Article Text

The In Banking Looked Back In The

The few Saline years County been going through depression and the fifteen years before that period of most normal inflation and prosperity. These recent occurrences such diamterically opposed ditions make hard for us to member how things were back the normal times before the World War started and the preceding that. Therefore, especially interestthese extracts from read by Barnhill of the Wood Huston Bank before the meeting of Group the souri State Bankers' Association Sedalia November The excerpts: report on banking conditions Saline County at the present time not be wholly unlike report from other counties prising Group located as they are in contiguous territory, and two exceptions pendent upon practically the interests for supportnamely, agriculture. Howard and Lafayette counties have some coal and Pettis shops and otherwise their terests nearly identical. line strictly agricultural the farmer all prosper and when suffers suffer. With grain and livestock are the bread and staff of life, and in this rection Saline is county of showing. This is borne out mean by statistics compiled by the state labor bureau (1906) and from which take the following figures:

Saline Led Group

Value of surplus products Group County Value Saline $6,929,076 Lafayette 6,271,287 Pettis 5,167,735 Howard 1,690,172 Benton 1,056,000 Cooper 2,914,693 Johnson 2,843,000 Saline being first in the group fourth in the Francois and Jackson being second and third, respectiveThe same report shows value livestock shipped from Saline 1906 $3,249,000. which is third the state, Nodaway and Boone being first second. Cattle shipped, 50,550 head, which third the state, Schuyler and Clinton counties being first and second.

Our Chickens in the Pot

Live poultry shipped pounds which first in the state. Saline takes off her hat Pettis the single item of dressed poul Pettis being the first in the with pounds. Over when killed chicken way, allowed to leave the never county. With report like the foregoing not quite natural that Saline should have thousands of farmers who in better shape today than they have ever not also quite natural that the banks of Saline County should make showing keepwith these resources, for are the banks dependant upon resources for existence? The consolidated bank statements under date of August last, show sixteen banks with: Capital and Deposits 2,900,000 payable Total $3,920,000 Loans, $2,700,000 Loans, real estate 450,000 Reserve 770,000 Total $3,920,000 Demand for Money

From this statement readily that banks seen Saline in healthy condition though the same time they heavy demand experiencing most all banks money, throughout the country not altogether from the same causes. With this demand attributable to several money conditions: First, the advanced prices especially real commodities, estate, and feeding cattle, requiring more money to the than heretofore, Second, heavy land farmers investing all their many land and surplus high priced calling on the banks for money which operate, Saline Cash Southwest Third, the withdrawal of for the particularly Texas. These conditions, together increased number account for this demand for locally. Our money feeders buy until late last winter and consequently the bulk of the fat cattle have late market, and in instances stockers purchased before the shipment of fat cattle well under way, thus hitting the banker "goin" and comin'." Six Prosperous Years Another factor local ditions this: The last half years have been prosperous and prior to this year most the banks had surplus funds. Some of them took on gilt edge real estate paper, which was offered account of the heavy land buying, rather than purchase outside paper. However, they not seeking real estate loans now.

This splendid bank statement of Saline County with total sources $3,920,000 formed day. interesting to study the evolution of this statement note the trials and vicissitudes through which passed during the last three cades.

Banks Increase in Number 1874 Saline County had banks with combined capital and deposits of banks with capital $185,000 and deposits of $425,000. 1882, nine banks with $1,000,000 on deposit. The following year the statement showed about the same while in 1885 there eleven banks with deposits of $725,000 and loans of seemed that there strong demand for money in those days also. During the next few years the banks grew gradually and in October, 1902, find this statement: Capital and $1,000,000 Deposits 1,765,000 Bills payable 125,000 Total $2,940,000 Loans $2,440,000 Reserve 500,000 Total $2,940,000 The Panic of

Now come to the panic 1893. In less than from the year date of the foregoing statement find this: Capital and $1,000,000 Deposits 1,250,000 payable 220,000 Total $2,470,000 Loans $2,100,000 Reserve 370,000 Total $2,470,000 Thus that within few months the deposits of the decreased bills county about doubled and the payable reduced by one-third. Those troublous times, not only Saline throughout the entire country, the bank statement conditions the responding does to the atmosphere. mercury In the of time began smile once more and ity the bank statement began climb with deposits as follows: 1898, 1901, 1903, 1906, and 1907, $2,900,000.

Such Overdrafts! looking these statements the item was ially noticeable. During and 95 the overdrafts the amounted $50,000 county From 1899 to the present time they averaged only $10,000, which is quite an This was brought improvement. about by concerted action on the of the Marshall banks and to what little work show will along the right line withstanding the old saying that overdrafts like the with always.' History of Saline Banking From the standpoint of history Saline cannot claim any priority of the other counties this group. The first banking house to open doors in Saline County branch of the Bank of the State Missouri, which began business Arrow Rock (then metropolis the county) in 1854 with capital, one-half of which subscribed locally. Dr. Boyer cashier and he was succeeded by Mills, veteran banker of Central Missouri, who finally removed to Kansas City tablished private banking which continued by the Western Exchange Bank. Hid Gold Graveyard

The branch bank Arrow Rock continued in business until the troublous period, when officers notified by the bank bring their parent Louis The local officers hasty caucus and decided ignore the demand. Under darkness the borne into the interior and buried Tasso near Orearville's graveyard The directors afterward reconsidered their action and livered the money to the bank. After the liquidation the branches of the old Bank of the State Missouri, bank started in Arrow Rock 1867 with $50,000 capital under the name of the Bank of with Sappington president, H. Mills cashier, George Murrell, McMahan and others directors

