Click image to open full size in new tab

Article Text

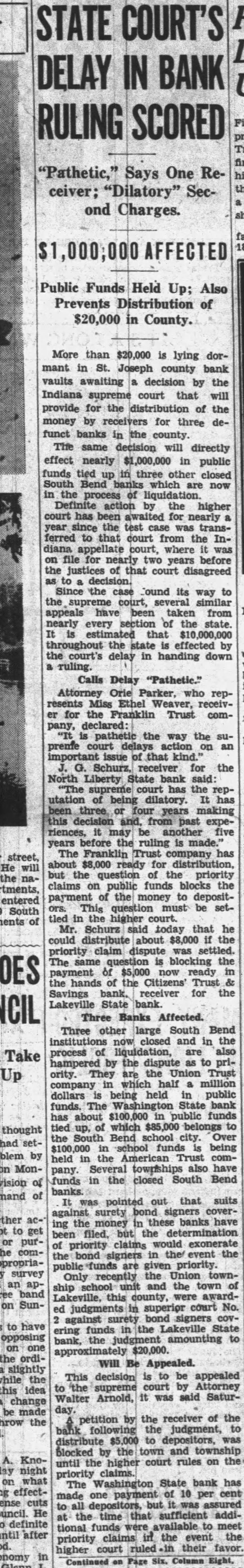

STATE COURT'S DELAY IN BANK RULING SCORED

"Pathetic," Says One Receiver; "Dilatory" Second Charges.

AFFECTED

Public Funds Held Up; Also Prevents Distribution of $20,000 in County.

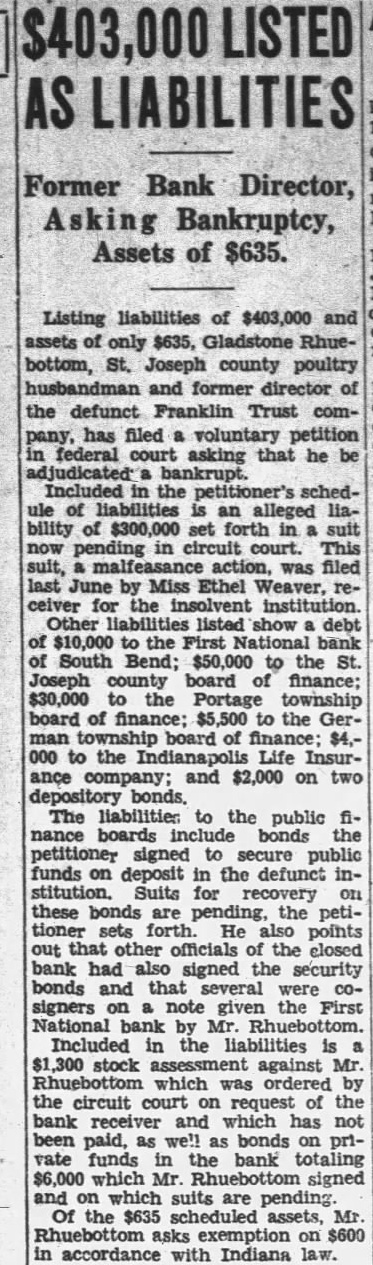

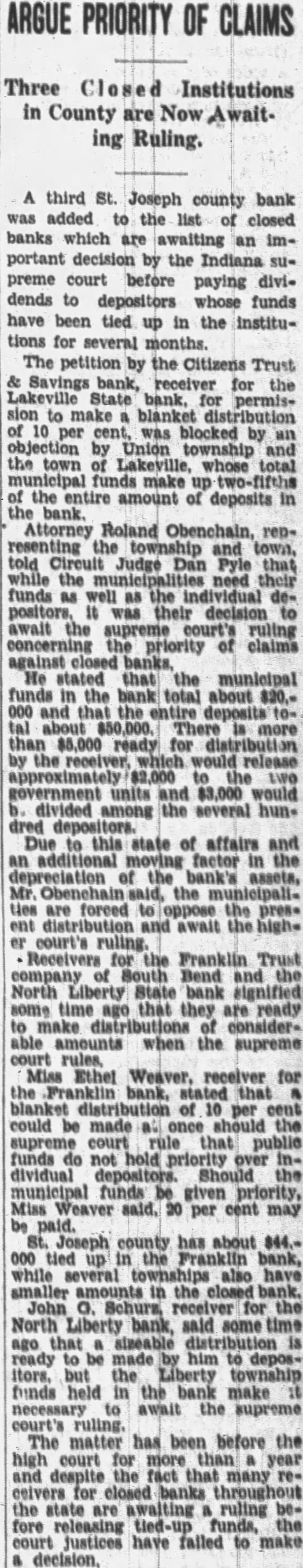

More than $20,000 is lying dormant in St. Joseph county bank vaults awaiting decision by the Indiana supreme court that will provide for the distribution of the money by receivers for three defunct banks in the county. The same decision will directly effect nearly $1,000,000 in public funds tied up in three other closed South Bend which are now in the liquidation. Definite action by the higher court has been for nearly since the test case was transferred to that court from the Indiana court, where on file nearly two years before justices of that court disagreed decision. Since the Cound its way to the supreme court, several similar appeals have been taken from every section of the state. estimated that throughout the state effected by court's delay in handing down ruling.

Calls Delay Attorney Orie Parker, who represents Miss Ethel receivfor the Franklin Trust company, declared: pathetic the way the court delays action on an important issue of that kind.' Schurz, receiver for the North Liberty State bank said: supreme court has the reputation being dilatory. or years making decision and, from past experiences, another five years before the ruling is made. The Franklin company has about $8,000 for the question the priority claims on public funds blocks the payment the money to depositThis question must be setin the higher Mr. Schurz said today that he could distribute about $8,000 if the priority claim dispute was The blocking the payment $5,000 ready the hands of Citizens' Trust Savings bank. receiver for Lakeville State bank

Three Banks Affected. Three other large South Bend closed and in the process liquidation, are also hampered by the dispute to priority. They are Union Trust company half million dollars being held in public funds. The bank about $100,000 public funds tied up, of which $85,000 belongs to Bend school Over $100,000 school funds being held the American Trust comSeveral townships also have pany. funds in the closed South Bend banks. was pointed out that suits against surety bond signers coverthe money these banks have ing but determination been priority claims would exonerate the bond signers in event the public funds are given priority. Only recently the Union ship the town of this county, awarded in superior court No. against bond covering in Lakeville State the amounting to bank, $20,000. Will Be Appealed. This decision to be appealed the supreme court Attorney Walter Arnold, was said Saturday. petition by the receiver of the following the judgment, distribute blocked by town and until the higher court rules on the claims. The Washington State bank has one payment of 10 per but time that sufficient addithe tional funds were available to meet claims in the event the priority court ruled their favor. higher Continued Page Six. Column