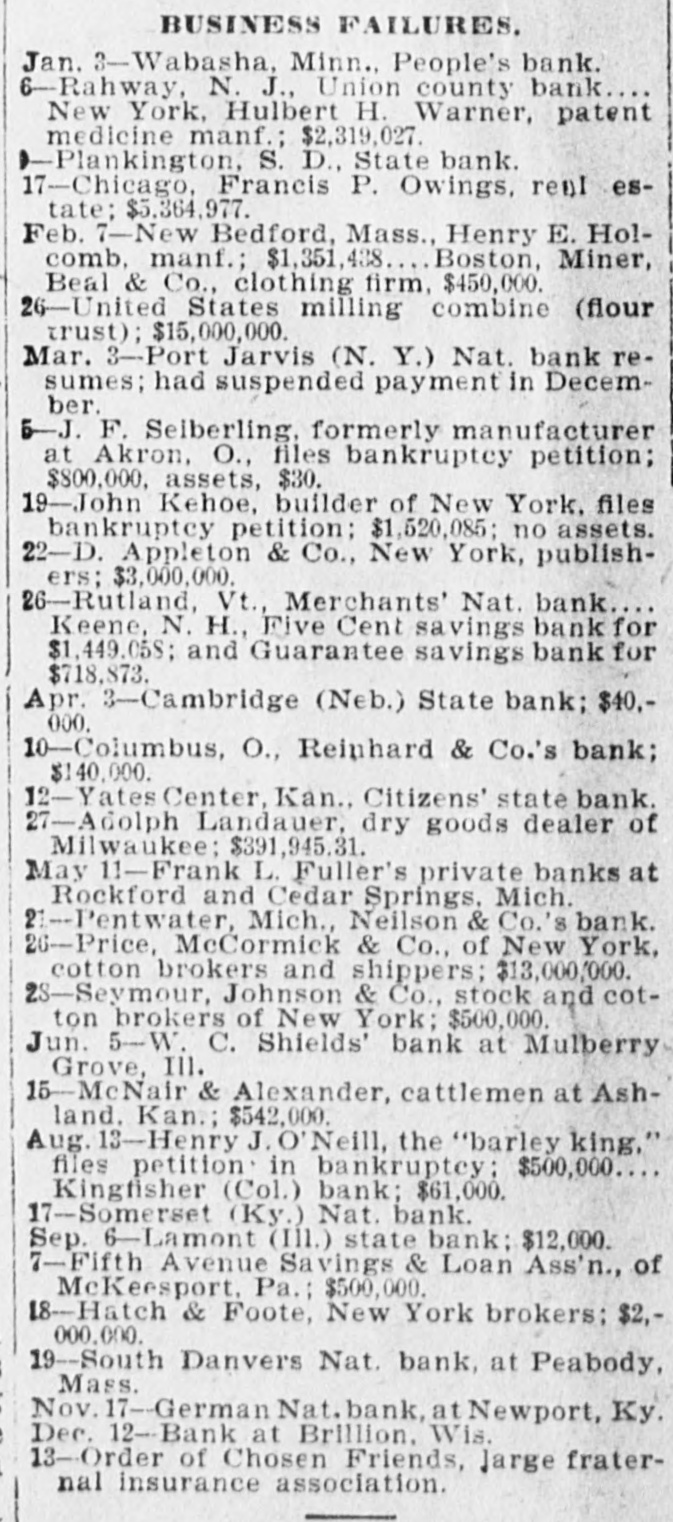

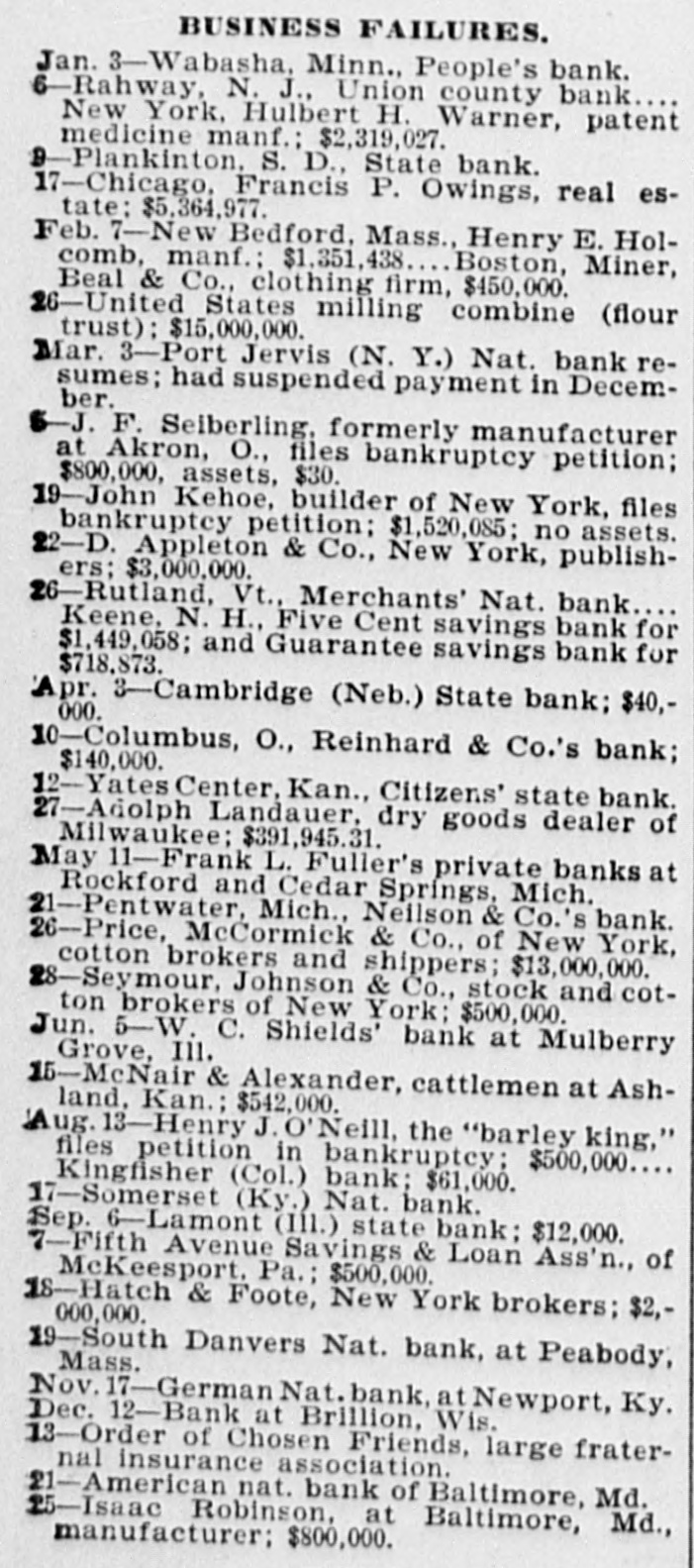

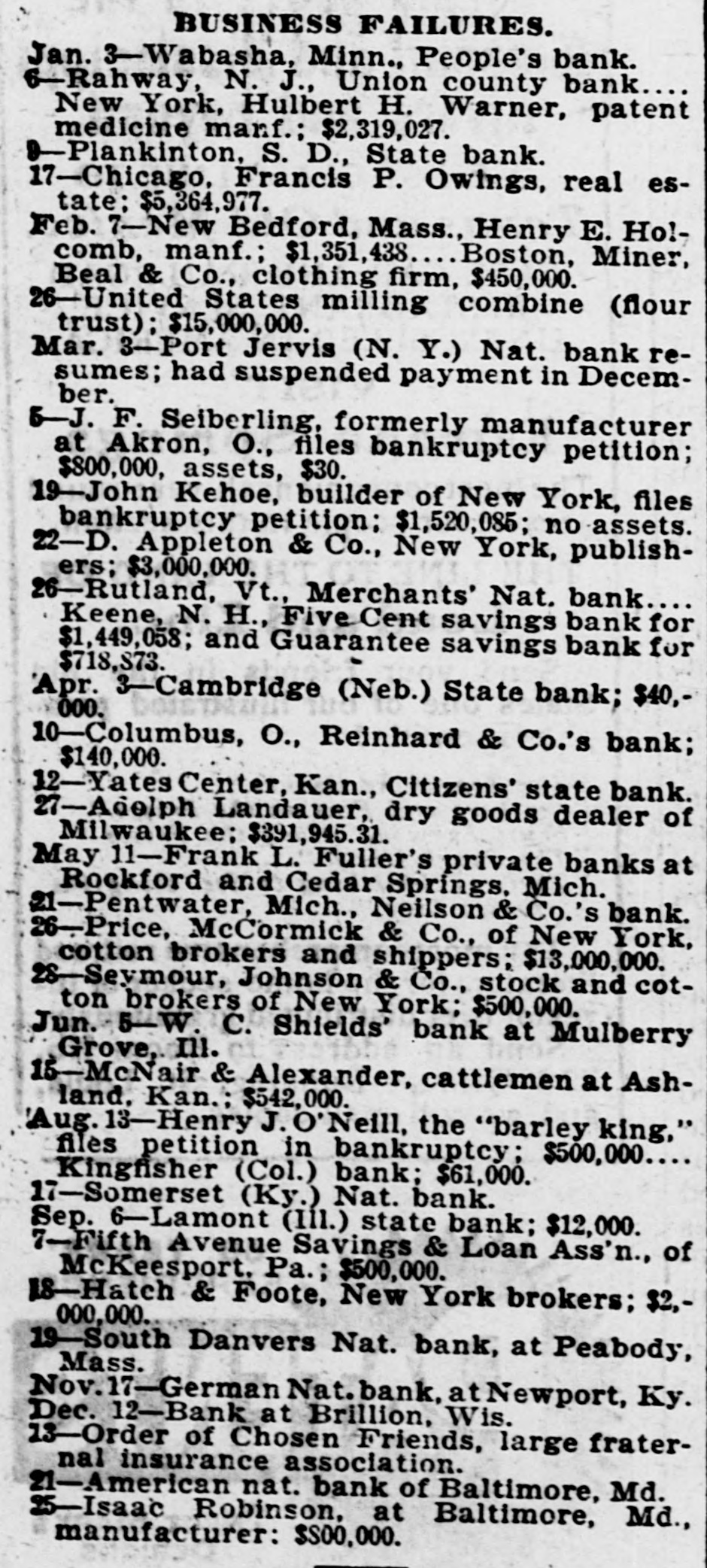

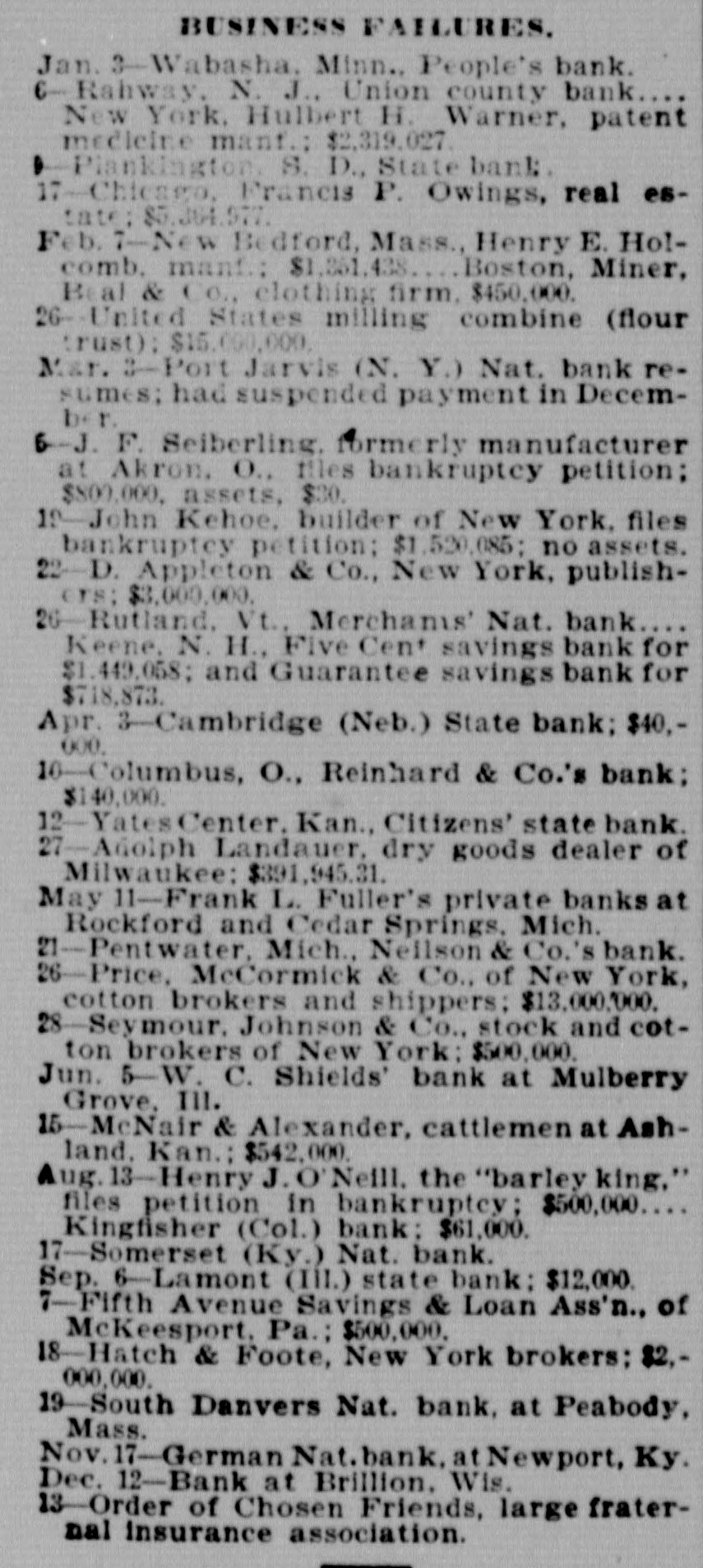

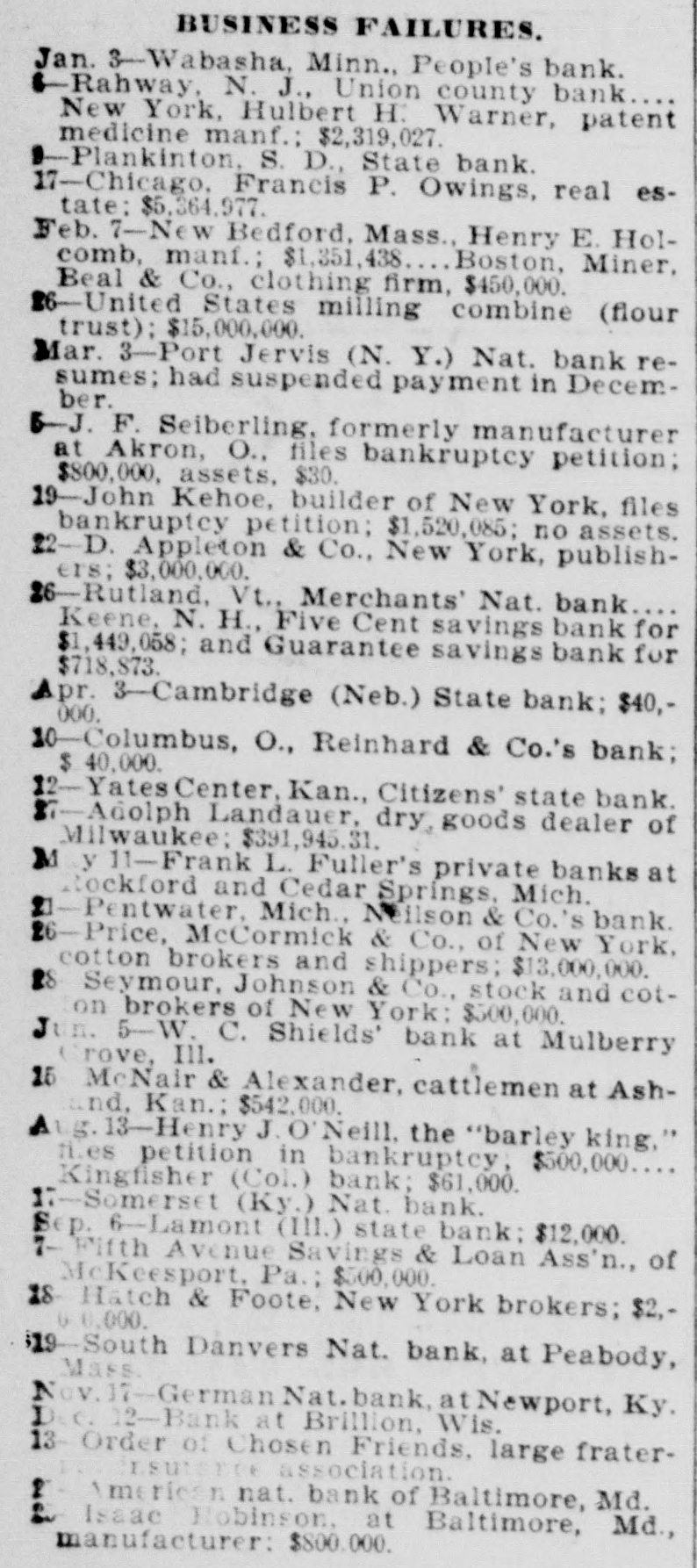

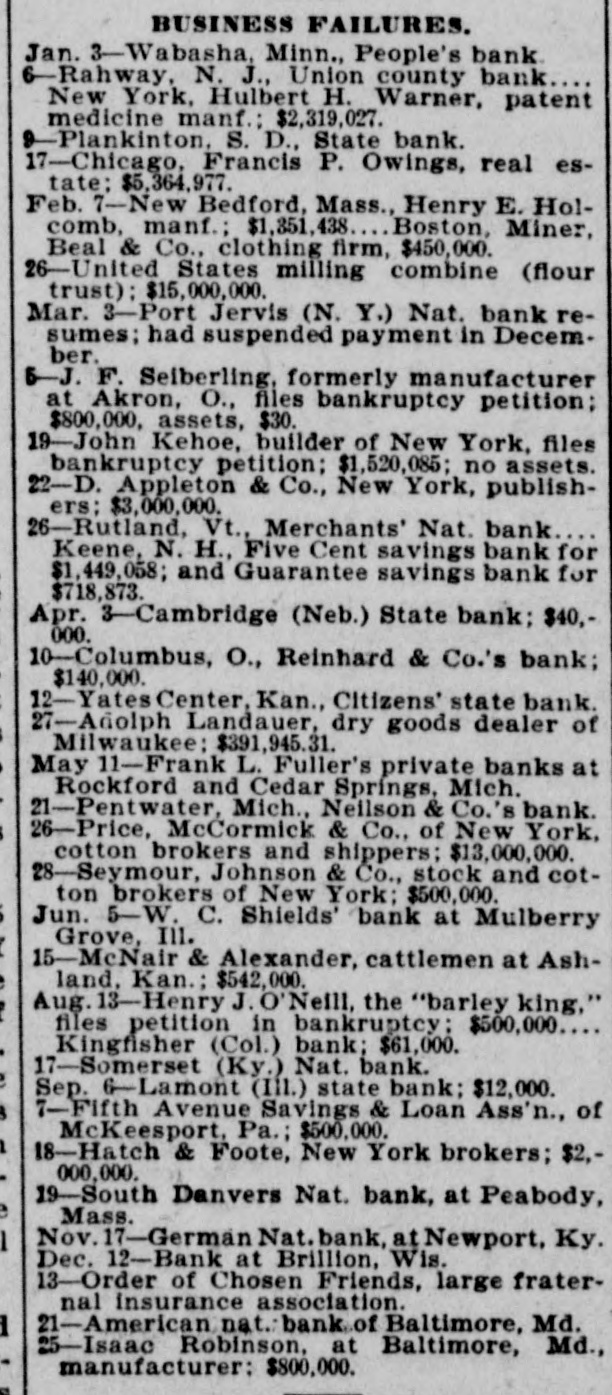

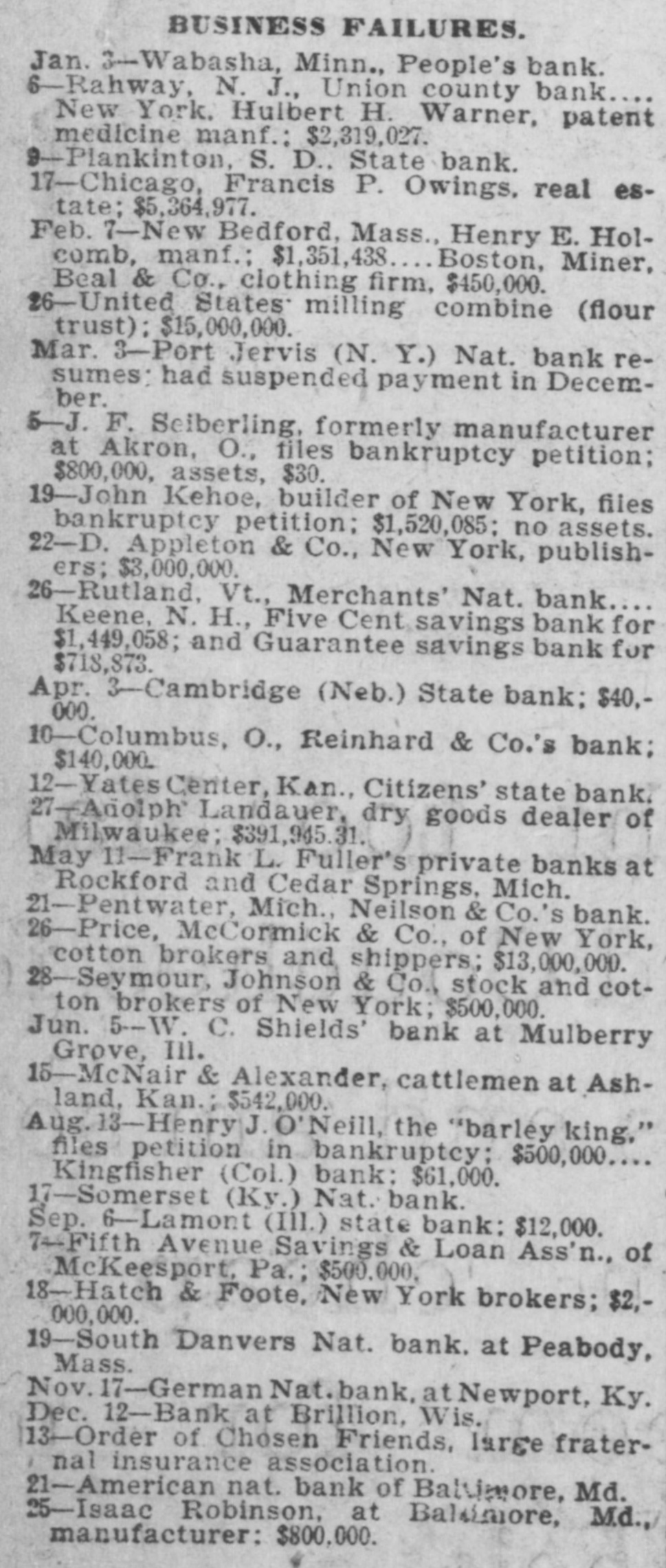

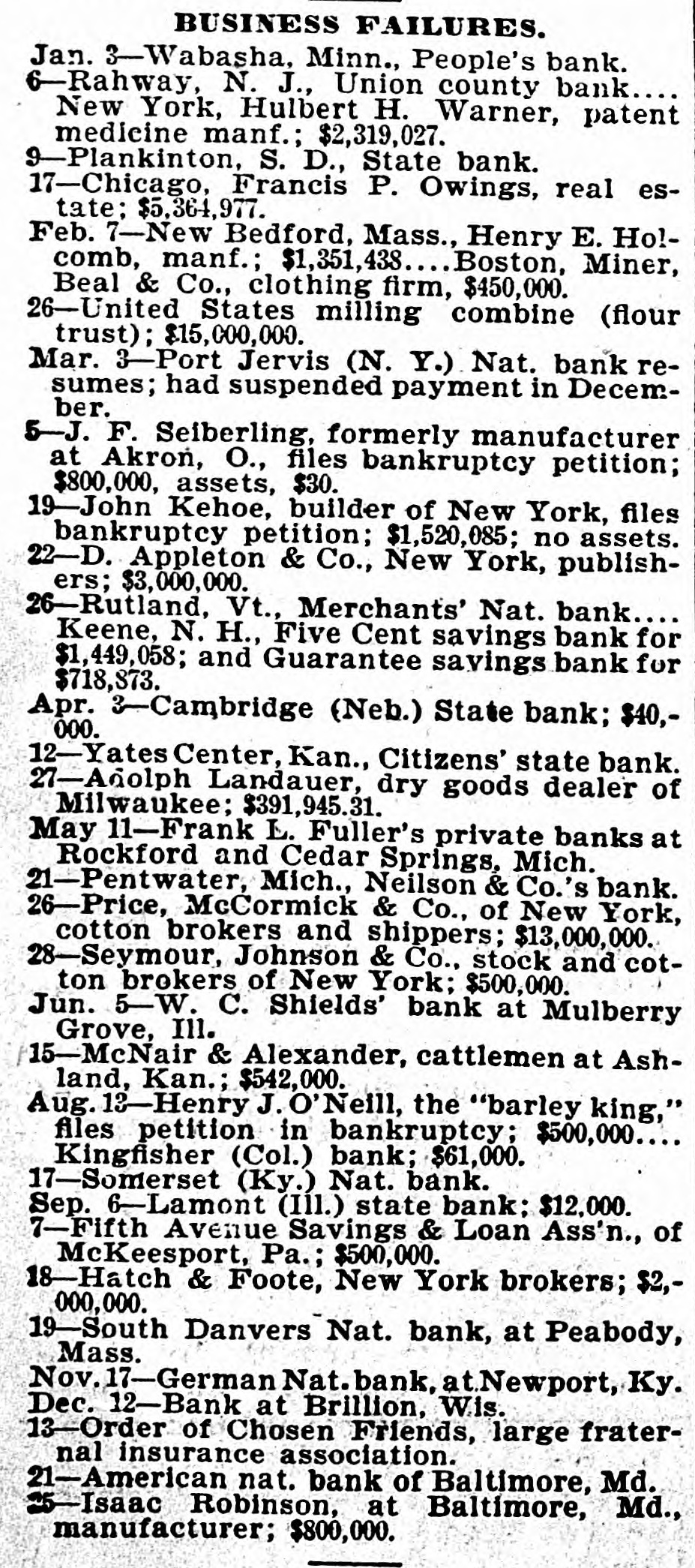

Article Text

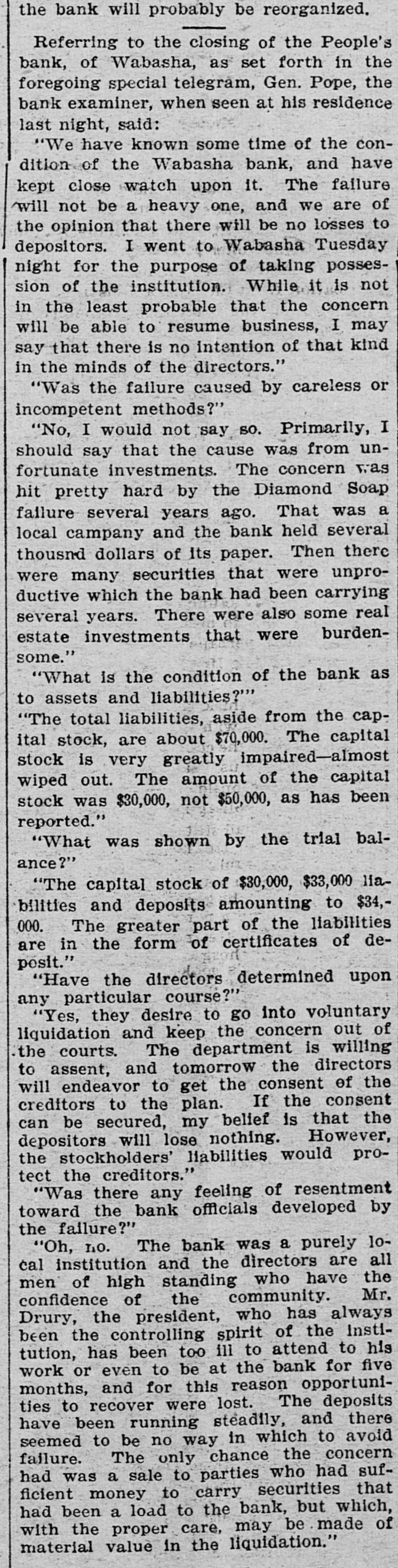

