Article Text

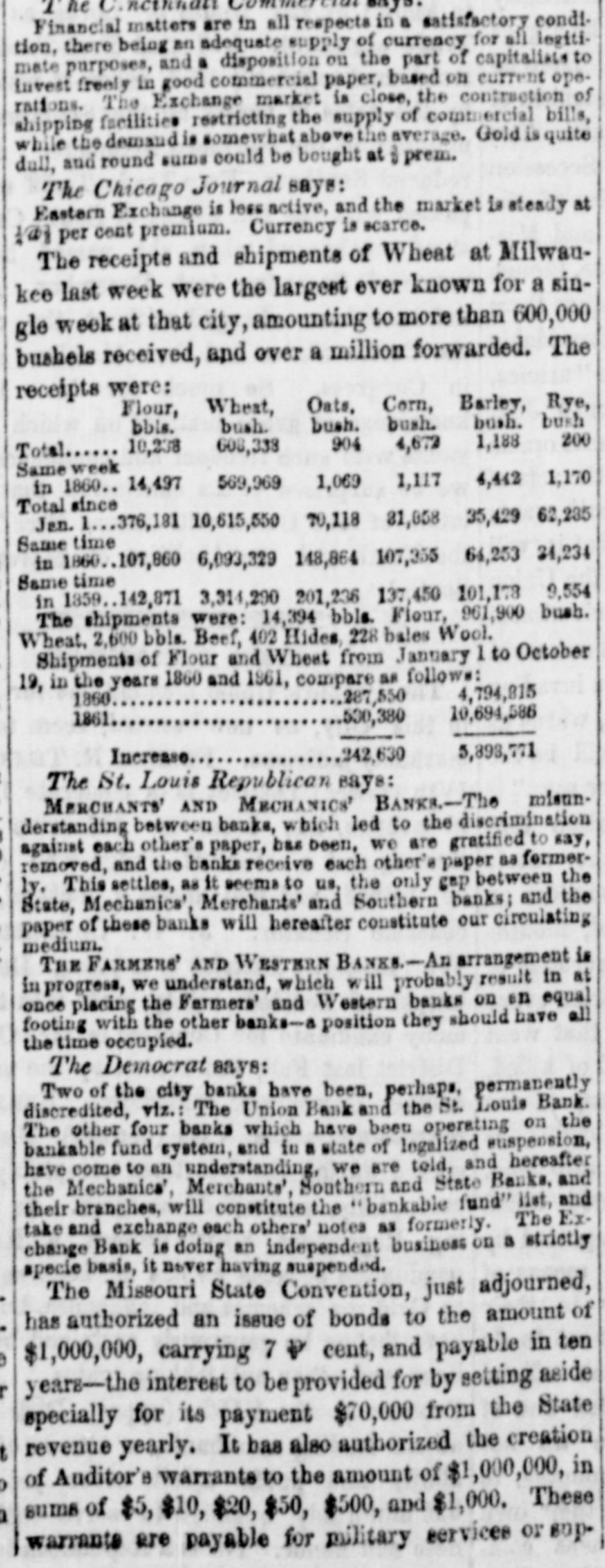

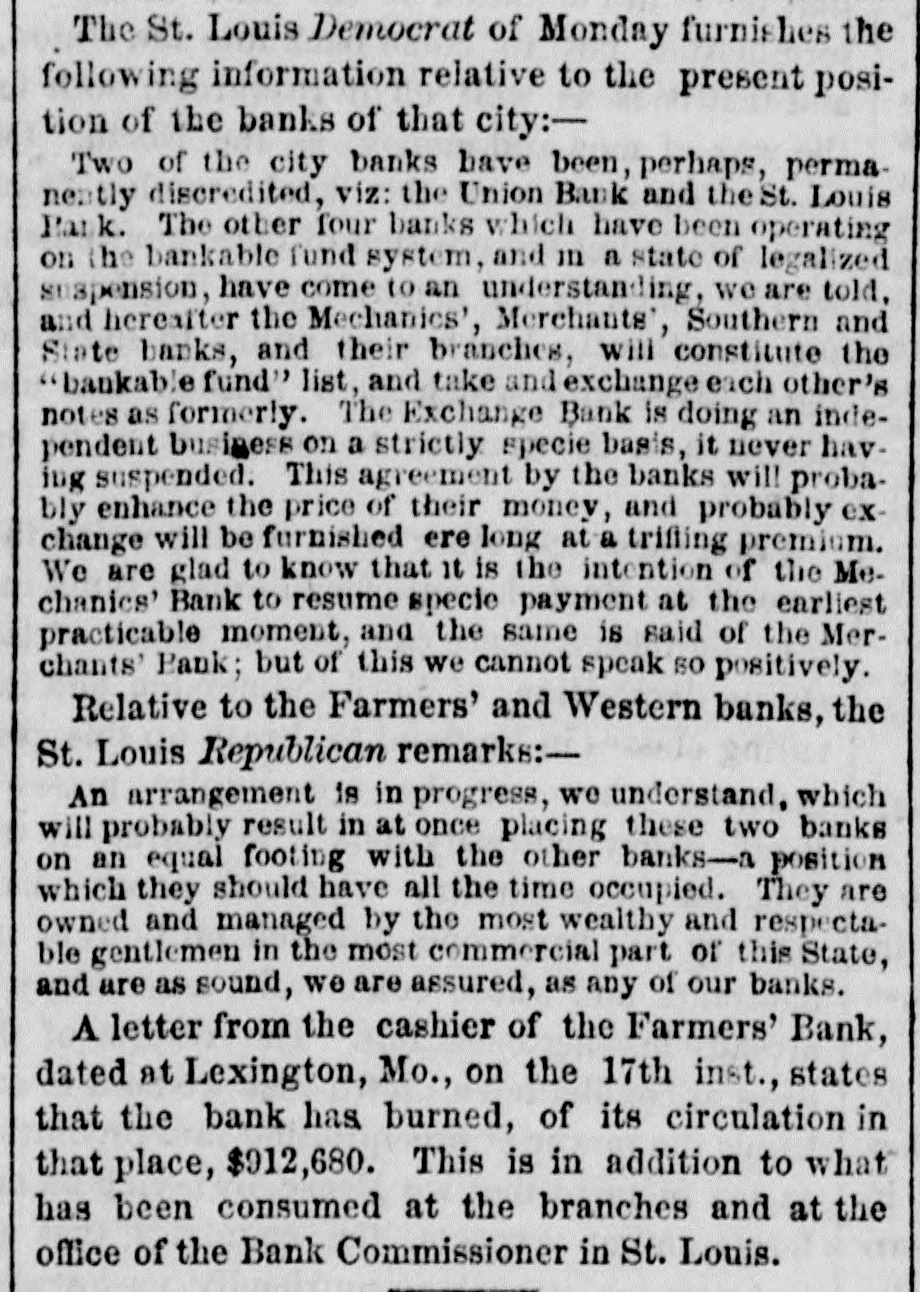

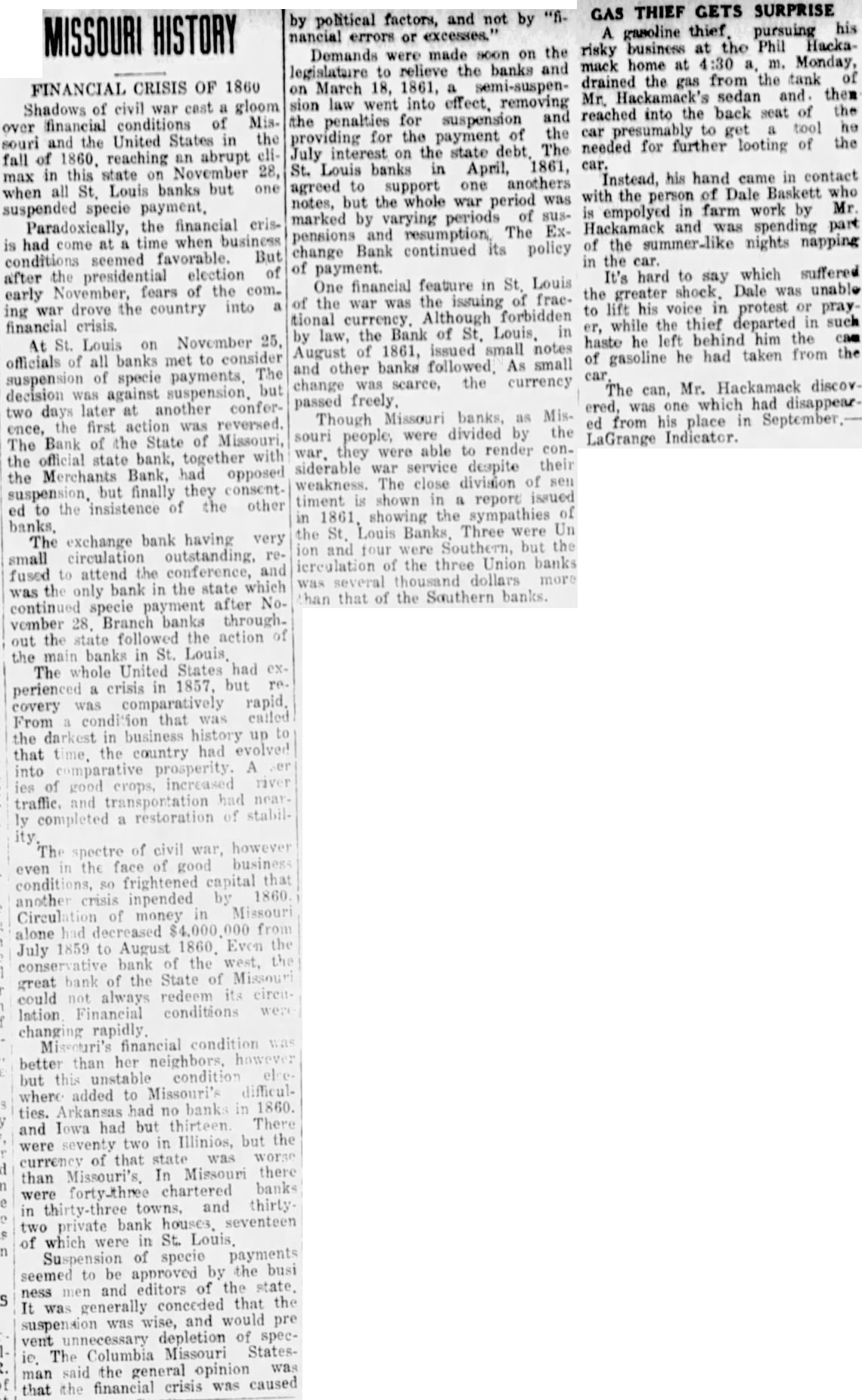

Commercial. MONEVARY. We have no material change to note in the money market here. It is, perhaps, alittle easier, and more confidence prevails; but there is yet great pre sure. The effects of the little flire up about the City Bank, have almost is PP a ed, and we doubt not, is a few days more, its notes will pass as currently as ever. We don't believe there is any good reason why they shoul not. The old Banks sell exchange, when they have it, at 1/2c. premium; but they cannot supply the demand, and 2 per cent. ts paid to other dealers. All the banks of St. Louis, excepting the Merchants' Bank, have suspended. That bank rode out the sto m of 1857, without striking her colors., The State Bank of South Carolina, the Bank of South Carolina, the Railroad