New Arrow Rock Bank

In the course time the Bank Missouri was removed by from Arrow Rock to KansCity, and in 1882 the private bank of Nelson Baker ganized at Arrow Rock to take place. Later this bank sold Florida, speculator of St. Louis The failure of this bank 1895 was followed by the of the owner. In Brown Company conducted private banking business Miami and continued the same until broken up by the all claims being paid in full. Mr. Brown had previously endeavored obtain for Miami the branch back before was located Arrow Rock, there being great rivalry between these two towns that Brown still living, residing in California, and the father of George merchant Marshall. Directly after the close of the in 1865 the Brownsville Banking Savings Association organized and has enjoyed profitable existence ever since though the name of the town has been changed to Sweet Springs, the name of the bank correspond ingly changed to the Bank Sweet Springs. First Marshall Bank

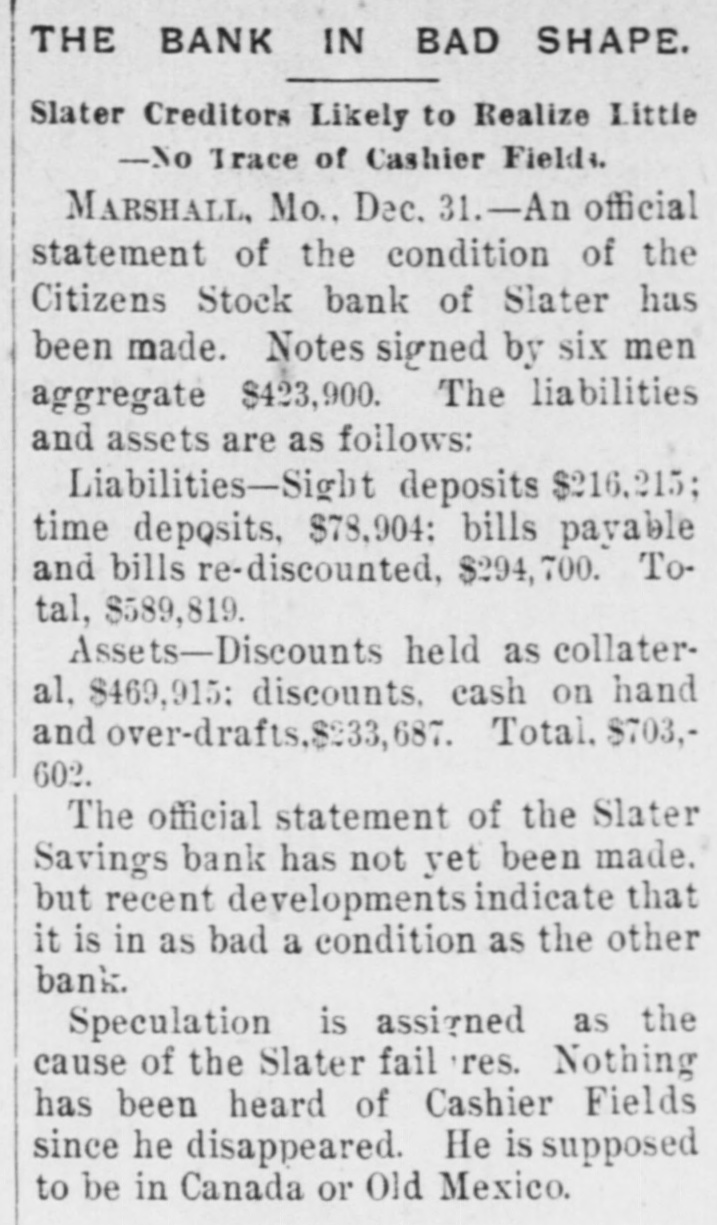

In the late 60s Eakin Hamner established private bank Miami and succeeded by the Miami Savings Bank. About this time Dunnica, Cordell Montague opened private bank being the first bank in town. The banking house of Gilliam Doak established shortly after. In February, 1874, the private bank of Huston was openMarshall and continues busineess on the same site. The business of Dunnica, Cordell Montague was reorganized the Saline County Bank 1874 and later absorbed the Farmers' Savings Bank, which removed from Marshall in 1879. Quit With Death of Partner The firm of Gilliam Doak continued business with the death the active partner, Doak. in There have been four bank failures in Saline County. In 1892 Cordell Dunnica failed at Marshall. This was the first bank failure in the county. The bank paid out 48 cent to creditors. Two years later the two banking institutions Slater. the Citizens' Stock Bank and the Slater Savings Bank, suspended on the day. The failures were most disastrous, creditors receiving but little claims aggregating about of million dollars. These two failures instrumental in bringing about the actment of the bank inspection 1895. In 1878 the legislaenacted law providing for the publication of bank stateboth state and private, otherwise inquiry made by the state into their methods of conducting business. The fourth failure the that Florida Arrow Rock 1895, already ferred

Mentions Woodbridge Saline provided with banking facilities, there being sixteen banks all incorporated the state law There private banks and only tional bank has ever been ized the county, the First National Bank of Marshall, which organized in 1882 and later reorganized the Bank Saline. This bank managed until veteran banker Saline Counhaving performed about thirty-five of faithful service years Miami, Nelson and Marshall. has recently sold banking terests removed to Colorado account of his health. His friends regret to see him drop the ranks. In the way of equipment the

Marshall banks have kept the times. The Bank of and the Bank remodeled their quarters comfortable and convenient. About four years Farmers' Savings Bank erected handsome 3-story building of about $40,000 and cost Wood Huston Bank has completed its building about the same cost. structure and story the of the and tirely use follows the style of architecture that has been attractive banks the larger cities during last few The the years. think, well and complete, and venient tend to all tation to inspect them