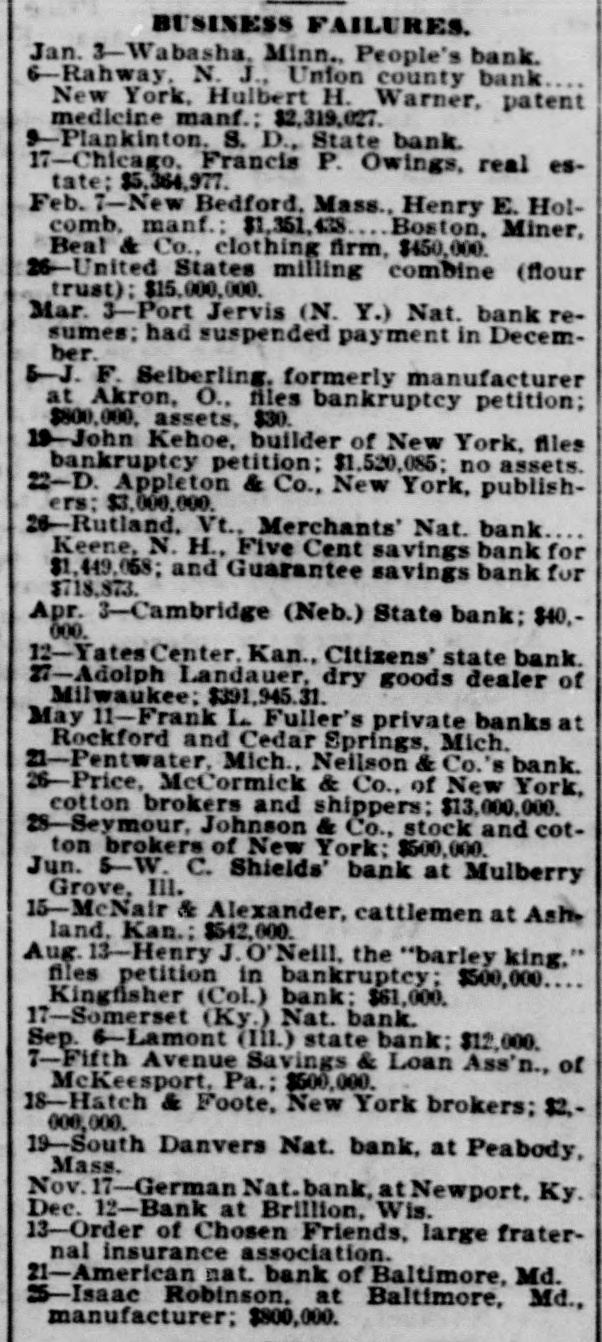

the bank will probably be reorganized. Referring to the closing of the People's bank, of Wabasha, as set forth in the foregoing special telegram, Gen. Pope, the bank examiner, when seen at his residence last night, said: "We have known some time of the condition of the Wabasha bank, and have kept close watch upon it. The failure /will not be a heavy one, and we are of the opinion that