Article Text

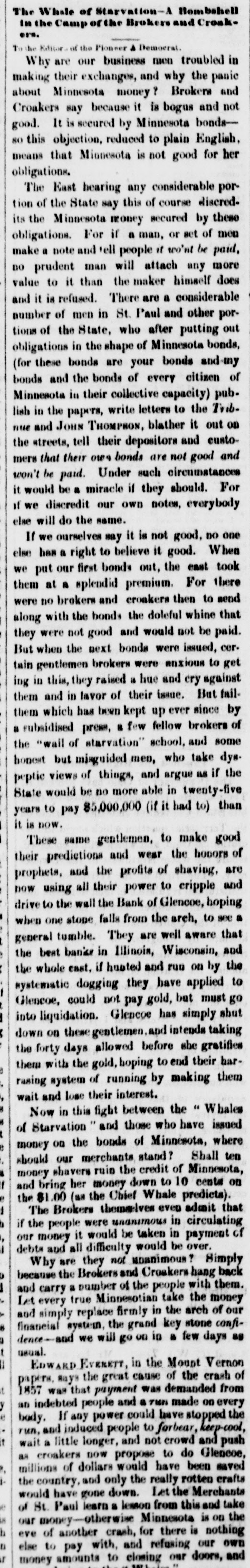

The Whale of Starvation- Bombshell in the Camp of the Brokers and Croakers. To the Kilitor of the Pioneer A Democrat. Why are our business men troubled in making their exchanges, and why the panie about Minnesota money ? Brokers and Croakers say because it is bogus and not good. It is secured by Minnesota bonds— 80 this objection, reduced to plain English, means that Minnesota is not good for her obligations. The East hearing any considerable portion of the State say this of course discredits the Minnesota money secured by these obligations. For if a man, or set of men make a note and tell people it wo'nt be paid, no prudent man will attach any more value to it than the maker himself does and it is refused. There are a considerable number of men in St. Paul and other portions of the State, who after putting out obligations in the shape of Minnesota bonds, (for these bonds are your bonds and-my bonds and the bonds of every citizen of Minnesota in their collective capacity) publish in the papers, write letters to the Tribnue and John THOMPSON, blather it out on the streets, tell their depositors and eustomers that their own bonds are not good and won't be paid. Under such circumstances it would be a miracle if they should. For if we discredit our own notes, everybody else will do the same. If we ourselves say it is not good, no one else has a right to believe it good. When we put our first bonds out, the east took them at a splendid premium. For there were no brokers and croakers then to send along with the bonds the doleful whine that they were not good and would not be paid. But when the next bonds were issued, certain gentlemen brokers were enxious to get ing in this, they raised a hue and cry against them and in lavor of their issue. But failthem which has been kept up ever since by a subsidised press, a few fellow brokers of the "wail of starvation" school, and some honest but misguided men, who take dys. peptic views of things, and argue ILS if the State would be no more able in twenty-five years to pay $5,000,000 (if it had to) than it is now. These same gentlemen, to make good their predictions and wear the honors of prophets, and the profits of shaving, are now using all their power to cripple and drive to the wall the Bank of Glencoe, hoping when one stope falls from the arch, to see a general tumble. They are well aware that the best banks in Illinois, Wisconsin, and the whole east, if hunted and run on by the systematic dogging they have applied to Glencoe, could not pay gold, but must go into liquidation. Glencoe has simply shut down on these gentlemen, and intends taking the forty days allowed before she gratifies them with the gold, hoping to end their harrasing system of running by making them wait and lose their interest. Now in this fight between the " Whales of Starvation and those who have issued money on the bonds of Minnesota, where should our merchants stand Shall ten money shavers ruin the credit of Minnesota, and bring her money down to 10 cents on the $1.00 (as the Chief Whale predicts). The Brokers themselves even admit that if the people were unanimous in circulating our money it would be taken in payment of debts and all difficulty would be over. Why are they not unanimous Simply because the Brokers and Croakers hang back and carry a number of the people with them. Let every true Minnesotian take the money and simply replace firmly in the arch of our financial system, the grand key stone confidence-and we will go on in a few days as usual. Edward EVERETT, in the Mount Vernon papers, says the great cause of the crash of 1857 was that payment was demanded from an indebted people and a 7MN made on every body. If any power could have stopped the run, and induced people to forbear, keep-cool, wait a little longer, and not crowd and push as croakers now propose to do Glencoe, millions of dollars would have been saved the country, and only the really rotten crafts would have gone down. Let the Merchants of St. Paul learn a lesson from this and take our money-otherwise Minnesota is on the eve of another crash, for there is nothing else to pay with, and refusing our own money amounts to closing our doors, and