Bank, the Planters' and the Merch ints' Bank of South Carolina have suspended It is proposed to hold public méetings in Alabama urging the Banks of that State to suspend also. CHEESE-Western Reserve 11@11}c per pound. FLOUR-We quote: $5.00 Superfine in barrels " " 6 50@6 75 Extra, 3 25@3 50 " in sacks, WHEAT--This article is searce, and will sell readily at $1 25@1 30 per bushel. BACON--Shoulders 10}, clear sides 13@ 14; hams 13}@14c per 1b. CORN.-White 80 per bushel; mixed 75c. OATS.-45@59c per bushel. LARD-Supply limited. Sales at 13½ to 15c per lb. according to package. MEAL-Is selling at 80c. B bushel. FEATHERS-We quote at 41@43c. ฿ ₺. GINSENG--40@45c. B lb. GROCERIES.-We quote; Fair sugar 9}@10 B fb.; prime to choice 10@10}c.; in barrels }@1c. advance on these figures. New York Coffee Sugars 10}@11żc. B lb., crushed and powdered 11}@12c.: Loaf 11@ 12c. B Ib. MOLASSES AND SYRUP.-Molasses in barrels 40@45c B gal.; half barrels 45@ 48c; Sugar House 43@45c. Golden Syrup in barrels 75c.: half barrels 80c.; and kegs (ten gals.) 85c. COFFEE.-Rio 16@16}c.; Laguyra none in market; Java 19@20c. B lb. Stock light. TEA.-Imperial 50c@$1; Gunpowder 50 @75c.; Young Hyson 40@60; Black 60 @1 50. SALT.-We quote Coarse Sack at $1 50 and Fine at $1 60@$1 75; and Barrel at 40c. B bushel. COTTON YARNS.-The tollowing are the agents' quotations for Cotten Yarns: 700 and 800, 9c. P doz.; 600, 10c.; 500, Ilc., and 400, 12c. WHISKY.--Rectifled is held at 21@24c B gallon, and country at 50@75c B gallon according to quality. CANDLES.-Star 18c per 1b. for ligh weight; 20c for full weight. Tallow, summer pressed 13c; Sperm 45a50e per 1b, Raisins-Layer $3a3 25 per box; W.R $2 50a2 75. SOAP-Turpentine $2 25a2 75 per box. BRAN-$1.10 per cwt. HAY-$26@27 per ton. RYE-$1 00@1 15 per bushel. BARLEY-$1 25 per bushel.