Article Text

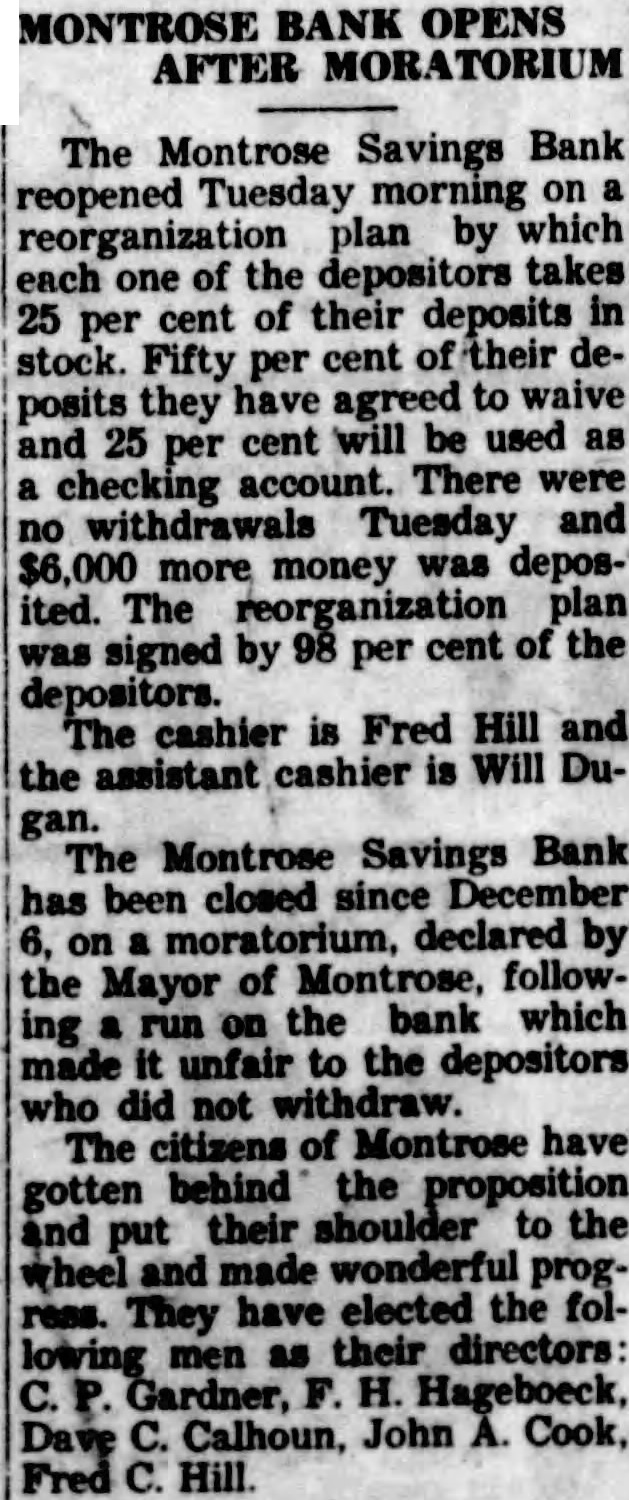

MONTROSE BANK OPENS AFTER MORATORIUM The Montrose Savings Bank reopened Tuesday morning on a reorganization plan by which each one of the depositors takes 25 per cent of their deposits in stock. Fifty per cent of their deposits they have agreed to waive and 25 per cent will be used as a checking account. There were no withdrawals Tuesday and $6,000 more money was deposited. The reorganization plan was signed by 98 per cent of the depositors. The cashier is Fred Hill and the assistant cashier is Will Dugan. The Montrose Savings Bank has been closed since December 6, on a moratorium, declared by the Mayor of Montrose, following a run on the bank which made it unfair to the depositors who did not withdraw. The citizens of Montrose have gotten behind the proposition and put their shoulder to the wheel and made wonderful progress. They have elected the following men as their directors: Gardner, F. H. Hageboeck, Dave C. Calhoun, John A. Cook, Fred Hill.