Click image to open full size in new tab

Article Text

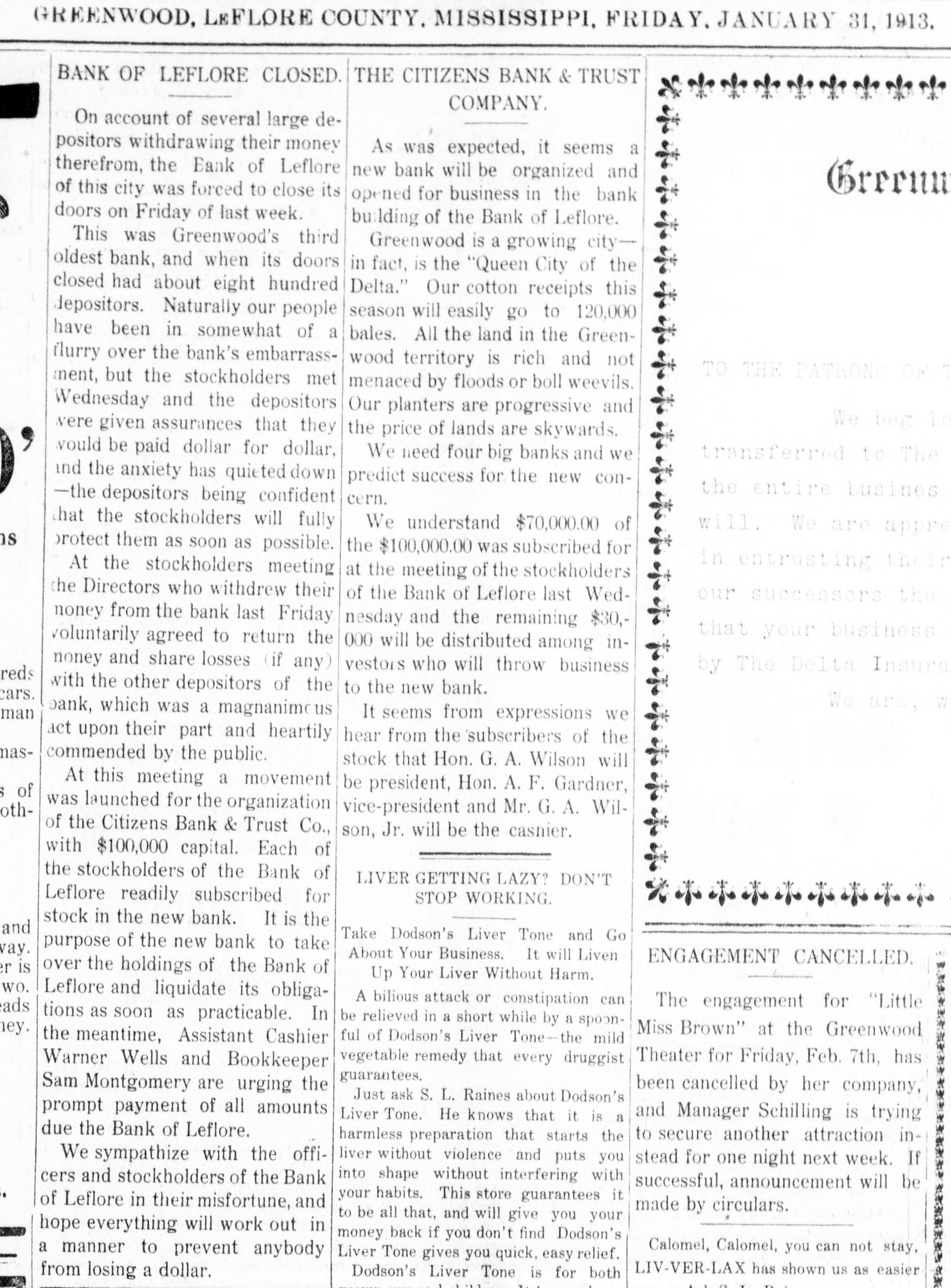

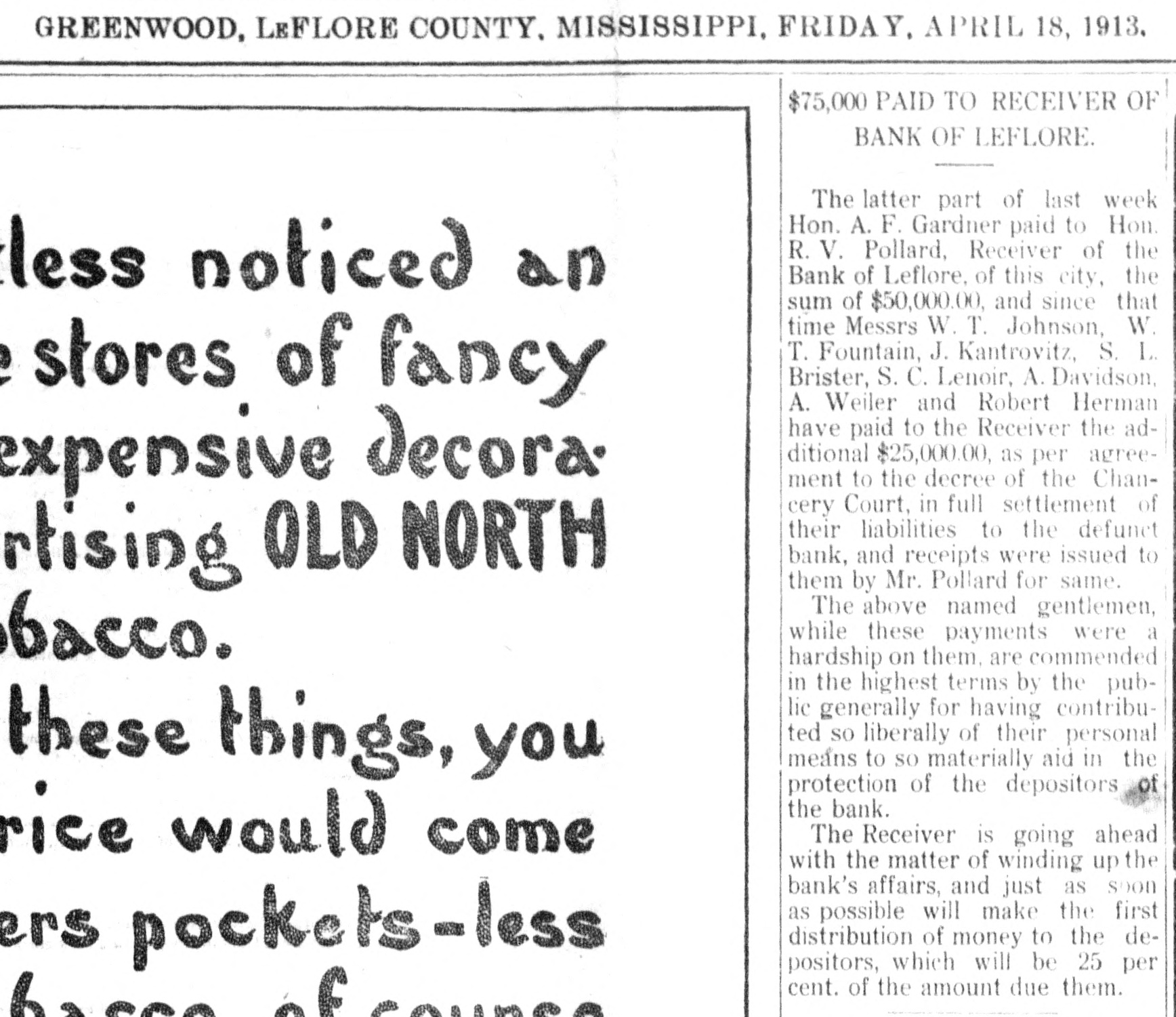

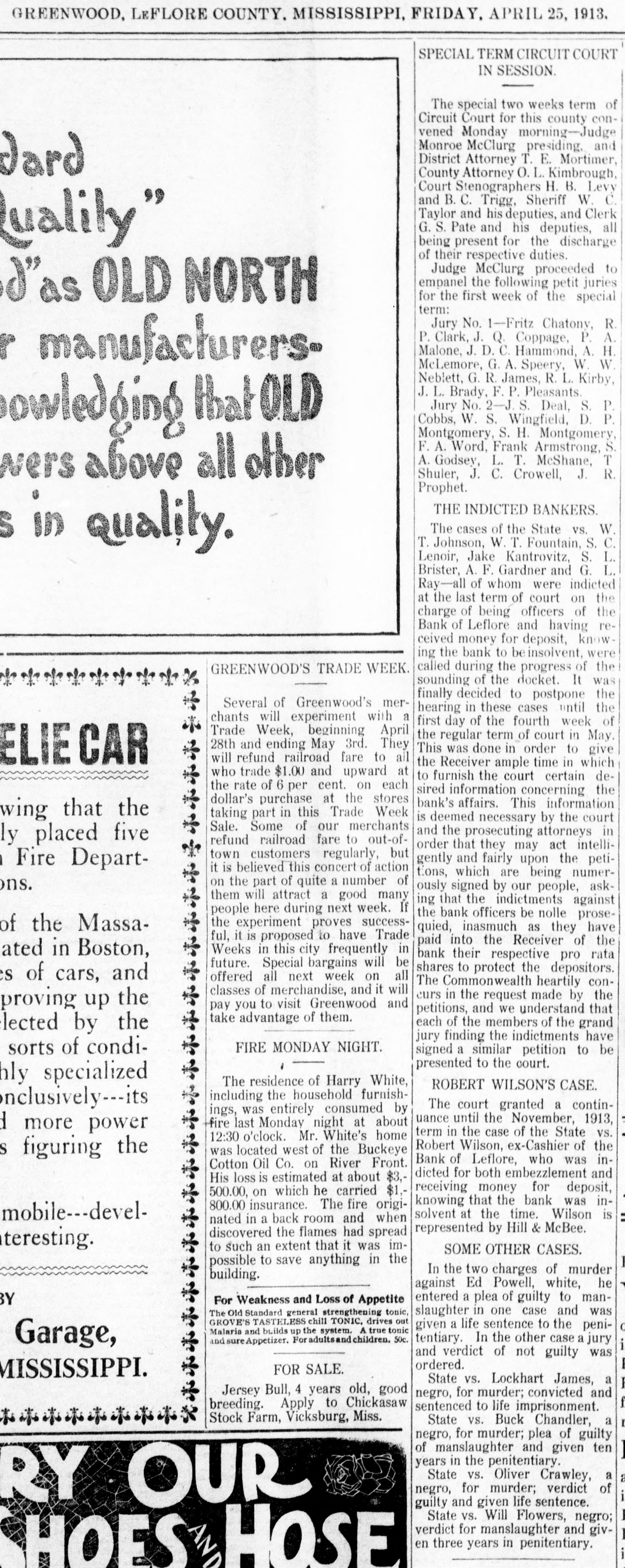

GREENWOOD, LEFLORE COUNTY. MISSISSIPPI, FRIDAY, APRIL 25, 1913 SPECIAL TERM CIRCUIT COUI IN SESSION. The special two weeks term Circuit Court for this county en vened Monday morning-Jud Monroe McClurg presiding, at District Attorney T. E. Mortime County Attorney O.L. Kimbroug Court Stenographers H. B. Le and B. C. Trigg, Sheriff W. Taylor and his deputies, and Cle G. S. Pate and his deputies, being present for the dischar ualily" of their respective duties. Judge McClurg proceeded empanel the following petit juri OLD NORTH for the first week of the speci term: Jury No. 1-Fritz Chatony, P. Clark, J. Q. Coppage, P. Malone, J. D. C. Hammond, A. manufacturers\ McLemore, G. A. Speery, W. Neblett, G. R. James, R. L. Kirb J. L. Brady, F. P. Pleasants. Jury No. 2-J. S. Deal, S. Cobbs, W. S. Wingfield, D. owledging Hat OLD Montgomery, S. H. Montgomer F. A. Word, Frank Armstrong, A. Godsey, L. T. McShane, above all other Shuler, J. C. Crowell, J. Prophet. THE INDICTED BANKERS. The cases of the State VS. \ T. Johnson, W. T. Fountain, S. in quality. Lenoir, Jake Kantrovitz, S. Brister, A. F. Gardner