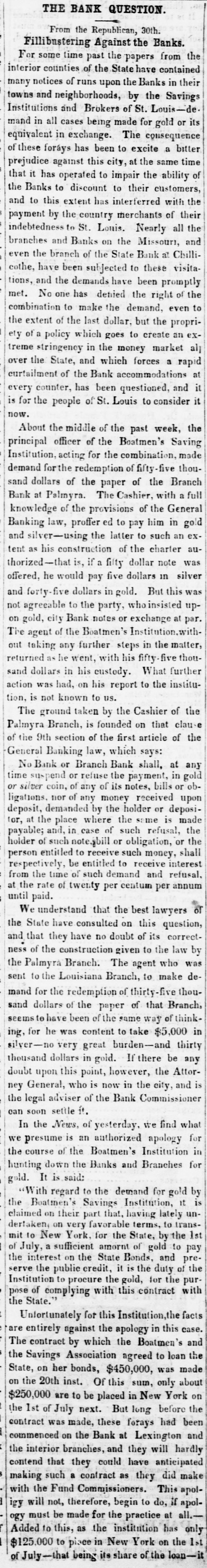

Article Text

THE BANK QUESTION. From the Republican, 30th. the Fillibustering Against the Banks. from some time past the papers contained For counties of the State have in their interior notices of runs upon the Banks Savings many and neighborhoods, by the Louis-de. towns and Brokers of St. or its Institutions in all cases being made for gold mand equivalent in exchange. The consequence a bitter these forays has been to excite same time of against this city, at the ability of prejudice that it has operated to impair the customers, Banks to discount to their with the the this extent has interferred of their and to by the country merchants all the payment to St. Louis. Nearly and Banks on the branch of the State Bank at branches indebtedness the Missouri, these visita- Chilli- and even have been subjected to cothe, and the demands have been promptly of the tions, No one has denied the right even to combination met. to make the demand, the extent of the last dollar, but propri- an exthe of policy which goes to create market alj ety stringency in the money a rapid treme the State, and which forces over of the Bank accommodations and curtailment counter, has been questioned, consider is every for the people of St. Louis to the now. About the middle of the past week, Saving officer of the Boatmen's made Institution, principal acting for the combination, thoufor the redemption of fifty-five Branch of the paper of with a The Cashier, at of the provisions of the in gold demand sand Bank knowledge dollars Palmyra. him the General full law, proffer ed to pay exBanking silver-using the latter to such an auand his construction of the charter note was tent as -that is, if a filty dollar silver offered, thorized- he would pay five dollars in this was forty-five dollars in gold. insisted But and agreeable to the party, who at par. upnot city Bank notes or exchange on gold, of the Boatmen's Institution.wit the matter, The taking agent any further steps fifty-five in thouout as he went, with his What further returned dollars in his custody. instituaction sand was had, on his report to the is not known to us. the tion, ground taken by the Cashier that of clauThe Branch, is founded on of Palmyra section of the first article of Banking law, General the 9th which Bank shall, says: at any the No Bank or Branch the payment, in gold obtime suspend or refuse of its notes, bills or upon or silver coin, of any money received deposit, ligations. demanded nor of any where by the the holder same or is deposi- made the for, at the place of such refusal, payable; and, in case or obligation, or the holder of such to ote.bill receive such money, interest shall person entitled be entitled to receive and refusal. respectively, of such demand annum until at from the the rate time of twenty per centum per or paid. understand that the best lawyers question, We State have consulted on this its correctthe and that of the they construction have no doubt given of to the who law was by ness Branch. The agent make dethe Palmyra the Louisiana Branch, to for the redemption of of the paper of of sand sent mand to dollars thirty-five that Branch, think- thou- in to have been of the same way $5,000 seems he was content to take thirty ing, for very great burden-and be any silver-no dollars in goid. If there Attorthousand this point, however, the and is doubt General, upon who is now in the Commissioner city, ney the legal adviser of the Bank can soon settle News, it. of yesterday. we find what for In the is an authorized Institution apology in we presume of the Boatmen's Branches for hunting the course down the Banks and gold. "With It regard is said: to the demand Institution, for gold it by Boatmen's Savings lately unthe OD their part that, having terms, to transdertaken claimed on very favorable for the State, by the 1st the mit to New sufficient York, amornt of gold and to pre- pay is it credit, of July, interest a on the State Bonds, the duty of the serve the public procure the gold, contract for the with purthe pose of complying Institution to with this Unfortunately State. for this Institution,the this case. facts entirely against the apology in and are contract by which the Boatmen's loan the The Savings Association agreed to was made the State, on her bonds, $450,000, only about 20th inst. Of this sum, York on $250,000 on the are to be placed in New before the the 1st of July made, next. these But forays long had been and contract was on the Bank at Lexington will hardly commenced interior branches, and they anticipated the that they could have did make contend such a contract as they This apolmaking Fund Commissioners. if apolwith the not, therefore, begin to do, at be made for the practice has ogy to this, as the on the igy Added will must in New institution York all.- only 1st of $125.000 July-that to place being its share of the loan-