Click image to open full size in new tab

Article Text

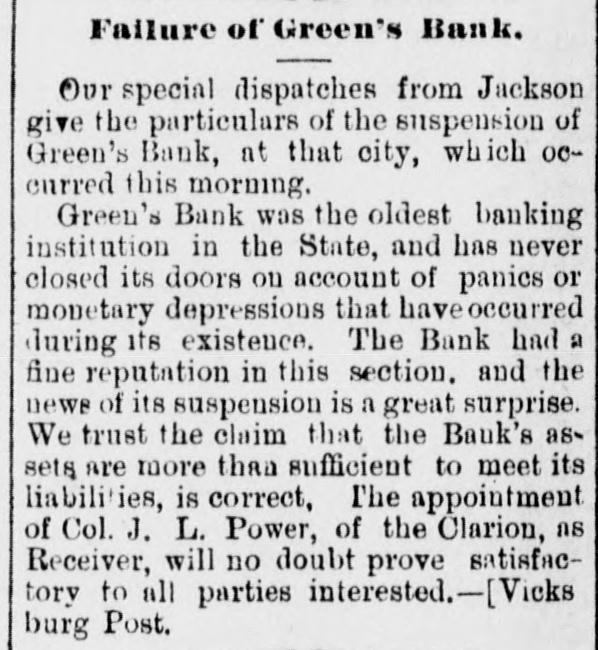

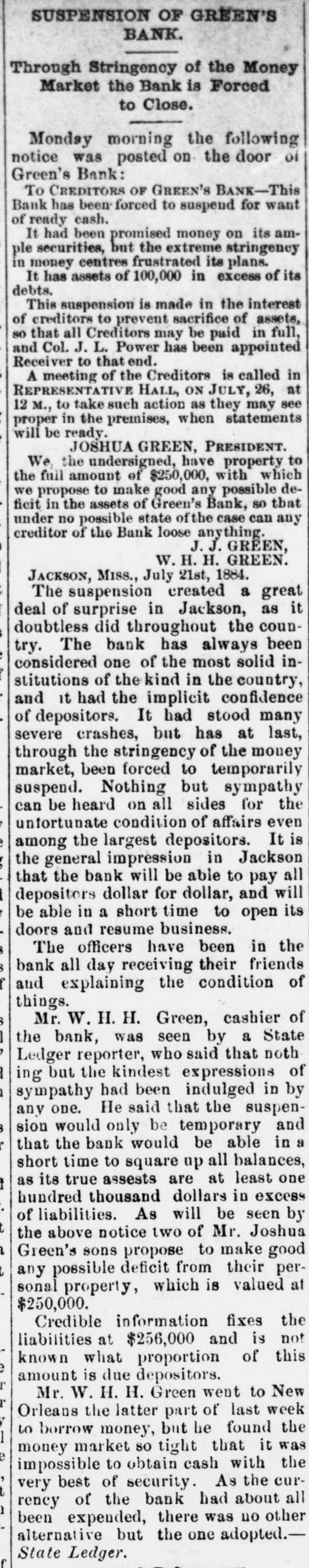

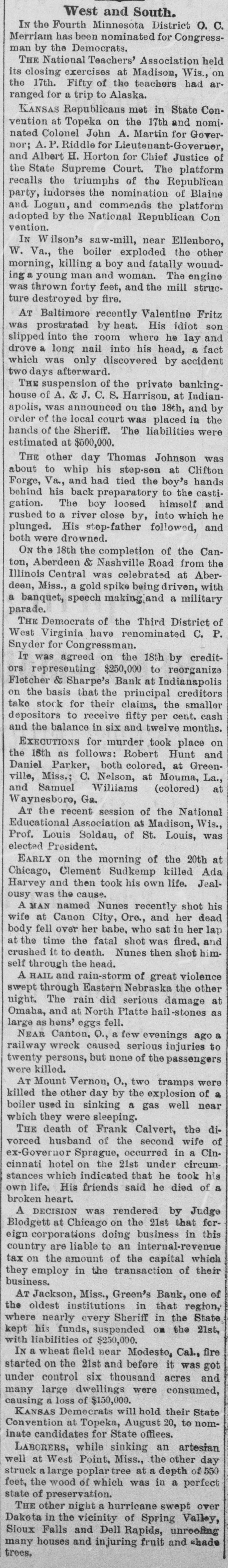

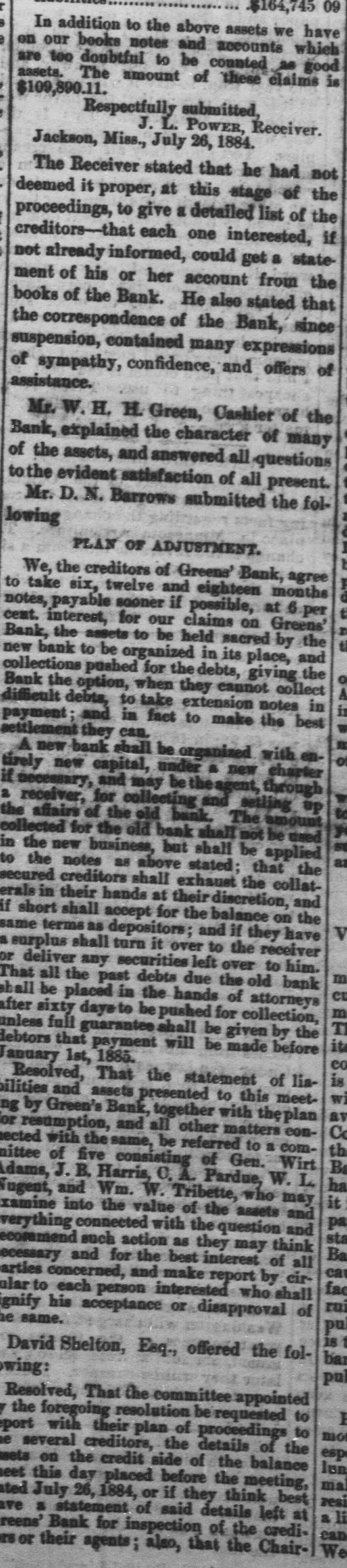

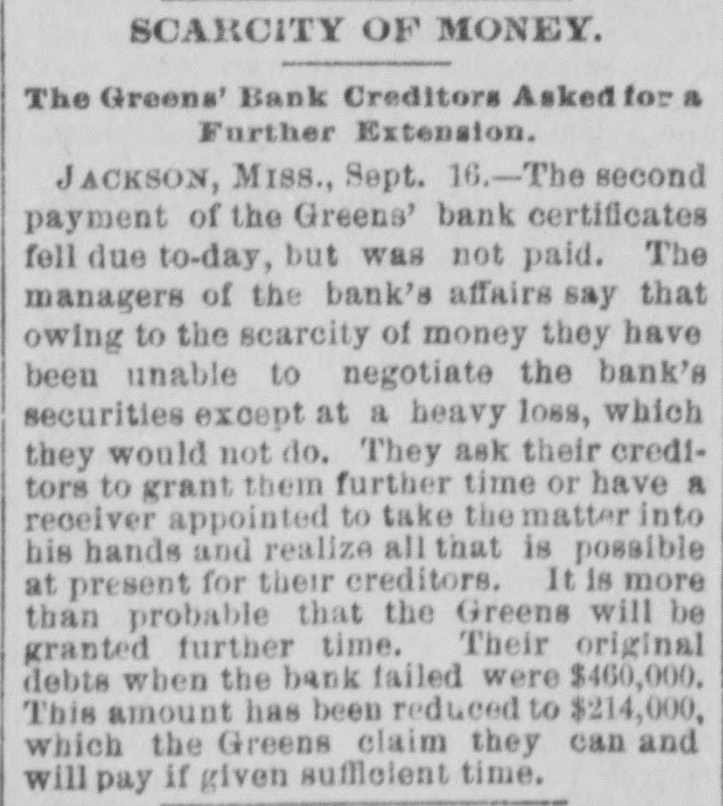

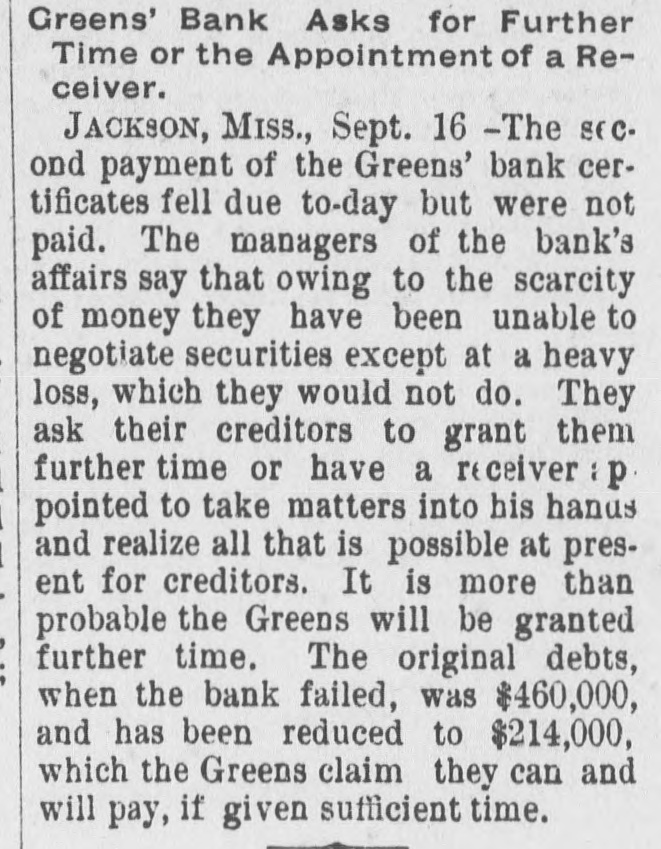

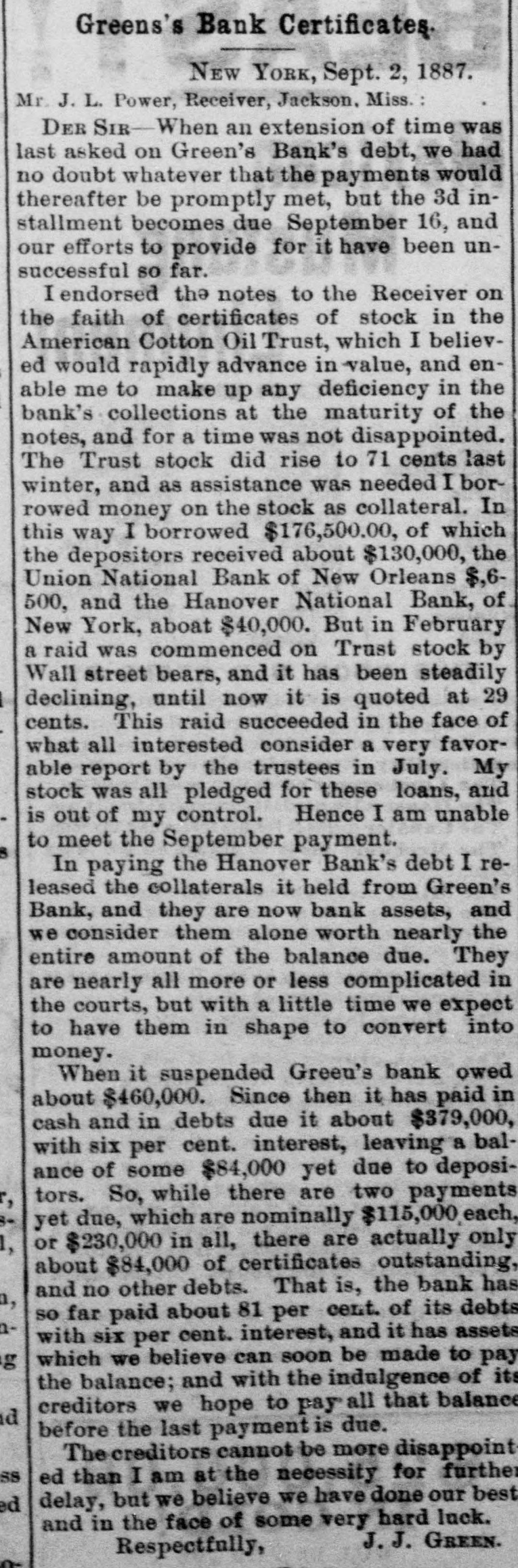

West and South. IN the Fourth Minnesota District O. C. Merriam has been nominated for Congressman by the Democrats. THE National Teachers' Association held its closing exercises at Madison, Wis., on the 17th. Fifty of the teachers had arranged for a trip to Alaska. KANSAS Republicans met in State Convention at Topeka on the 17th and nominated Colonel John A. Martin for Governor; A. P. Riddle for Lieutenant-Goveruer, and Albert H. Horton for Chief Justice of the State Supreme Court. The platform recalls the triumphs of the Republican party, indorses the nomination of Blaine and Logan, and commends the platform adopted by the National Republican Con vention. IN W ilson's saw-mill, near Ellenboro, W. Va., the boiler exploded the other morning, killing a boy and fatally wounding a young man and woman. The engine was thrown forty feet, and the mill structure destroyed by fire. AT Baltimore recently