there will be no losses to depositors. I went to Wabasha Tuesday night for the purpose of taking possession of the institution. While it is not in the least probable that the concern will be able to resume business, I may say that there is no intention of that kind in the minds of the directors." "Was the failure caused by careless or incompetent methods?" "No, I would not say so. Primarily, I should say that the cause was from unfortunate investments. The concern was hit pretty hard by the Diamond Soap failure several years ago. That was a local campany and the bank held several thousnd dollars of its paper. Then there were many securities that were unproductive which the bank had been carrying several years. There were also some real estate investments that were burdensome." "What is the condition of the bank as to assets and liabilities?" "The total liabilities, aside from the capital stock, are about $70,000. The capital stock is very greatly impaired-almost wiped out. The amount of the capital stock was $30,000, not $50,000, as has been reported." "What was shown by the trial balance?" "The capital stock of $30,000, $33,000 liabilities and deposits amounting to $34,000. The greater part of the liabilities are in the form of certificates of deposit." "Have the directors determined upon any particular course?" "Yes, they desire to go into voluntary liquidation and keep the concern out of the courts. The department is willing to assent, and tomorrow the directors will endeavor to get the consent of the creditors to the plan. If the consent can be secured, my belief is that the depositors will lose nothing. However, the stockholders' liabilities would protect the creditors." "Was there any feeling of resentment toward the bank officials developed by the failure?" "Oh, no. The bank was a purely local institution and the directors are all men of high standing who have the confidence of the community. Mr. Drury, the president, who has always been the controlling spirit of the Institution, has been too ill to attend to his work or even to be at the bank for five months, and for this reason opportunities to recover were lost. The deposits have been running steadily, and there seemed to be no way in which to avoid failure. The only chance the concern had was a sale to parties who had sufficient money to carry securities that had been a load to the bank, but which, with the proper care, may be made of material value in the liquidation."