Article Text

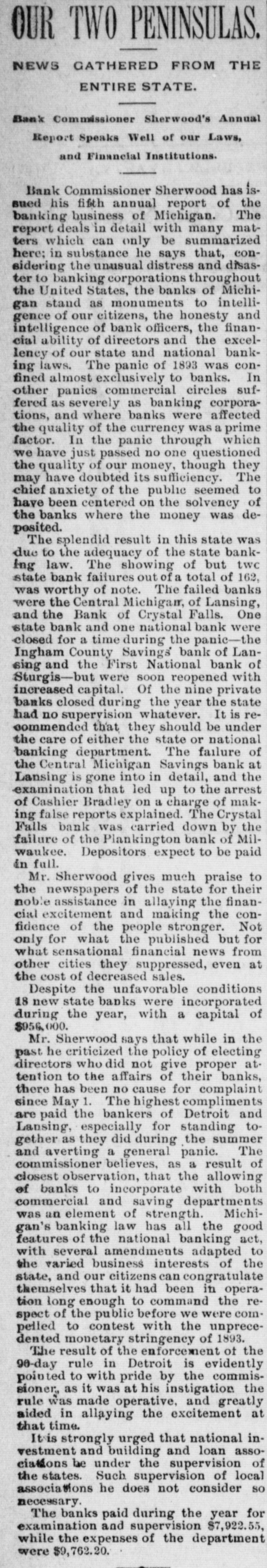

OUR TWO PENINSULAS. NEWS GATHERED FROM THE ENTIRE STATE. Bank Commissioner Sherwood's Annual Report Speaks Well of our Laws, and Financial Institutions. Bank Commissioner Sherwood has issued his fifth annual report of the banking business of Michigan. The report deals in detail with many matters which can only be summarized here; in substance he says that, considering the unusual distress and disaster to banking corporations throughout the United States, the banks of Michigan stand as monuments to intelligence of our citizens, the honesty and intelligence of bank officers, the financial ability of directors and the excellency of our state and national banking laws. The panic of 1893 was confined almost exclusively to banks. In other panics commercial circles suffered as severely as banking corporations, and where banks were affected the quality of the currency was a prime factor. In the panic through which we have just passed no one questioned the quality of our money, though they may have doubted its sufficiency. The chief anxiety of the public seemed to have been centered on the solvency of the banks where the money was deposited. The splendid result in this state was due to the adequacy of the state bankIng law. The showing of but twc state bank failures out of a total of 162, was worthy of note. The failed banks were the Central Michigan, of Lansing, and the Bank of Crystal Falls. One state bank and one national bank were closed for a time during the panic-the Ingham County Savings' bank of Lansing and the First National bank of Sturgis-but were soon reopened with increased capital. Of the nine private banks closed during the year the state had no supervision whatever. It is recommended that they should be under the care of either the state or national banking department. The failure of the Central Michigan Savings bank at Lansing is gone into in detail, and the examination that led up to the arrest of Cashier Bradley on a charge of making false reports explained. The Crystal Falls bank was carried down by the failure of the Plankington bank of Milwaukee. Depositors expect to be paid in full. Mr. Sherwood gives much praise to the newspapers of the state for their noble assistance in allaying the financial excitement and making the confidence of the people stronger. Not only for what the published but for what sensational financial news from other cities they suppressed, even at the cost of decreased sales. Despite the unfavorable conditions 18 new state banks were incorporated during the year, with a capital of $956,000. Mr. Sherwood says that while in the past he criticized the policy of electing directors who did not give proper attention to the affairs of their banks, there has been no cause for complaint since May 1. The highest compliments are paid the bankers of Detroit and Lansing, especially for standing to-