Valentine Fritz was prostrated by heat. His idiot son slipped into the room where he lay and drove a long nail into his head, a fact which was only discovered by accident two days afterward. THE suspension of the private bankinghouse of A. & J. C. S. Harrison, at Indianapolis, was announced on the 18th, and by order of the local court was placed in the hands of the Sheriff. The liabilities were estimated at $500,000. THE other day Thomas Johnson was about to whip his step-son at Clifton Forge, Va., and had tied the boy's hands behind his back preparatory to the castigation. The boy loosed himself and rushed to a river close by, into which he plunged. His step-father followed, and both were drowned. ON the 18th the completion of the Canton, Aberdeen & Nashville Road from the Illinois Central was celebrated at Aberdeen, Miss., a gold spike being driven, with a banquet, speech making;and a military parade. THE Democrats of the Third District of West Virginia have renominated C. P. Snyder for Congressman. IT was agreed on the 18th by creditors representing $250,000 to reorganize Fletcher & Sharpe's Bank at Indianapolis on the basis that the principal creditors take stock for their claims, the smaller depositors to receive fifty per cent. cash and the balance in six and twelve months. EXECUTIONS for murder took place on the 18th as follows: Robert Hunt and Daniel Parker, both colored, at Greenville, Miss.; C. Nelson, at Mouma, La., and Samuel Williams (colored) at Waynesboro, Ga. AT the recent session of the National Educational Association at Madison, Wis., Prof. Louis Soldau, of St. Louis, was elected President. EARLY on the morning of the 20th at Chicago, Clement Sudkemp killed Ada Harvey and then took his own life. Jealousy was the cause. A MAN named Nunes recently shot his wife at Canon City, Ore., and her dead body fell over her babe, who sat in her lap at the time the fatal shot was fired, and crushed it to death. Nunes then shot himself through the head. A HAIL and rain-storm of great violence swept through Eastern Nebraska the other night. The rain did serious damage at Omaha, and at North Platte hail-stones as large as hens' eggs fell. NEAR Canton, O., a few evenings ago a railway wreck caused serious injuries to twenty persons, but none of the passengers were killed. AT Mount Vernon, O., two tramps were killed the other day by the explosion of a boiler used in sinking a gas well near which they were sleeping. THE death of Frank Calvert, the divorced husband of the second wife of ex-Governor Sprague, occurred in a Cincinnati hotel on the 21st under circumstances which indicated that he took his own life. His friends said he died of a broken heart. A DECISION was rendered by Judge Blodgett at Chicago on the 21st that foreign corporations doing business in this country are liable to an internal-revenue tax on the amount of the capital which they employ in the transaction of their business. AT Jackson, Miss., Green's Bank, one of the oldest institutions in that region, where nearly every Sheriff in the State kept his funds, suspended on the 21st, with liabilities of $250,000. IN a wheat field near Modesto, Cal., fire started on the 21st and before it was got under control six thousand acres and many large dwellings were consumed, causing a loss of $150,000. KANSAS Democrats will hold their State Convention at Topeka, August 20, to nominate candidates for State offices. LABORERS, while sinking an artesian well at West Point, Miss., the other day struck a large poplar tree at a depth of 550 feet, the wood of which was in a perfect state of preservation. THE other night a hurricane swept over Dakota in the vicinity of Spring Valley, Sioux Falls and Dell Rapids, unroefing many houses and injuring fruit and shade trees.