Article Text

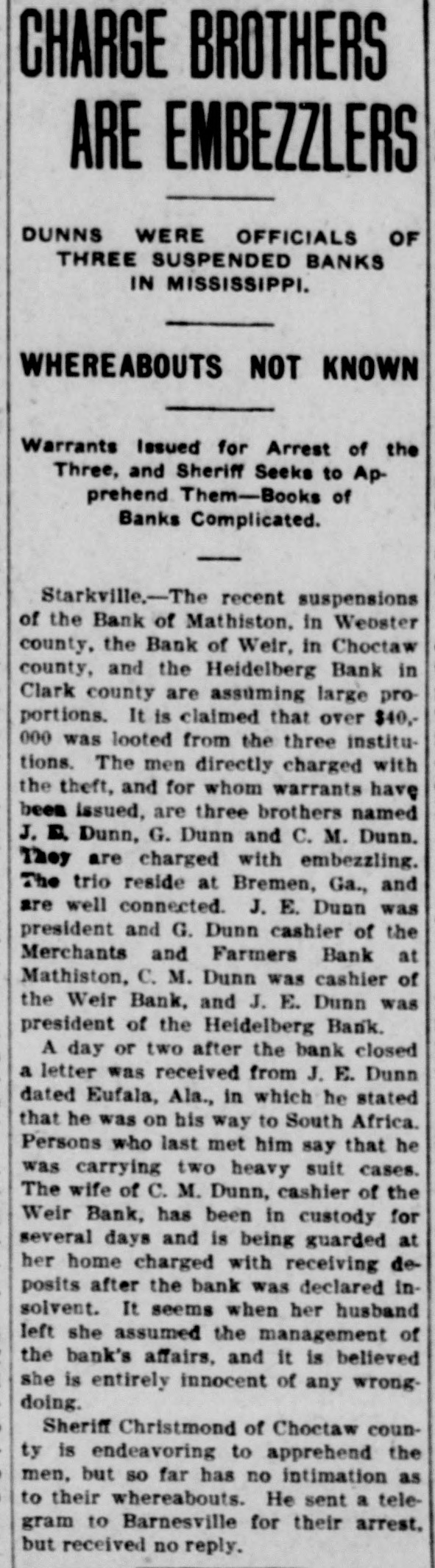

CHARGE BROTHERS ARE EMBEZZLERS DUNNS WERE OFFICIALS OF THREE SUSPENDED BANKS IN MISSISSIPPI. WHEREABOUTS NOT KNOWN Warrants Issued for Arrest of the Three, and Sheriff Seeks to Apprehend Them-Books of Banks Complicated. Starkville.-The recent suspensions of the Bank of Mathiston. in Webster county. the Bank of Weir, in Choctaw county, and the Heidelberg Bank in Clark county are assuming large proportions. It is claimed that over $40.000 was looted from the three institutions. The men directly charged with the theft, and for whom warrants have been issued, are three brothers named J. E. Dunn, G. Dunn and C. M. Dunn. They are charged with embezzling. The trio reside at Bremen, Ga., and are well connected. J. E. Dunn was president and G. Dunn cashier of the Merchants and Farmers Bank at Mathiston, C. M. Dunn was cashier of the Weir Bank, and J. E. Dunn was president of the Heidelberg Bank. A day or two after the bank closed a letter was received from J. E. Dunn dated Eufala, Ala., in which he stated that he was on his way to South Africa. Persons who last met him say that he was carrying two heavy suit cases. The wife of C. M. Dunn, cashier of the Weir Bank, has been in custody for several days and is being guarded at her home charged with receiving deposits after the bank was declared insolvent. It seems when her husband left she assumed the management of the bank's affairs, and it is believed she is entirely innocent of any wrongdoing. Sheriff Christmond of Choctaw county is endeavoring to apprehend the men, but so far has no intimation as to their whereabouts. He sent a telegram to Barnesville for their arrest, but received no reply.