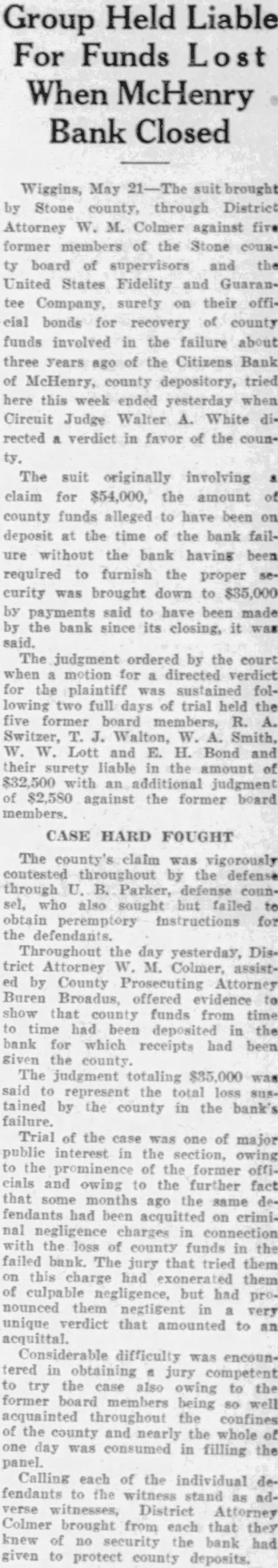

Group Held Liable For Funds Lost When McHenry Bank Closed Wiggins, county, through District Attorney W. M. Colmer against five former of the Stone board of supervisors and United States Fidelity and Guarantee Company, surety on their official bonds for of county funds involved in the failure about three years ago of the Citizens Bank of McHenry, county depository, tried here this week ended yesterday when Circuit Judge Walter White rected verdict in favor of the ty. The suit originally involving claim for $54,000, the amount county funds alleged to have been on deposit the time the bank failure without the bank having been required furnish the proper curity was brought down to $35,000 by payments said have been made by bank since its closing, was said. The judgment ordered by the court when motion directed plaintiff was sustained following two full days trial held the former board members, Switzer, Walton, W. Smith, Lott and Bond and their surety liable the amount $32,500 additional judgment $2,580 against the former board members. CASE HARD FOUGHT The county's was vigorously contested throughout by the defense through Parker, counalso sought but failed obtain peremptory for the Throughout the day yesterday, Distriet Attorney Colmer, by County Prosecuting Attorney Buren Broadus, offered evidence show county funds from time time been deposited the bank which receipts had been given The judgment totaling the total tained by the county in the bank's failure. Trial of the of interest the former cials the further fact that the fendants had criminal charges with county funds failed bank. The jury that tried them had exonerated them culpable negligence, but had nounced them negligent very unique verdict that amounted to acquittal. Considerable difficulty tered jury competent the also owing former being acquainted throughout confines county nearly the day was consumed in filling the panel Calling each of the individual fendants stand verse District Attorney Colmer brought from each that knew security bank given protect county deposits.