Article Text

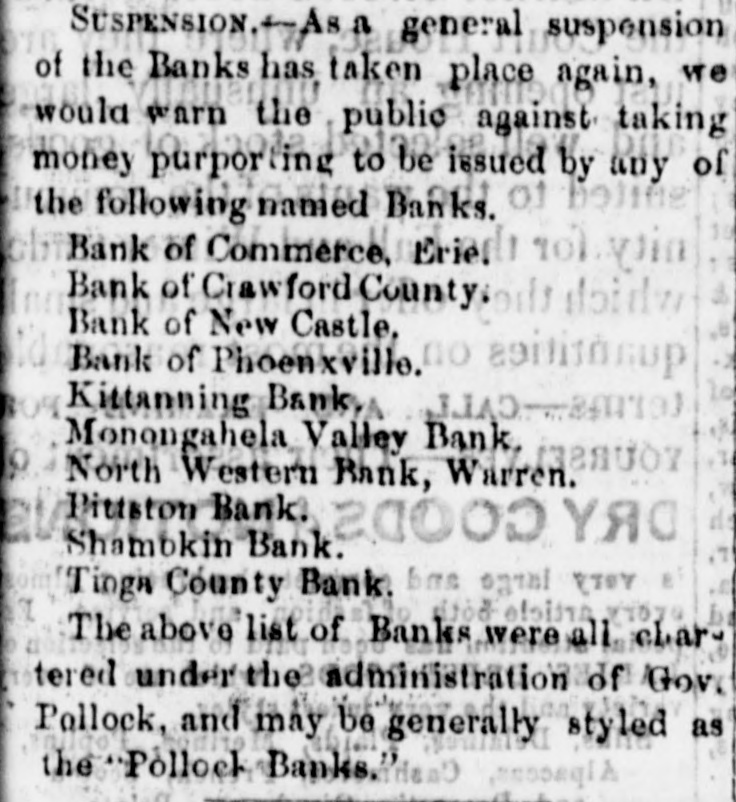

SUSPENSION. As a general suspension of the Banks has taken place again, we would warn the public against taking money purporting to be issued by any of boline the following named Banks. of 101 Bank of Commerce, Eriel ytin Bank of Crawford County: Bank of New Castle, no Bank of Phoenxville. Kittanning Bank Monongahela Valley Bank. North Western Bank, W17.1388007 Y.R.O (TOY Tinga County Bank. bas ogral The above list of Banks were all 77070 char tered under the administration of Gov. Pollock, and may be generally styled as the Pollock Banks.