and G. Ray-all of whom were indict at the last term of court on ti charge of being officers of tl Bank of Leflore and having I ceived money for deposit, know ing the bank to be insolvent, we called during the progress of tl GREENWOOD'S TRADE WEEK. sounding of the docket. It w finally decided to postpone ti Several of Greenwood's merhearing in these cases until tl chants will experiment with a first day of the fourth week Trade Week, beginning April the regular term of court in Ma 28th and ending May 3rd. They This was done in order to giv will refund railroad fare to all CAR the Receiver ample time in whi who trade $1.00 and upward at to furnish the court certain di the rate of 6 per cent. on each sired information concerning tl dollar's purchase at the stores bank's affairs. This informatic the that taking part in this Trade Week is deemed necessary by the cou Sale. Some of our merchants and the prosecuting attorneys five refund railroad fare to out-ofplaced order that they may act intel town customers regularly, but gently and fairly upon the pe Fire Departit is believed this concert of action tions, which are being nume on the part of quite a number of ously signed by our people, as them will attract a good many ing that the indictments again people here during next week. If the bank officers be nolle pros the experiment proves successMassathe of quied, inasmuch as they har ful, it is proposed to have Trade paid into the Receiver of tl Weeks in this city frequently in in Boston, bank their respective pro ra future. Special bargains will be shares to protect the depositor and of offered all next week on all cars, The Commonwealth heartily co classes of merchandise, and it will curs in the request made by th proving up the pay you to visit Greenwood and petitions, and we understand th: take advantage of them. each of the members of the gran by the jury finding the indictments hav FIRE MONDAY NIGHT. condiof sorts signed a similar petition to I presented to the court. specialized The residence of Harry White, ROBERT WILSON'S CASE. including the household furnishits onclusively The court granted a contir ings, was entirely consumed by uance until the November, 191 more fire last Monday night at about power term in the case of the State v 12:30 o'clock. Mr. White's home Robert Wilson, ex-Cashier of th the was located west of the Buckeye figuring Bank of Leflore, who was in Cotton Oil Co. on River Front. dicted for both embezzlement an His loss is estimated at about $3,receiving money for deposi 500.00, on which he carried $1,knowing that the bank was it 800.00 insurance. The fire origisolvent at the time. Wilson nated in a back room and when represented by Hill & McBee. discovered the flames had spread teresting. to such an extent that it was imSOME OTHER CASES. possible to save anything in the In the two charges of murde building. against Ed Powell, white, h entered a plea of guilty to man For Weakness and Loss of Appetite The Old Standard general strengthening tonic, slaughter in one case and wa GROVE'S TASTELESS chill TONIC. drives out given a life sentence to the pen Malaria and builds up the system. A true tonic tentiary. In the other case a jur and sure Appetizer. For adults and children. 50c. Garage, and verdict of not guilty wa ordered. FOR SALE. MISSISSIPPI. State vs. Lockhart James, Jersey Bull, 4 years old, good negro, for murder; convicted an breeding. Apply to Chickasaw sentenced to life imprisonment. Stock Farm, Vicksburg, Miss. State vs. Buck Chandler, negro, for murder; plea of guilt of manslaughter and given te years in the penitentiary. State vs. Oliver Crawley, negro, for murder; verdict o OUR # guilty and given life sentence. State vs. Will Flowers, negre verdict for manslaughter and giv en three years in penitentiary. HOES HOSE