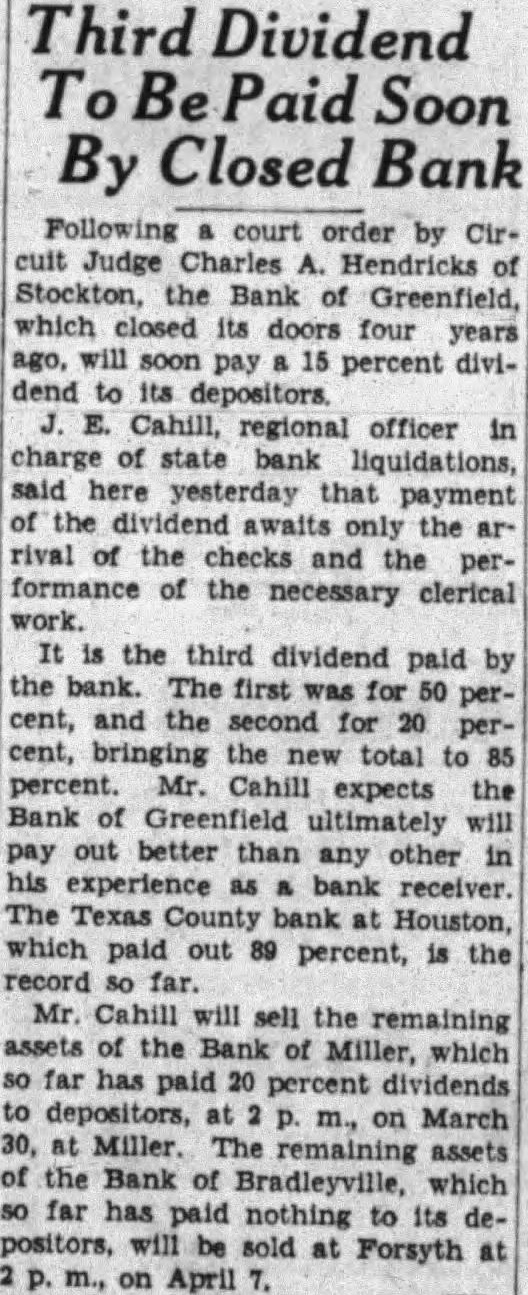

Article Text

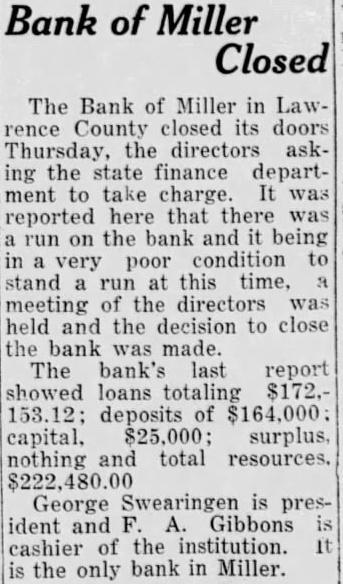

Bank of Miller Closed The Bank of Miller in Lawrence County closed its doors Thursday, the directors asking the state finance department to take charge. It was reported here that there was run on the bank and it being in a very poor condition to stand a run at this time, meeting of the directors was held and the decision to close the bank was made. The bank's last report showed loans totaling $172.153.12; deposits of $164,000: capital, $25,000; surplus, nothing and total resources. George Swearingen is president and F. A. Gibbons is cashier of the institution. It is the only bank in Miller.